The Solana ecosystem is buzzing with the hottest developments in DeFi.

And guess what? It might have just unleashed a project that could take down Chainlink.

Here's my January 2024 research report on PYTH.

Here's what we'll cover in today's edition:

Overview

Use Case

Adoption

Revenue

Tokenomics

Treasury

Governance

Team & Investors

Competitors

Risks & Audits

Summary

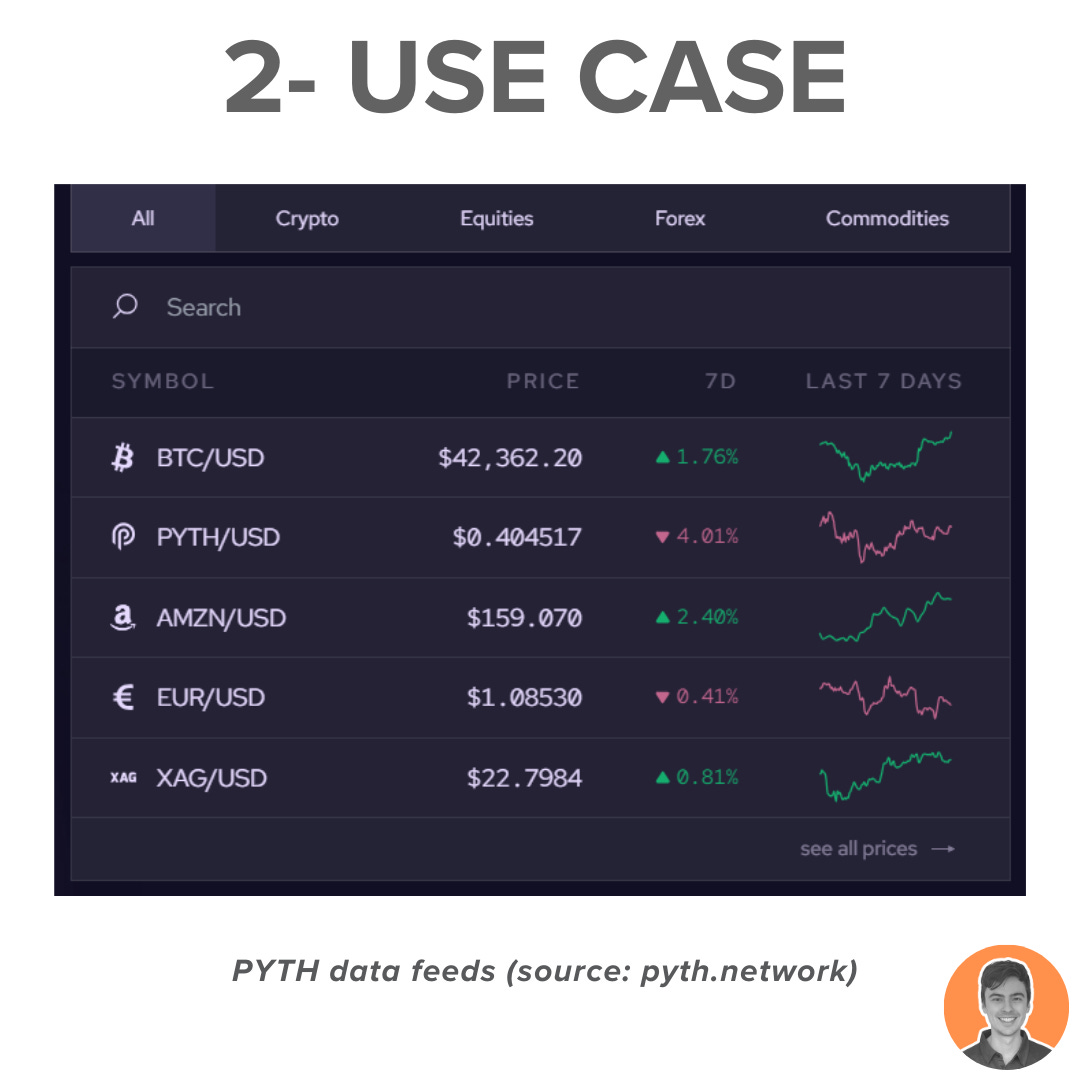

The Pyth Network is currently the largest and fastest-growing first-party oracle network. It offers real-time market data to financial dApps across more than 45 blockchains, providing over 400 low-latency price feeds for:

Cryptocurrencies

Equities

Forex

Commodities

In traditional markets, price feeds are typically owned and controlled by a limited number of centralized entities.

Decentralized price oracles play a vital role in the world of cryptocurrency. They provide accurate price information that is accessible to anyone.

But Pyth network isn't just the Chainlink of Solana, it's much more.

Pyth offers:

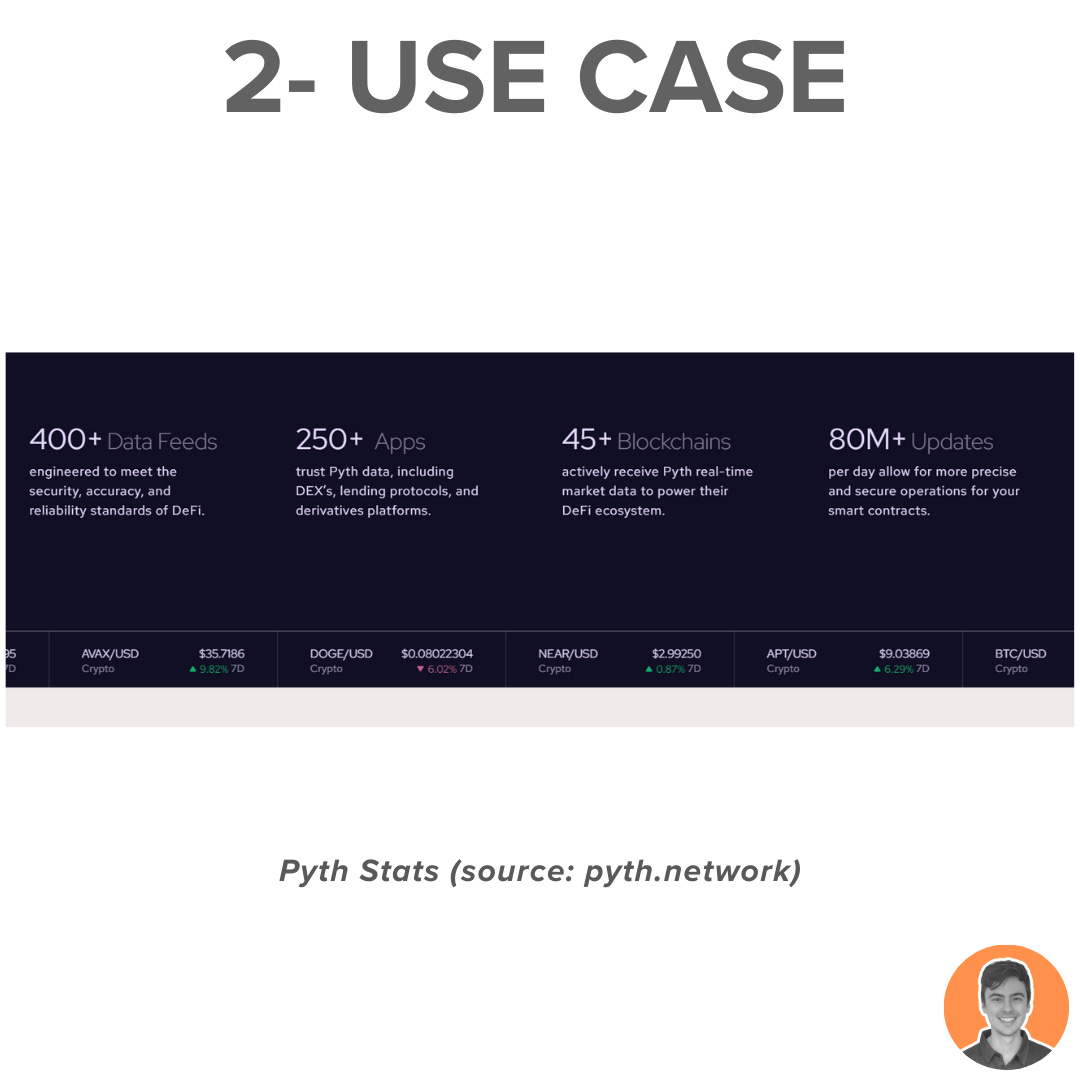

Pyth oracle prices update every 400ms

200k updates per day

449 price feeds

250+ Apps

45+Blockchains

80M+Updates per day

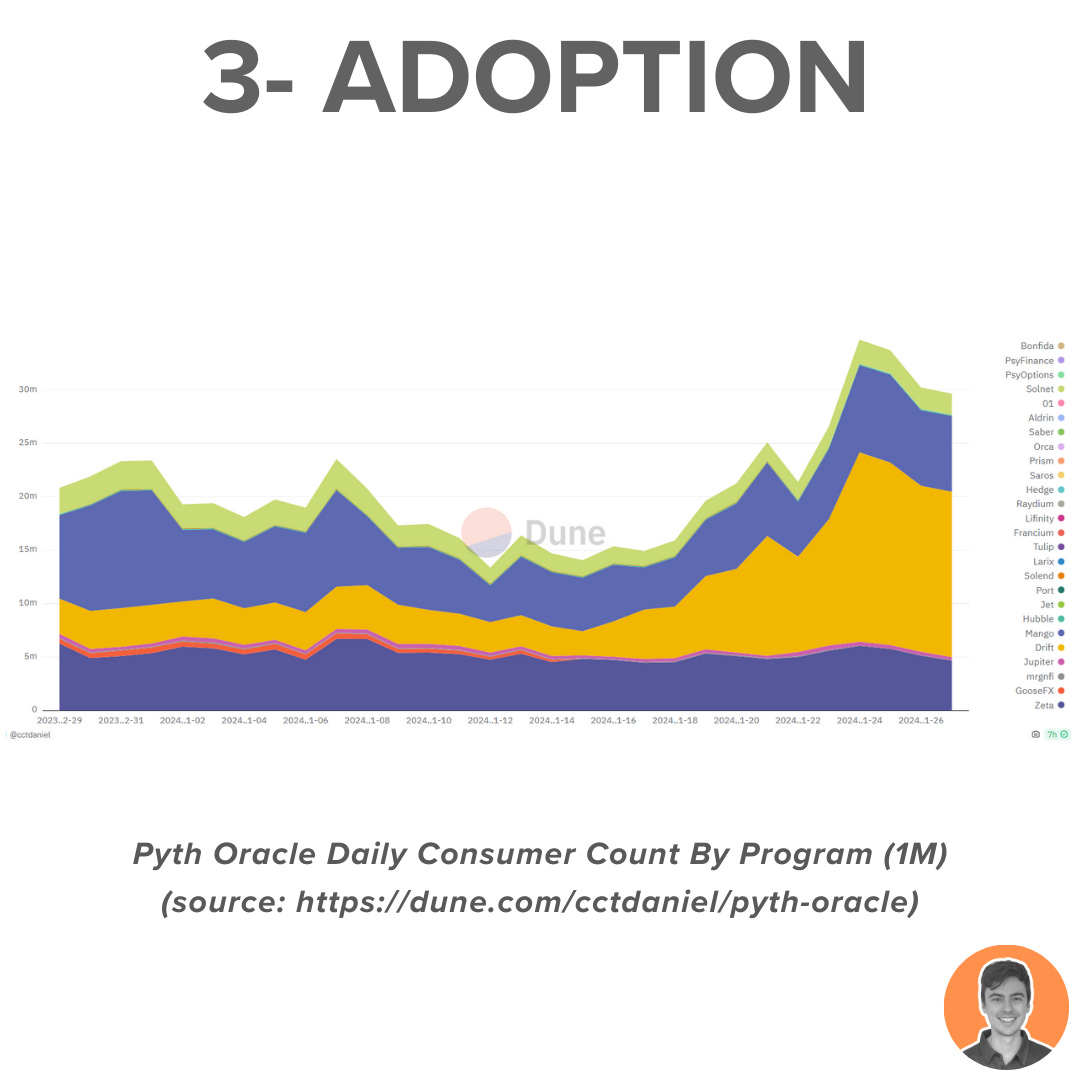

Pyth Network has been gaining in popularity at a rapid rate. Here are some impressive stats over the past 24hrs:

40m Publisher Price Updates

5.5m Publisher Price Update Transactions

118 Daily Active Consumers

70k Daily active users

