Thena Finance just unleashed their perp DEX: ALPHA.

Is this the catalyst for a tidal wave of adoption on the BNB Chain?

Don't miss my November 2023 research report on THE.

Here's what we'll cover in today's edition:

Overview

Use Case

Adoption

Revenue

Tokenomics

Treasury

Governance

Team & Investors

Competitors

Risks & Audits

Summary

Don't forget to bookmark this post for future reference. 📚

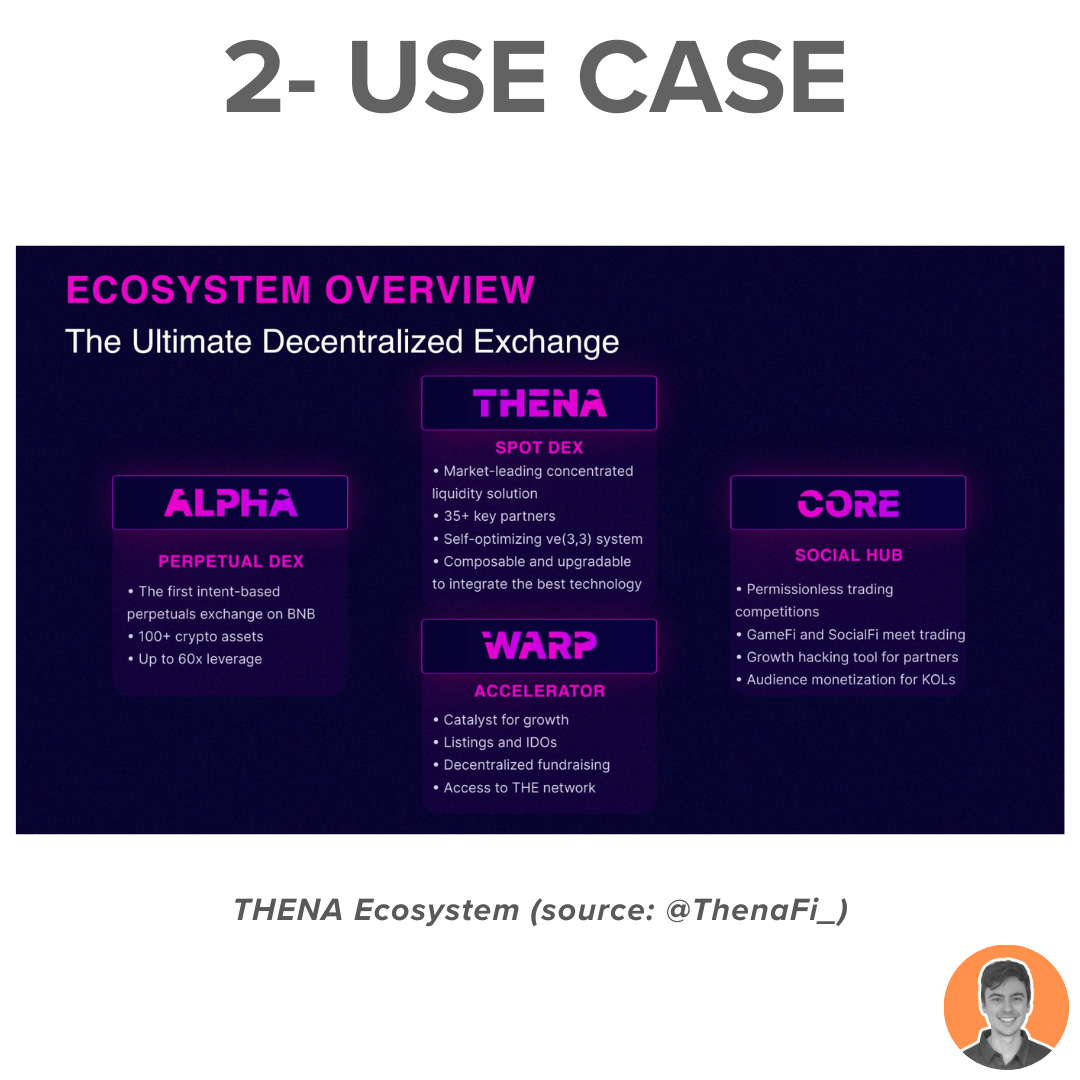

Thena is a DEX, liquidity layer & AMM. The project was launched at the start of 2023 and has been built on the BNB chain.

The protocol allows users to:

Swap tokens with low fees

Stake assets to earn passive income

Provide liquidity layer for BNB chain

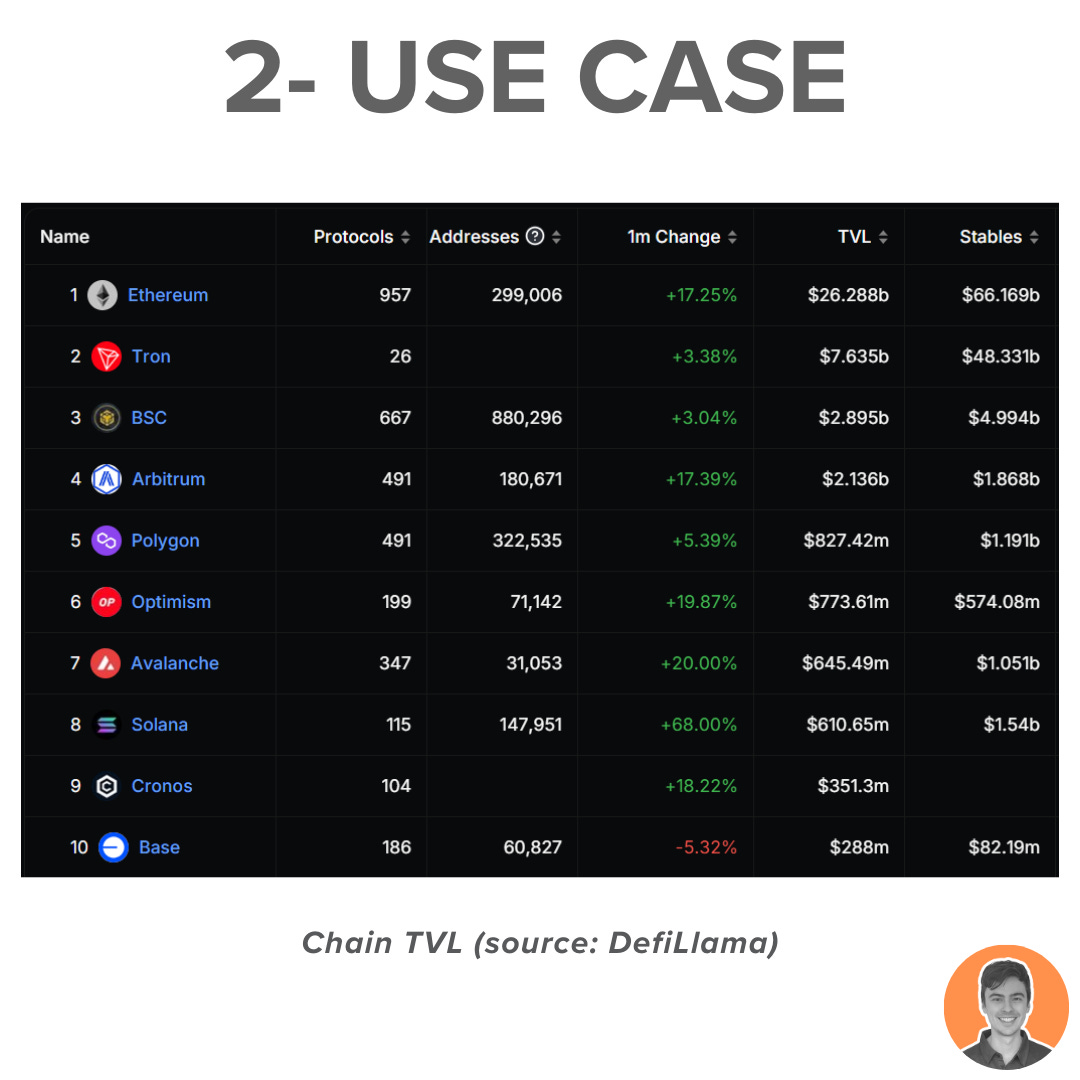

The BNB chain is the 3rd largest chain in terms of overall TVL (Behind Ethereum & Tron). It has over 600 protocols and 880k active addresses in the last 24h.

This means a huge amount of growth potential for Thena as it aims to become the native liquidity layer On BNB.

Thena has recently launched their own perpetual DEX called ALPHA.

Currently in the public Beta phase, it has already begun to garner attention.

Additionally, the team has introduced $THE borrowing/lending feature and continues to introduce innovative products on the platform.

