MakerDAO is a revenue generating machine.

Regardless of market conditions, it continues to print money.

With some upcoming bullish catalysts, it doesn't look like slowing down any time soon.

Here's my November 2023 research report on MKR.

Here's what we'll cover in today's edition:

Overview

Use Case

Adoption

Revenue

Tokenomics

Treasury

Governance

Team & Investors

Competitors

Risks & Audits

Summary

The Maker Protocol enables users to obtain loans by using their crypto assets as collateral.

Here's how it works:

Deposit collateral (Approved ERC tokens)

Mint the stablecoin $DAI

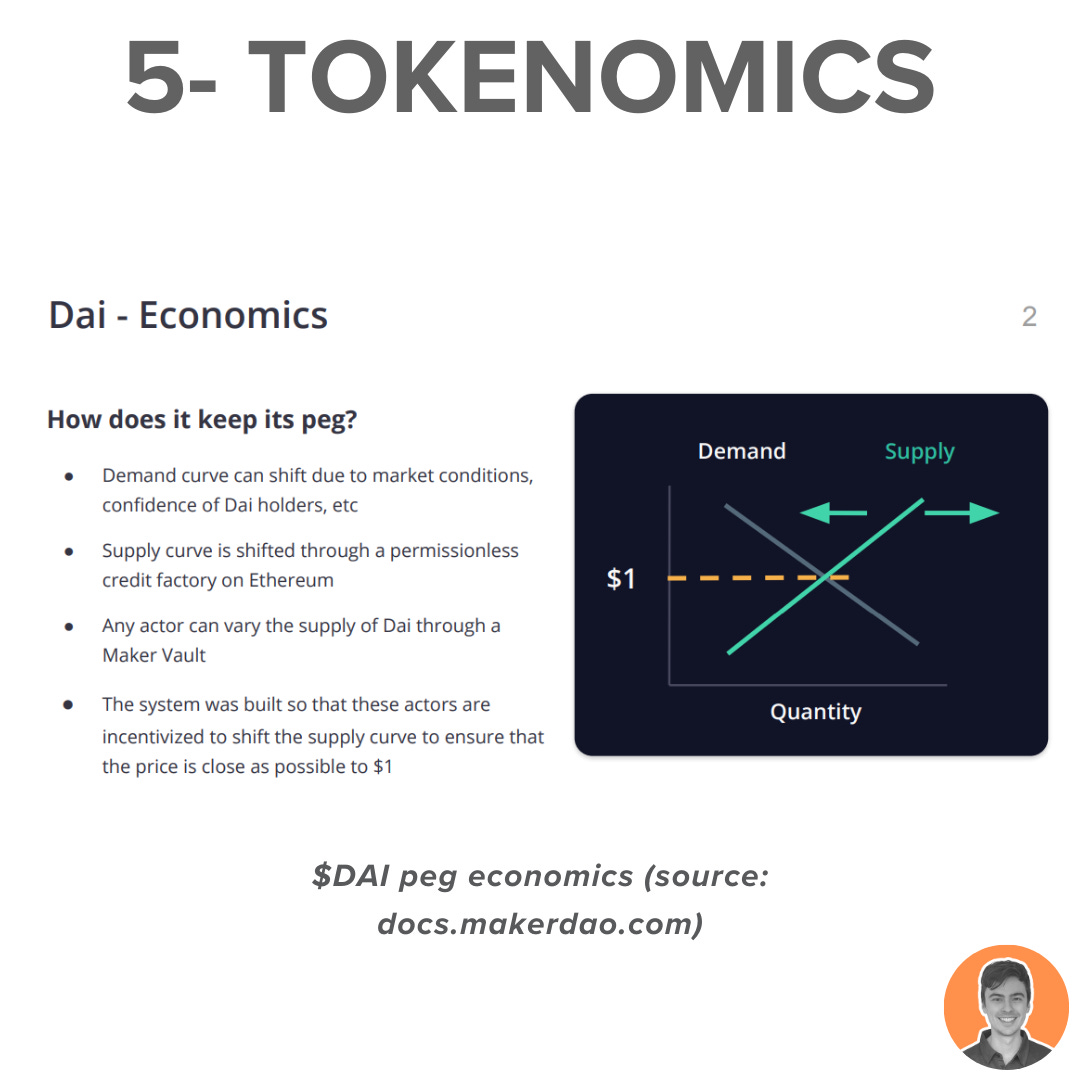

$DAI is currently the largest decentralized stablecoin, with a soft peg to the USD.