2.6m Daily User Interactions

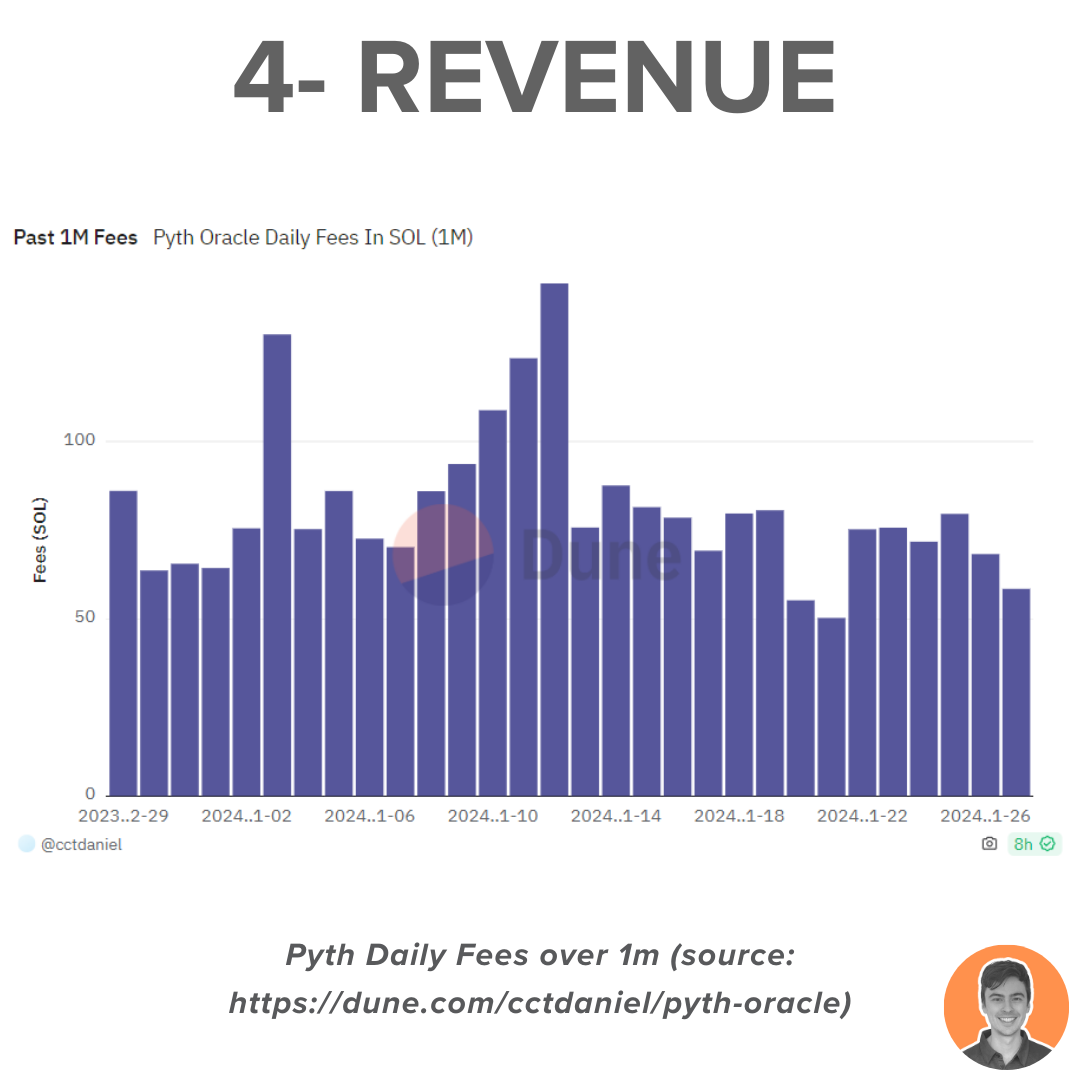

Consumers are required to pay fees to access the data through the protocol. These fees are charged at a fixed rate per Pyth price update on a target chain.

For the past month, the protocol fees have remained consistently in the range of 50-80 SOL.

$4.8k - $7.6k per day.

$PYTH is the governance token of the Pyth Network. Holders of the token can vote on update proposals for the protocol.

