Dymension is much more than just an airdrop.

It's the Lego kit for modular blockchains and could be one of the biggest projects of the year.

Here's your February 2024 research report on DYM.

Make sure you read to the end to find my overall project ranking.

Here's what we'll cover in today's edition:

Overview

Use Case

Adoption

Revenue

Tokenomics

Treasury

Governance

Team & Investors

Competitors

Risks & Audits

Summary

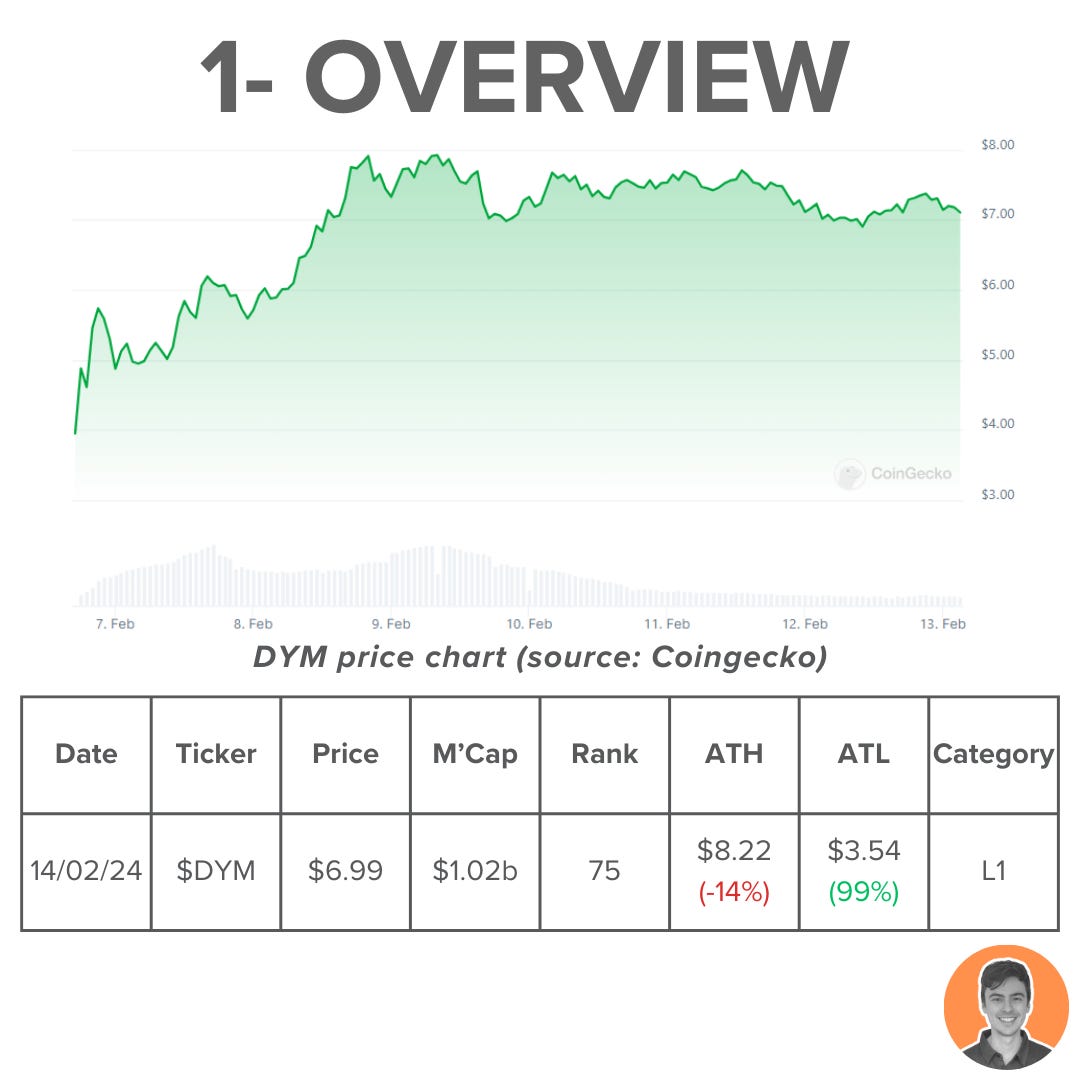

Dymension is a decentralized delegated Proof-of-Stake L1 blockchain secured by the $DYM token. It is custom built to provide RollApps with:

Security (secured by the validators)

Interoperability (interact via a single IBC connection to Dymension)

Liquidity (Embedded AMM)

