Pendle- Deep Dive

October 2023

Billions of dollars will flow into crypto through real-world assets.

Pendle is well-positioned to seize this opportunity with the launch of their first two RWA products.

Here's everything you need to know about Pendle.

Here's what we'll cover in today's edition:

Overview

Use Case

Adoption

Revenue

Tokenomics

Treasury

Governance

Team & Investors

Competitors

Risks & Audits

Summary

Pendle is a decentralised yield-trading protocol where users can execute various yield-management strategies.

Pendle allows users to:

Optimise their yield

Earn fixed yield or long yield

Provide liquidity with stETH

Adapt to market conditions through hedging

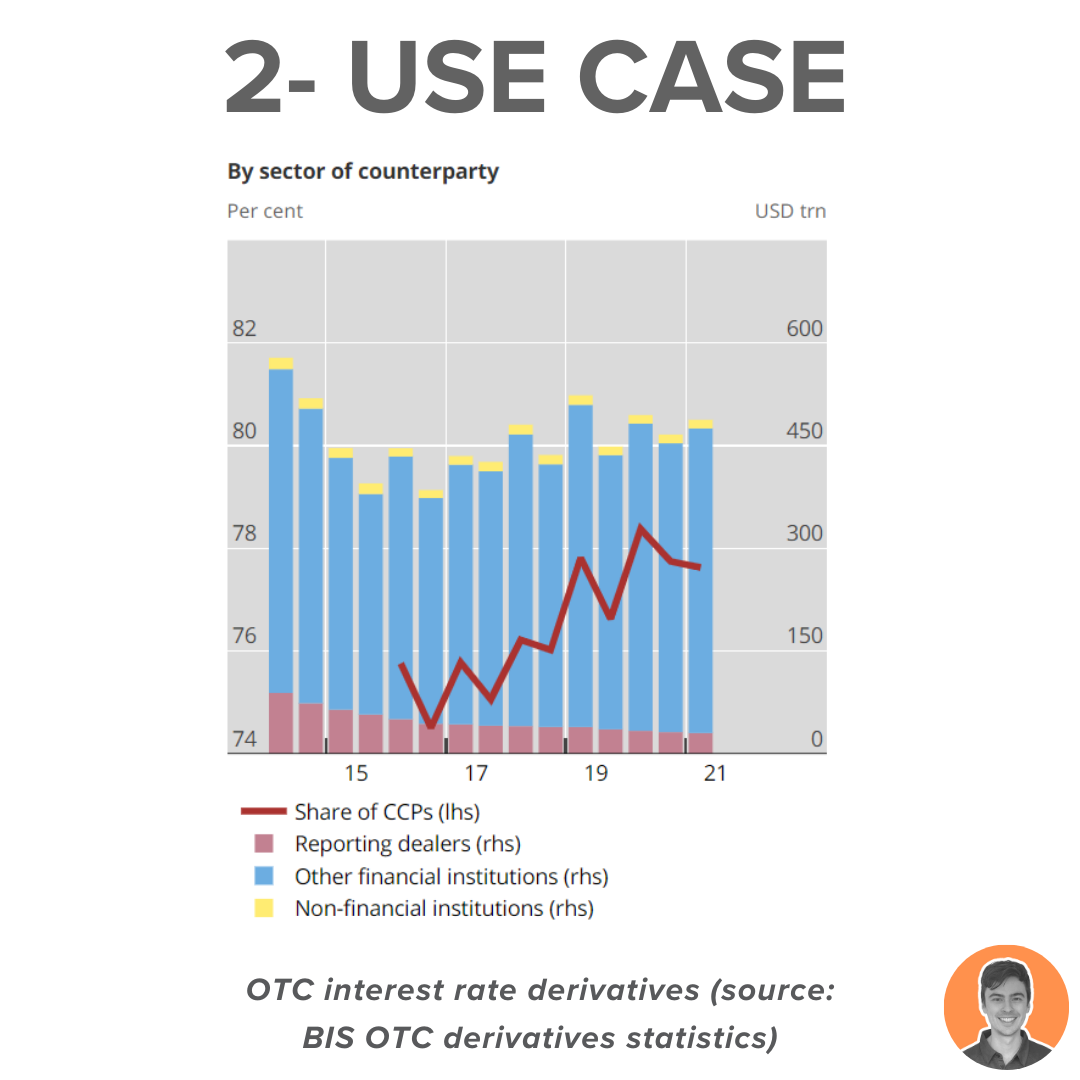

The interest derivatives market in Traditional Finance is valued at over $400 trillion in notional value.

Pendle's goal is to bring this market on-chain and into the world of DeFi.

This will enable accessibility for all investors, regardless of their size and standing.