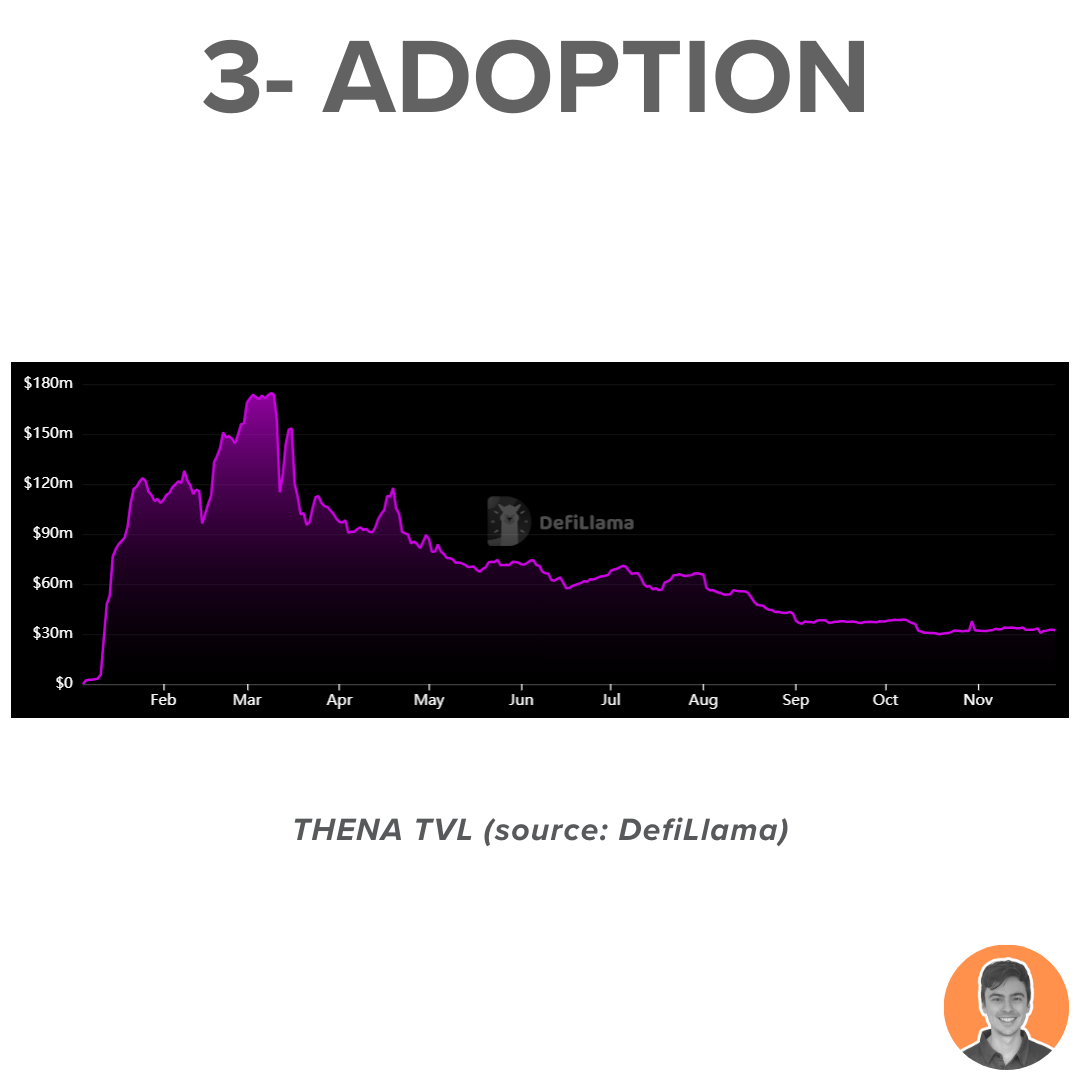

The current TVL stands at $32.6m, reflecting a 13% decrease over the past month.

Since reaching its peak at $175m in Mar'23, the overall trend has been downward.

This is concerning news. However, there are indications that the TVL may be stabilising, forming a base around $30m.

Over the past 30d, Thena has generated an impressive $518k in revenue, making it the 4th highest on BNB chain (38th overall).