Use cases include:

Financial independence

Self-Sovereign Money Generation

Savings Earned Automatically (DSR)

Fast, Low-cost Remittances

Stability in Volatile Markets

DAI can also be used to pay for gas in the Ethereum ecosystem- improving onboarding experience.

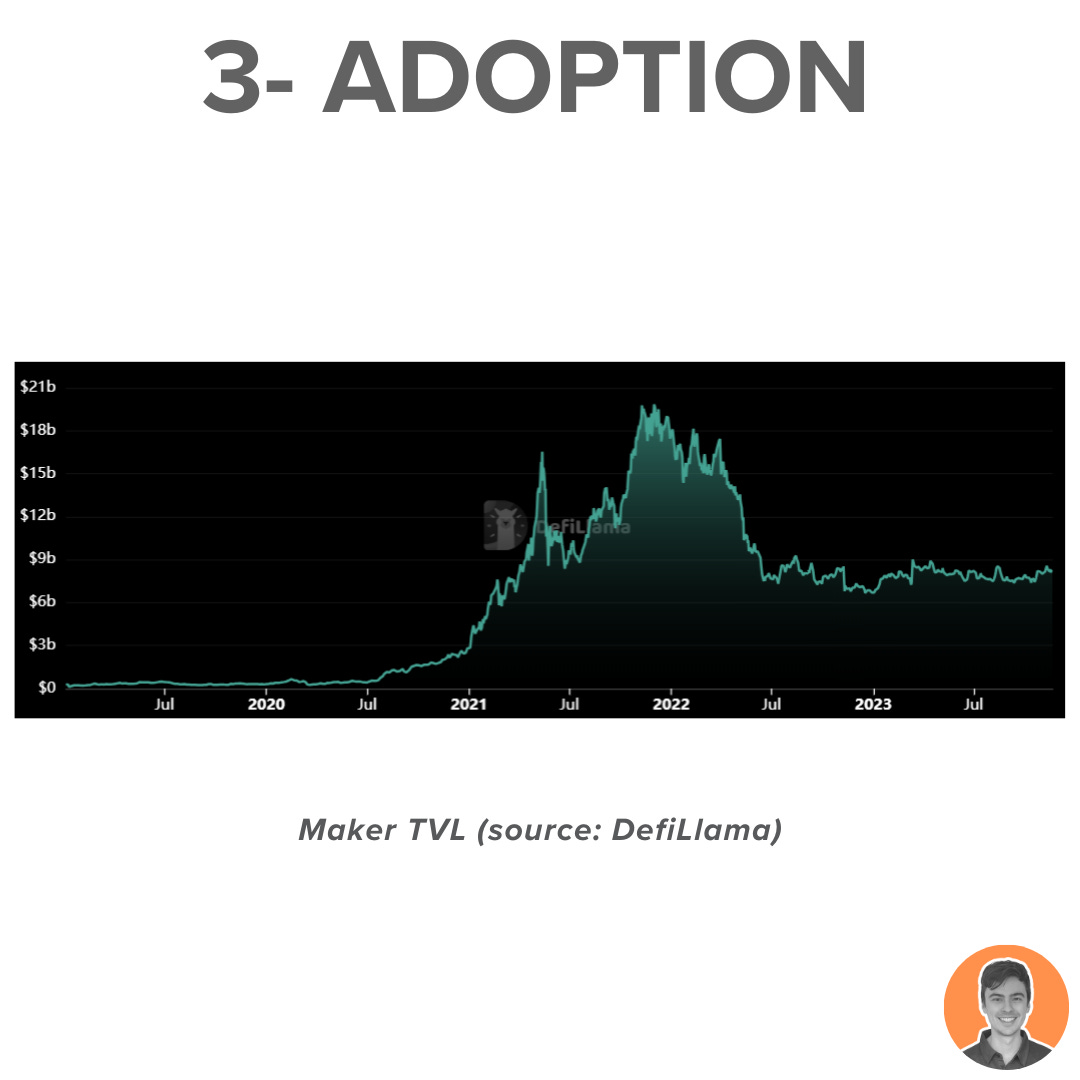

The TVL currently stands at $8.3b, having remained in a tight range of $7-8b since June 2022.

The release of RWAs on Maker has provided a significant boost to the overall TVL in recent months. The current breakdown of TVL is as follows:

MakerDAO: $5.7b

Maker RWAs: $2.6b

In the last 30d, MKR has generated $15.7m in revenue.