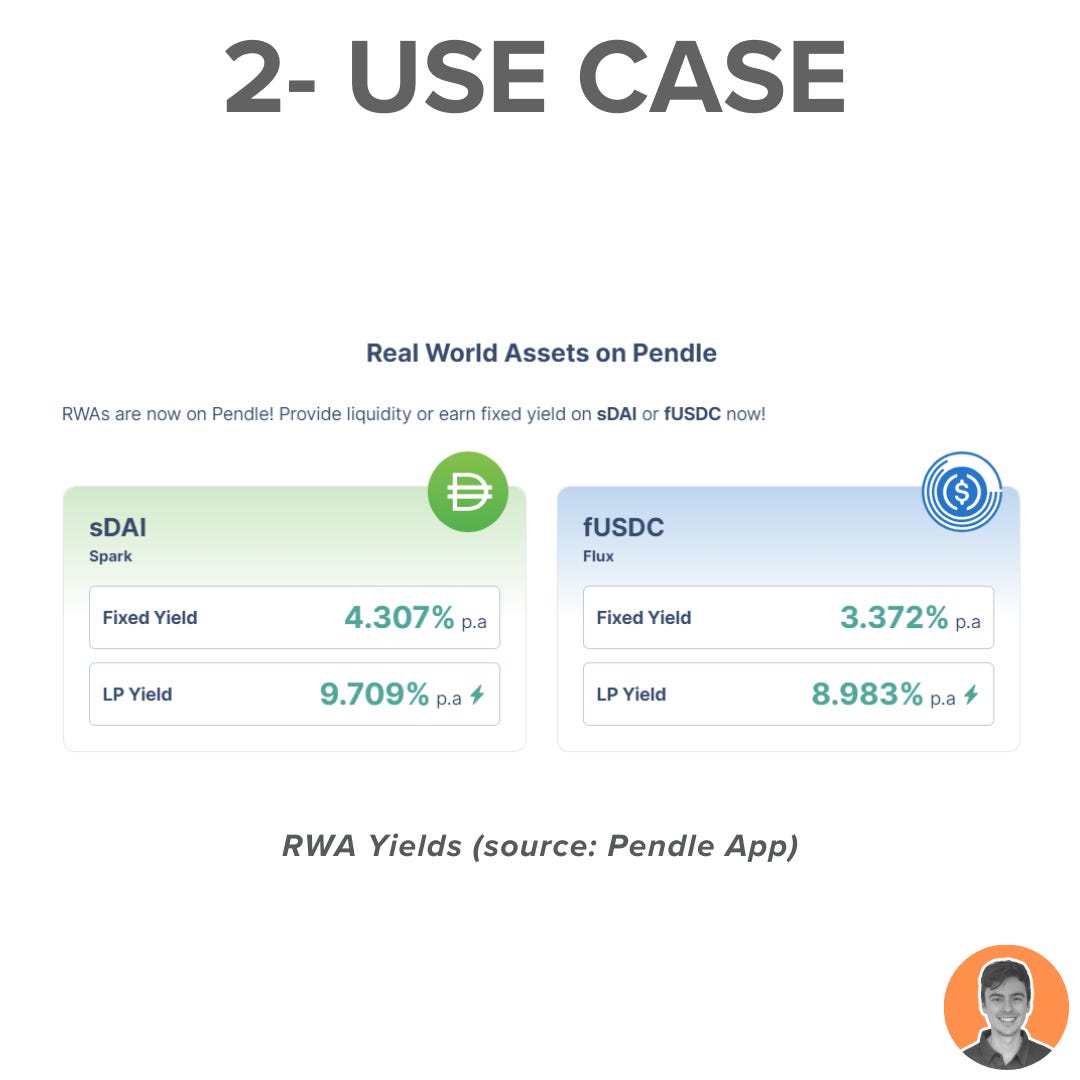

In September, Pendle expanded their product offering to include Real World Assets.

Their initial listings include:

FluxDeFi fUSDC (a tokenized T-Bill product)

MakerDAO / spark_protocol_ sDAI (ERC-4626 representation of DAI in the Dai Savings Rate module)

