On a Roll...bit

Rollbit Deep Dive

Over the next 5 years, online gambling revenue is set to explode to a staggering $131 billion.

And guess what? Rollbit is ready to grab a big chunk of that pie.

Don't miss out on my research report for November 2023 on RLB.

Here's what we'll cover in today's edition:

Overview

Use Case

Adoption

Revenue

Tokenomics

Treasury

Governance

Team & Investors

Competitors

Risks & Audits

Summary

Rollbit is an online crypto casino and has quickly become one of the most popular and innovative in the space.

It has several key products:

Casino

Sports betting

NFTs

Crypto futures (x1000)

Crypto portfolio (Buy, Hold or Sell)

Degen EXchange (RLB, UNIBOT etc.)

Online betting is projected to generate significant revenue:

$95b in 2023

$131b by 2027

Humans love gambling, and this will never change.

Rollbit has strategically positioned themselves to capitalize on two thriving sectors: cryptocurrency and online gambling.

Rollbit claims to have achieved impressive numbers:

Over 1m registered users

Approximately $40m wagered per day

Over $5b wagered overall

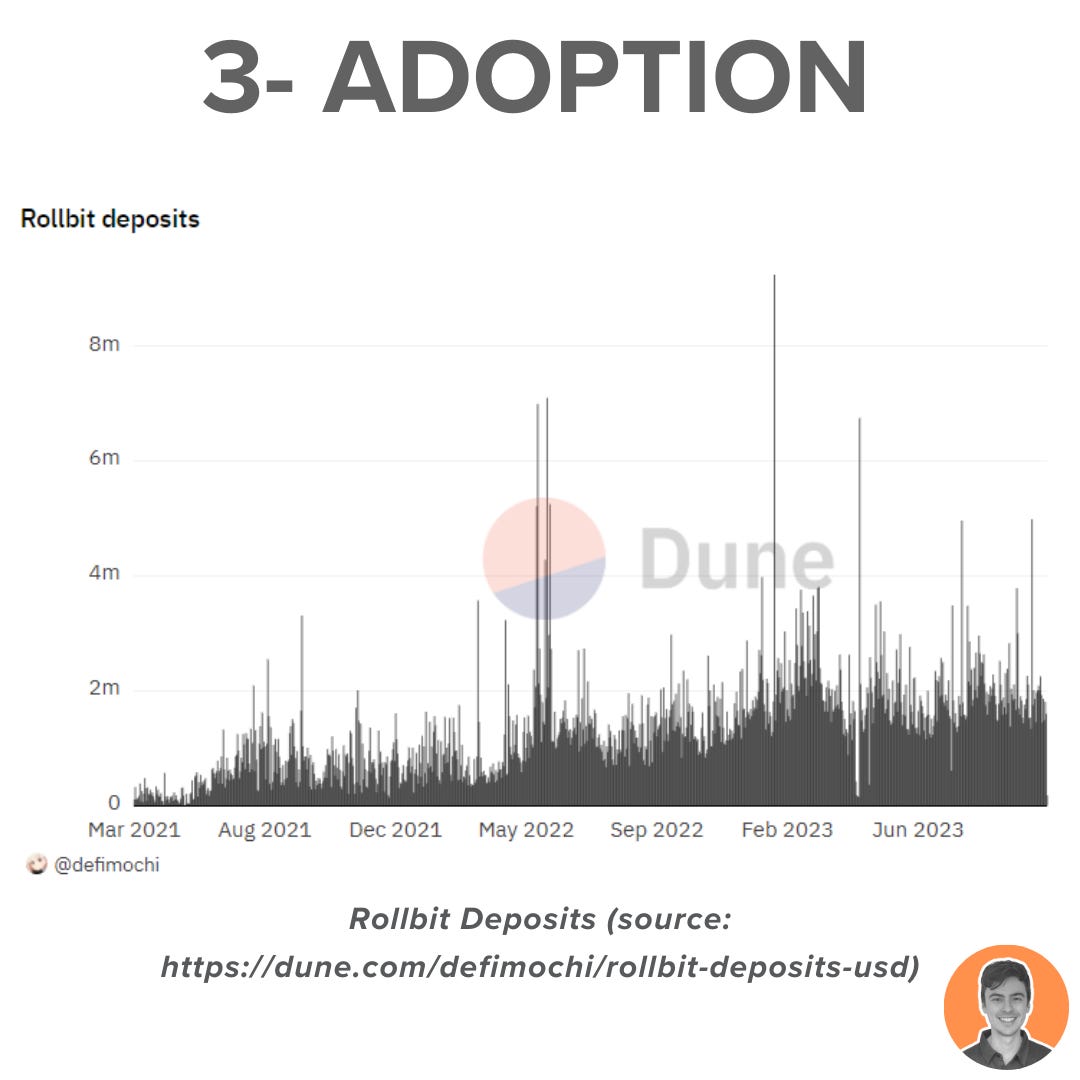

Additionally, the Rollbit user deposits show a promising upwards growth trend (Dune Dashboard created by

In the past 24hrs, Rollbit has generated the following revenues:

$1.08m - Casino

$162k - Crypto Futures

$100k - Sports

This totals to $1.34m in 24-hour revenue.

If the data is accurate and verified, this would place Rollbit in 3rd place according to DefiLlama stats.

