Synthetix: The ultimate 'picks & shovels' play for the upcoming bull market.

As the DeFi backbone for derivatives trading, Synthetix has already raked in $54 million in annualized revenue.

Check out my November 2023 research report on SNX.

Here's what we'll cover in today's edition:

Overview

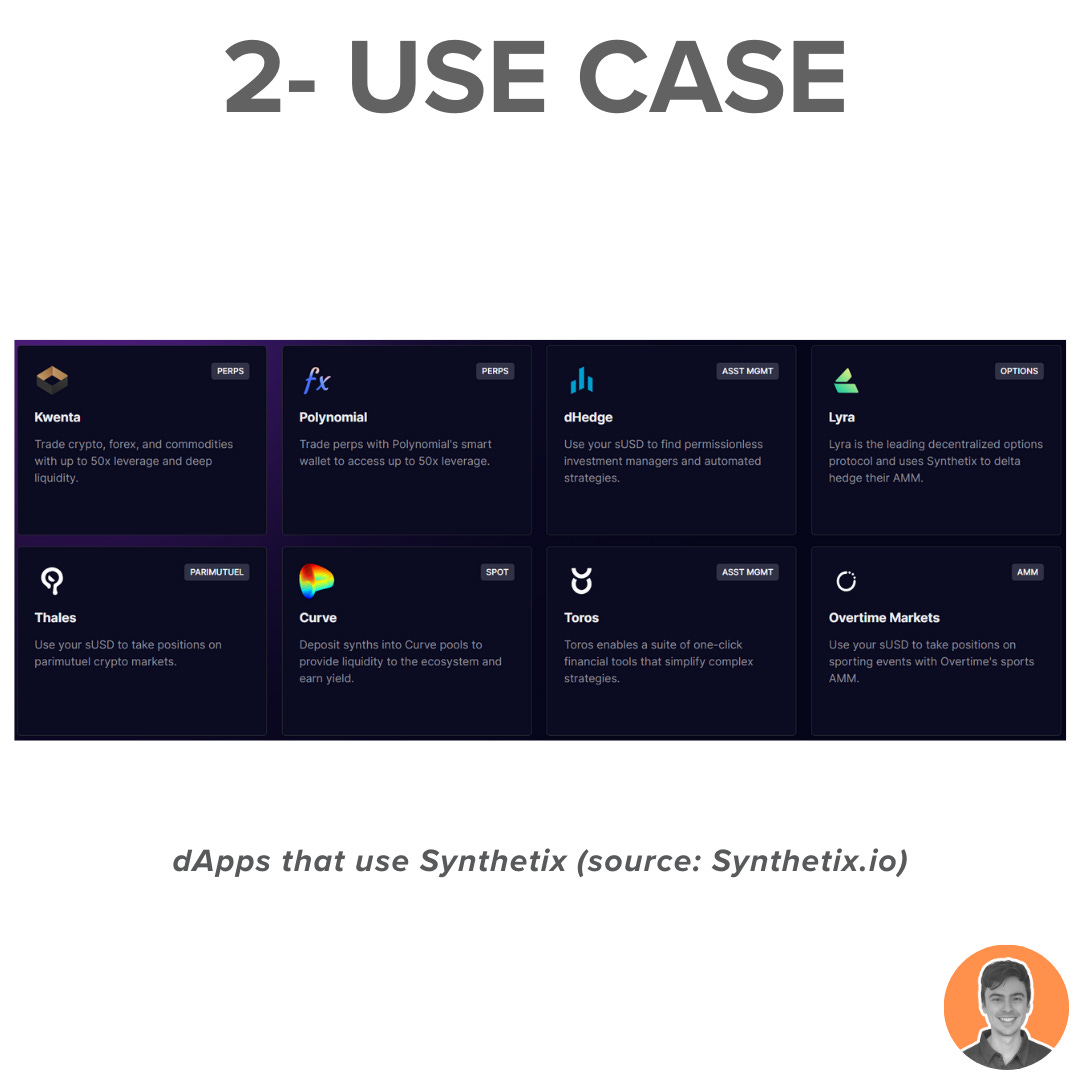

Use Case

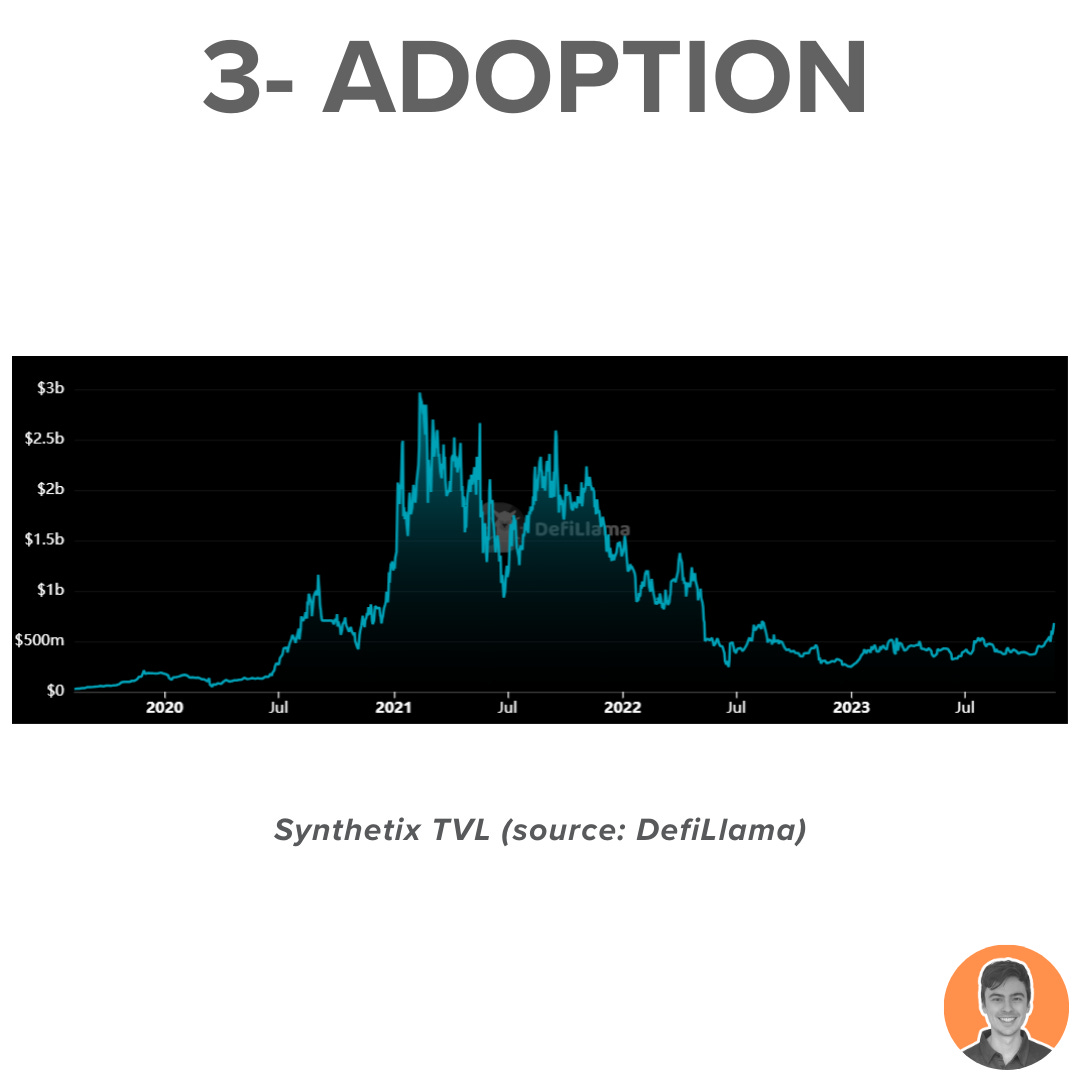

Adoption

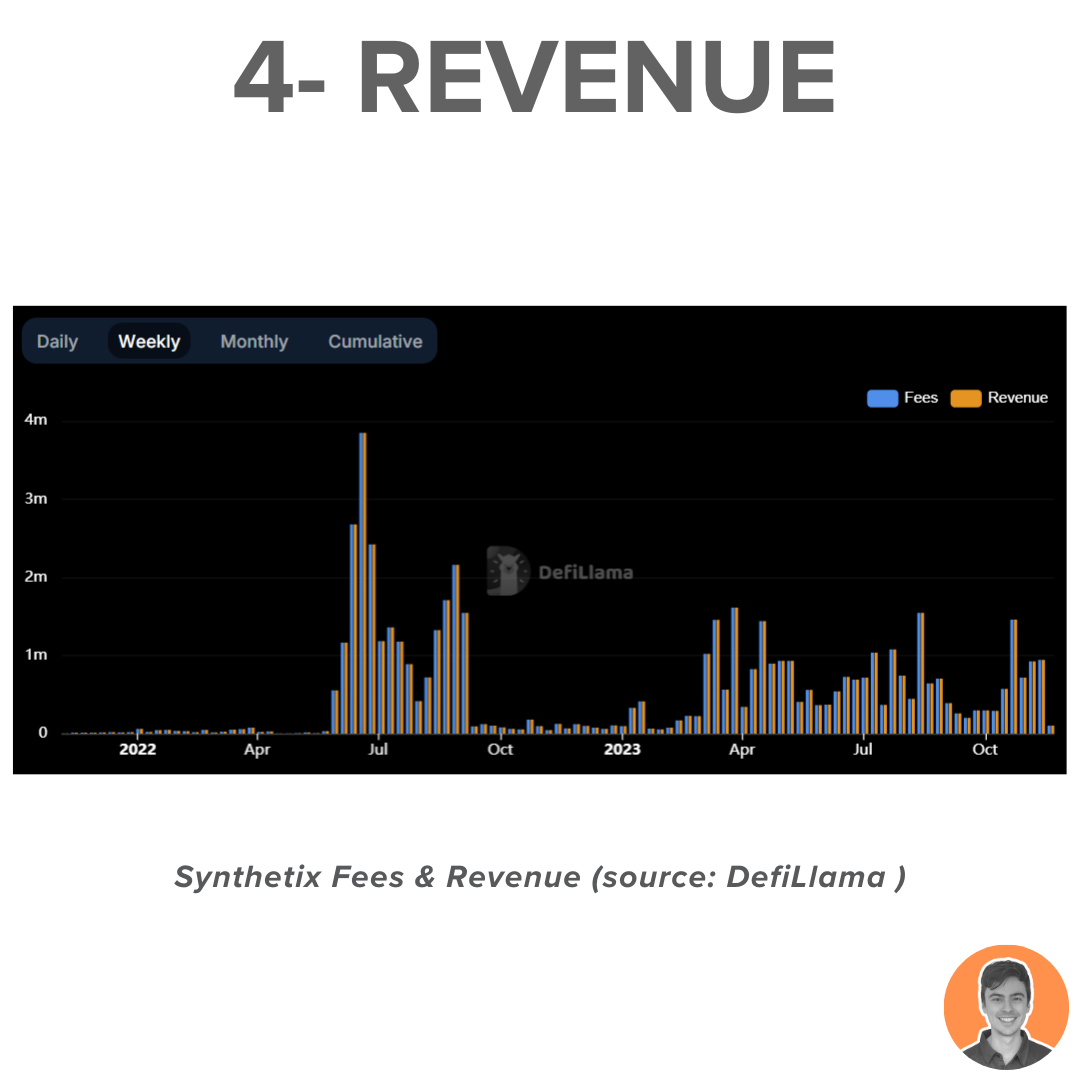

Revenue

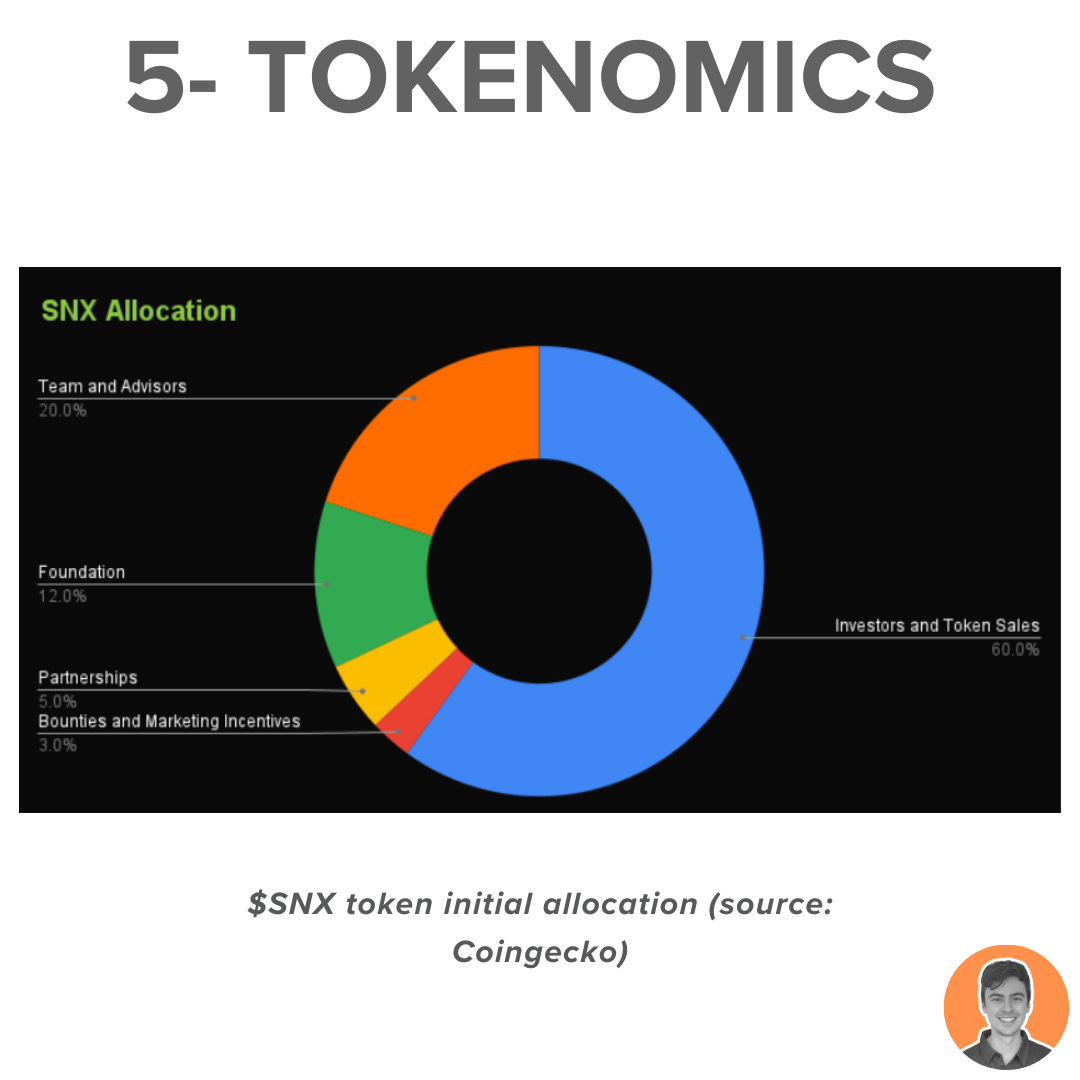

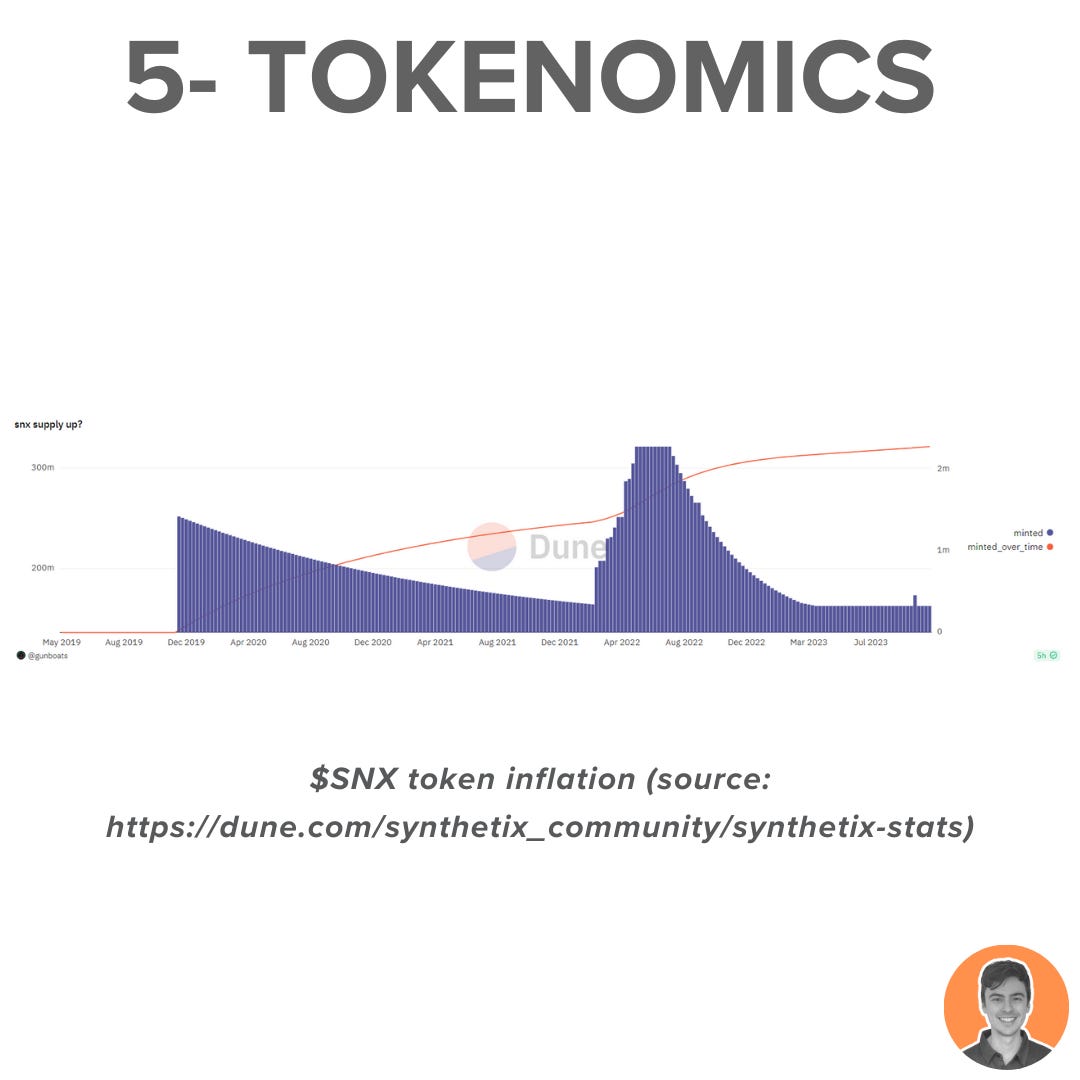

Tokenomics

