The Google of Crypto

Chainlink

Discover why Chainlink is revolutionizing the industry, driving institutional adoption, and shaping the decentralized future.

Here's my October 2023 research report on LINK.

Here's what we'll cover in today's edition:

Overview

Use Case

Adoption

Revenue

Tokenomics

Treasury

Governance

Team & Investors

Competitors

Risks & Audits

Summary

Don't forget to bookmark this post for future reference.

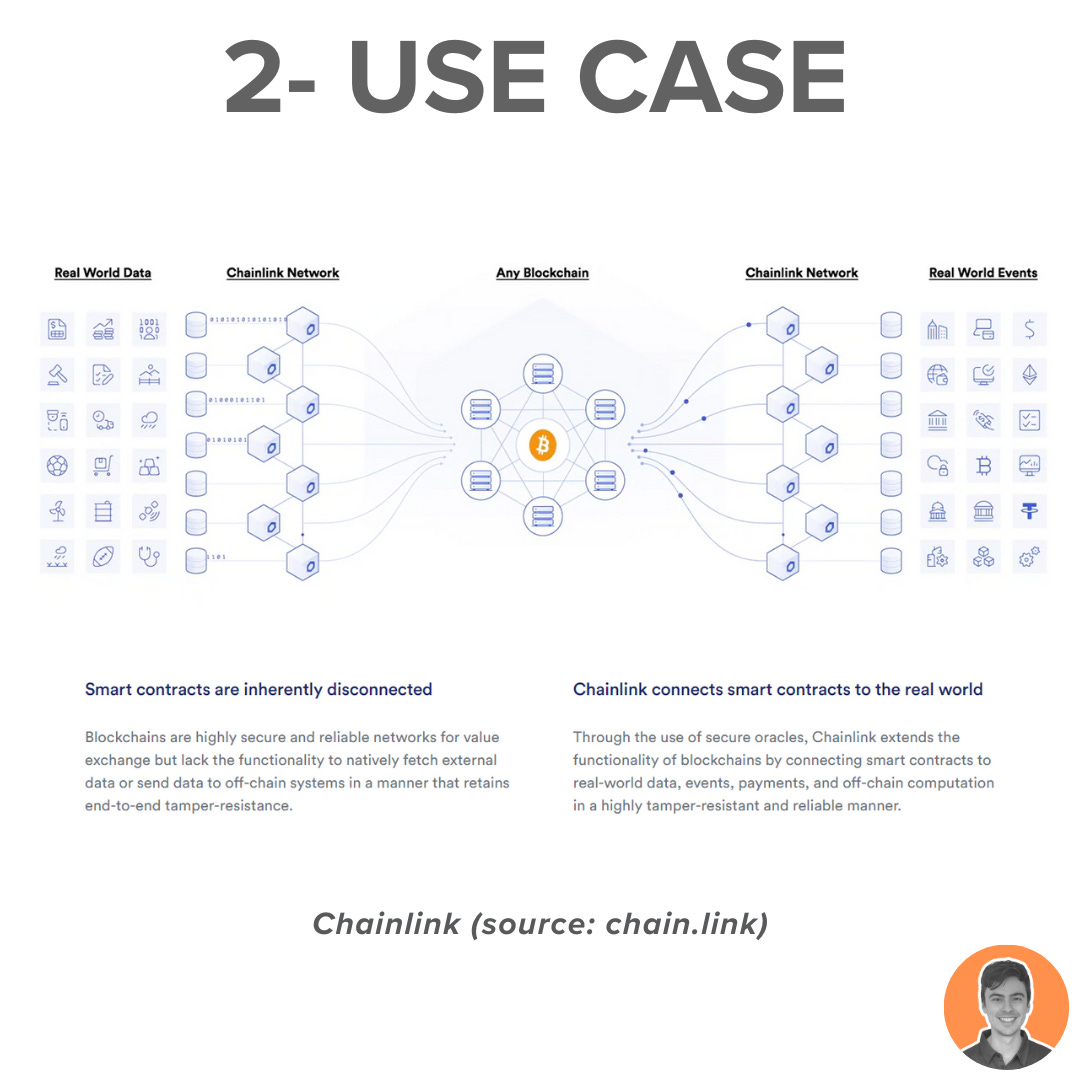

Chainlink is a decentralised oracle network that connects smart contracts to the real world.

It's infrastructure is widely adopted and used for:

Price feeds

Data feeds

Proof of reserves

Smart contract automation

Verifiable on-chain randomness (VRF)

Chainlink is widely utilized across various industries, including:

Financial services

DeFi

Gaming

NFT collectibles

Climate markets

Enterprise

Insurance

It is among a handful of crypto projects that are critical for a robust and decentralized future.

The launch of CCIP has been a game-changer for Chainlink, enabling seamless transfer of data and value between existing systems and both public and private blockchains.

The adoption of CCIP continues to surge:

Base chain

ANZ/ SWIFT

Vodafone

DTCC

Affine Pass NFTs

The current Total Value Secured (TVS) using Chainlink oracles stands at $11.3b (across 348 protocols).

Chainlink is the dominant and most widely used oracle, capturing over 46% of the market share.

Other notable oracles in the space include WINkLink, Chronical, Pyth, and TWAP.

Chainlink accrues fees and rewards through several methods:

CCIP

Keepers

Requests

VRF V1

VRF V2

In the past 30d, Chainlink has generated:

$180k in fees

$111k in revenue

This places it at the top among other oracles and 71st overall according to DeFiLlama.

The $LINK token is used within the network for the following components:

Node operator fees

Implicit staking

Explicit staking

The recently released Chainlink 2.0 aims to create a new era of growth through:

Chainlink Staking

BUILD Program

SCALE Program

These are the current supply stats:

Circulating supply = 556.8m

Max supply = 1b

Market cap = $6.1b

FDV = $10.9b

Market cap/ FDV = 0.56

Chainlink has allocated team tokens, which make up 30% of the total supply, to fund development.

Based on current prices:

$72m $LINK

$800m USD

According to DefiLlama, this would position it as the fifth largest in terms of Treasury value.

A substantial war chest.

Governance is facilitated through validation, which monitors on-chain Oracle behavior and helps users choose oracles.

Chainlink products are also widely used by other DeFi projects to assist in their own decentralised governance.

The project was founded in 2014 by @SergeyNazarov and Steve Ellis.

Chainlink Labs has since expanded to employ over 400 individuals.

To date, the project has successfully raised $32M in funding through four rounds.

Chainlink is the market-leading oracle solution, enjoying a significant first-mover advantage and dominant market share (46% of TVS).

Considering the team's continuous growth and ecosystem development, I don't anticipate this changing anytime soon.

The codebase and smart contracts have undergone multiple audits throughout the years.

As per the CRC, Chainlink has been assigned a 2/5 rating in its securities framework.

A score of 1/5 indicates that it is least likely to be considered a security under the Howey test.

Overall, I am very bullish on $LINK and the Chainlink protocol.

There are a number of upcoming bullish catalysts:

CCIP

Chainlink staking

Economics 2.0

Institutional adoption

Ecosystem expanding

Market conditions improving

Overall weighted score = 8.78

Note: I am NOT an ambassador or advisor of Chainlink. This is NFA.