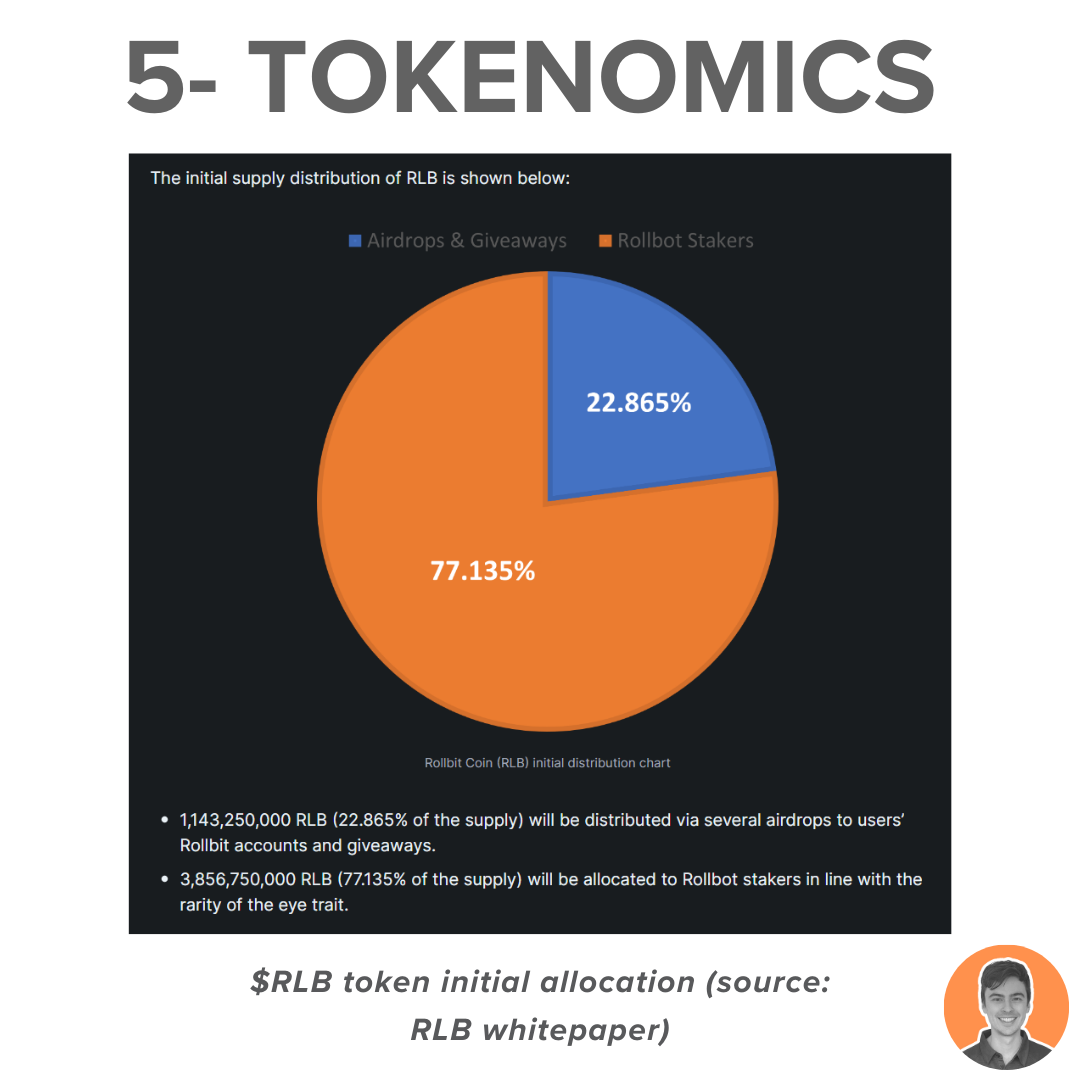

$RLB was initially distributed 100% through airdrops to reward early users and stakers.

There was no ICO or any OTC sale of RLB.

Originally, the token was launched on the Solana blockchain. However, it has recently been migrated to Ethereum due to congestion issues.

Rollbit utilizes a portion of its daily revenue from its Casino, Crypto Futures, and Sportsbook verticals to purchase and burn $RLB tokens.

30% from futures

20% from sports betting

10% from the casino

This process, called 'Buy & Burn,' is what makes $RLB deflationary.

These are the current supply stats:

Circulating supply = 3.1b

Total burnt= 1.9b

Max supply = 5b

Market cap = $750m

FDV = $750m

Market cap/ FDV = 1

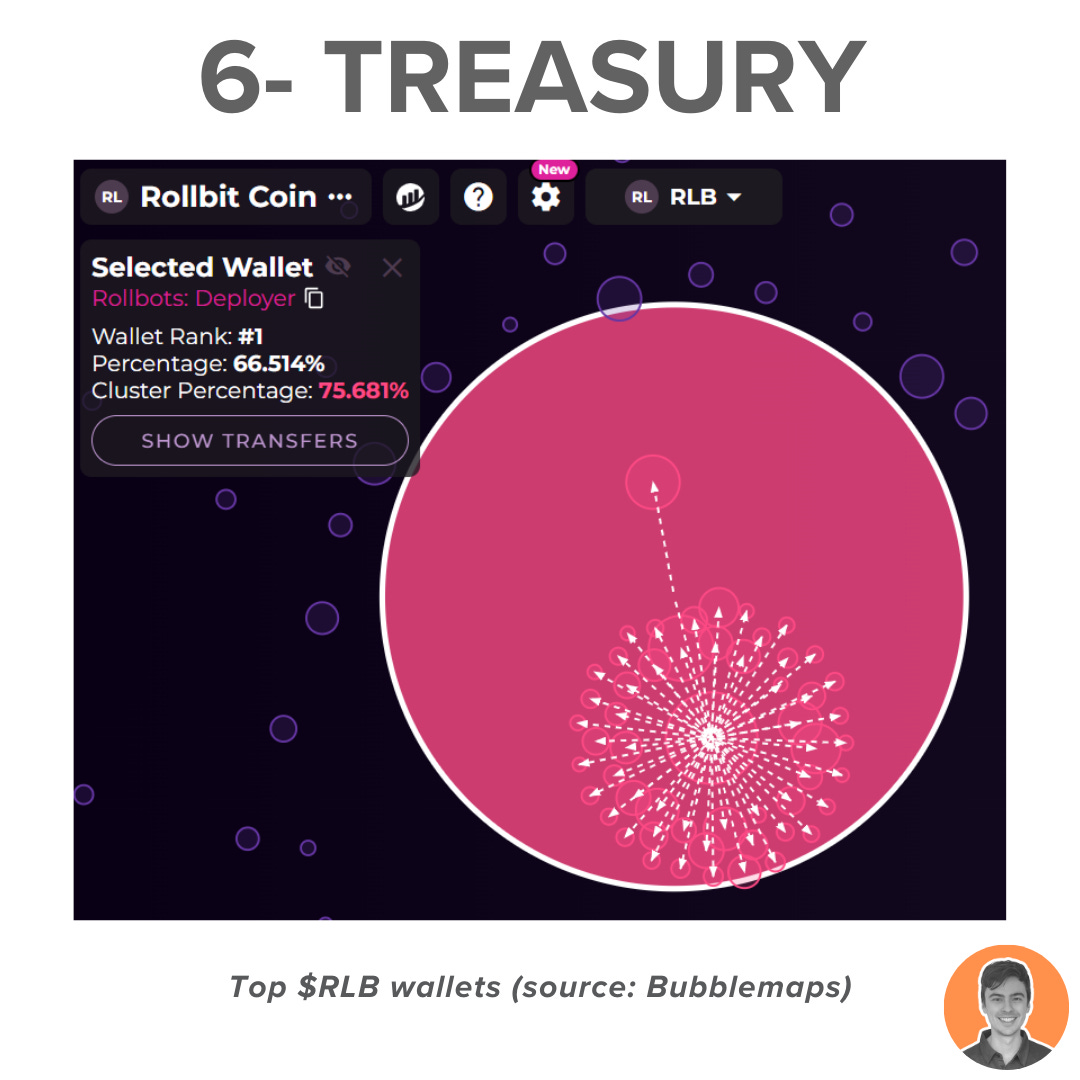

The Rollbit documentation does not provide any information about a treasury or the management of protocol wallets.

There are 2 main wallets of importance:

Deployer: holding $456m ($RLB)- 66.5% of the token supply.

Hot Wallet: containing $24.5m - 1.6% of the token supply.

When users want to withdraw from the Rollbit platform, the Deployer wallet sends RLB to the hot wallet.

The hot wallet handles transactions such as withdrawals, liquidity provision, and exchanges.

Thread below from @JPW_rb detailing some further information.

https://twitter.com/JPW_rb/status/1690002734764732417

Over 76% of the token supply is accounted for in this cluster.

Suggesting that the majority of users choose to hold their RLB on the platform rather than in their own wallets.

This poses a significant risk of centralization and potential 'bank runs'.