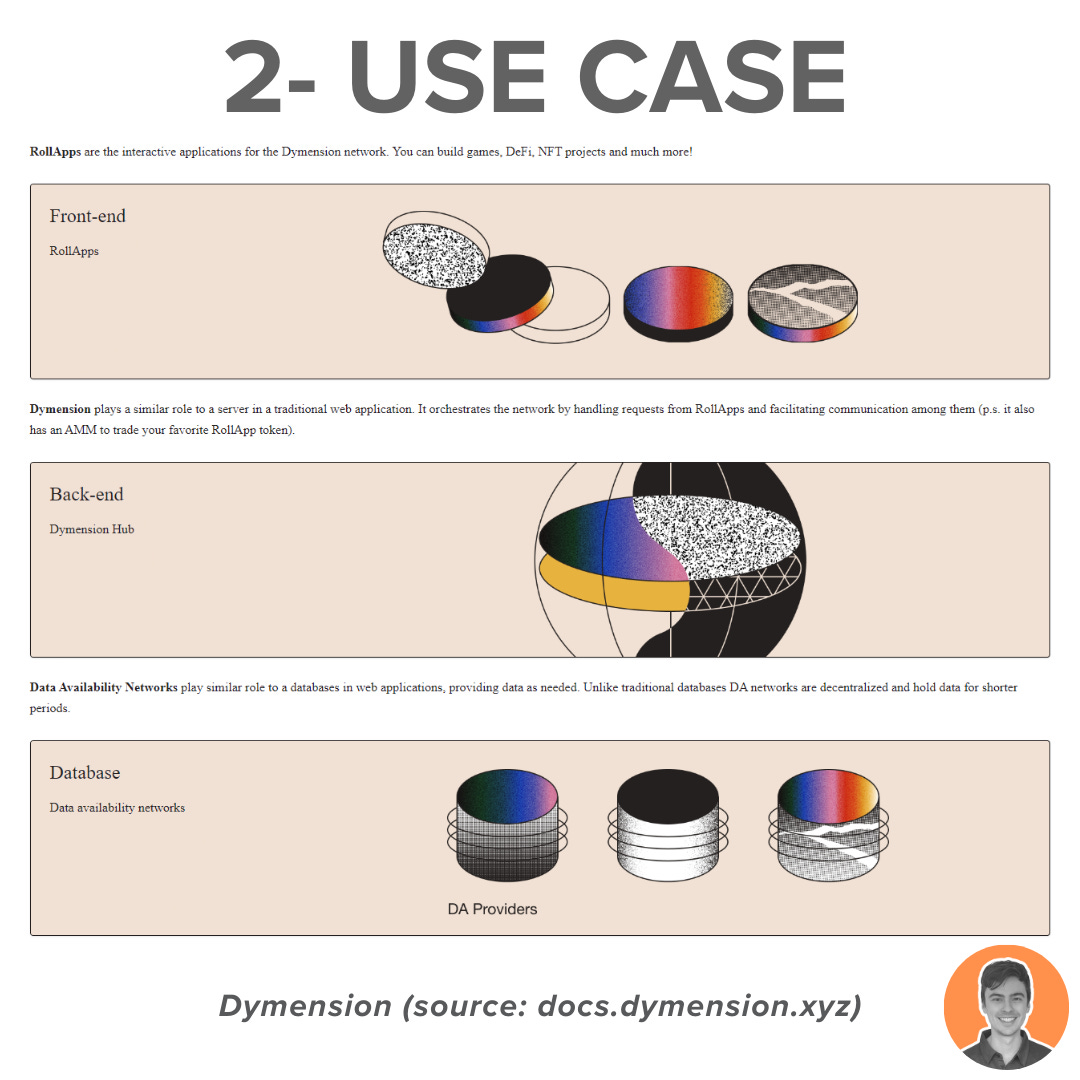

Dymension is like an internet service provider, connecting RollApps to the crypto economy. It enables fast deployment of modular blockchains in a few minutes.

Front end → RollApps

Back end → Dymension Hub

Database → Data availability networks

The Dymension Hub was constructed using the Cosmos SDK and serves as the settlement layer.

It leverages IBC for secure message transfer between Dymension RollApps.

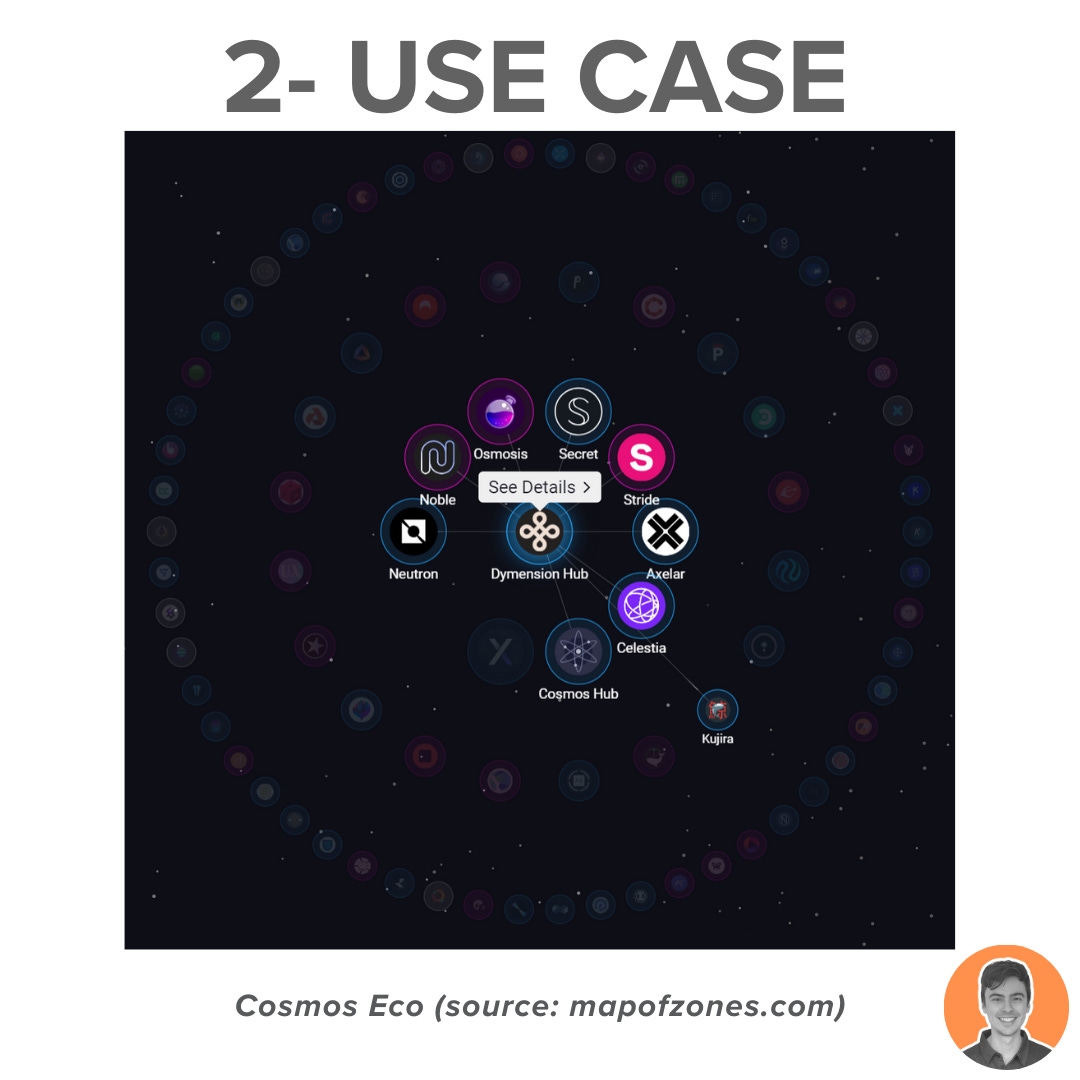

I am bullish on the entire Cosmos ecosystem, and I think Dymension is positioned to capitalize on this growth.