When annualized, this amounts to an impressive $191m.

Making it the 3rd highest among all protocols (DefiLlama).

The fees and revenue are primarily generated through the interest paid by borrowers on the platform.

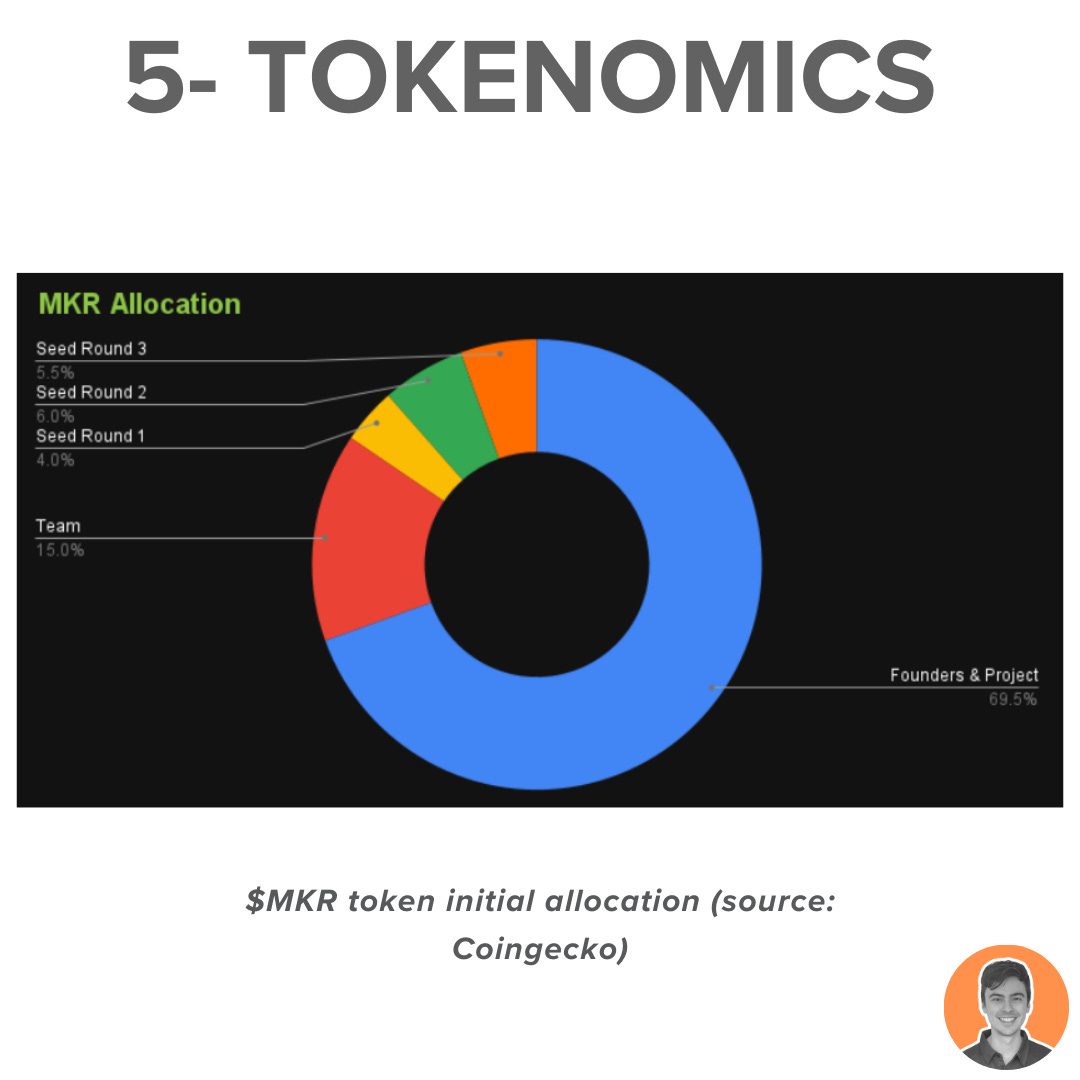

The $MKR token serves two primary purposes:

Governance

Recapitalization resource

In addition to its governance role, MKR can also be utilized for system recapitalization.

If the system debt exceeds the surplus, the MKR token supply may expand through a Debt Auction.