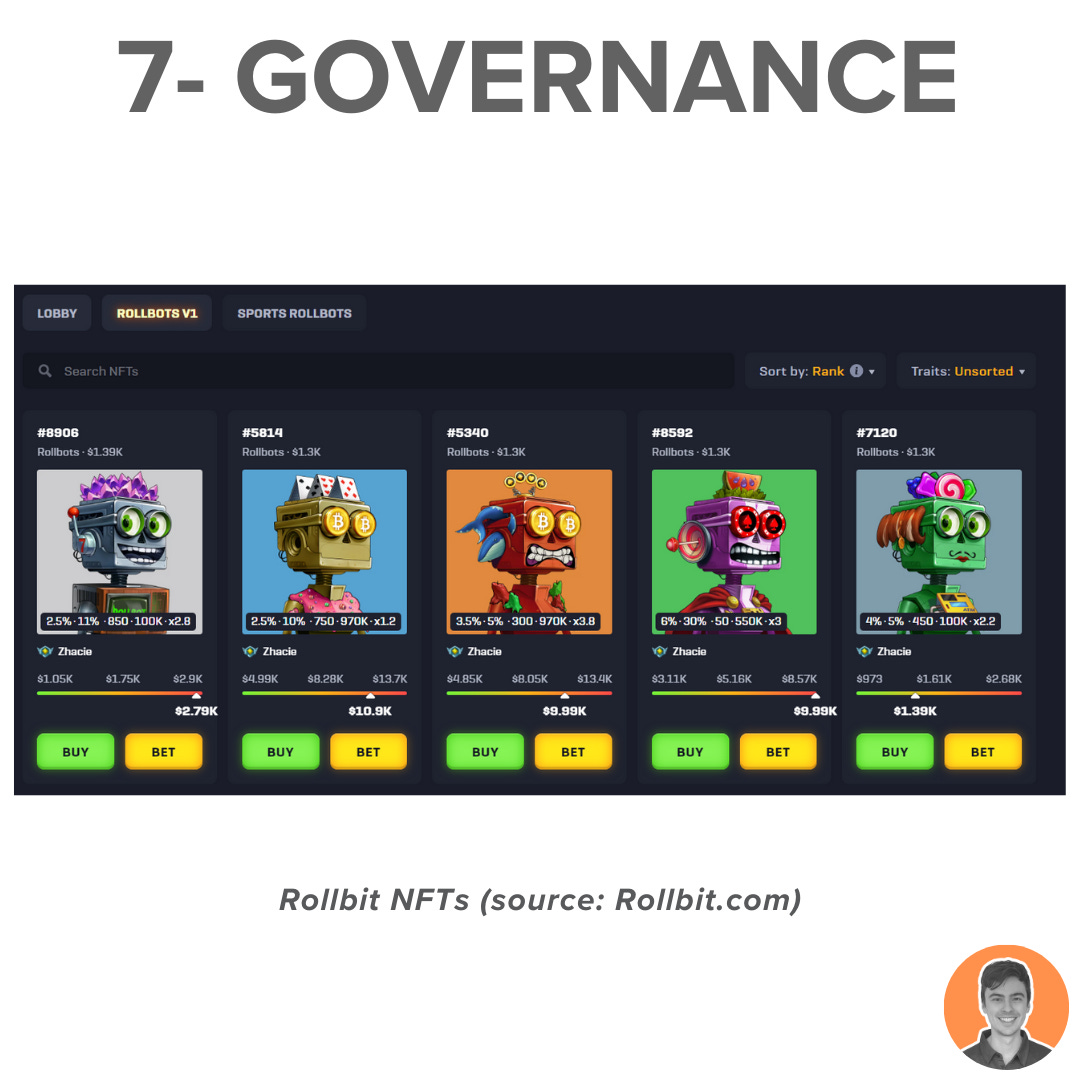

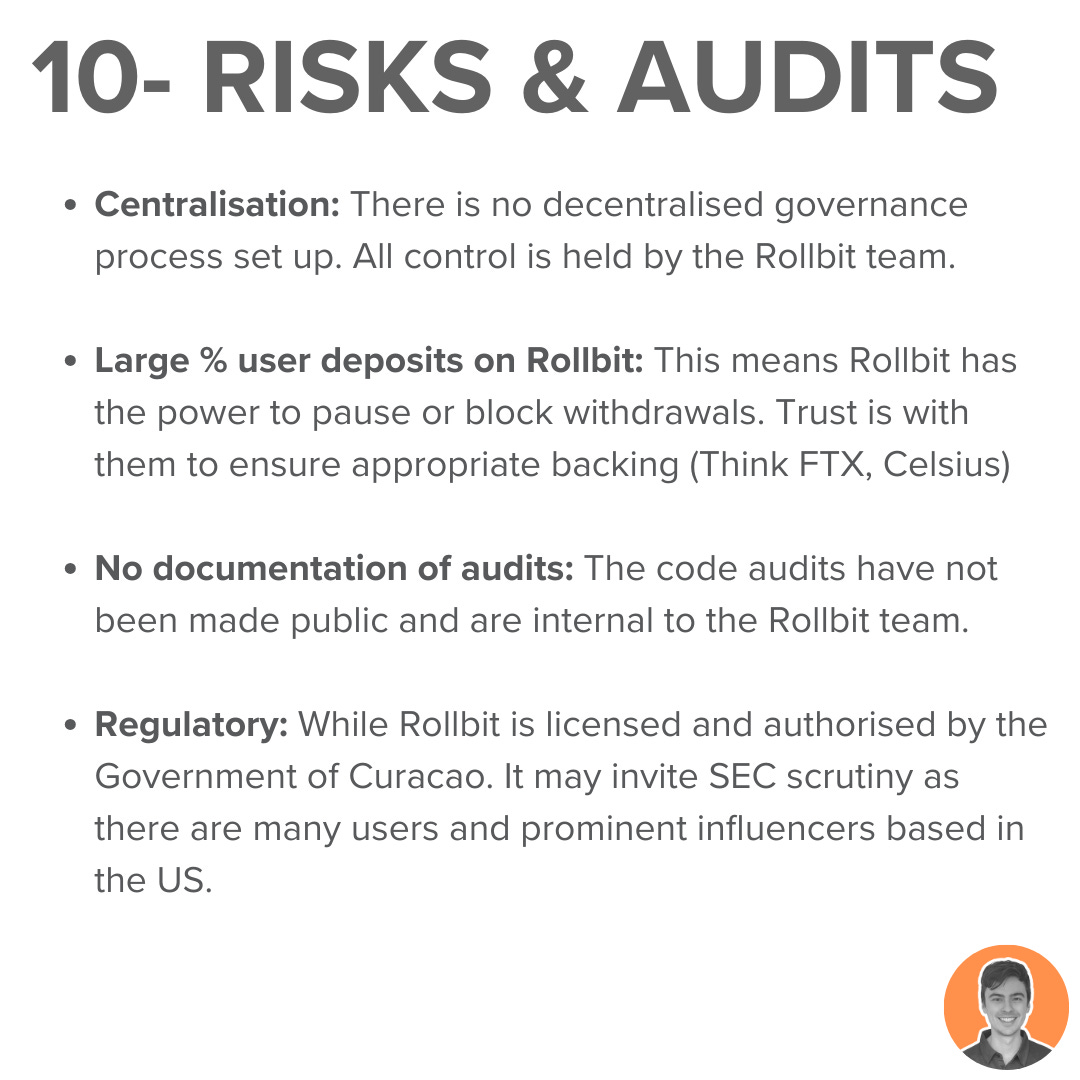

Concerns about centralization arise due to the lack of a decentralized governance process for the protocol.

However, the Rollbit community is thriving and expanding, with successful Rollbot NFTs offering VIP membership and exclusive privileges to holders.

Rollbit was launched in Feb 2020 by @Lucky_Rollbit and @Razer_Rollbit.

Recently, the team has partnered with the reigning Serie A winners @sscnapoli to become their official European betting partner.

Bringing significant mainstream attention and increased brand visibility.