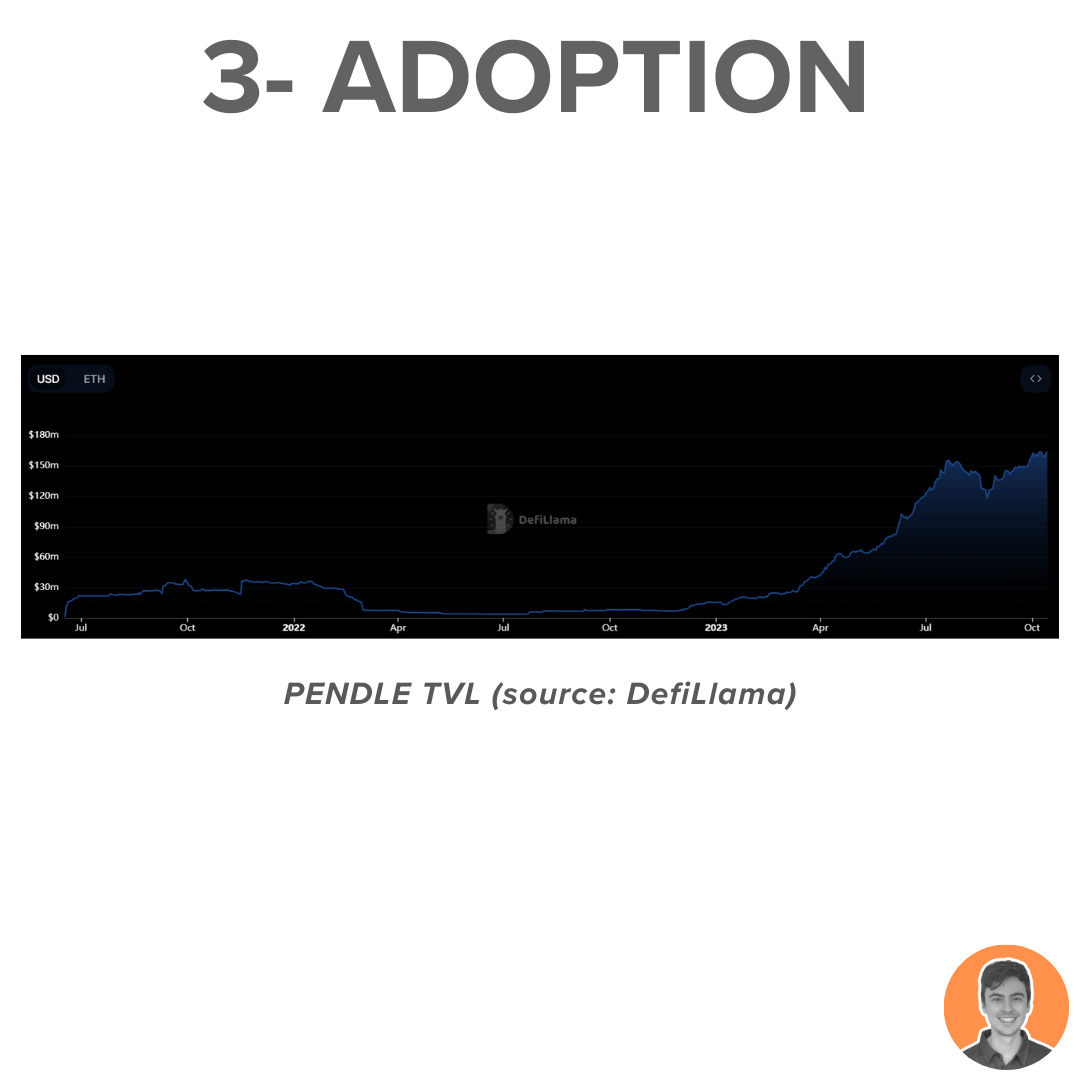

TVL has reached an impressive $164 million and has been consistently trending upwards since the beginning of 2023.

Pendle operates on five chains:

Ethereum

Arbitrum

BSC

Optimism

Avalanche

The majority, over 90%, of TVL is on Ethereum and Arbitrum.

The protocol has two sources of revenue:

Swap Fees

YT Fees - (3% from all yield)

Currently, all revenues are distributed to vePENDLE holders.

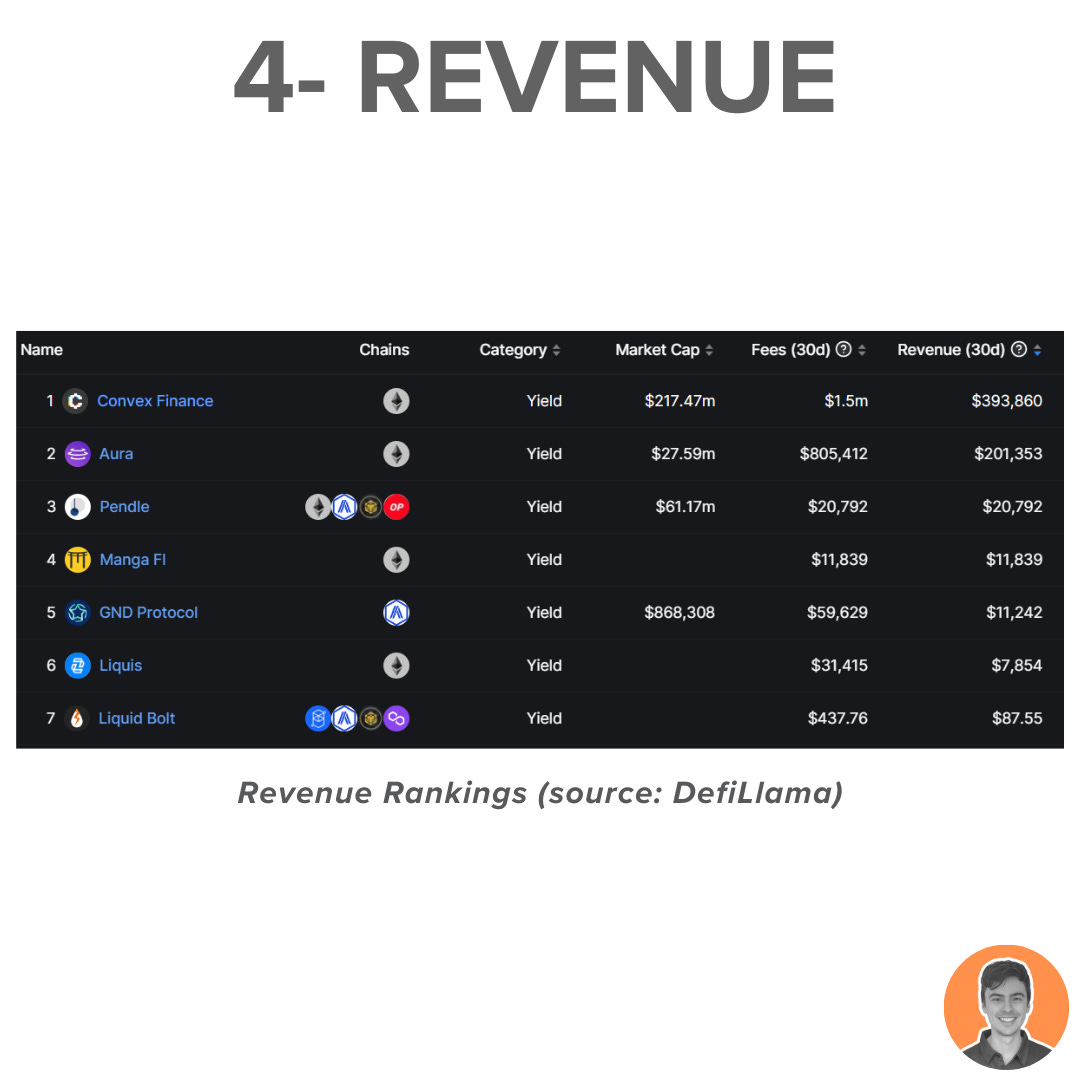

In the past 30 days, Pendle has generated $20k in revenue, ranking:

3rd among Yield projects

84th among all projects

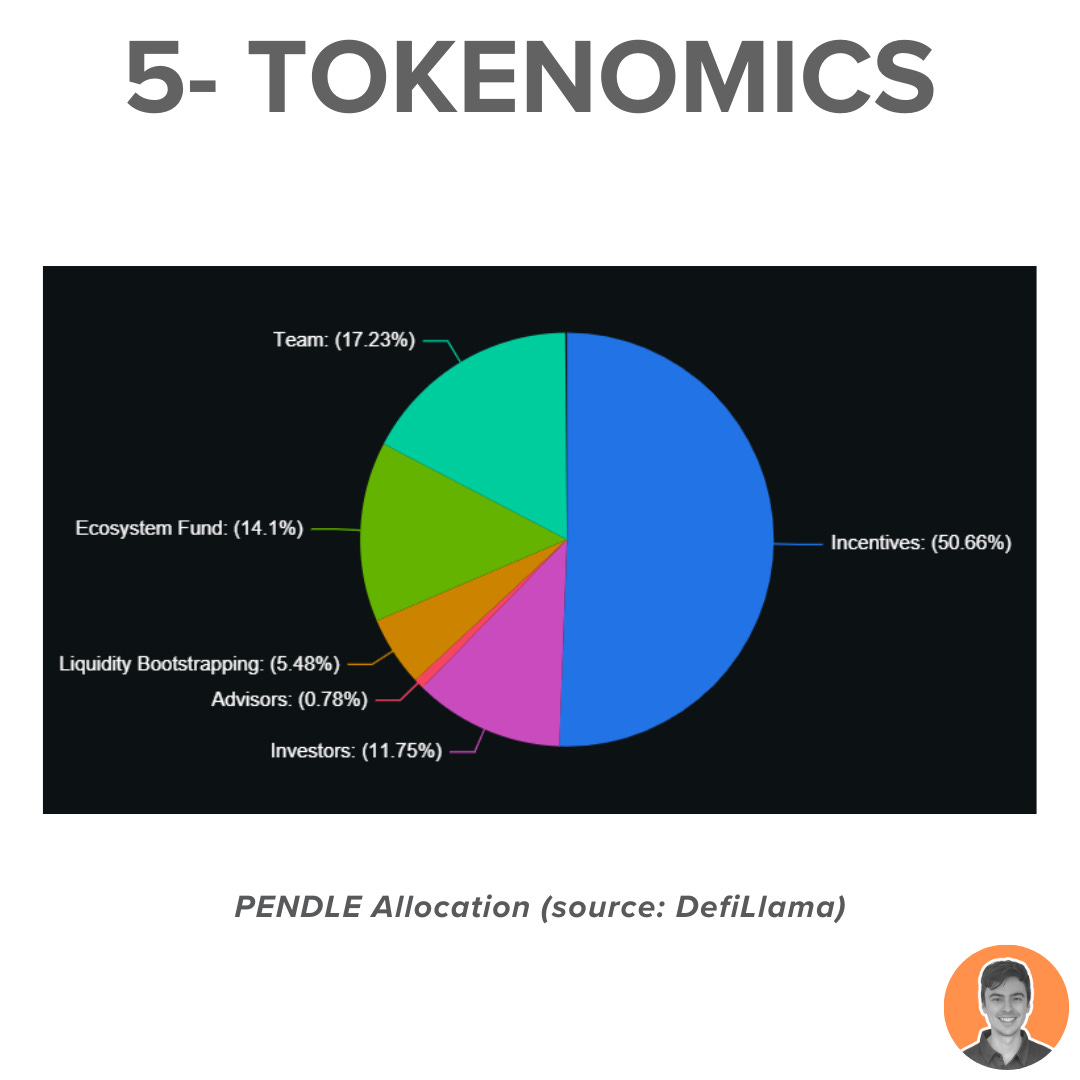

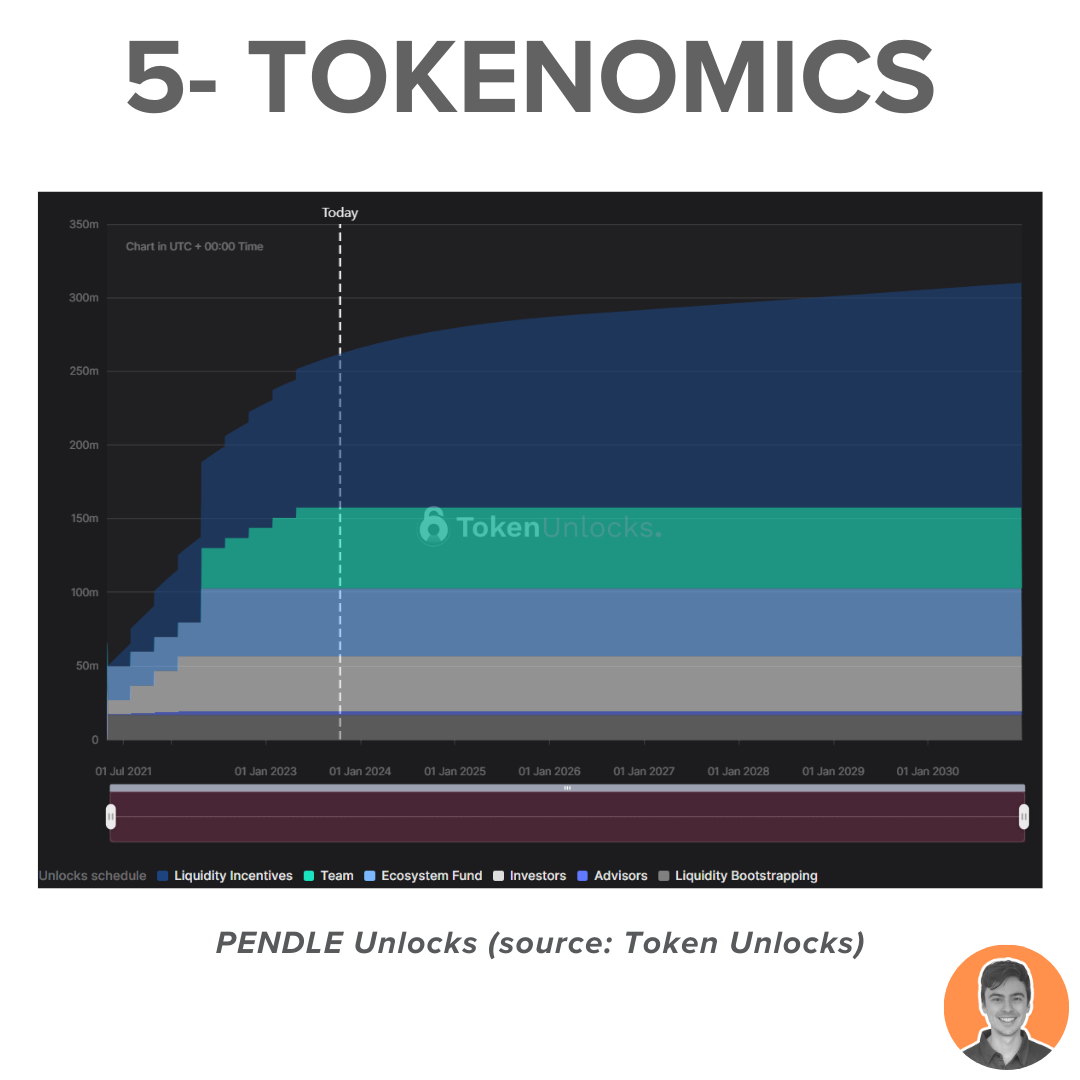

The supply of $PENDLE follows a hybrid inflation model. Weekly emissions will decrease by 1.1% each week until April 2026.

Holders are incentivised to lock for vePENDLE for a few reasons:

Share of protocol revenue

Vote for pools (incentives)

Receive swap fees from pools

These are the current supply stats:

Circulating supply = 97m

Total supply = 258m