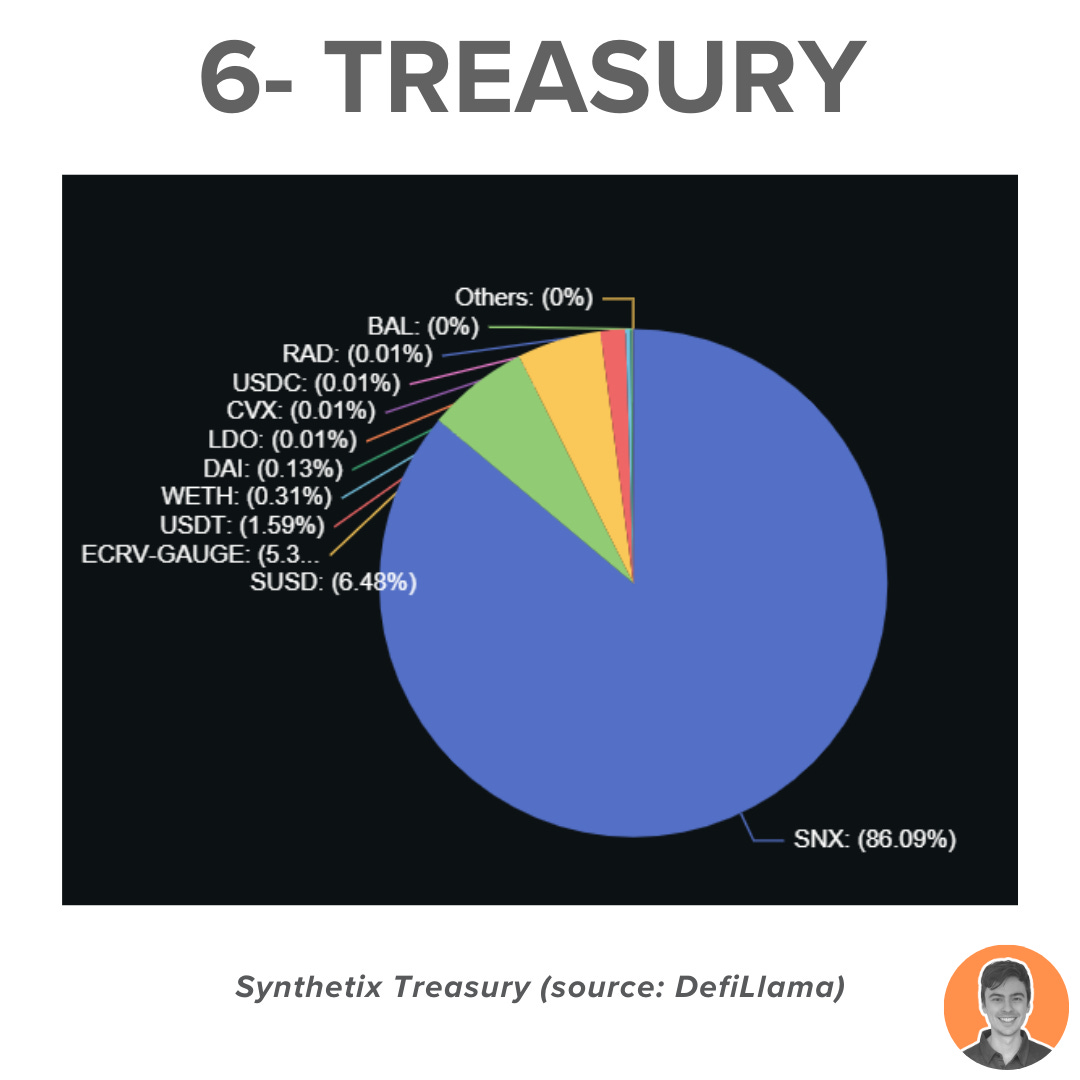

Treasury

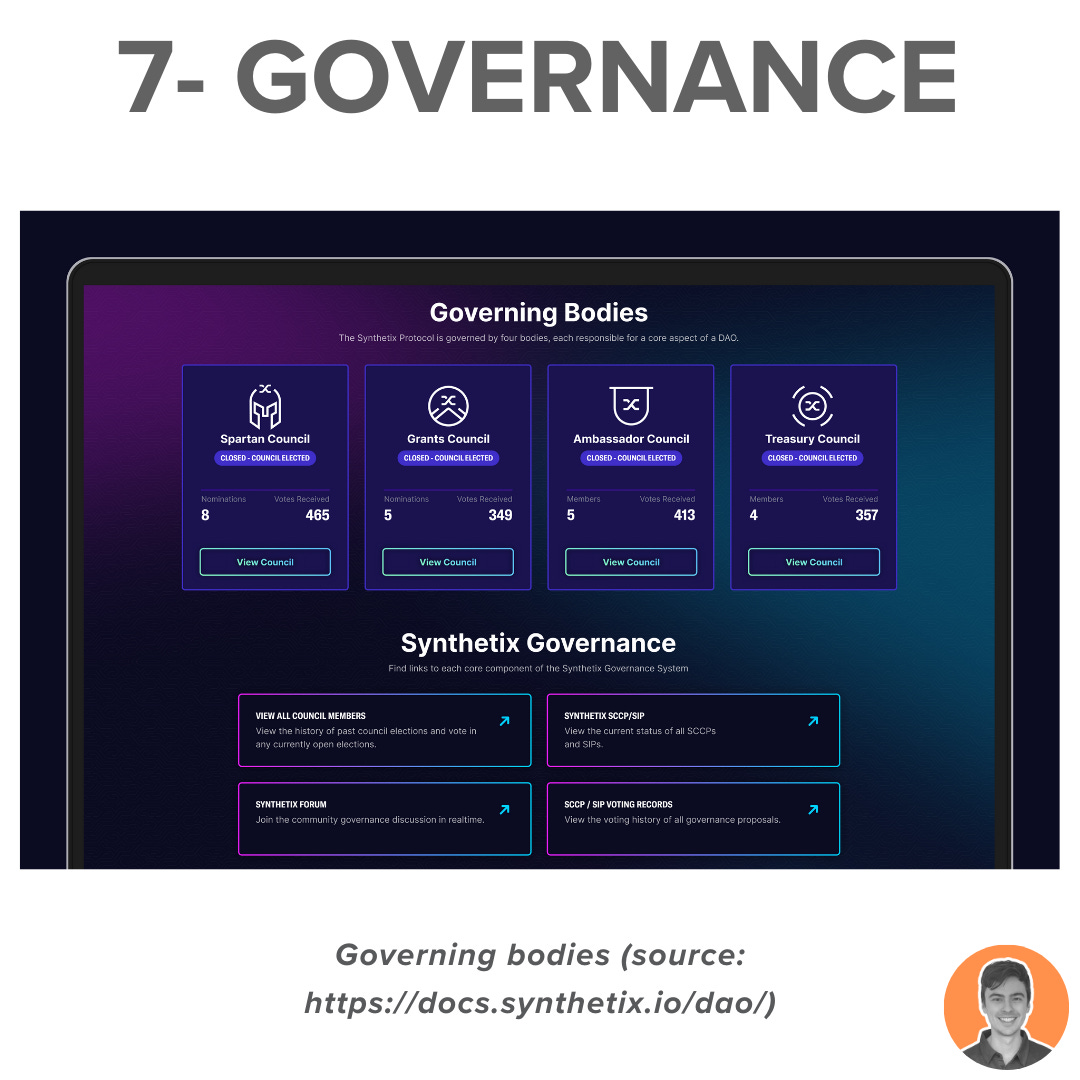

Governance

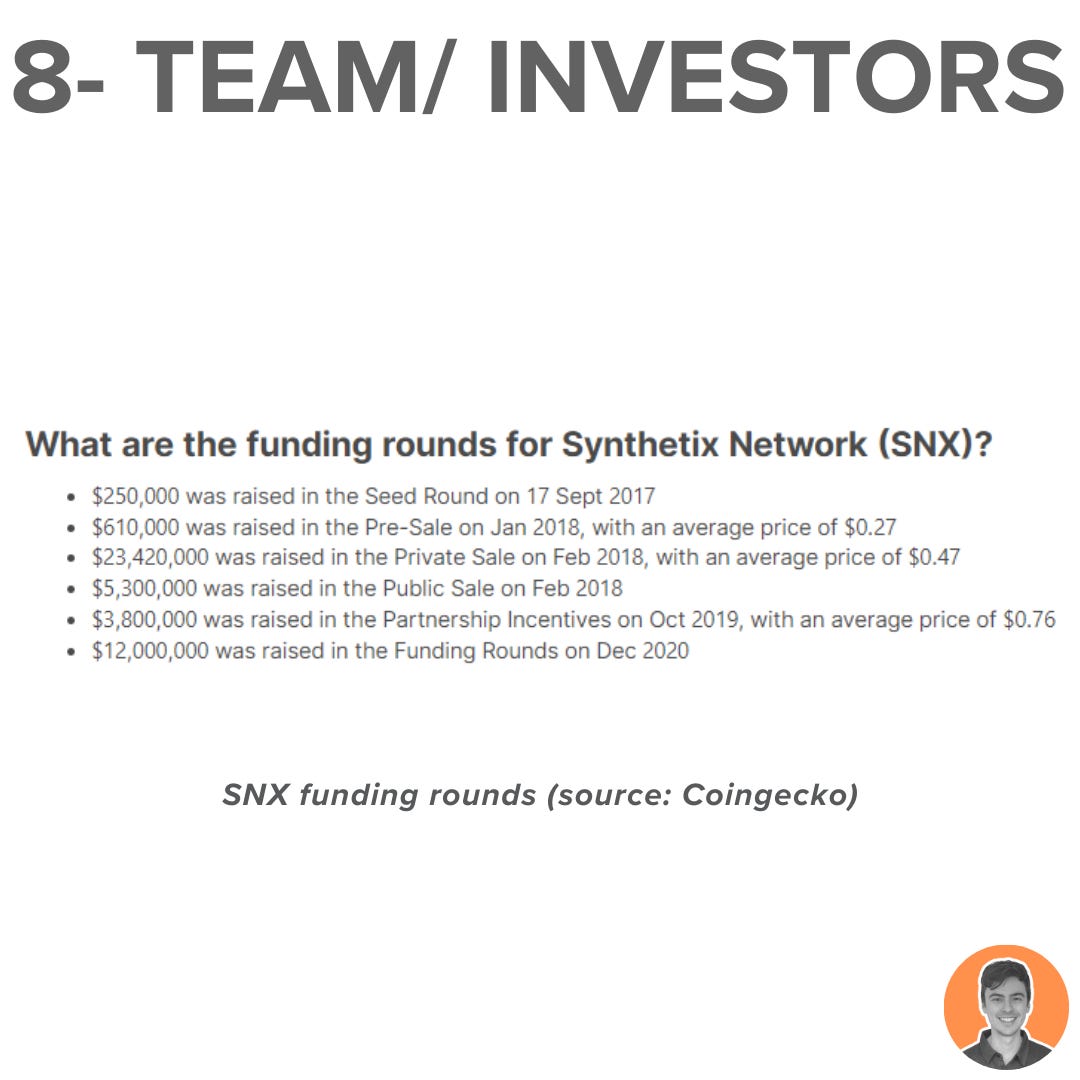

Team & Investors

Competitors

Risks & Audits

Summary

Synthetix is a decentralized protocol that allows for the creation and trading of synthetic assets (commodities, stocks, & currencies).

While it doesn't have user-facing front-ends, it is the backbone to popular DeFi applications like Kwenta, Polynomial, dHedge, and Lyra.

The Synthetic on-chain asset class is poised for significant growth in the coming years.