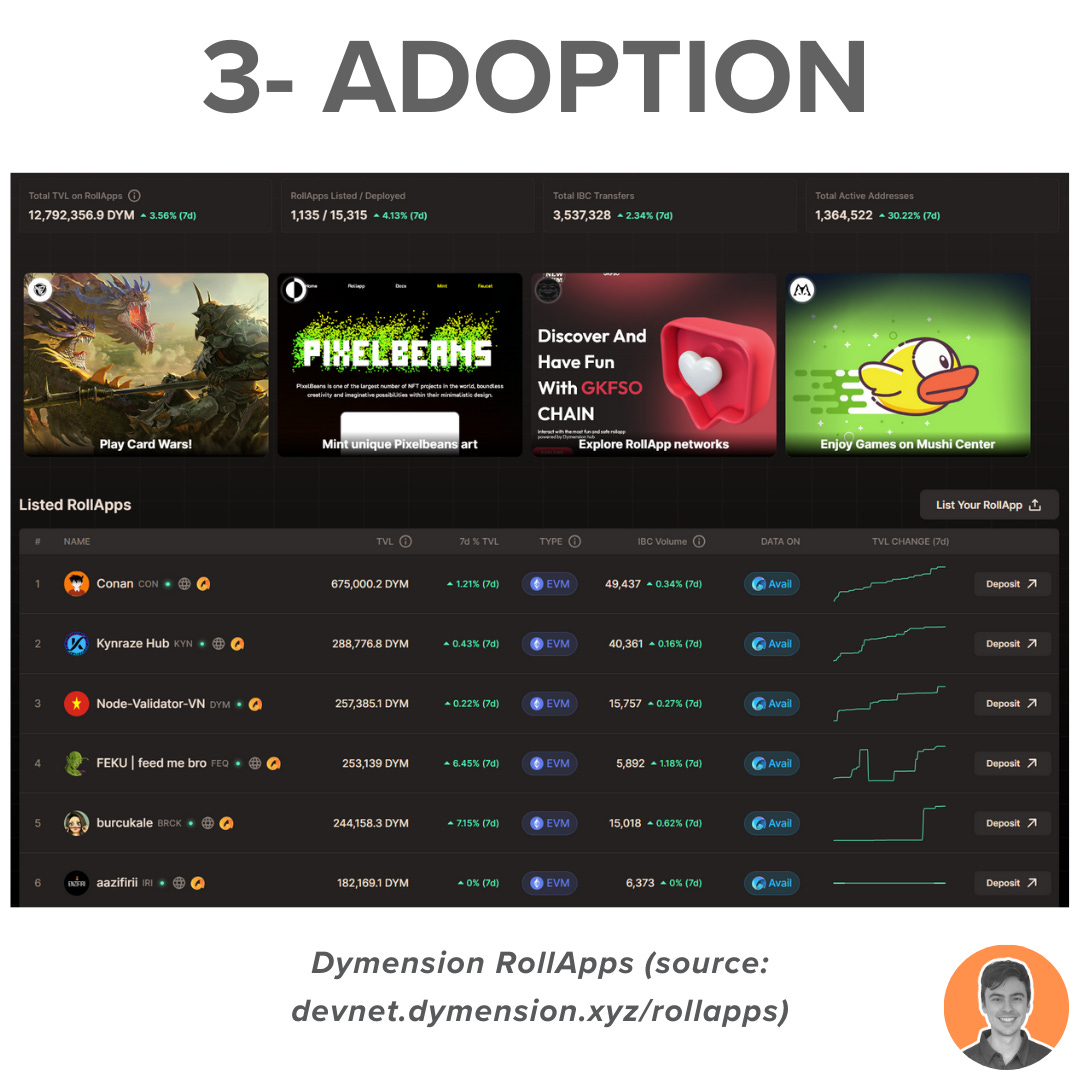

The Dymension mainnet was only launched on 7th Feb '24.

However, here are some stats from their Froopyland testnet:

12.8m $DYM- Total TVL on RollApps

1,135 RollApps listed

15,315 RollApps deployed

3.5m Total IBC Transfers

1.36m Total Active Addresses

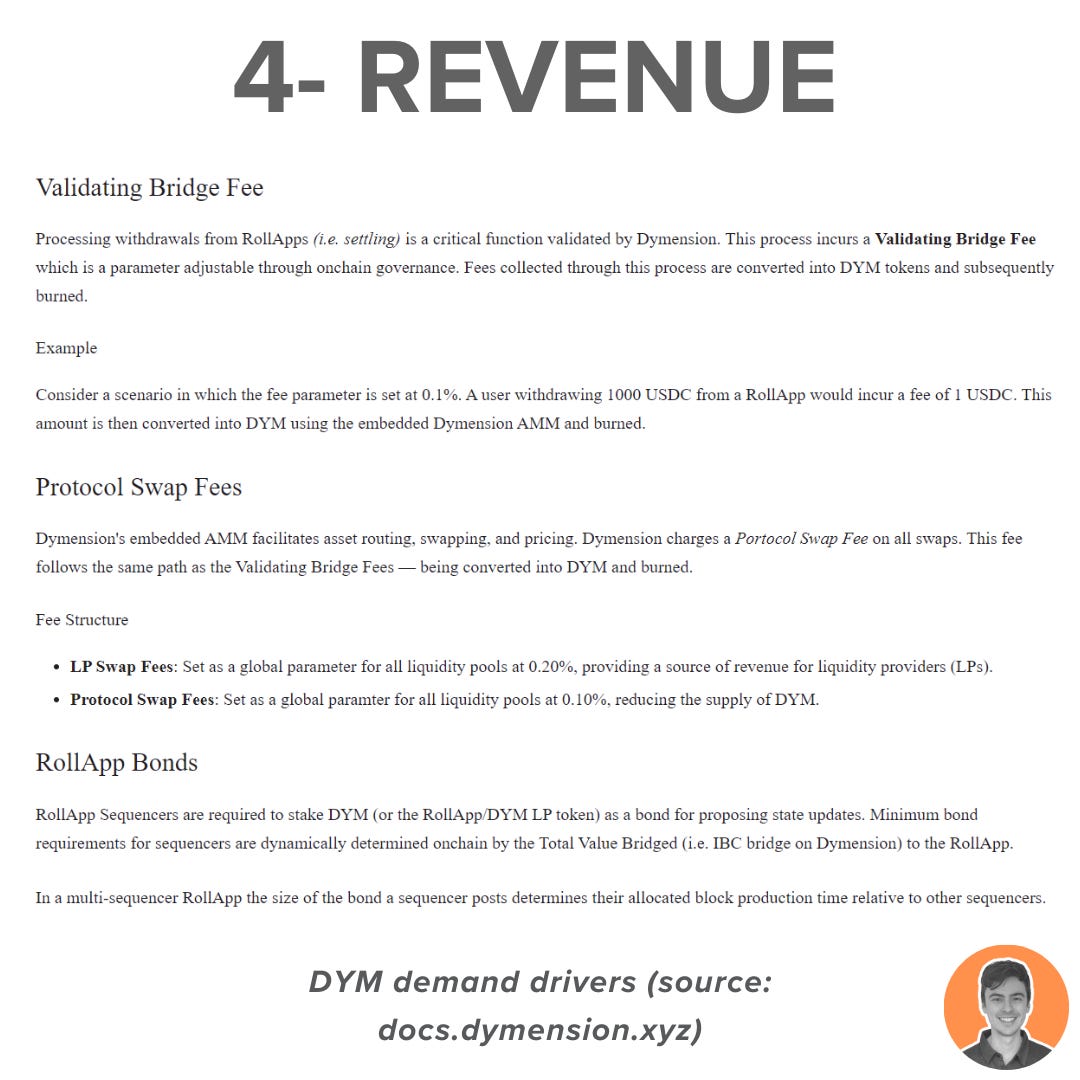

DYM Demand is driven by 3 main mechanisms:

Burn: DYM tokens burned to validate bridging & swap fees.

Transaction Fees: Fees are distributed among DYM validators & stakers.

Supply Lockup: RollApp bonds reduce circulating supply, enhancing security and stability.

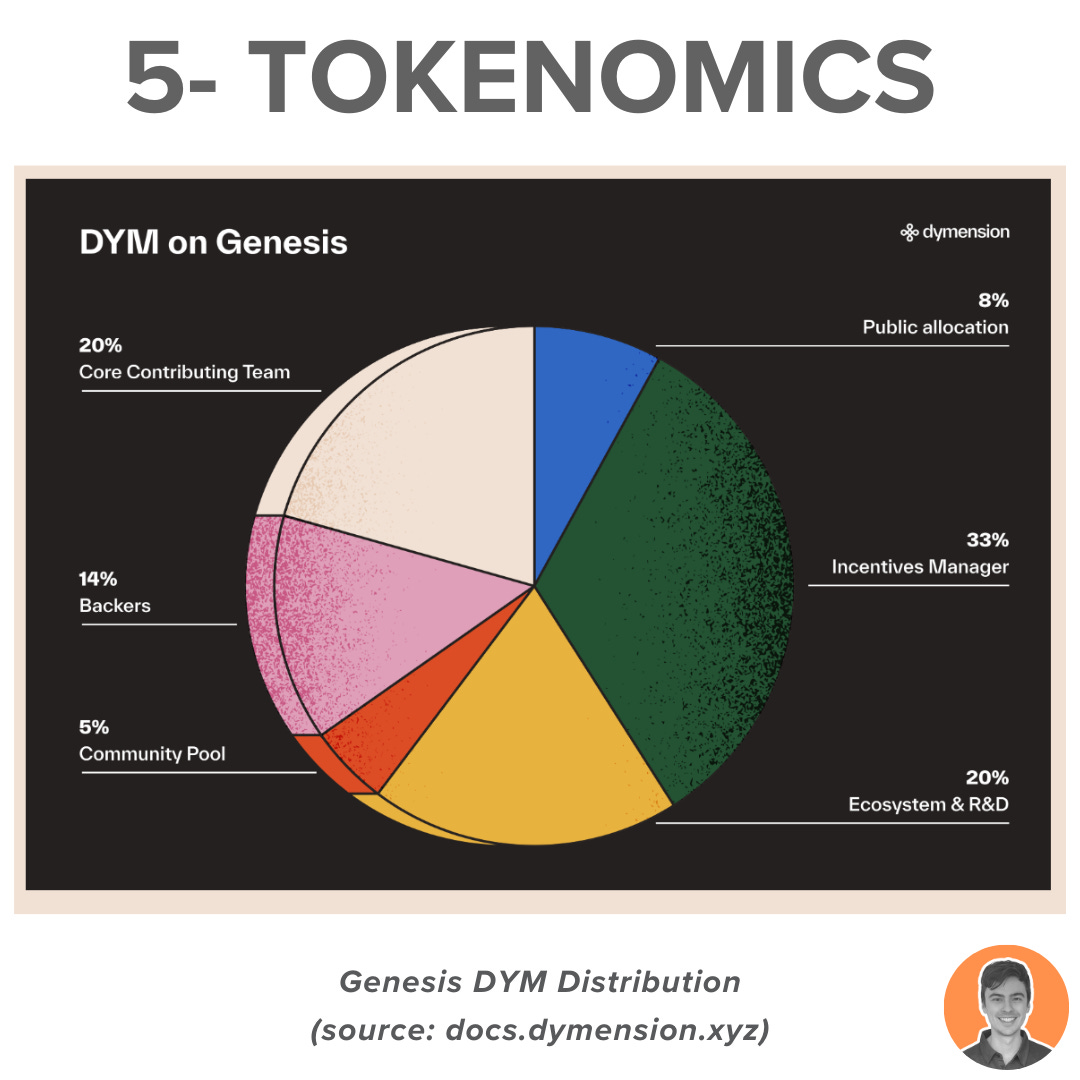

$DYM is the native token for Dymension used for governance, fees, and network security.