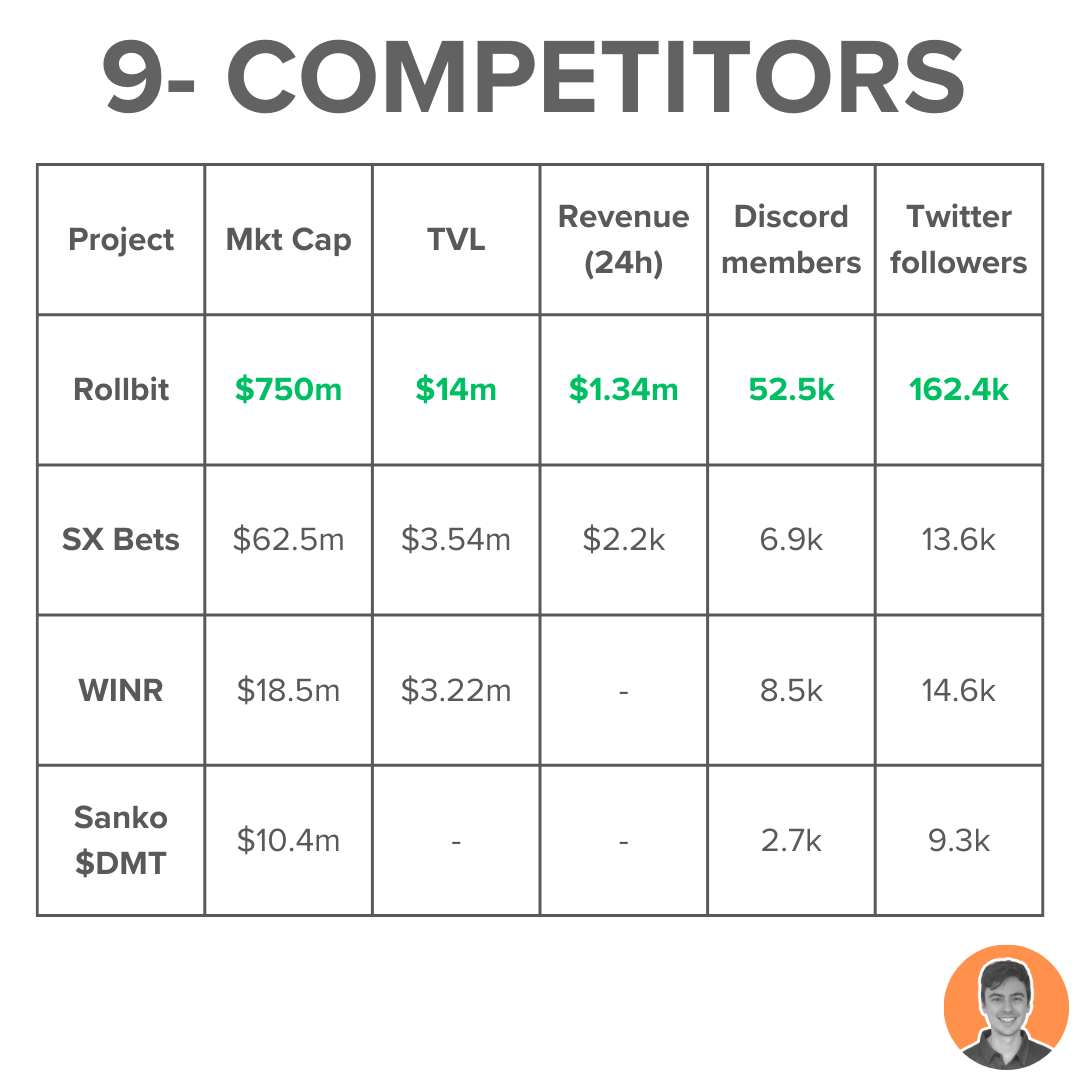

Rollbit has firmly established itself as the market leader in the crypto casino/gambling sector.

Its toughest competition currently comes from:

@SX_Bet - $SX

@WINRProtocol - $WINR

@SankoGameCorp - $DMT

Nice to see some strong decentralised options emerging.

The team has not published the results or any details of the code audits, although the project has a good track record thus far.