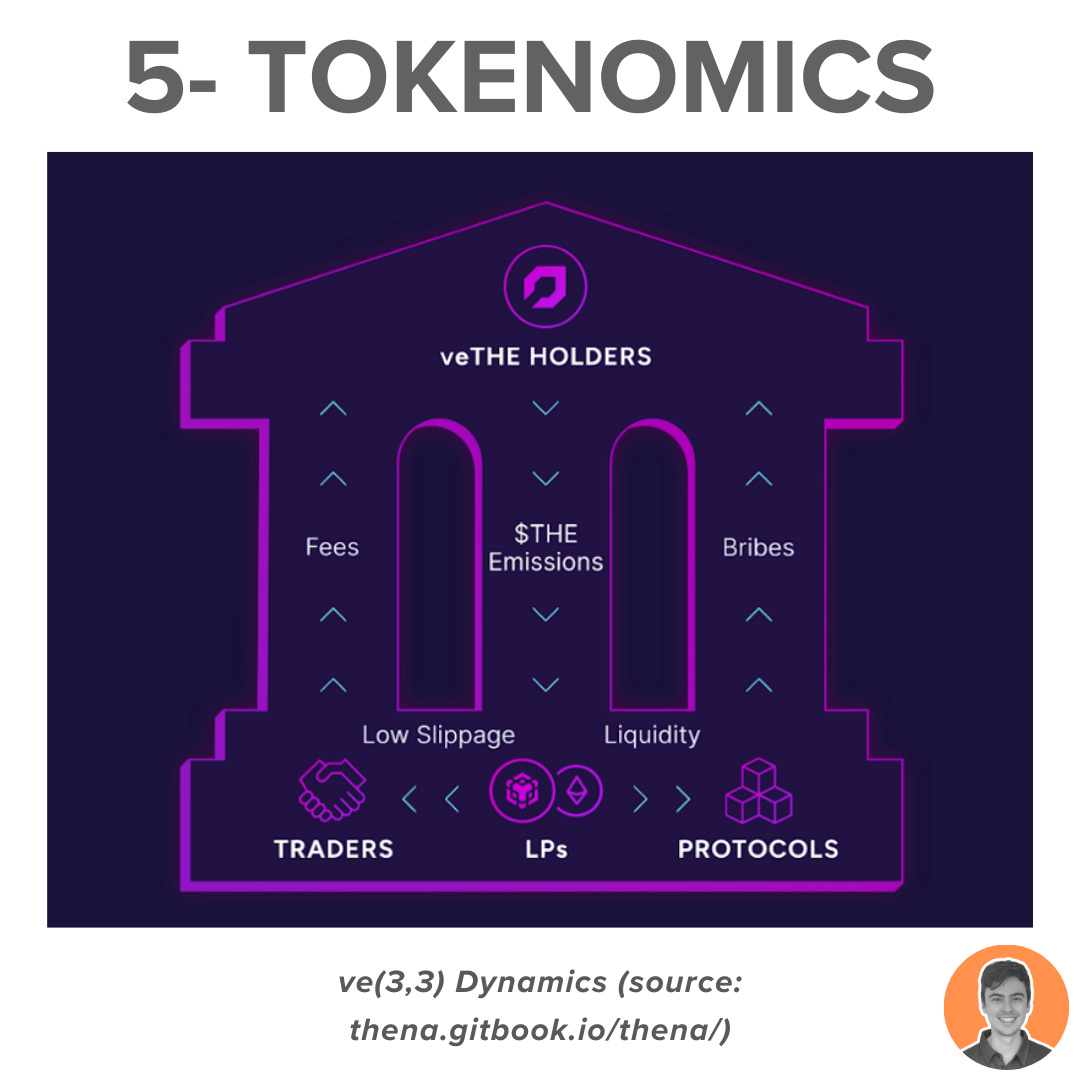

Trading fees are directed to holders that lock their tokens for $veTHE.

Holders currently receive 80% of the platform trading fees.

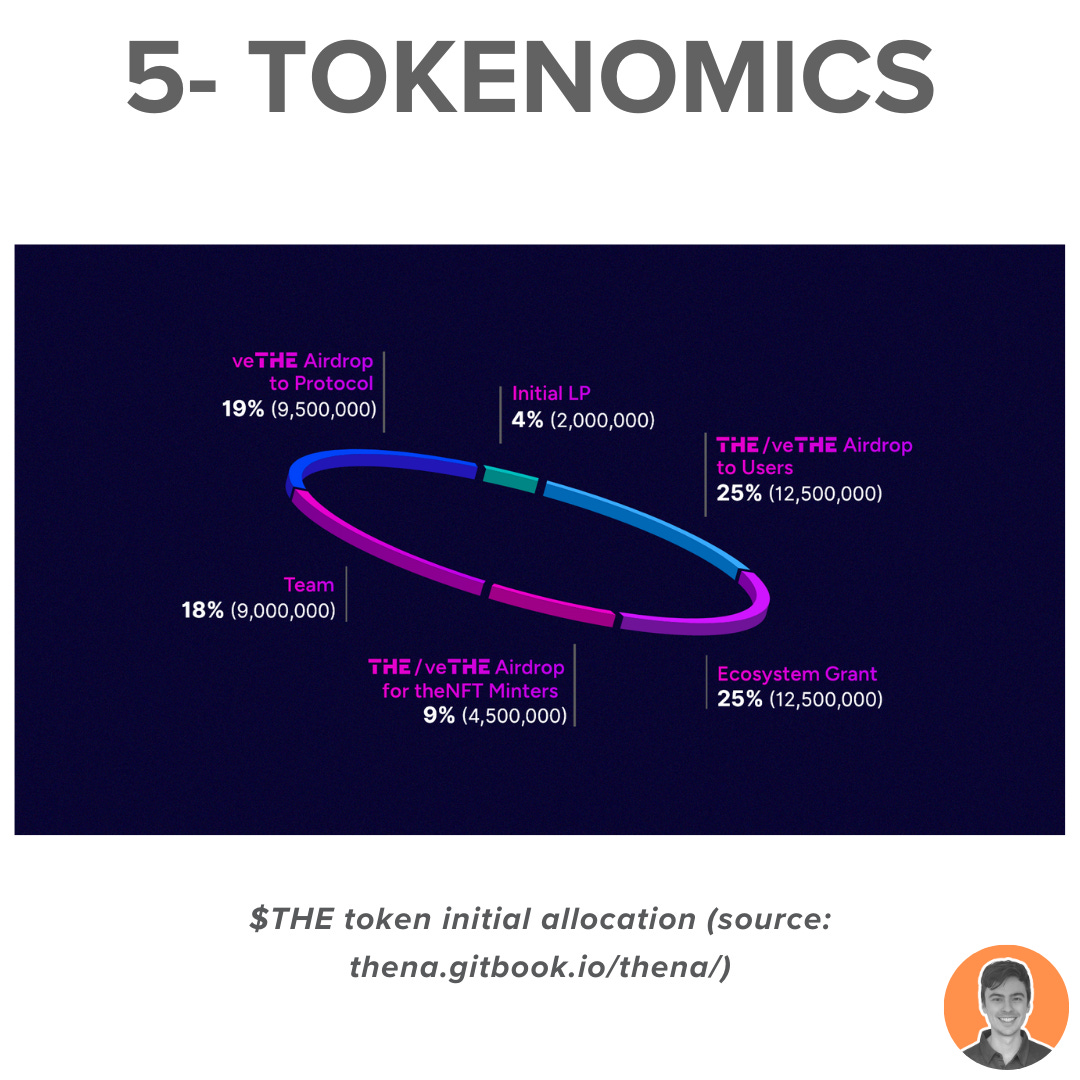

There are three main tokens that are used in the Thena Ecosystem:

$THE - Utility token

$veTHE - Governance token

theNFT - Non-fungible token

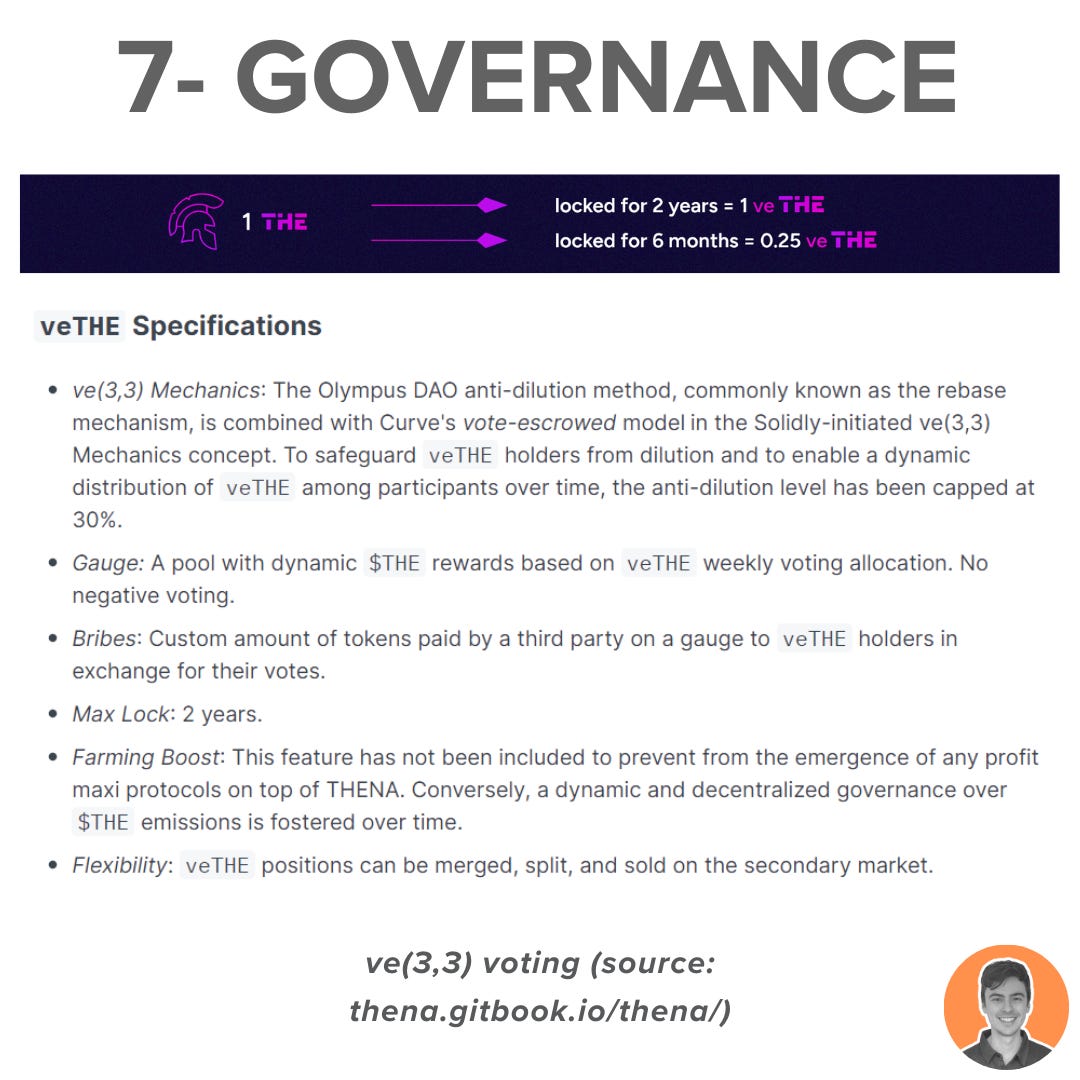

The protocol has incorporated a combination of the Olympus DAO anti-dilution method and the Curve vote-escrowed model.

Users can lock their $THE tokens for up to 2 years to get $veTHE.

$veTHE voters then receive:

Trading fees generated by the pool(s) they vote for

Bribes deposited for the pools they vote for

Weekly veTHE distribution (rebase)

These are the current supply stats:

Circulating supply = 26.2m

Total supply = 146.2m

Market cap = $3.6m

FDV = $20.2m

Market cap/ FDV = 0.18

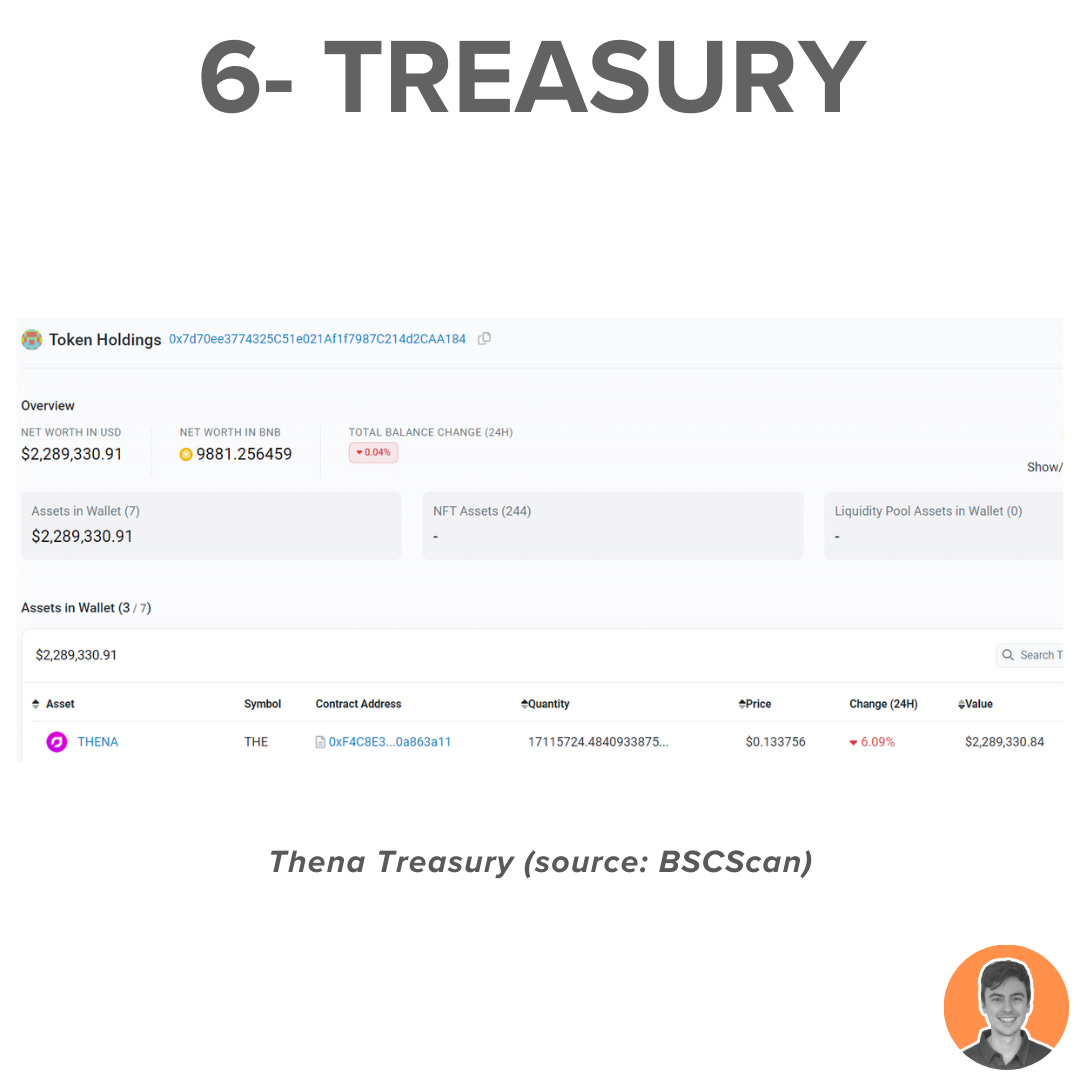

While Thena doesn't have a dedicated 'Treasury', 25% of the initial supply was allocated to the Ecosystem Grant.

Through Bubblemaps, I managed to locate what I believe is the wallet for the treasury/ecosystem grant, which contains:

17.1m $THE tokens

Total value = $2.29m

Project governance revolves around the intricate ve(3,3) mechanics.

In addition to weekly voting for liquidity pools through gauges and bribes, holders of $veTHE can also participate in governance by casting votes on proposals for protocol improvements.

Thena was launched in Jan 2023 and is led by an anonymous team. They pride themselves on being a community run protocol with no VCs and no seed round.

Tokens were airdropped to early users and other BNB chain protocols in a 'fair launch'.

