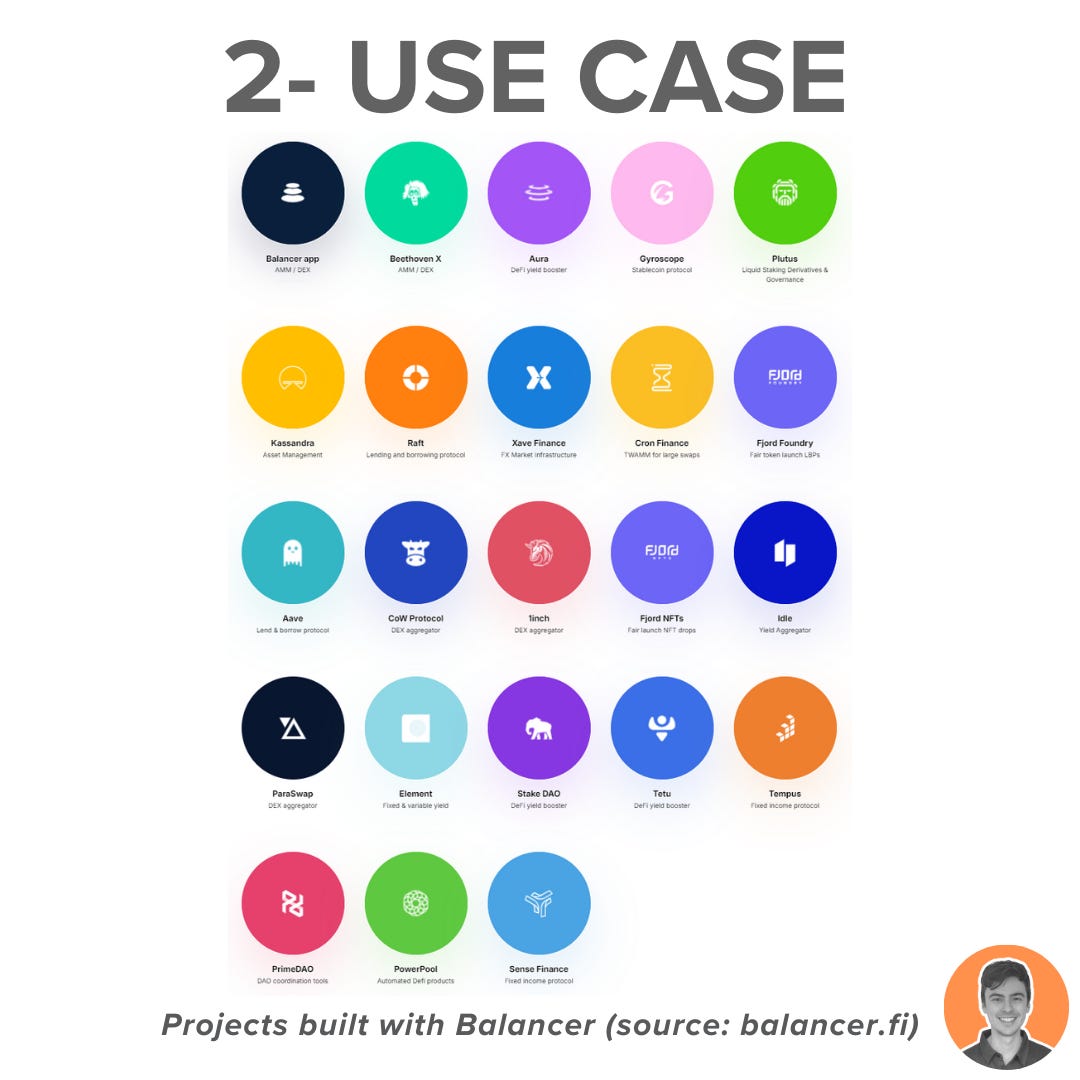

Aave, Gyroscope, and Beethoven X have something in common: they all leverage the powerful Balancer tech stack.

But brace yourself, because with the upcoming V3 launch, Balancer is about to unleash some truly game-changing upgrades.

Here's your February 2024 report on BAL.