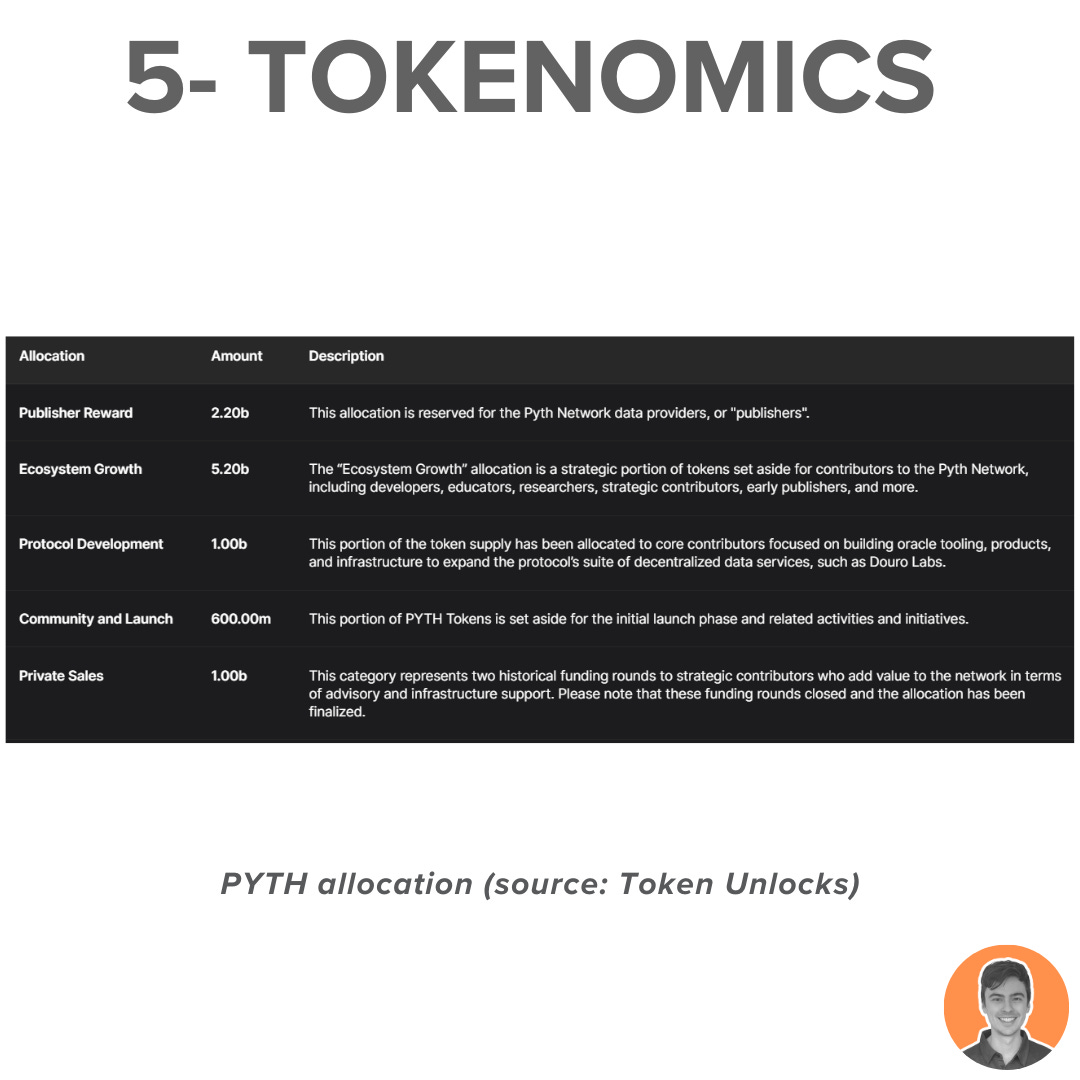

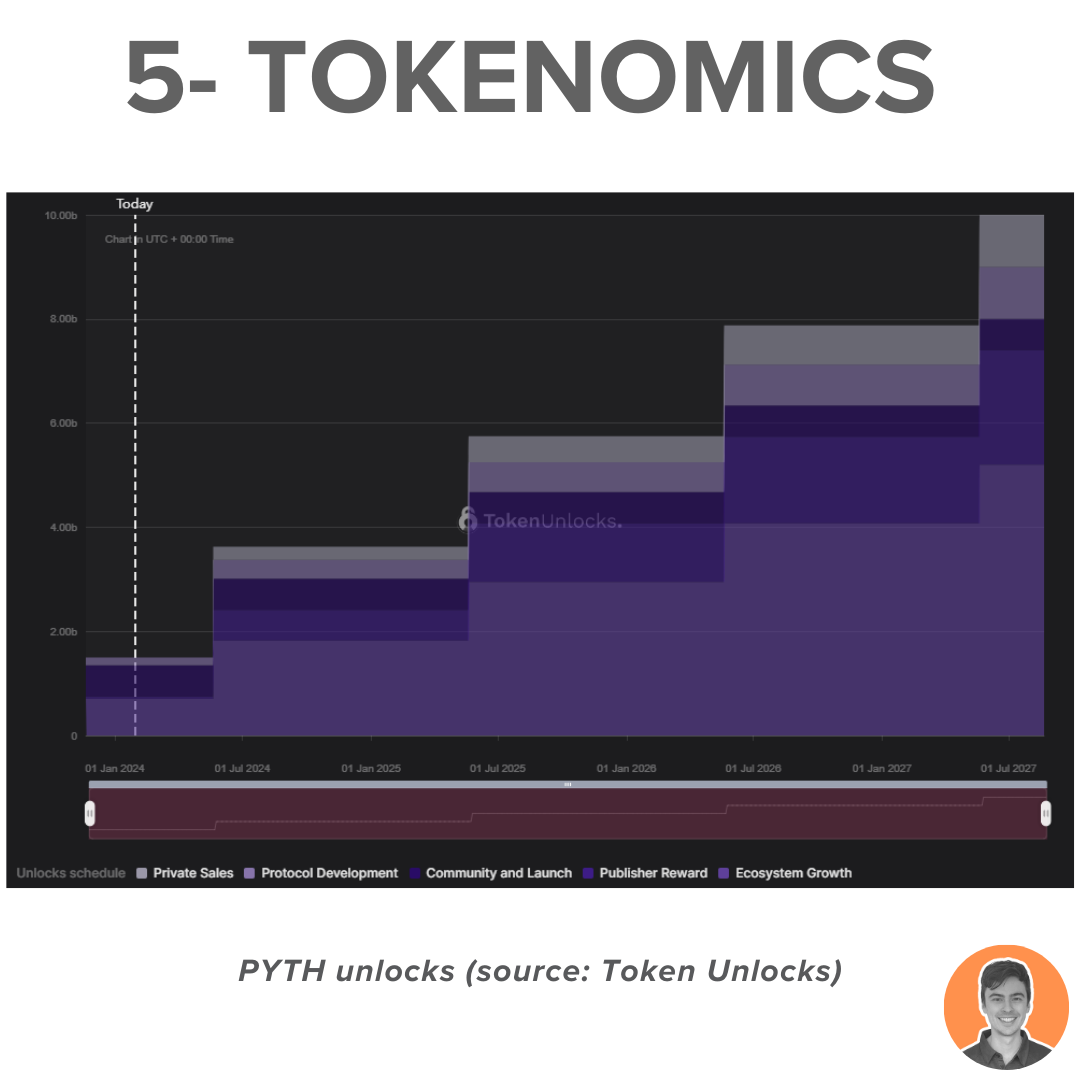

52% of the supply is earmarked for the "Ecosystem Growth", followed by 22% for publisher rewards and 10% for both Private Sales and Protocol Development.

In Nov 2023, Pyth Network airdropped 6% of supply to network users and community members. Rumors are rampant about future airdrops to PYTH stakers.