Market cap = $62m

FDV = $165m

Market cap/ FDV = 0.38

All team and investor tokens have now been unlocked.

Future token inflation goes purely to liquidity incentives.

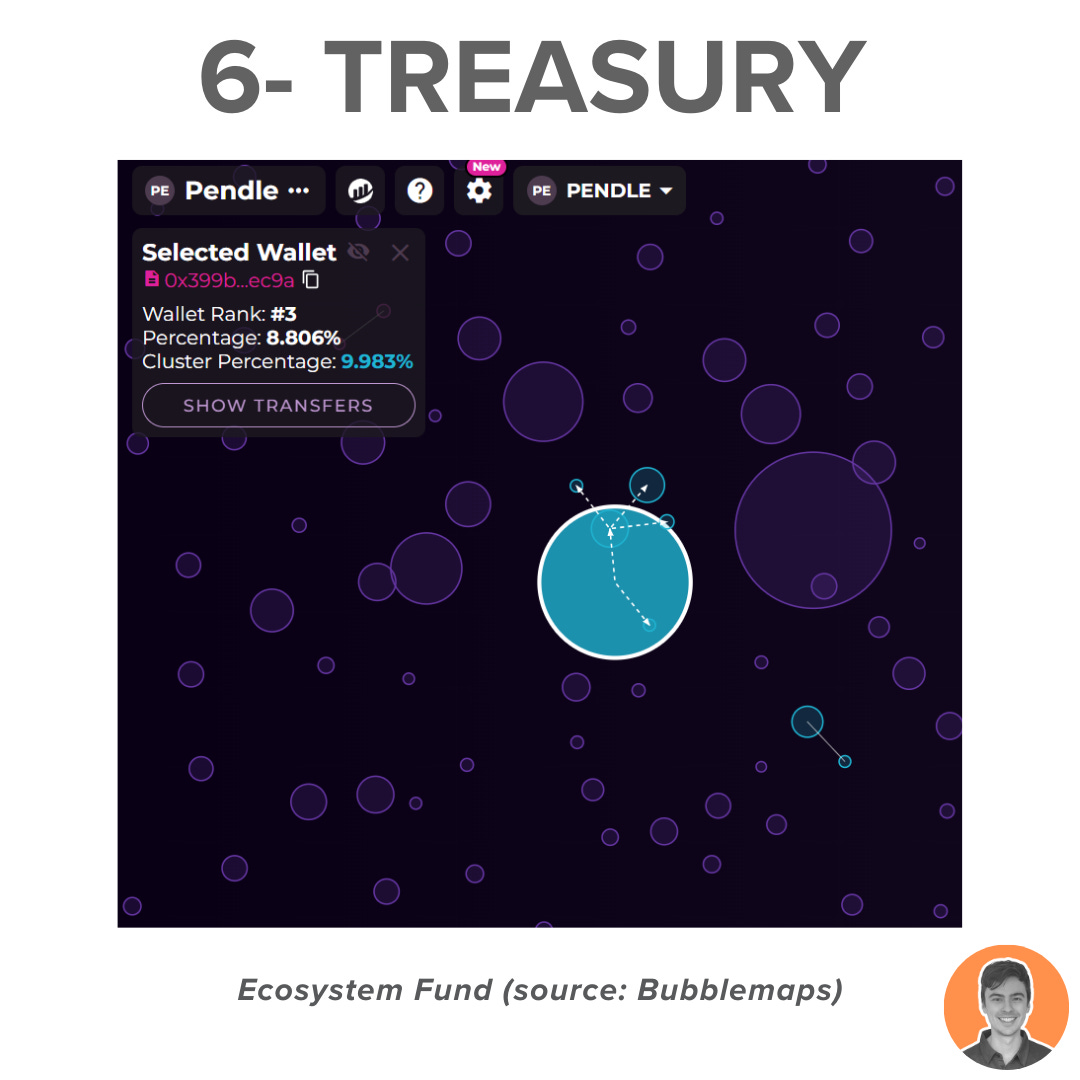

The closest to a treasury is the "Ecosystem Fund," which currently holds:

22.76m $PENDLE

A total of $14.7m USD

Wallet:

0x399Be606db281a054E359Eb709df9F21E922eC9a

The fund is primarily used for on on-chain integrations, particularly for liquidity bootstrapping purposes.