Here's what we'll cover in today's edition:

Overview

Use Case

Adoption

Revenue

Tokenomics

Treasury

Governance

Team & Investors

Competitors

Risks & Audits

Summary

Don't forget to bookmark this post for future reference. 📚

At its core, Balancer is a decentralized AMM protocol. However, when you delve deeper, you'll find that the team is building a robust tech stack that serves as a liquidity hub for:

New AMMs/DEXs under development

Yield-bearing assets

DAO governance

Balancer is not only a forward-thinking DEX but also a foundational technology for nurturing future DeFi innovations.

Its unique architecture streamlines the process for delivering unique financial tech to the market.

Some include Aave, Beethoven X, Radiant and Fjord.

What I'm most excited about for Balancer is the anticipated release of V3 this year (Q2 2024).

It promises to build on the innovation of V2 and propel Balancer to become:

Yield bearing hub of DeFi

Launchpad for innovative AMM deployment

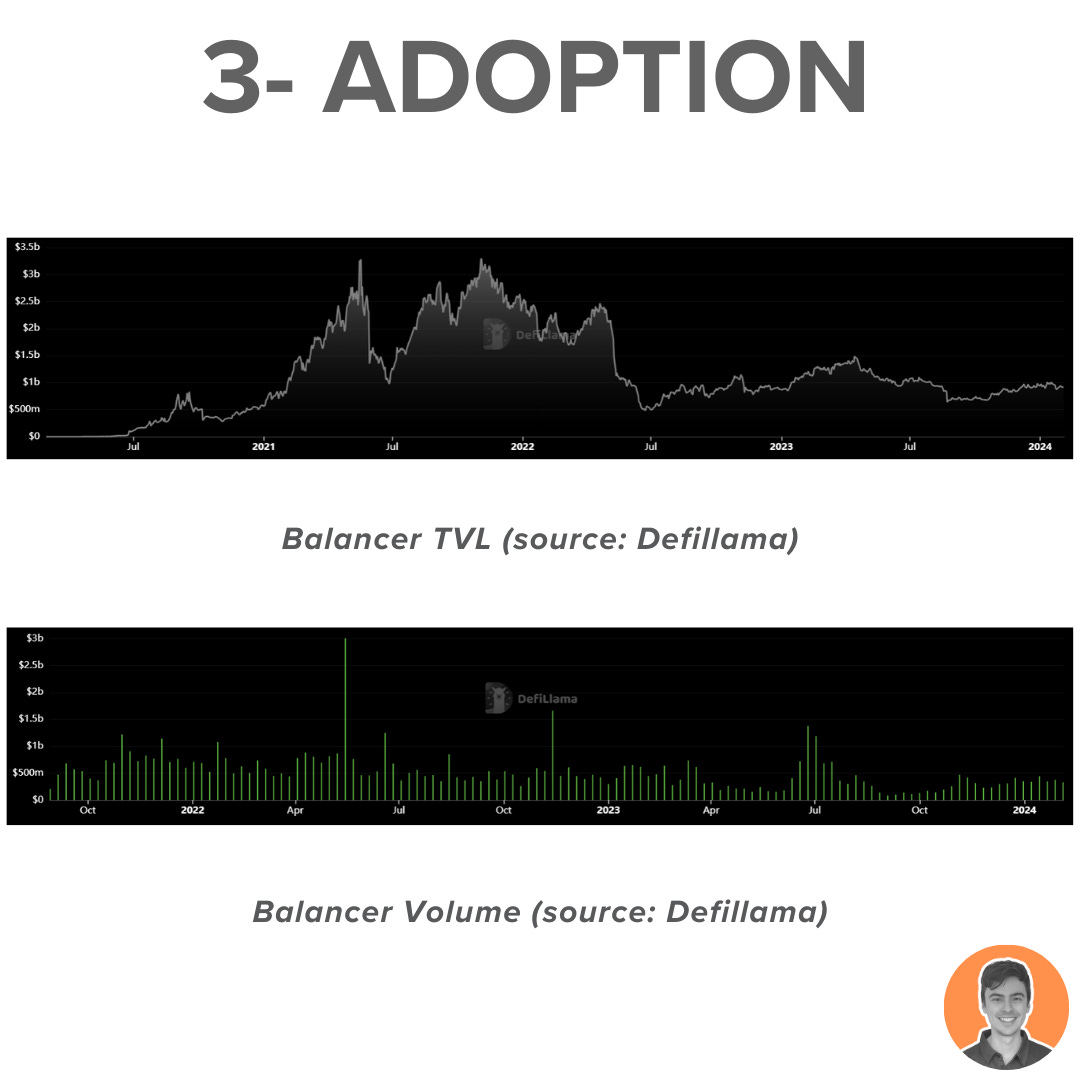

Balancer TVL is currently sitting at 915m. Putting it 23rd amongst all DeFi protocols and 4th amongst other Dex's.