Current supply stats:

Circulating supply: 1.5b

Max supply: 10b

Market cap: $580m

FDV: $3.87b

Market cap/FDV: 15%

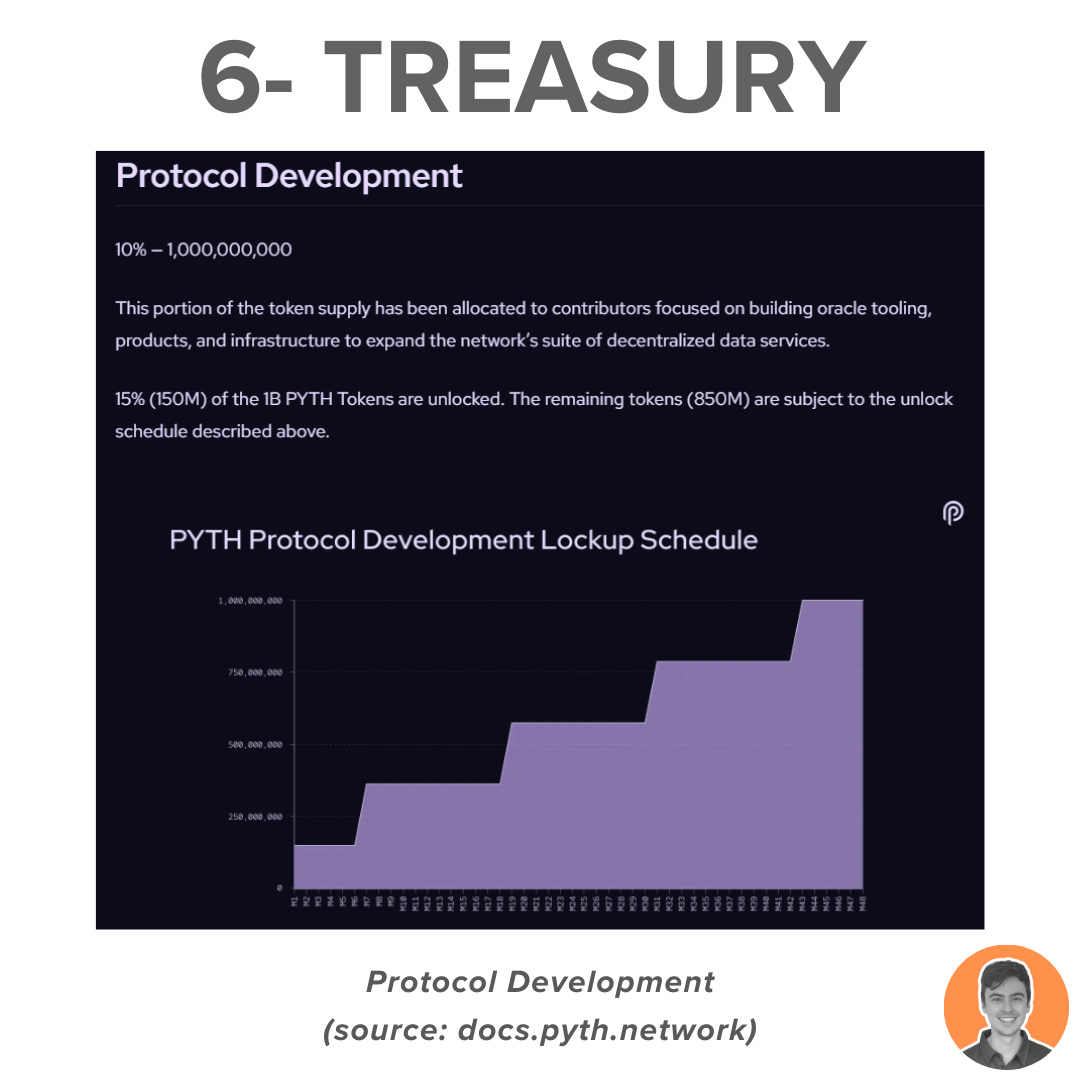

The Pyth network doesn't have a Treasury, but it allocated 1b $PYTH tokens for 'Protocol Development'. 15% are currently unlocked, with the rest to be fully vested by 2027.