Increasingly, users are seeking solutions that offer:

Permissionless trading of spot synthetics

On-chain derivatives of traditional assets such as commodities, stocks, and currencies

The TVL currently stands at $677m, up 57% over the last month.

Supported by the strong increase in on-chain derivatives trading volume over the past few months and into the bull market.

Its TVL is close to breaking out of the range it has been sitting in since May 2022.

Over the past 30d, SNX has generated an impressive $4.2m in revenue, making it the 6th highest among all protocols according to DefiLlama.

Fees are generated on every synthetic asset exchange, ranging from 0.1% to 1% (avg. 0.3%). All fees are then directed towards $SNX stakers.

There are three main tokens that are used in the Synthetix Ecosystem:

$SNX - Staking & governance

$sUSD- mint sUSD by locking their SNX as collateral

$eSNX- Synthetix V3

The majority of $SNX tokens are circulating, meaning no future unlocks to dilute the price.

SNX's inflation is based on a 70% staking ratio, adjusted weekly by 10% depending on whether the ratio is above or below the target.

SR> 82% => lower inflation by 10%

SR is between 58% and 82% => no change

SR is <58% => increase inflation by 10%

These are the current supply stats:

Circulating supply = 326.5m

Total supply = 327.2m

Market cap = $1.14b

FDV = $1.14b

Market cap/ FDV = 1.0

The @synthetix_io Treasury consists of:

$11.98m in stablecoins

$0.46m in BTC/ETH

$125.65m m in their own token (SNX)

In total, the treasury holds a healthy $145.96m (including their own token).

Placing them in 20th position according to DefiLlama.

The protocol operates under the governance of four key bodies:

Spartan Council

Treasury Council

Ambassador Council

Grants Council

All of these councils are elected by SNX Stakers, and proposals (SIPs or SCCPs) are only implemented if they receive majority votes.

The project started in 2017 as Havven, a stablecoin protocol.

It was then rebranded as Synthetix in 2018, with a pivot to synthetic assets and derivatives trading.

Through various funding rounds and private sales between 2017-2020, it raised a total of $46.05 million.