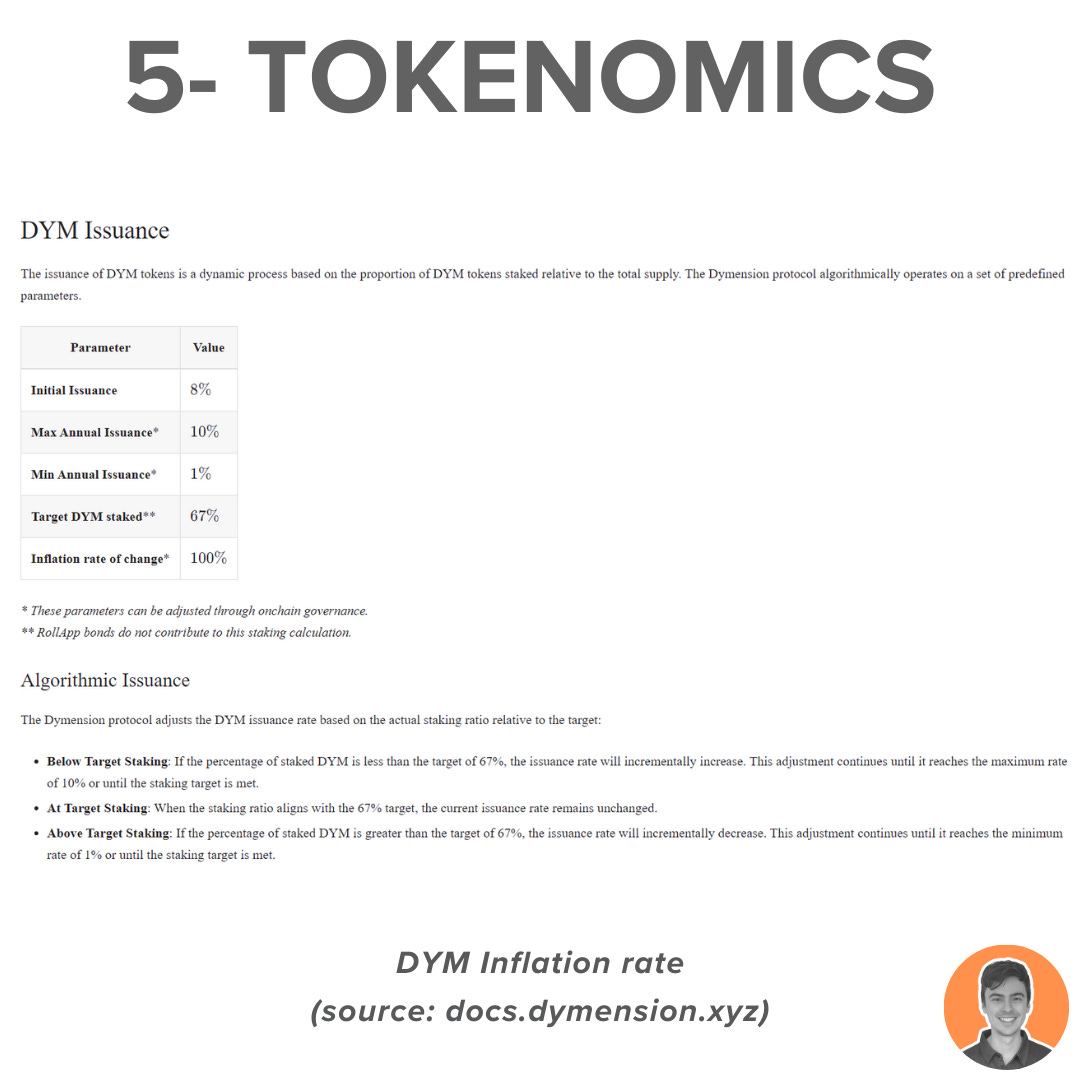

Issuance is based on staked DYM tokens compared to total supply:

Min Annual Issuance: 1%

Max Annual Issuance: 10%

Target staking ratio: 67%

The token inflation rate is based on the staking ratio:

Below Target: Issuance rate increases until it reaches 10% or the target is met.

At Target Staking: No change in issuance rate.

Above Target: Issuance rate decreases until it reaches 1% or the target is met.

7% of the $DYM supply was airdropped recently to users/stakers of Celestia, ETH L2s, Cosmos, Solana, and select NFT holders (Pudgy, Mad Lads etc.)

Current supply stats:

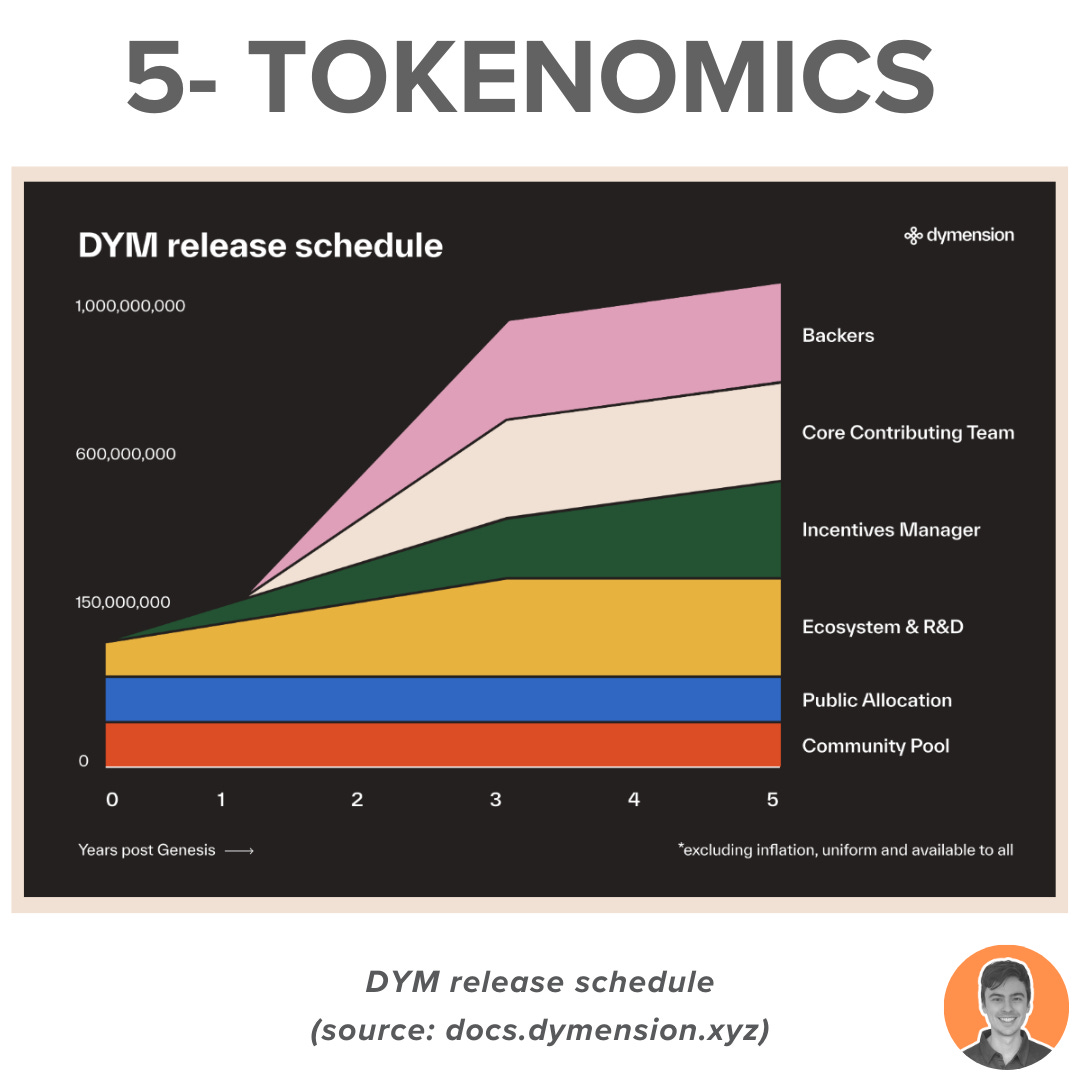

Circulating supply: 146m

Max supply: 1b

Market cap: $1.02b

FDV: $7b

Market cap/FDV: 15%

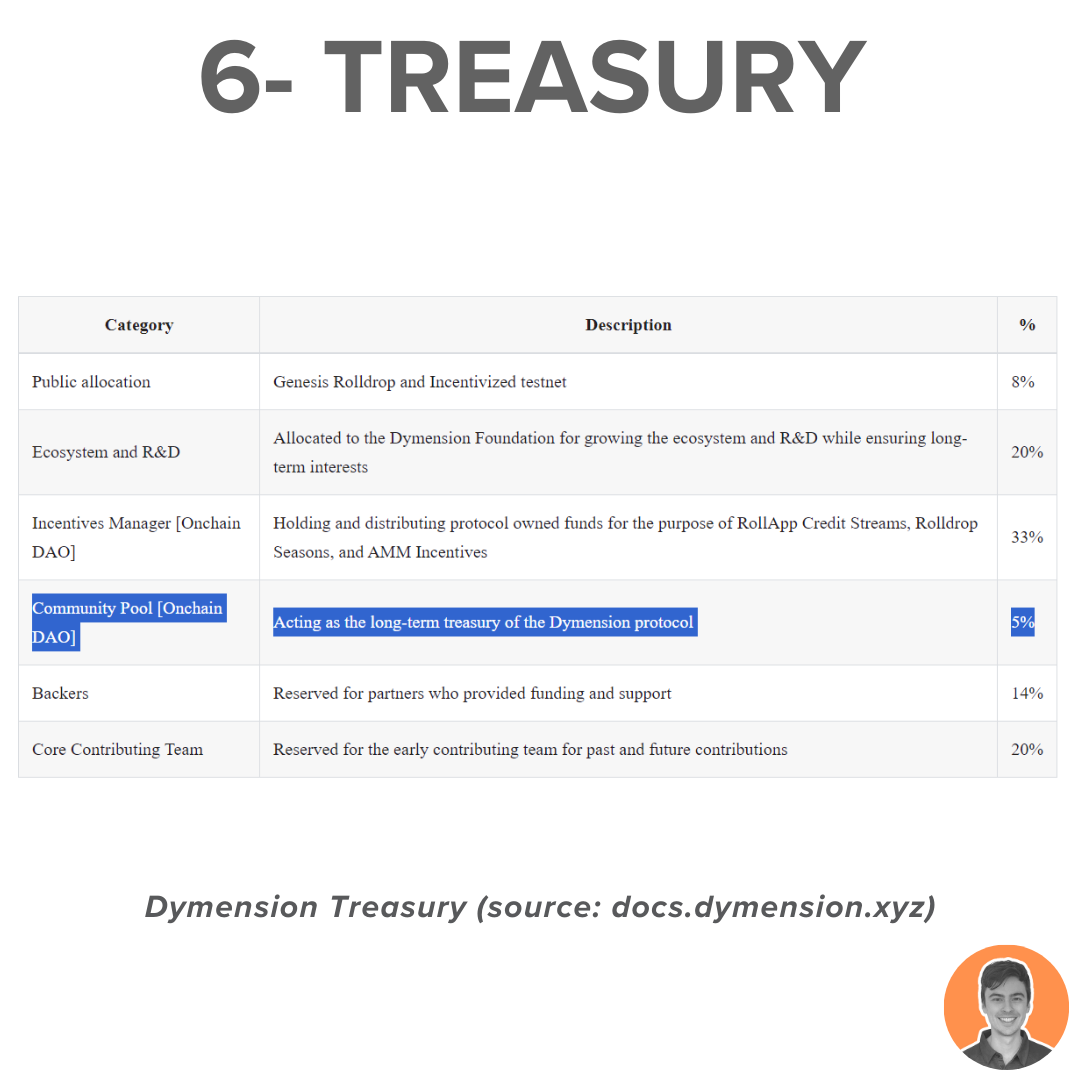

According to current valuations, the Dymension community pool (treasury) holds:

50m $DYM = 350m USD

These tokens were unlocked at genesis and are accessible to the DAO, but they are considered non-circulating supply. This provides the project with a substantial runway.

The first governance proposal has just passed and involves addressing some of the throughput and transaction issues on the chain due to high demand.

It is rumored that voting in these on-chain proposals will be a prerequisite for future airdrops to $DYM stakers.