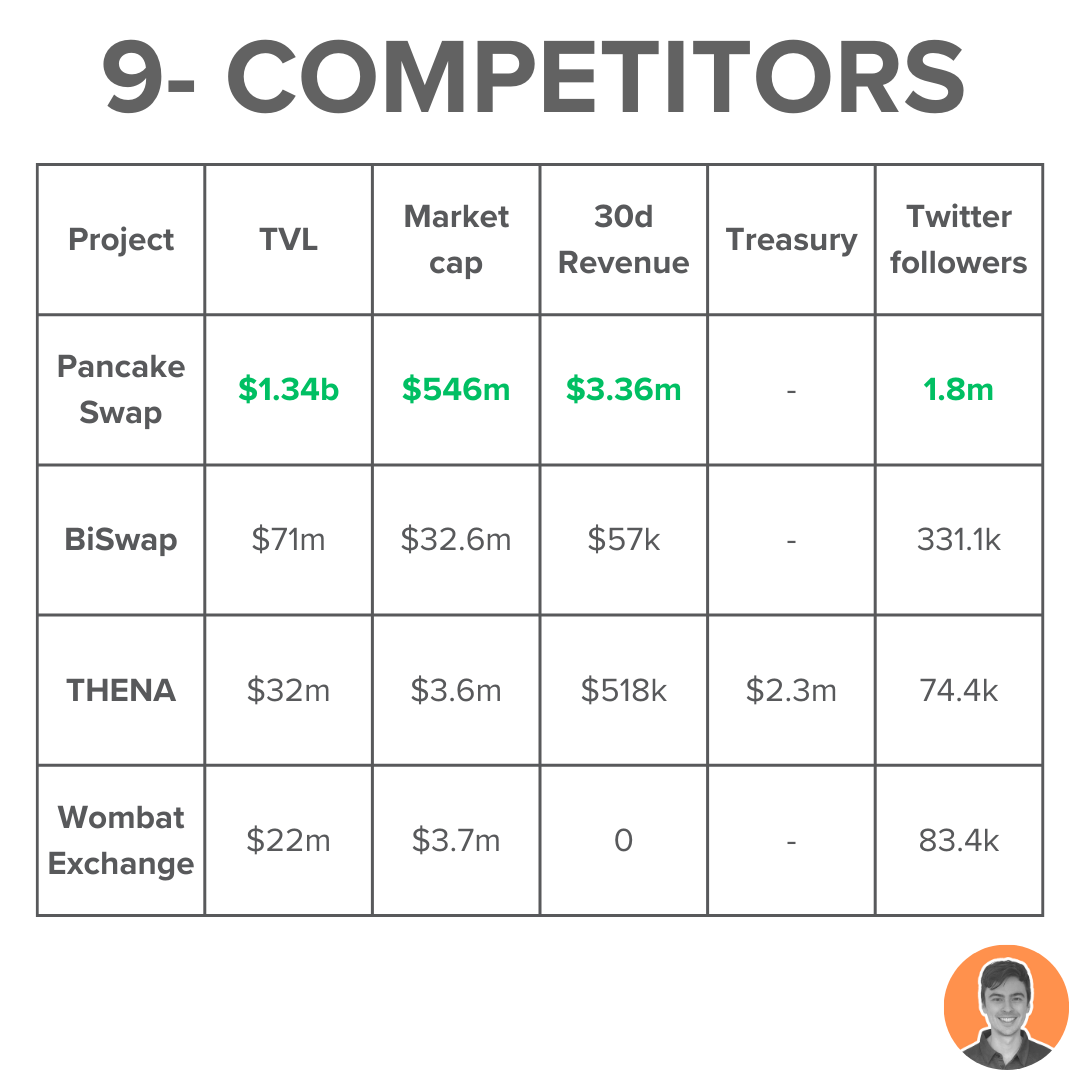

PancakeSwap is the clear market leading DEX on the BNB chain.

One impressive thing about Thena is its ability to generate strong fees and revenues for its token holders, regardless of it's size.

This could be a strong leading indicator of a growing protocol with real yield.