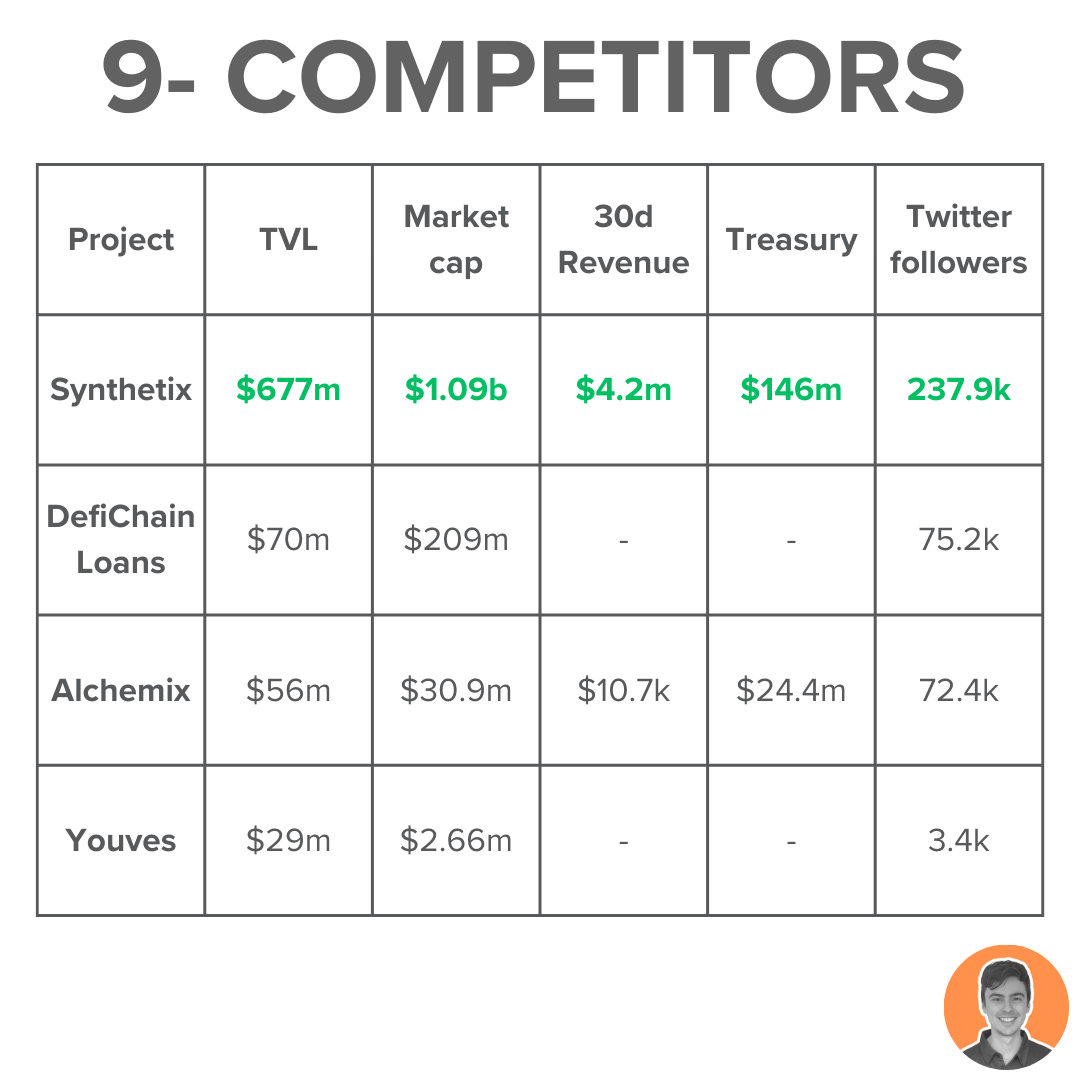

Synthetix is the clear market leader in the Synthetics category.

It has a first mover advantage and a strong ecosystem of projects that have been built using its infrastructure.

Alchemix is currently the top contender with impressive TVL and revenue stats among competitors.