Current value = $385m USD.

Impressive runway for a newly launched protocol.

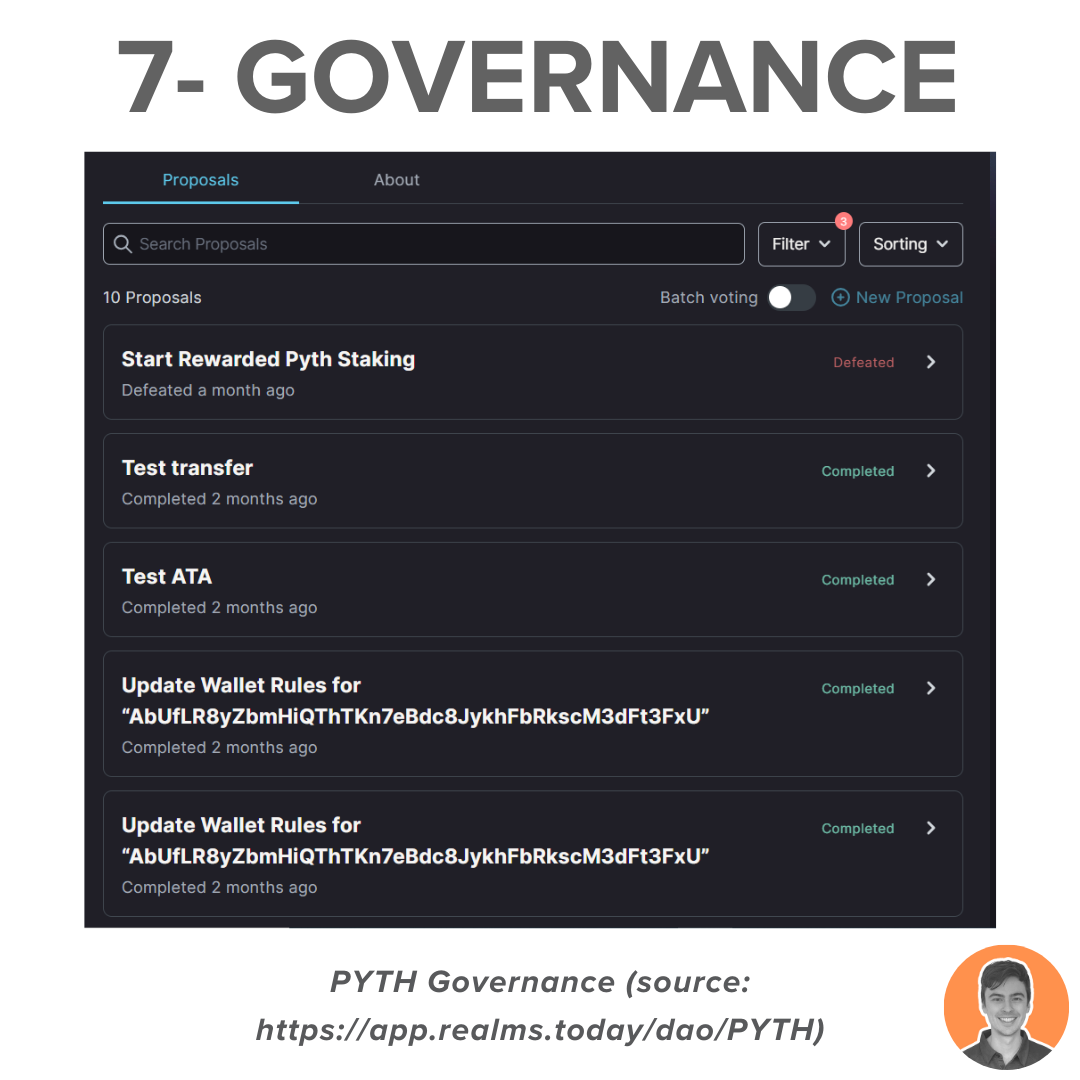

A decentralized governance process has been setup with 10 proposals already voted on. Proposals can relate to:

Size of update fees

Reward distribution mechanism

Approve software updates

Listed price feeds

Choose the publishers to provide data for each price feed

Pyth was incubated by Jump Crypto in 2021. It became independent with Duoro Labs who are now solely focused on developing the Pyth protocol.

Key contributors: Mike Cahill, Jayant Krishnamurthy & Ciarán Cronin.

Key investors: Multicoin Capital, Delphi Digital & Wintermute.