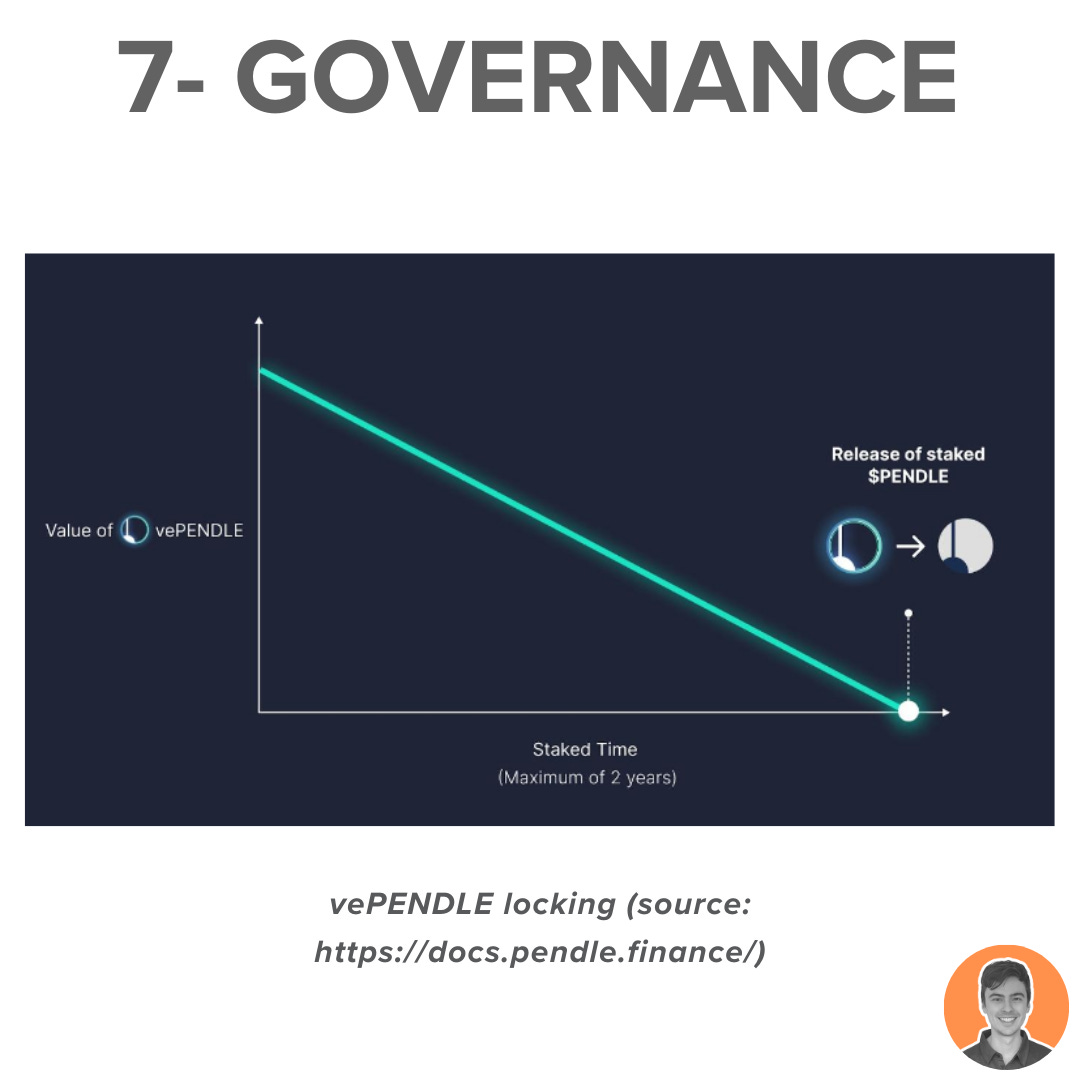

Pendle employs a decentralised governance process utilising vote escrowed mechanics - ve(3,3).

Here is an overview of the process:

Lock your $PENDLE (max 2yrs)