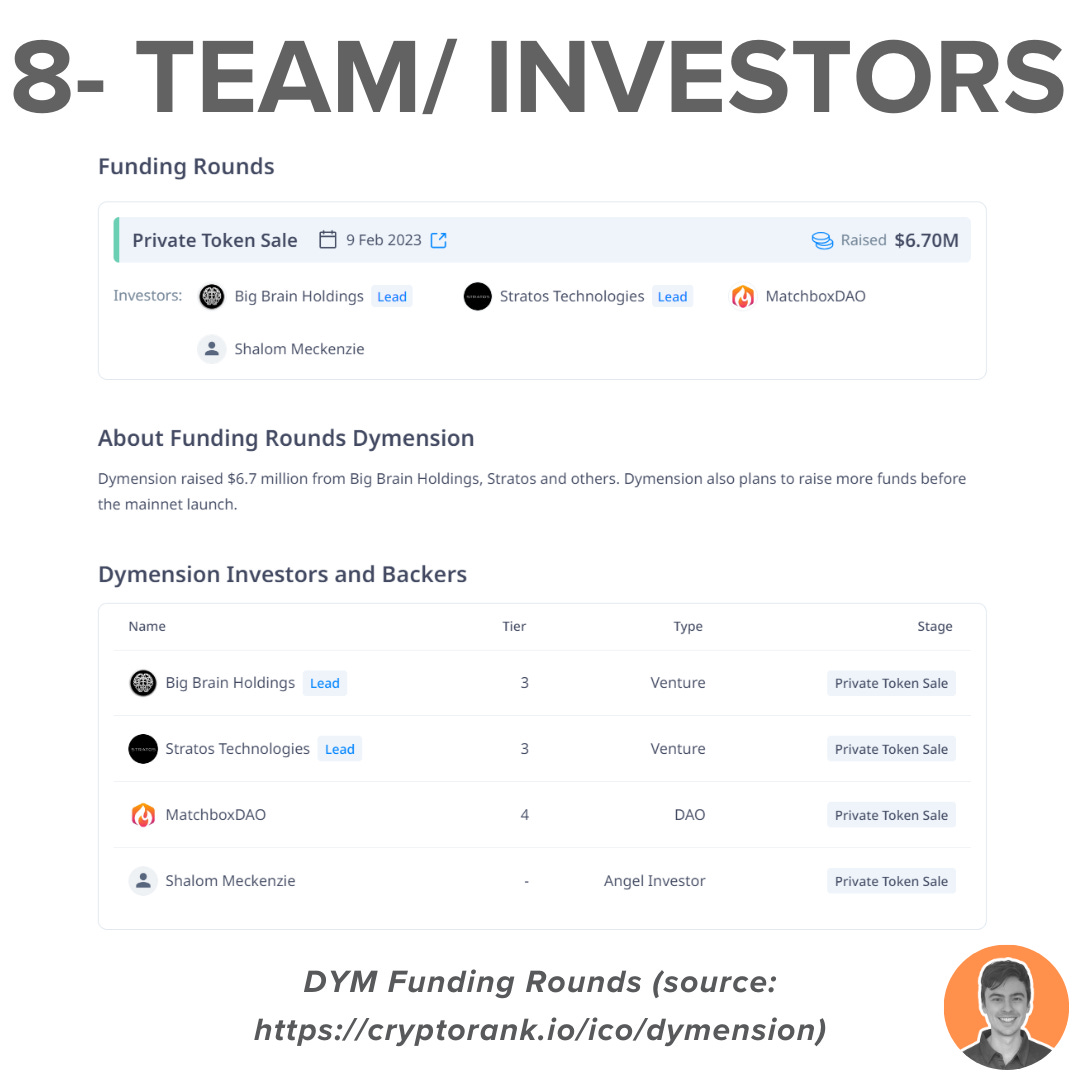

Dymension was founded in 2022 by Yishay Harel, Omri Dagan and Lior Zilpa.

In February 2023, Dymension raised $6.7m through a private token sale.

Investors included Big Brain Holdings, Stratos, Matchbox DAO and Shalom Meckenzie.