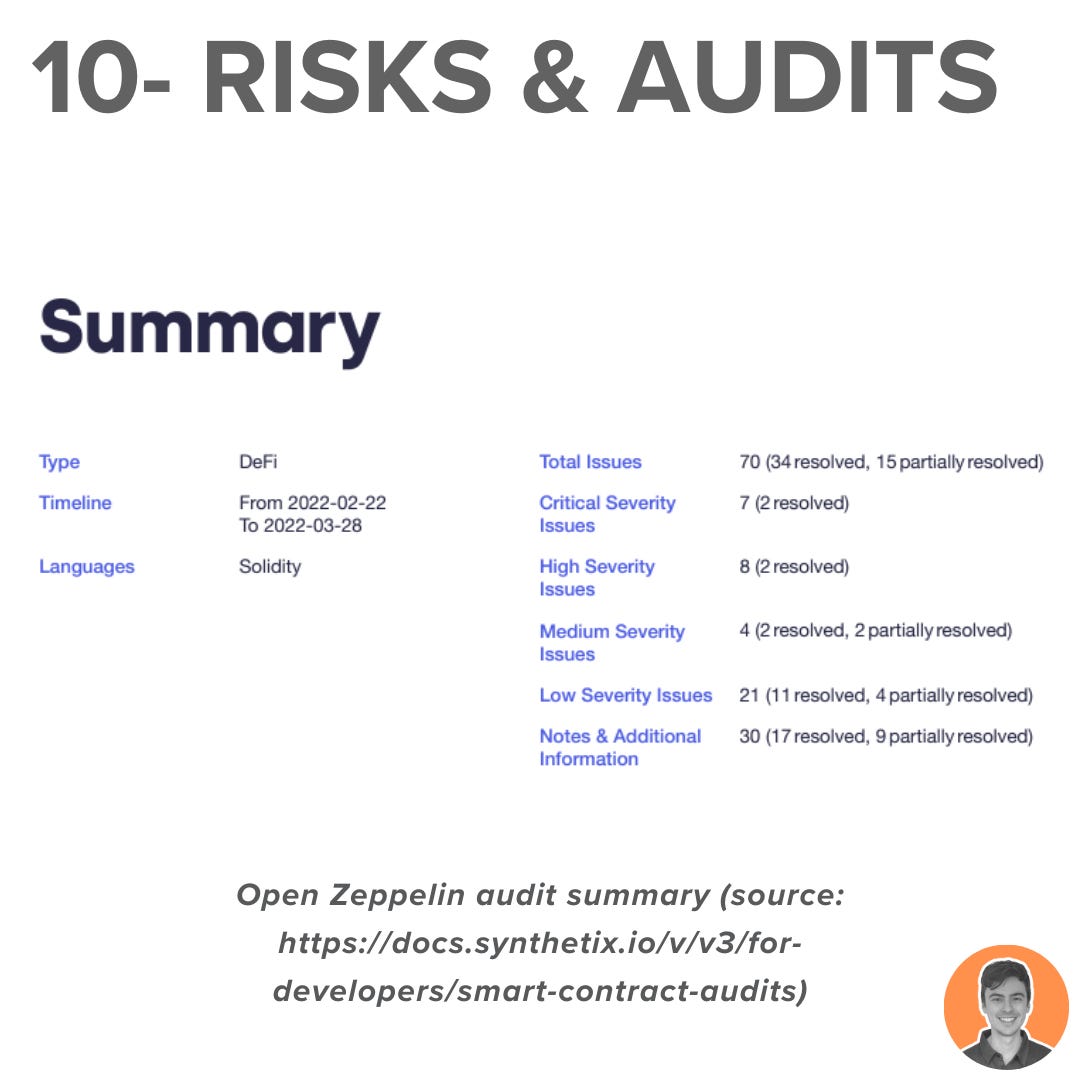

Synthetix V3 is currently under development and has been audited by Open Zeppelin, iosiro and 0xMacro.

The team are also running an Immunefi bug bounty program. Rewards are distributed according to the impact of the vulnerability.

As always, make sure to DYOR with any project.

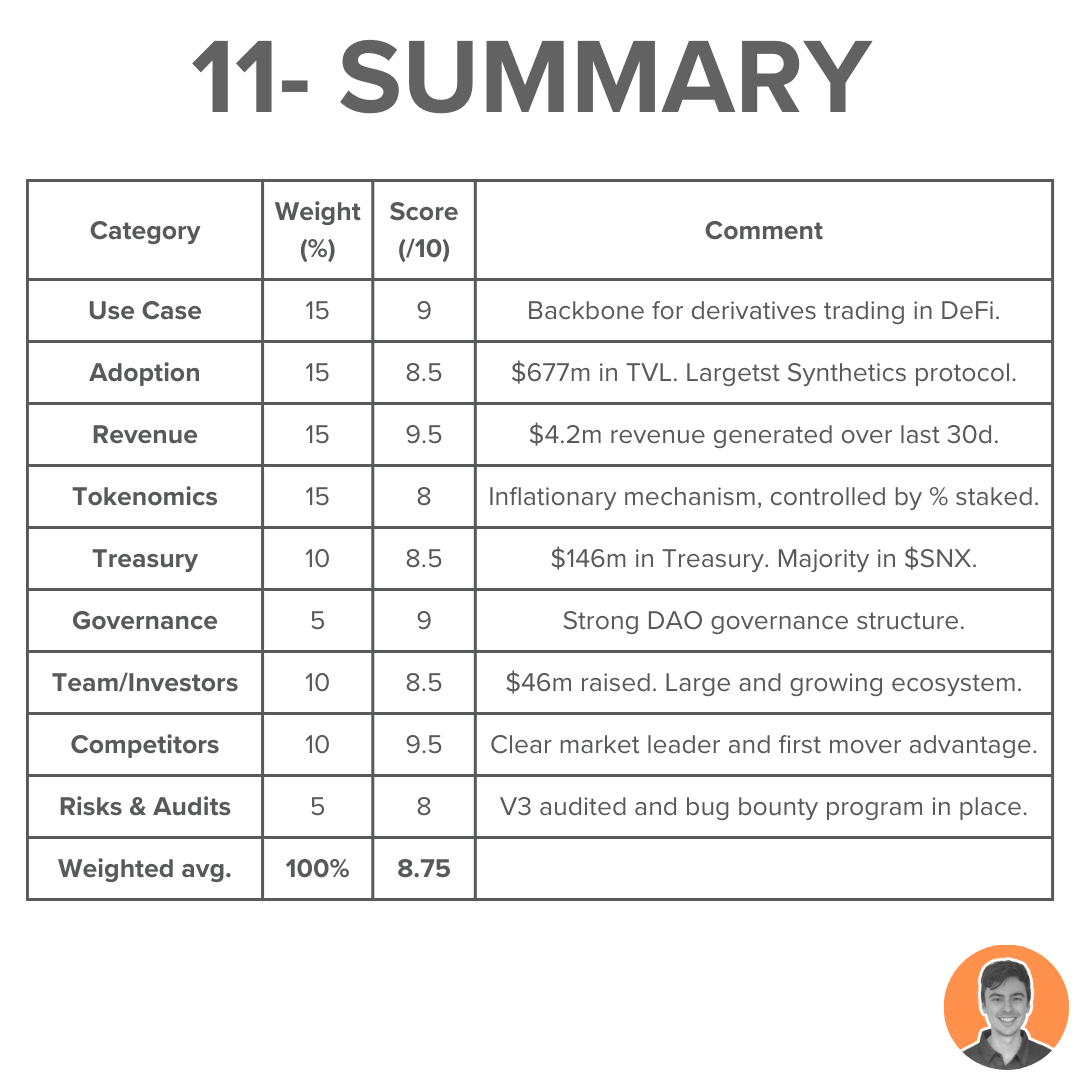

Overall, I am quite bullish on Synthetix.

There are a number of upcoming catalysts:

Full release of V3 (Perps, Base, USDC)

DEX perps eating CEX lunch

Infinex front-end (CEX like trading)

It's a good 'picks & shovels' play for the bull.

Overall weighted score = 8.75

Note: I am NOT an ambassador or advisor of Synthetix. This is NFA.