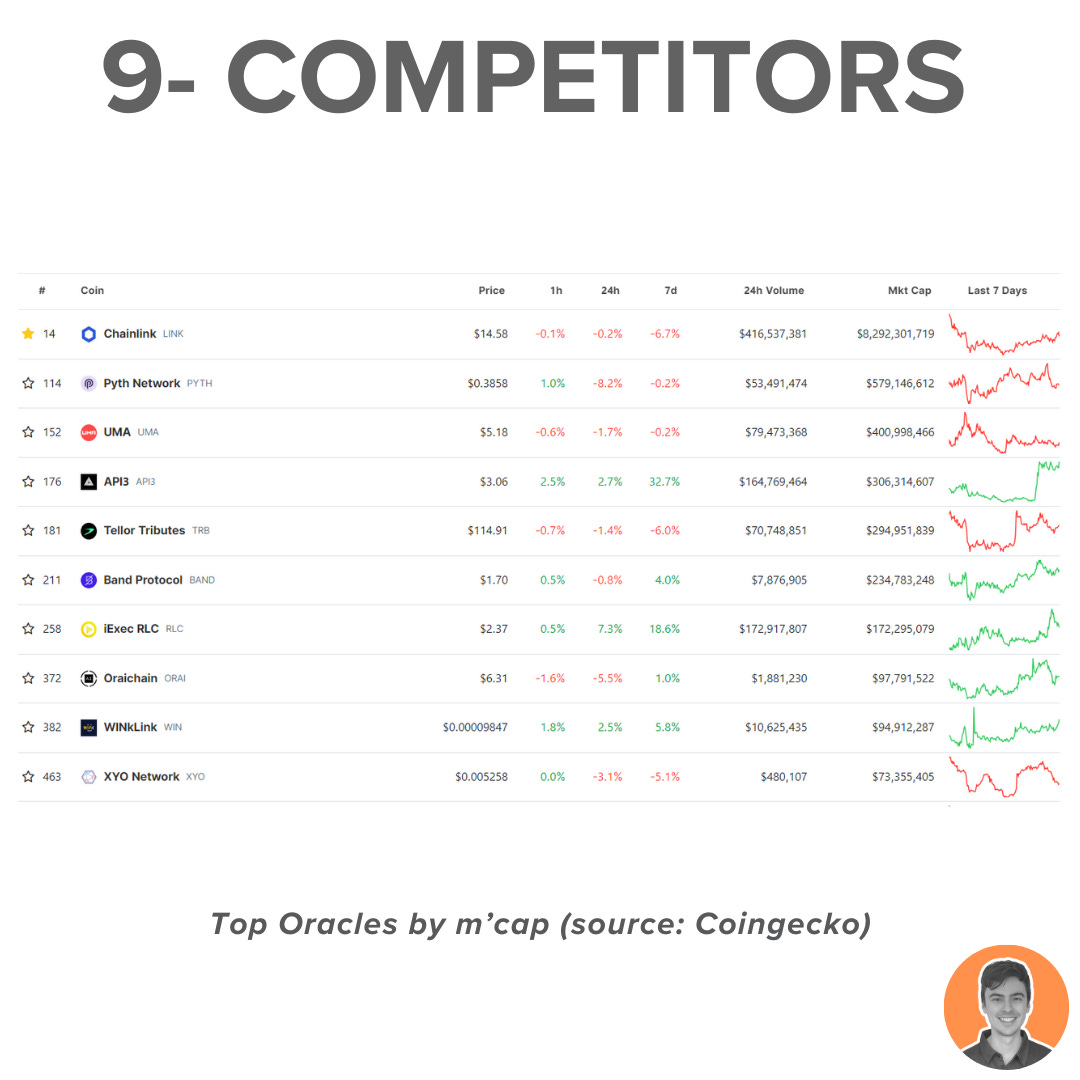

Chainlink is Pyth network's main competitor. It's the original oracle solution and has endured over 6 years and multiple bear markets.

While I love Chainlink, there's space for other competitors in the Oracle market and Pyth is well-positioned to take a piece of the pie.