While still 72% down from ATHs ($3.31b in Nov '21), its TVL has been trending slowly higher since July '22. Forming a solid base.

Over the past 30d, Balancer has generated:

$1.5m in fees

$649k in revenue

Putting it 35th overall and 6th amongst Dex's according to Defillama.

As of August 2023, the protocol takes 50% of the swap fees and 50% of wrapped token yield fees on non-exempt pools.

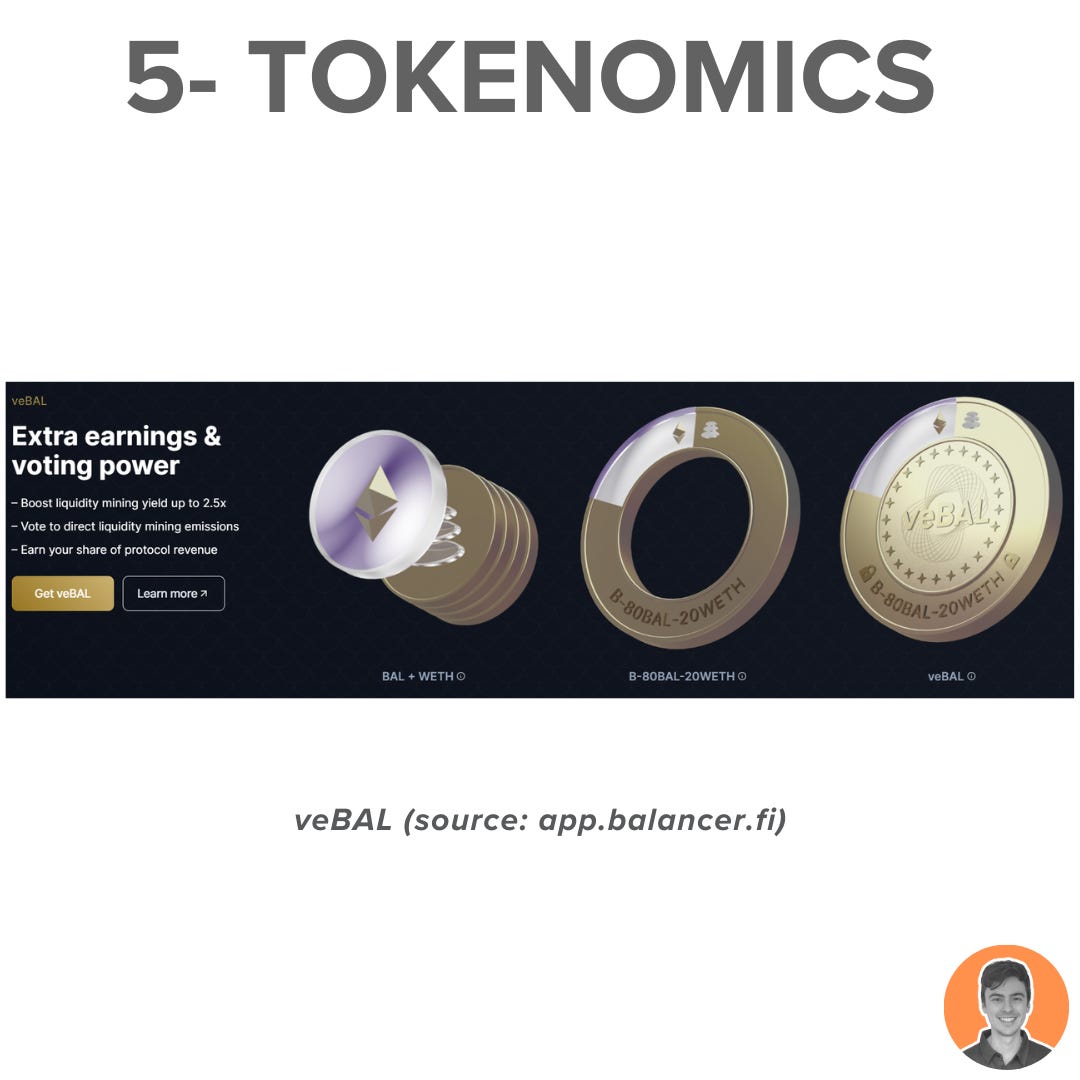

There are two main tokens in the ecosystem:

$BAL - Governance token

$veBAL - Time locked BAL (80:20)

The ve8020 initiative set-out by Balancer is an innovative way to solve some of the issues that single sided staking poses to DAO Governance tokenomics (e.g. Curve).