The main risks that I see are:

Centralization

A large % of user deposits on Rollbit

Lack of audit documentation

Regulatory compliance

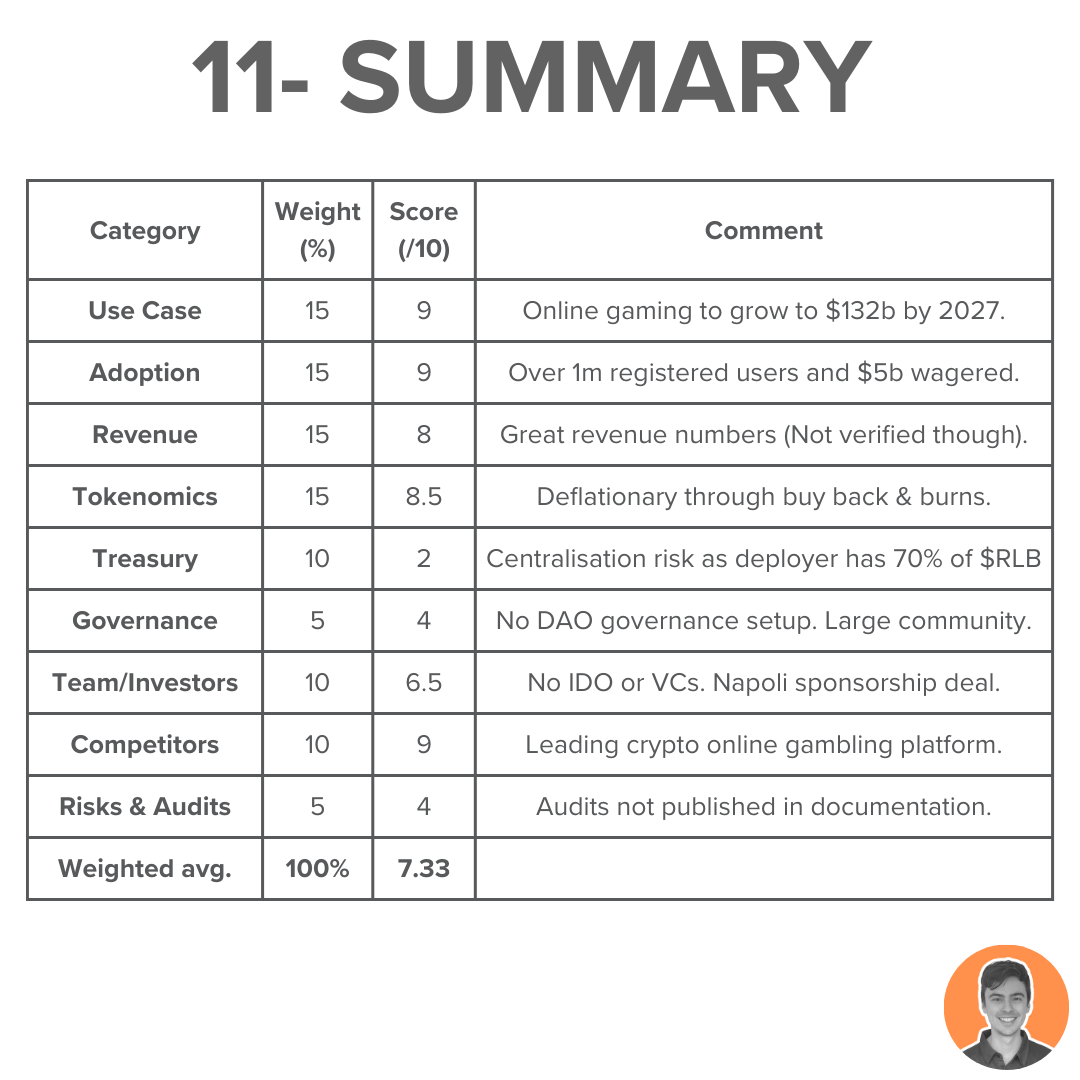

Rollbit is well-positioned in fast-growing sectors: gambling and crypto.

Despite concerns about centralization and risk management, RLB's price action and narrative are strong.

The project has fantastic 'Pumpamentals' and strong adoption.

Overall weighted score = 7.33

Note: I am NOT an ambassador or advisor of Rollbit. This is NFA.