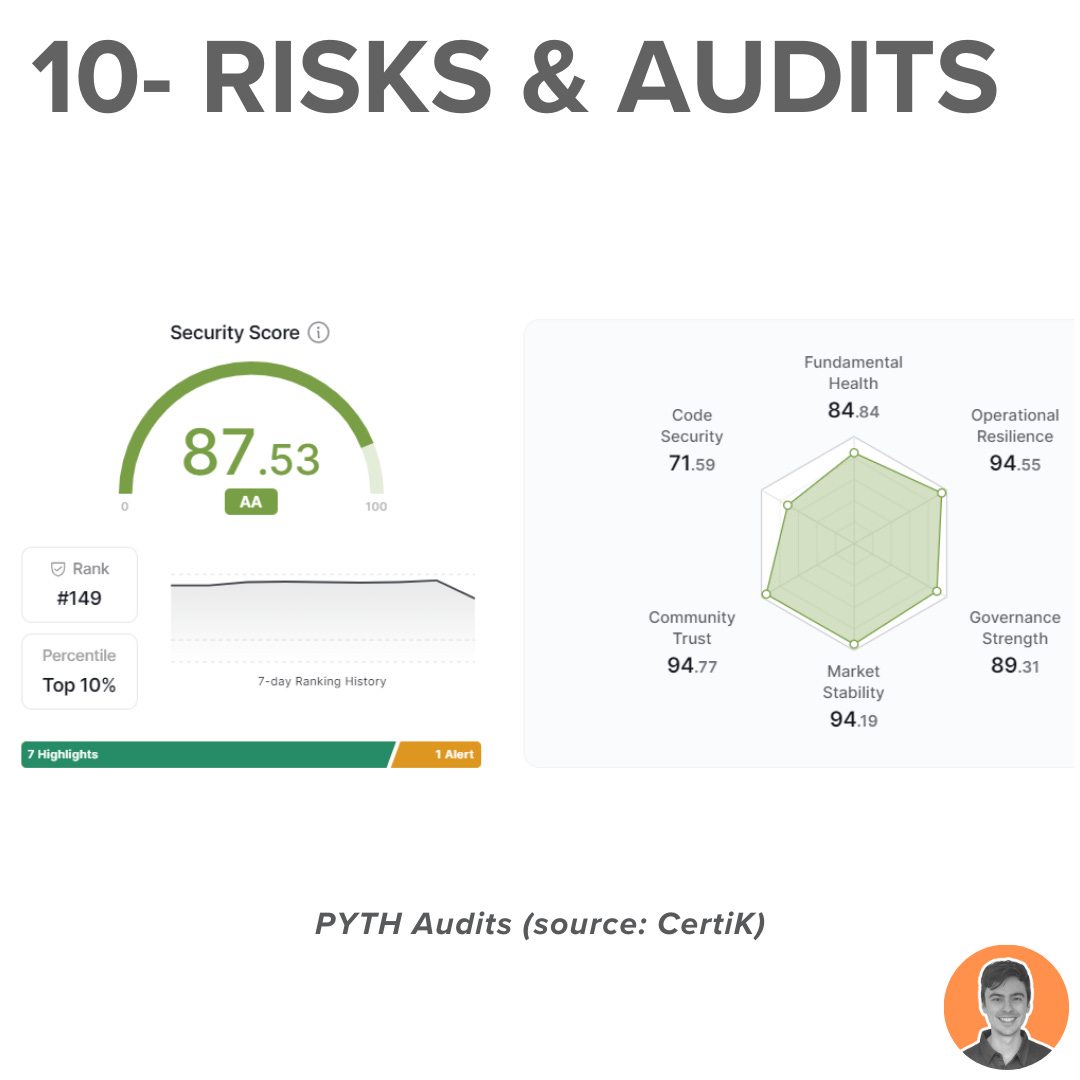

The Pyth software has undergone a number of audits from different firms and there's a bug bounty program up to $500k.

CertiK has given Pyth a security score of 87.53, putting it in the top 10% of protocols they have surveyed.

Lowest scores in fundamental health & code security.

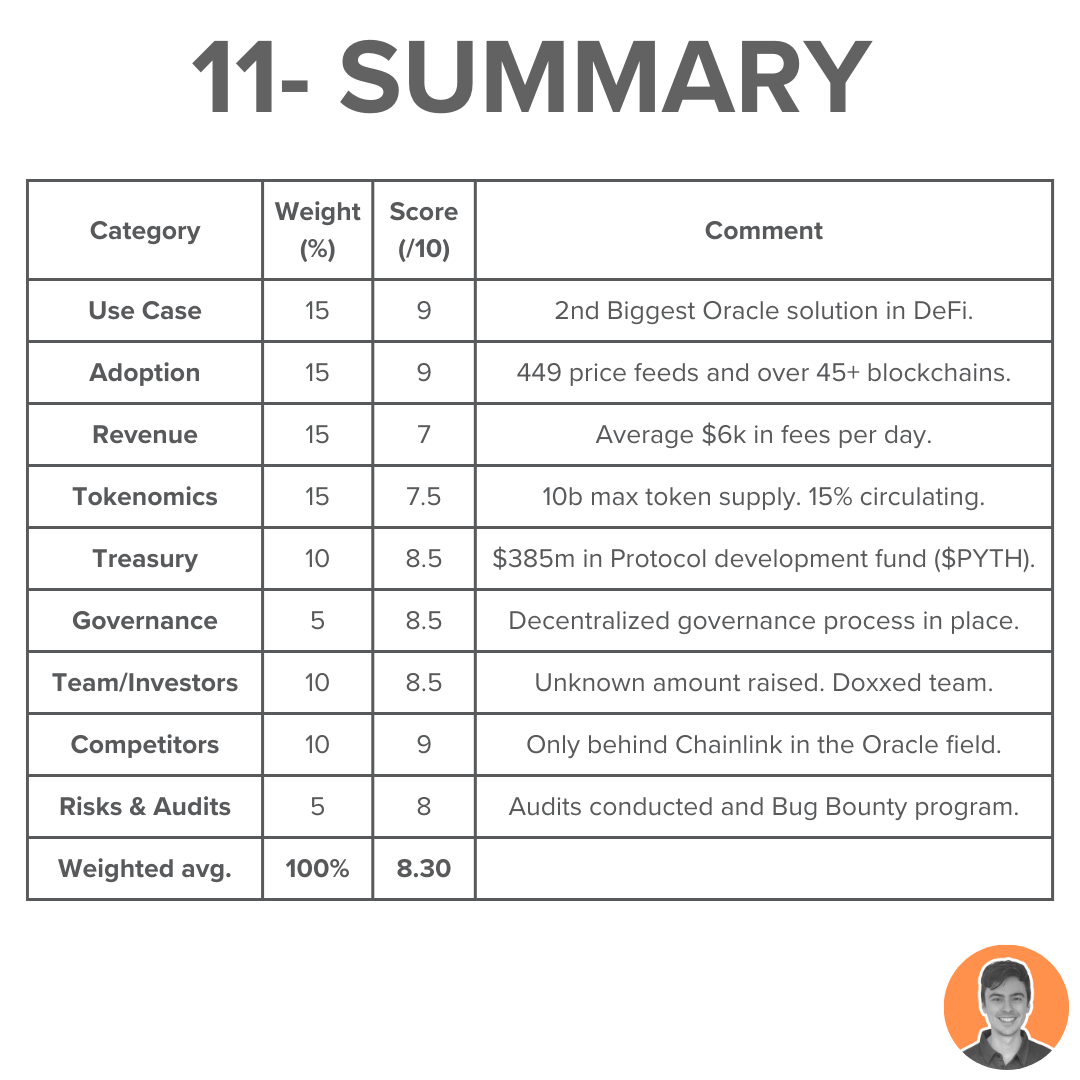

While I still think Chainlink is the no. 1 Oracle solution, I think Pyth has enormous potential. Definitely one to watch closely.

Upcoming catalysts:

Airdrop rumors for $PYTH staking

Increase in tokenization of assets

Solana eco growth

Overall weighted score = 8.30

Note: I am NOT an ambassador or advisor of Pyth. This is NFA.

Awesome as always !

Compare FDV vs Chainlink. I think that this project is overpriced now. Tocenomics also not good.