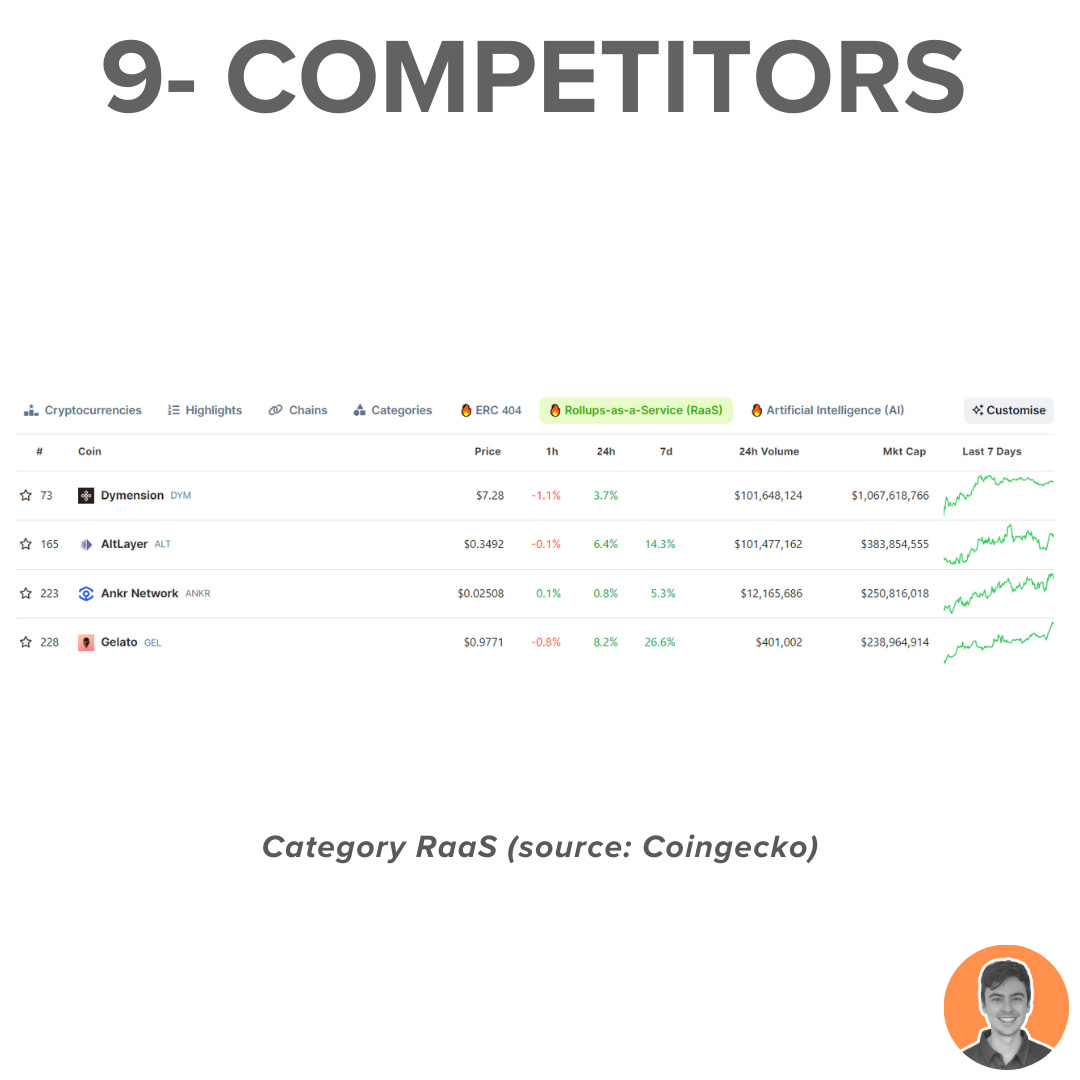

Dymension is part of a new wave of modular blockchain applications that are gaining rapidly in popularity. Some refer to it as "Rollups-as-a-Service"

While Celestia paved the way with their modular DA network, the two projects aren't really competing against each other.

CertiK security score: 70.88, top 20% of projects.

Main concern: no publicly available code audit or bug bounty in place yet.

Despite being relatively new, the project excels in community engagement, market potential, and operations.

The recent airdrop created huge amounts of hype around Dymension. However, looking past the short term noise, the fundamentals and potential are strong.

Upcoming catalysts:

Airdrops to stakers

RollApps on mainnet

Cosmos eco growth

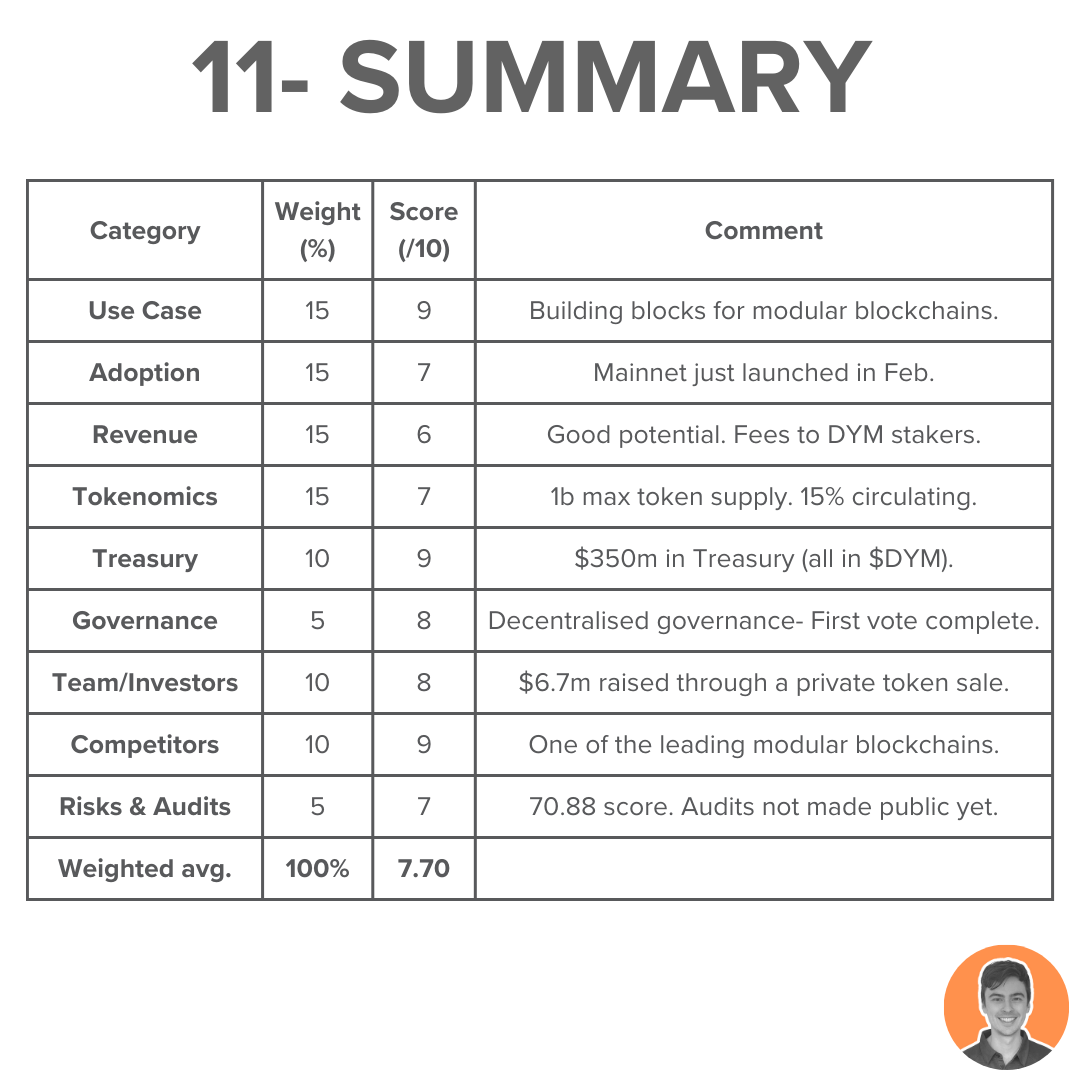

Overall weighted score = 7.70

Note: I am NOT an ambassador or advisor of Dymension. This is NFA.