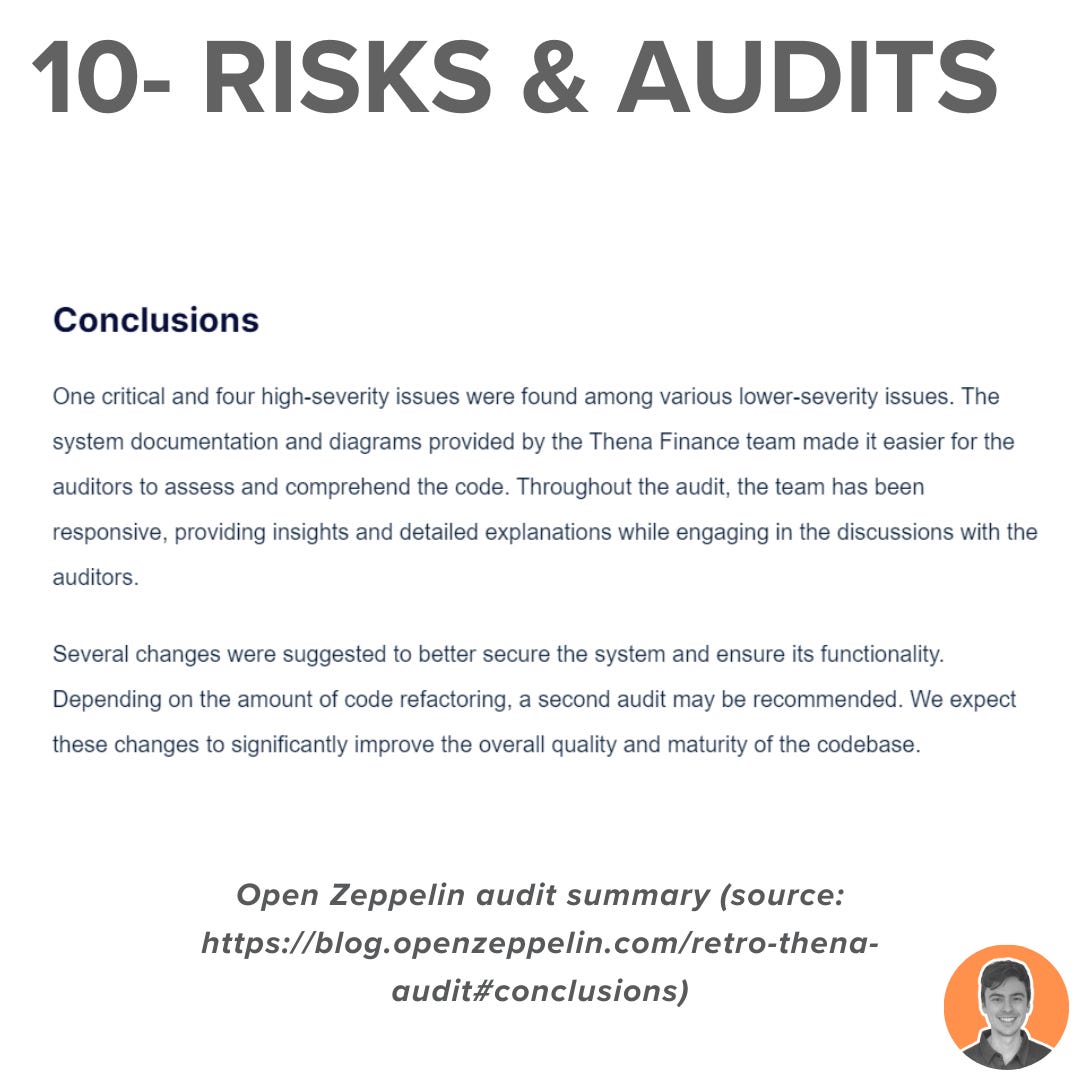

Thena V2 has been audited by OpenZeppelin in June 2023.

Here are some other key points:

Thena is adapted from Velodrome codebase

Velodrome audited through Code4rena bug bounty contest

The AMM part of Solidly has been audited by PeckShield

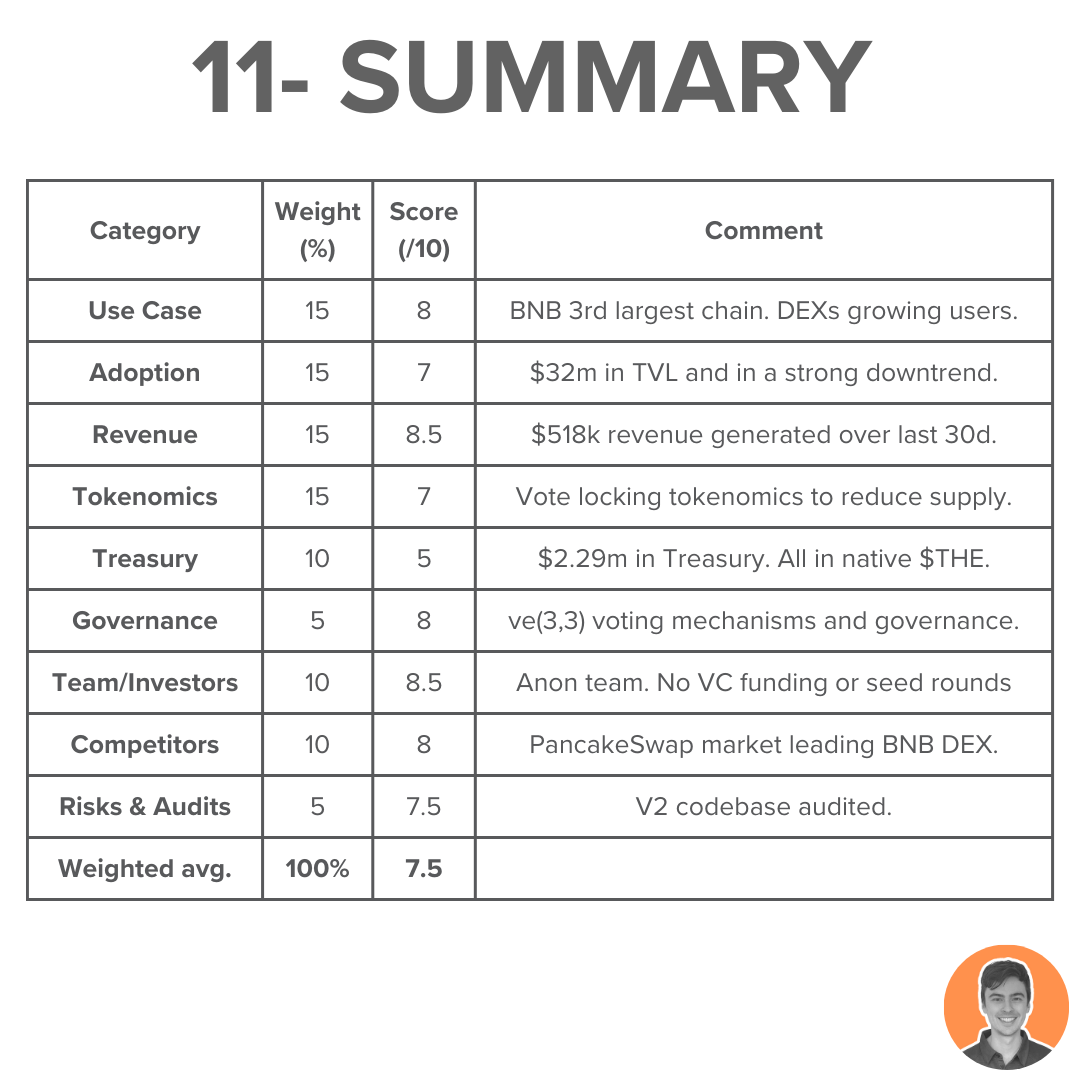

Overall, I think THENA could be a high r/r play for the bull.

Upcoming catalysts:

ALPHA perps

THENA Debit Card

Fiat on/off-ramp

Expert trading mode

I would like to see TVL gains and am not a huge fan of the complex ve(3,3) locking.

Overall weighted score = 7.5

Note: I am NOT an ambassador or advisor of THENA. This is NFA.