Receive $vePENDLE

Vote for and direct the flow of rewards to different pools

Receive rewards

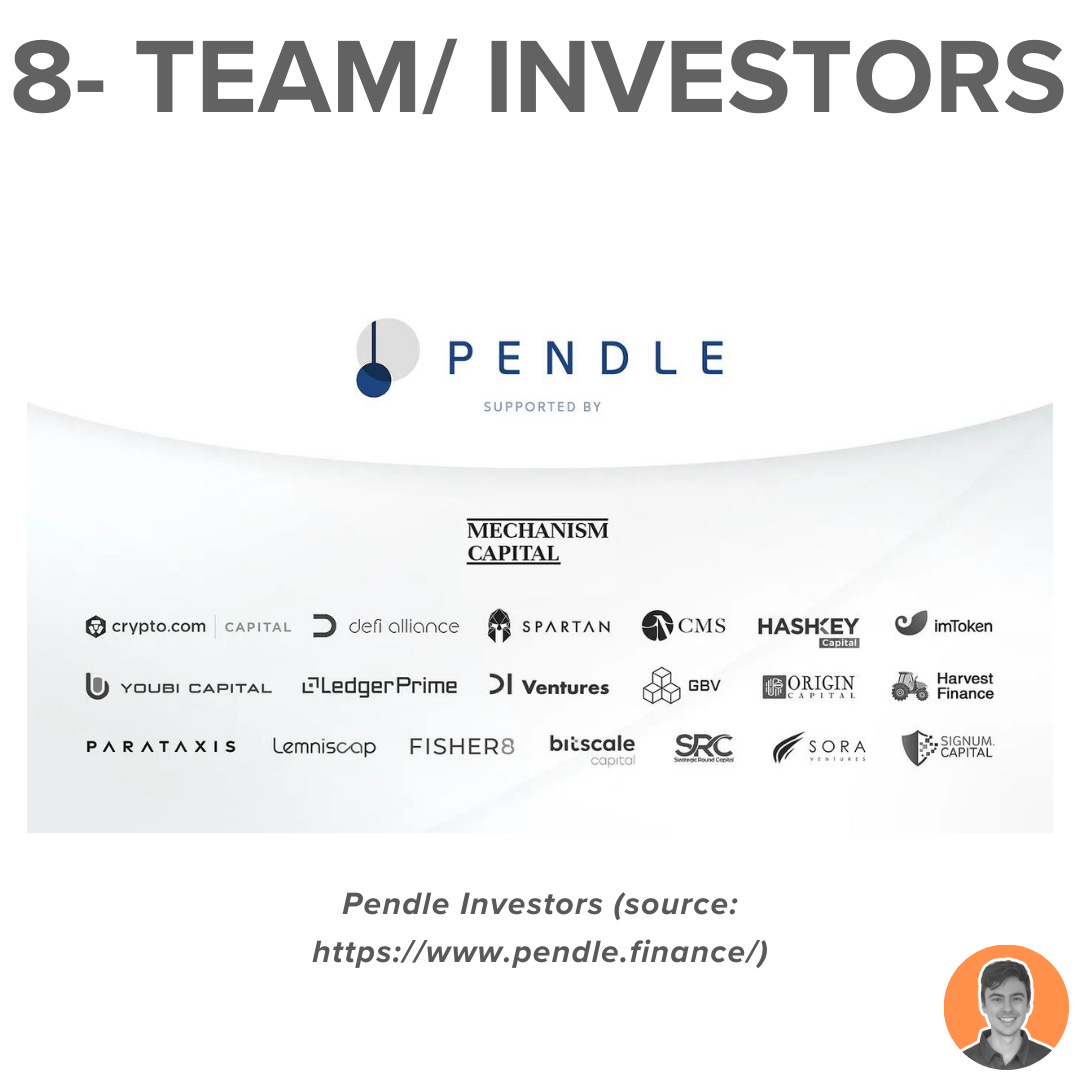

Pendle was launched in January 2021 and is led by a predominantly anonymous team:

TN Lee – Co-founder (@tn_pendle)

Vu Gaba Vineb – Co-founder & Developer (@gabavineb)

In 2021, the project raised $3.7 million, with Mechanism Capital leading the funding round.