Let's examine some key differences:

Users obtain veBAL by locking 80/20 BAL/WETH Balancer Pool Tokens instead of pure BAL. Ensuring deep liquidity even if a large portion of BAL tokens are locked.

Max locking period is 1 year, reduced from veCRV's 4 year period.

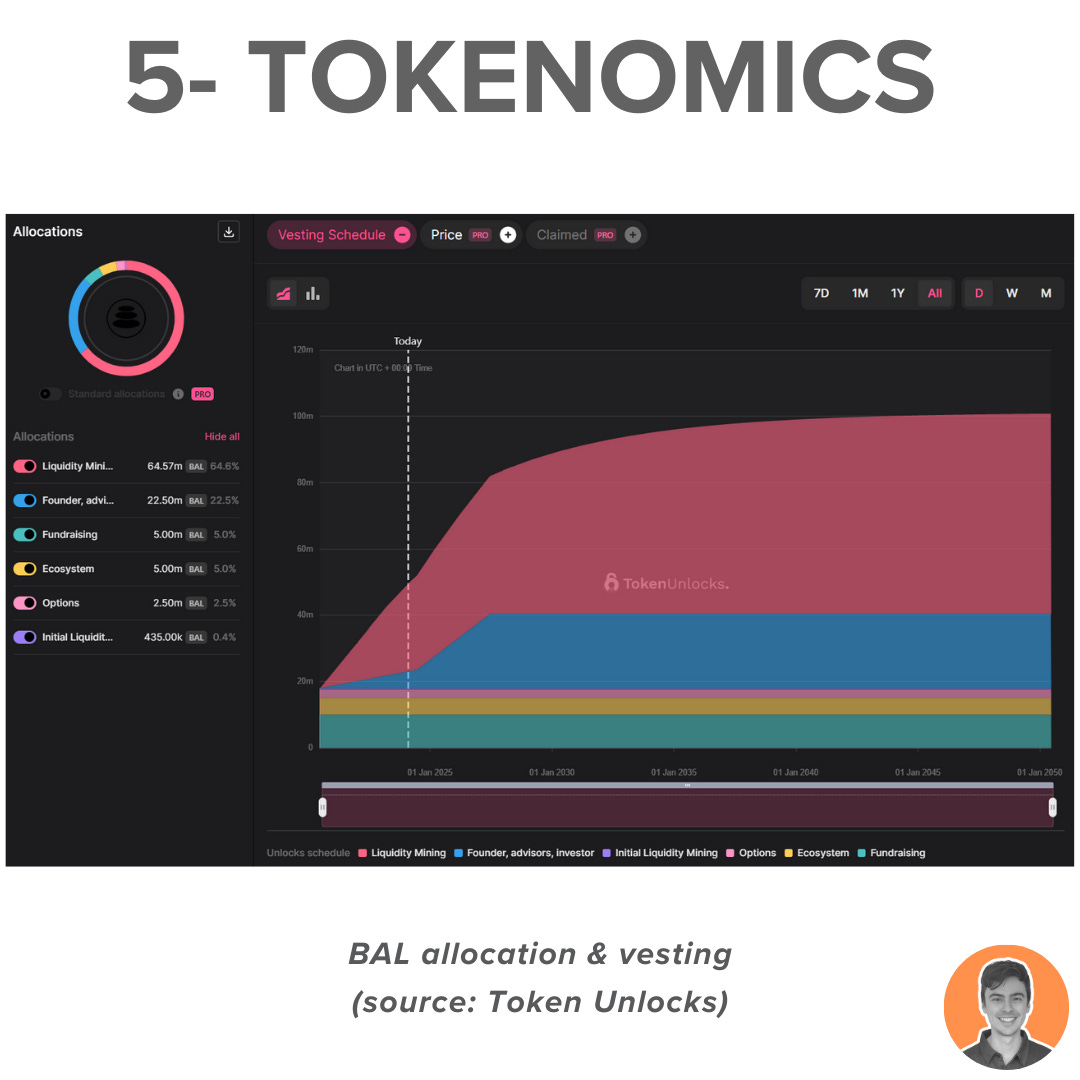

Current supply stats:

Circulating supply: 54.78m

Max supply: 96.15m

Market cap: $195m

FDV: $342m

Market cap/FDV: 57%

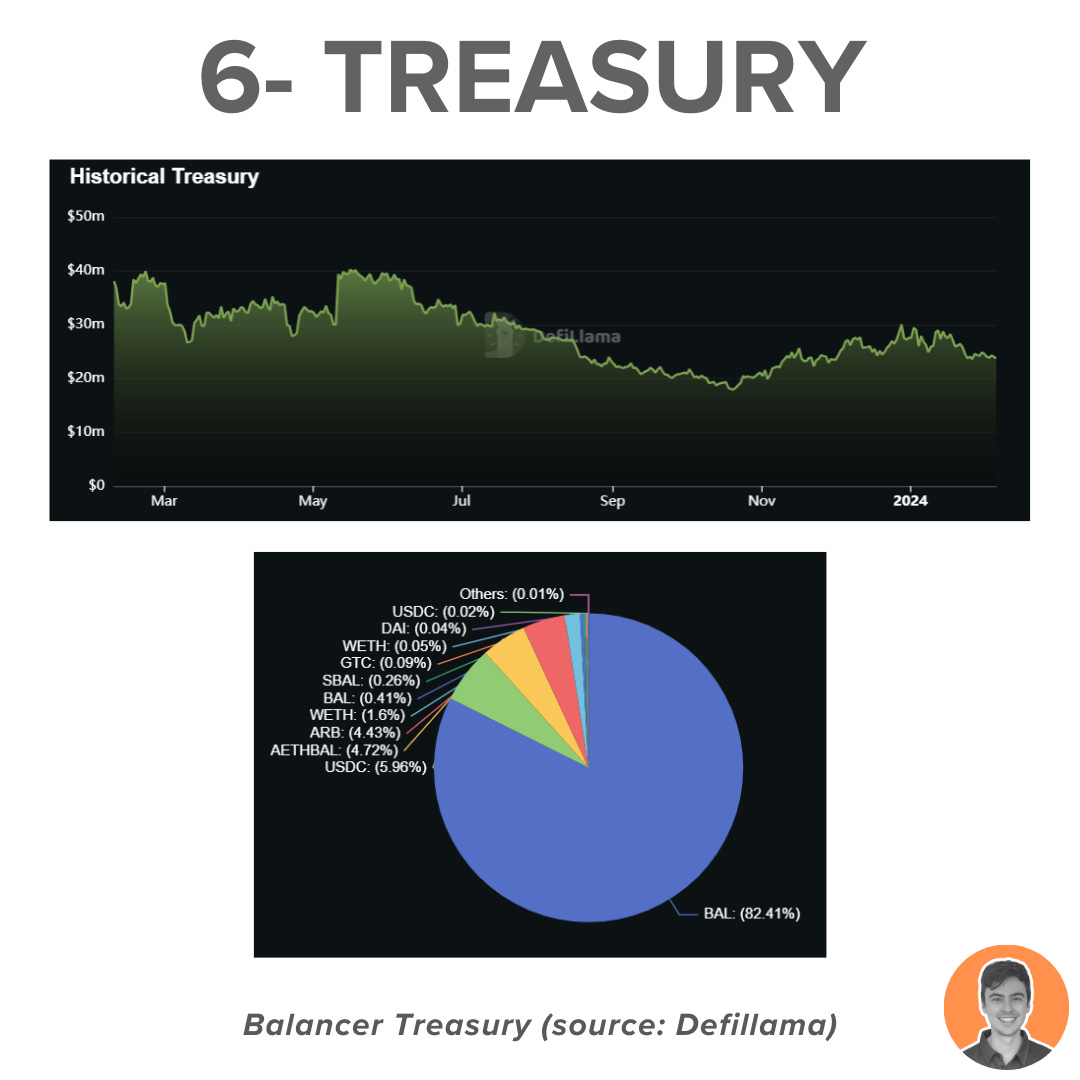

The Balancer Treasury is currently worth $23.77m. It is comprised of:

$19.59m in $BAL

$2.36m in others (ARB, AETHBAL)

$1.43m Stablecoins

$0.39m in majors (BTC & ETH)

These funds are currently held by the DAO multisig wallet.

