SEI: The Decentralized Robinhood Exchange in the Making.

Lightning-fast transactions, parallelized EVMs—this is the future of trading.

Don't miss my January 2024 research report on SEI.

Here's what we'll cover in today's edition:

Overview

Use Case

Adoption

Revenue

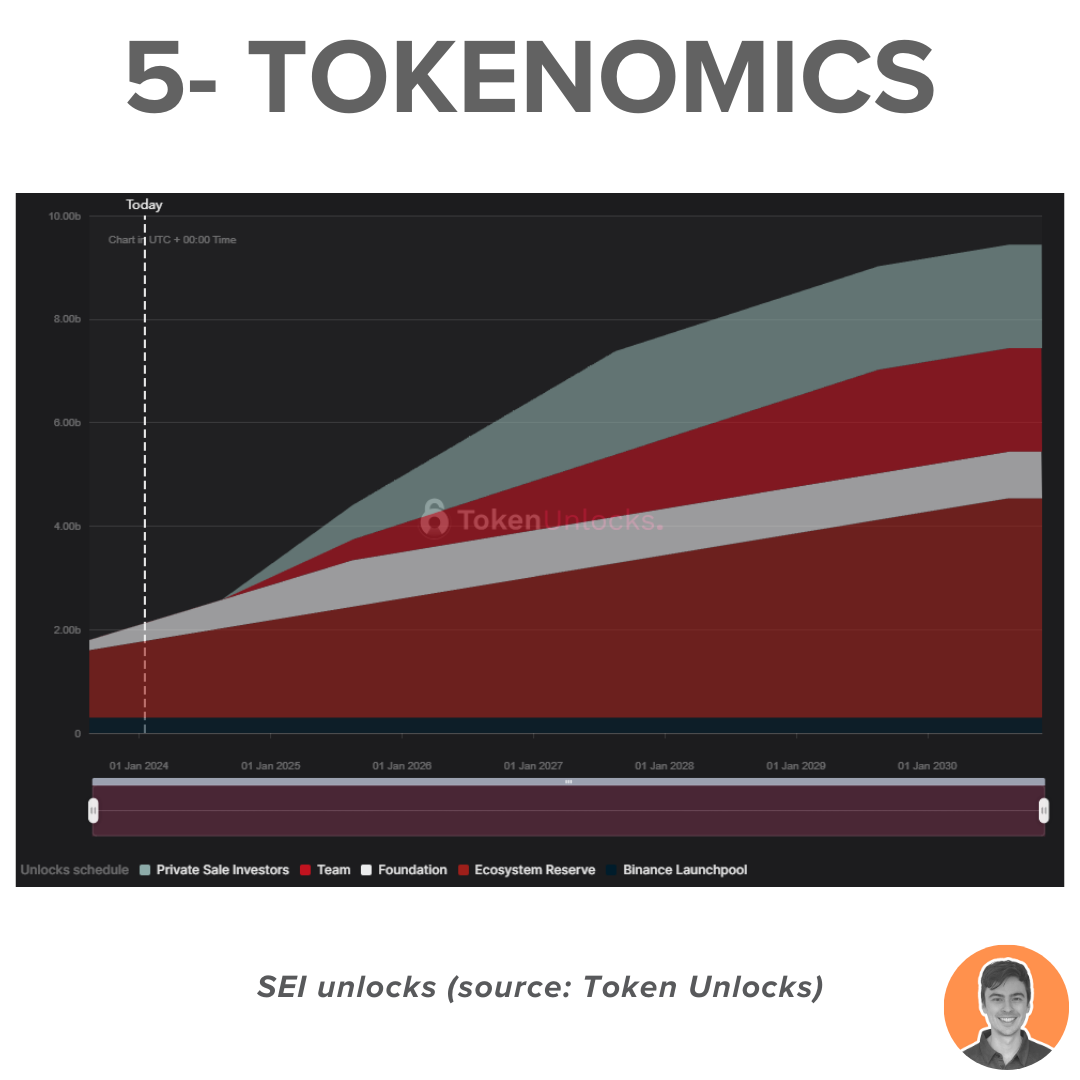

Tokenomics

Treasury

Governance

Team & Investors

Competitors

Risks & Audits

Summary

Sei is a Layer 1 blockchain designed specifically for trading digital assets across:

Gaming, Social, NFTs & DeFi.

It claims to be the fastest blockchain in the industry, with 380 ms transaction finality and was built using the Cosmos SDK.

Exchanges built on current Layer 1s face significant scaling issues.

The exchange trilemma: they can't achieve decentralization, scalability, and capital efficiency at the same time.

Sei solves the problem of exchange scalability with a specialized Layer 1 for trading.

By optimizing each layer, Sei provides exceptional infrastructure for digital asset exchange.

Sei offers:

Fastest chain to finality

Twin-turbo consensus

Market-based parallelization

Native matching engine

Frontrunning protection

The TVL on Sei currently stands at $11.4m, which is relatively low considering the project's market cap. However, Sei is a relatively new project/chain, with its Mainnet going live in August '23.

As the ecosystem continues to grow, I anticipate significant inflows into TVL.

The $SEI token captures revenue/fees in multiple ways:

Transaction fees on the Sei blockchain.

Tip validators for prioritized transactions.

Trading fees on exchanges built on the Sei blockchain.

Staking your $SEI with one of the validators can earn around 4.59% APR.

Sei operates as a decentralized “Proof of Stake” blockchain, powered by the $SEI token which has several functions:

Network Fees

DPoS Validator Staking

Governance

Native Collateral

Fee markets

Trading Fees

Total supply of SEI is capped at 10b tokens.

Around 3% of $SEI tokens were airdropped to early users of the chain from Solana, Ethereum, Arbitrum, Polygon, Binance Smart Chain & Osmosis.

Current supply stats:

Circulating supply: 2.425b

Max supply: 10b

Market cap: $1.9b

FDV: $7.8b

Market cap/FDV: 0.24

According to the token distribution, 9% of tokens were allocated to the Sei Foundation Treasury.

At today's value, that amounts to 900m $SEI, which is equivalent to $700m.

This provides the project with a substantial runway.

The SEI network is secured by over 39 active validators, ensuring accuracy through Sei's Twin Turbo Consensus mechanism.

Token holders can participate in governance by submitting on-chain transactions. However, a formal governance process has not yet been fully detailed.

Sei was founded in 2022 by Jay Jog @jayendra_jog (ex Robinhood) and Jeff Feng @jeffdfeng (ex Goldman).

Over the years, it has raised over $85m from various funding rounds.

Prominent investors include Multicoin Capital, Coinbase ventures, Jump Crypto & Delphi Digital.

Several projects are competing against Sei to build the best Layer 1 for trading. These projects include Aptos, Injective, Kujira, Sei, Sui, and Solana.

However, Sei stands out as a strong competitor, boasting incredibly fast transaction speeds and a rapidly growing ecosystem.

Sei was audited by CertiK in July of 2023. 1 critical risk was identified and resolved and 4 major risks acknowledged.

CertiK has given Sei a security score of 90.39, putting it in the top 10% of protocols they have surveyed.

Lowest scores in governance & fundamental health.

Sei has attracted a huge amount of attention and has some impressive tech. A lot of potential for this project.

Upcoming catalysts:

Sei v2- Parallelized EVM Blockchain

$120m SEI ecosystem fund

Sei Launchpad Program

Tokenized RWAs

Overall weighted score = 7.70

Note: I am NOT an ambassador or advisor of Sei. This is NFA.