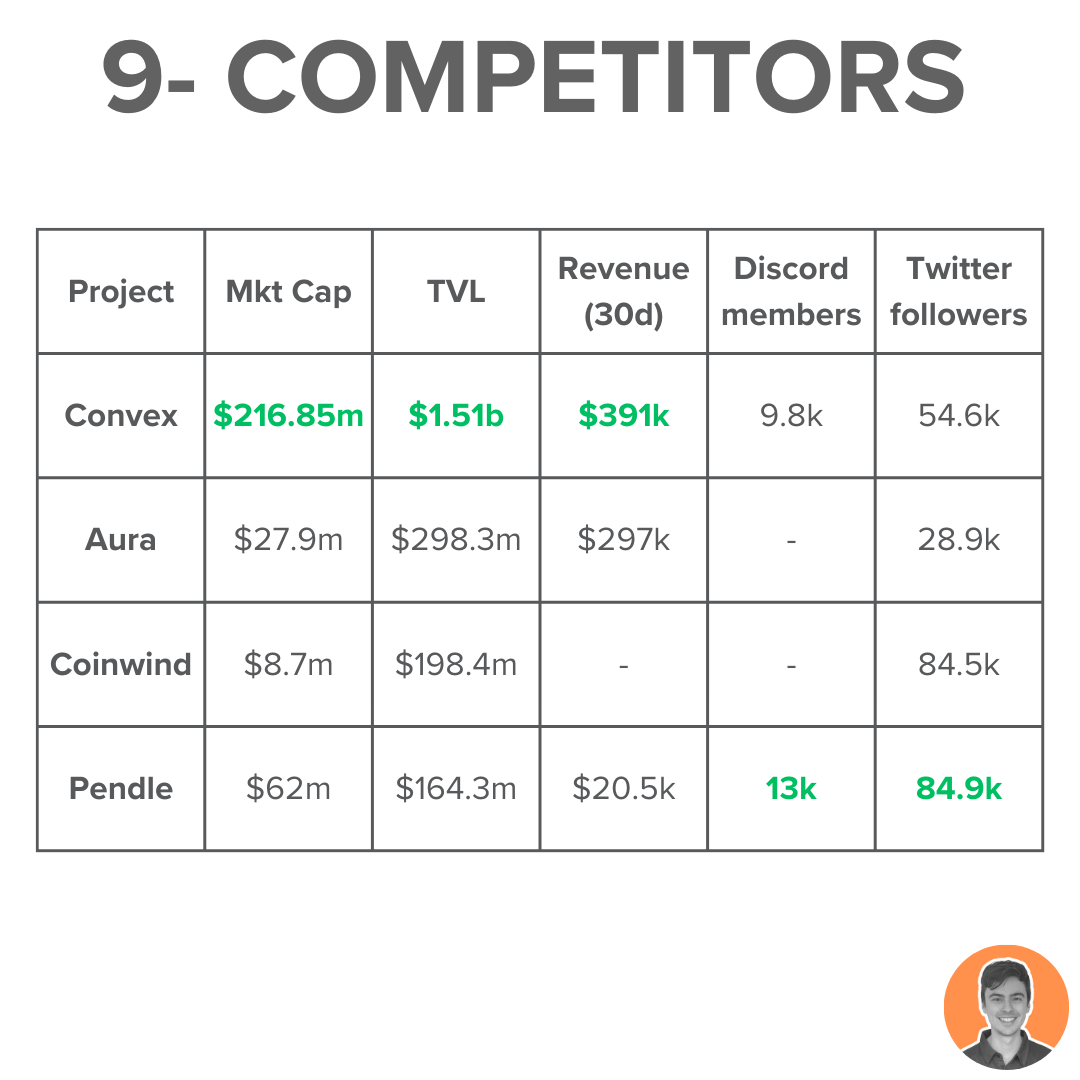

Although Convex holds the title as the largest and most established player in the yield category, Pendle is swiftly gaining ground.

Pendle, along with the Magpie ecosystem, are the only two protocols in the top 5 that have experienced positive growth in TVL over the past month.

The project code is open source and has undergone audits by six reputable wardens from Code4rena.

It is always important to consider investment risks:

Smart contract vulnerabilities

Underlying token (such as Frax/GLP depeg or exploits)

Third-party protocol interactions

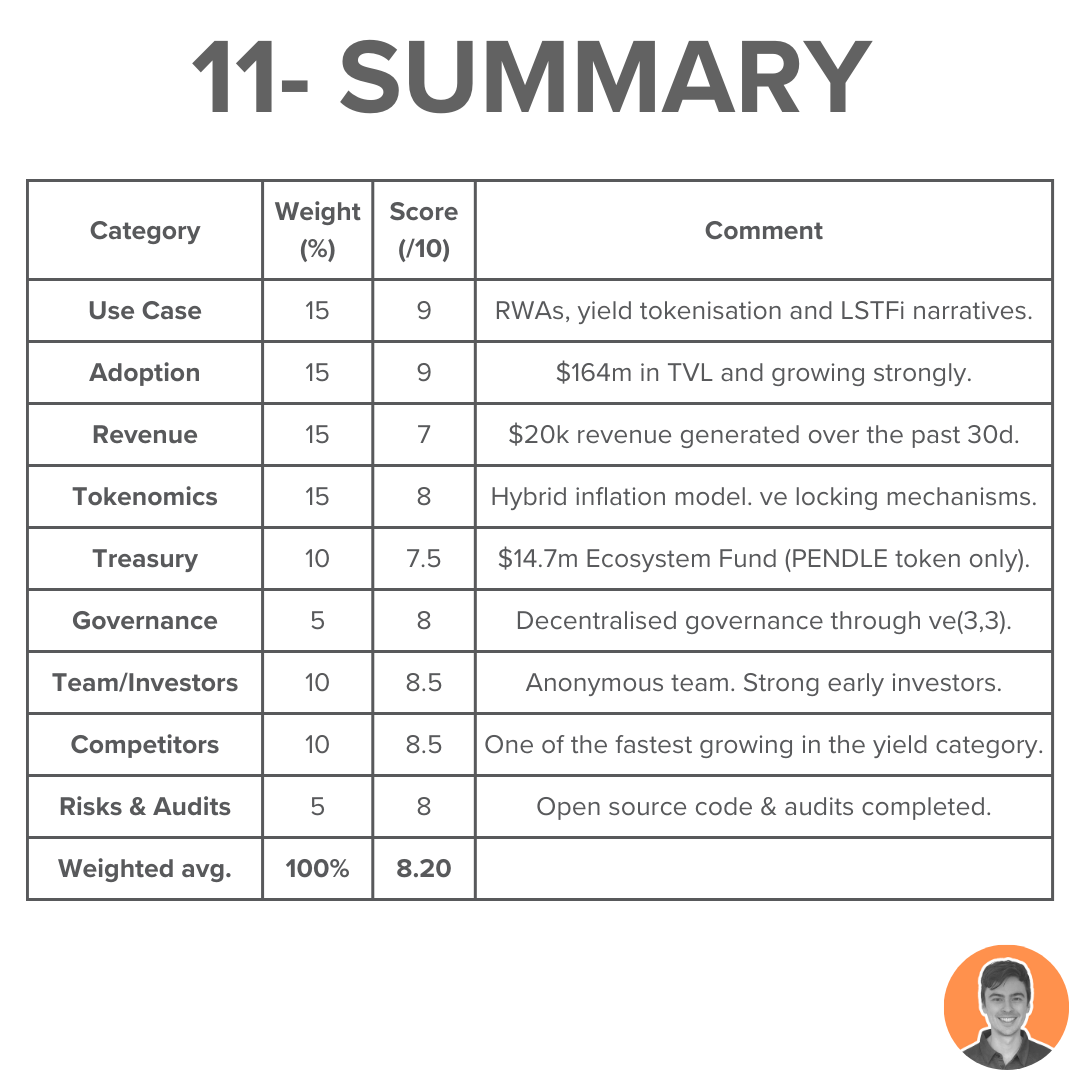

Pendle is strategically positioned in three rapidly growing sectors of DeFi:

RWAs

Yield trading

Liquid staking (LSTfi)

With a robust ecosystem, I believe Pendle is poised to emerge as one of the major winners in the upcoming bull market.

Overall weighted score = 8.20

Note: I am NOT an ambassador or advisor of Pendle. This is NFA.

Awesome. Specially as a Pendle holder.