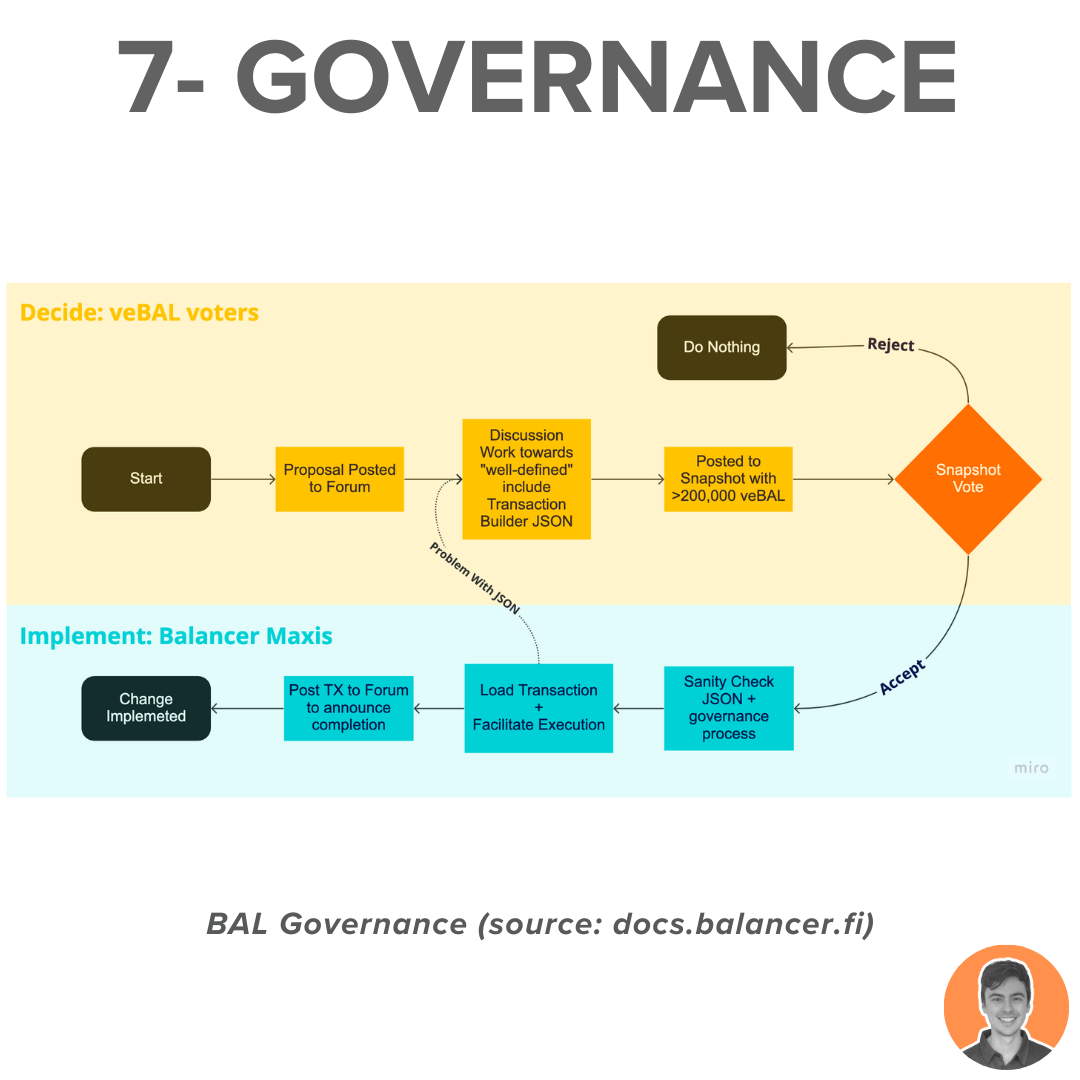

Balancer has implemented a robust decentralized governance process that has been in operation for a considerable period of time.

Additionally, they have introduced the ve8020 initiative, aimed at significantly enhancing the tokenomics of traditional DAO governance.

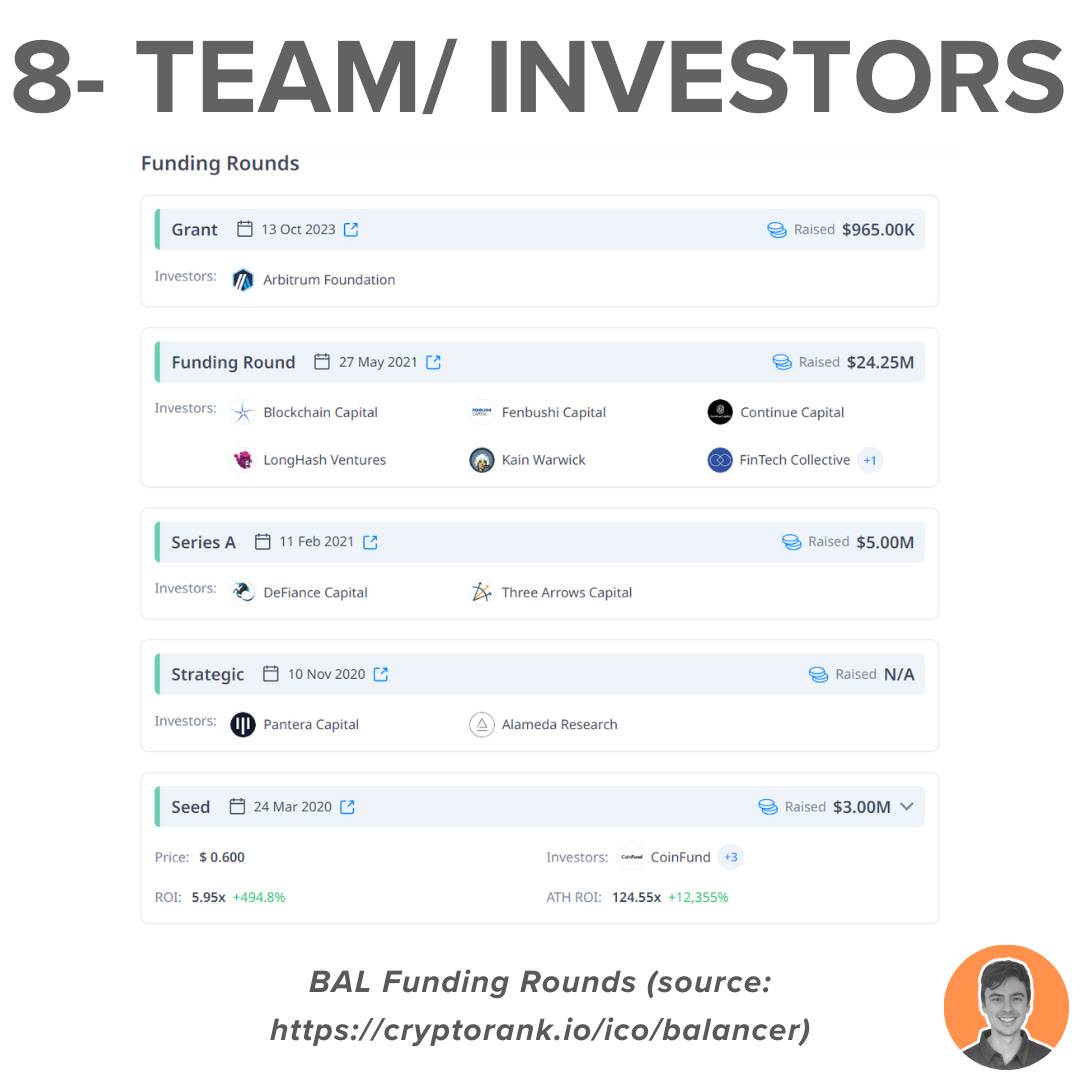

Balancer was founded in 2018 by Fernando Martinelli and Mike McDonald.

Since its inception, Balancer has successfully raised $39.25 million in funding.

Notable investors include Pantera Capital, Blockchain Capital, CoinFund, Fenbushi Capital & the Arbitrum Foundation.

Balancer is a prominent DEX that competes with several other platforms, including Uniswap, Curve, PancakeSwap, Sushi & Thorchain.

However, Balancer is positioning themselves as the best AMM & tech stack for new projects to utilize to quickly scale and build.

In 2023, Balancer experienced two significant exploits. One affected V2 pools, while the other involved a front-end attack.

It is noteworthy that Balancer had undergone multiple audits and maintained a generous bug bounty program (maximum $1 million USD).

Balancer is flying under the radar and the team have continued to develop innovative and useful products.

Upcoming catalysts:

Balancer V3 upgrade

Growth of LSTs & yield bearing stablecoins

Governance tokenomics- ve8020 pools

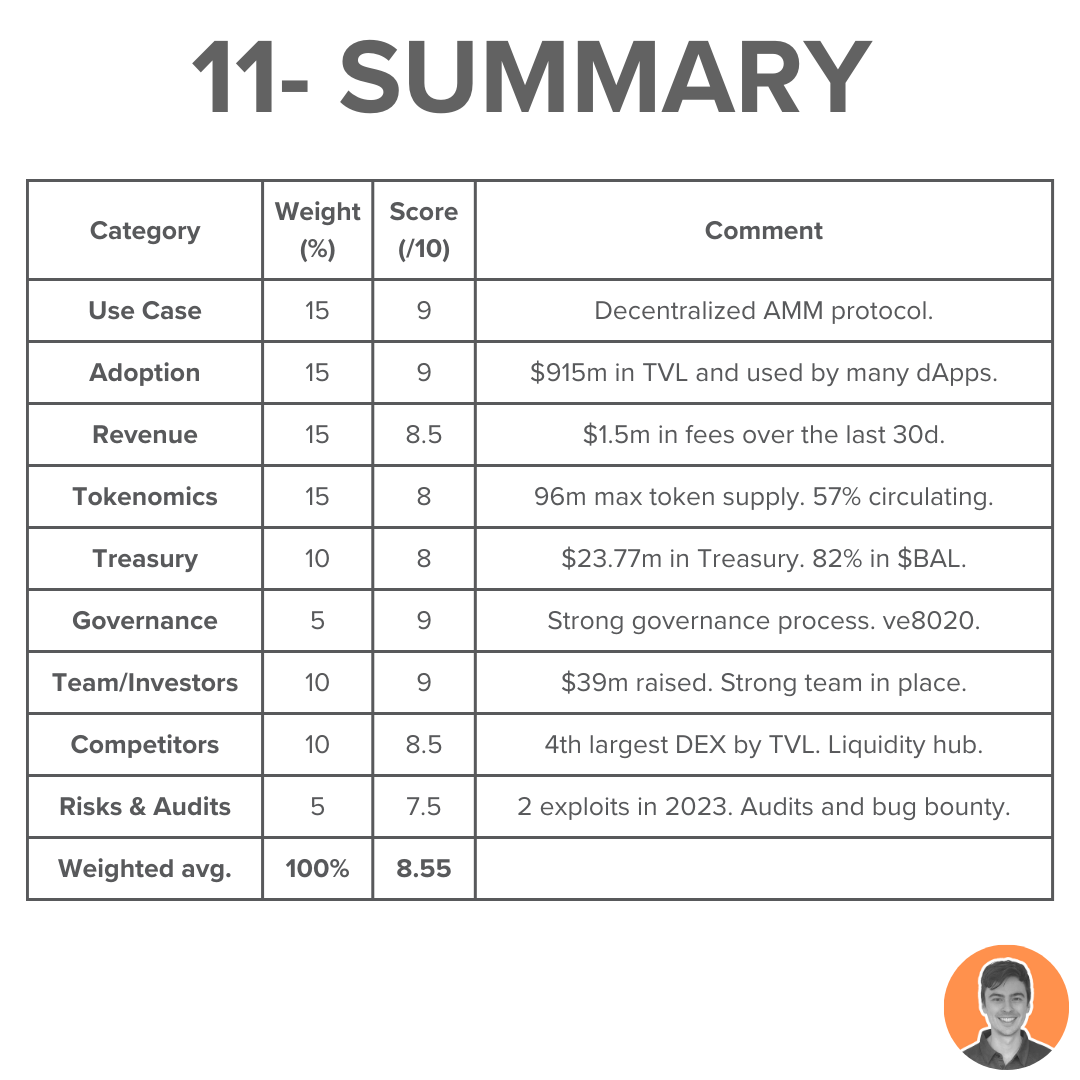

Overall weighted score = 8.55

Note: I am NOT an ambassador or advisor of Balancer. This is NFA.