As a result, this risk encourages MKR holders to align themselves and responsibly govern the @MakerDAO ecosystem in order to mitigate excessive risk-taking.

This also implies that the supply of MKR may fluctuate based on debt capitalization.

These are the current supply stats:

Circulating supply = 901k

Total supply = 977k

Max supply = 1m

Market cap = $1.28b

FDV = $1.39b

Market cap/ FDV = 0.92

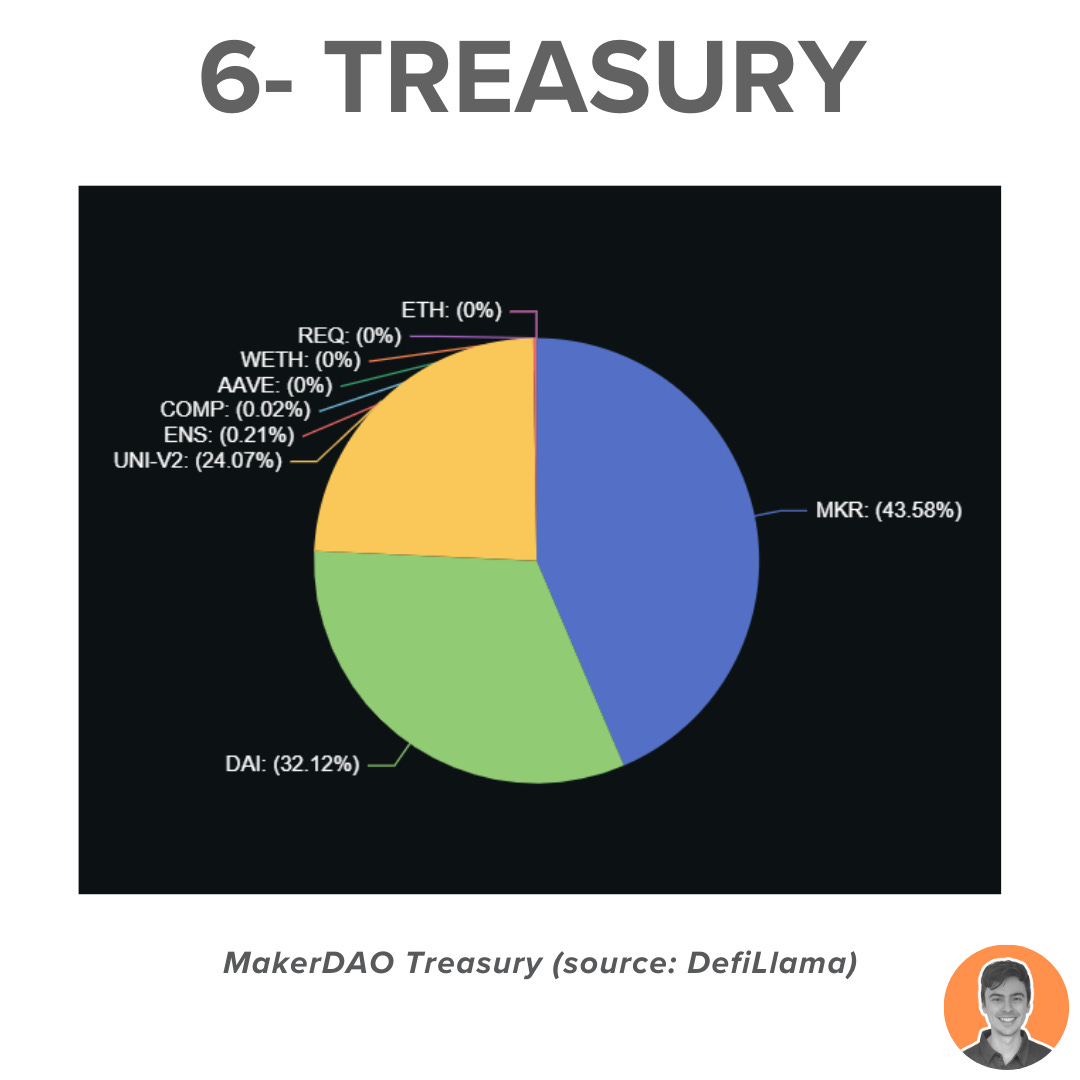

The @MakerDAO Treasury consists of:

$62.55m in stablecoins

$0.98m in BTC/ETH

$131.77m in their own token (MKR)

In total, the treasury holds a healthy $194.77m (including their own token).

Placing them in 14th position according to DefiLlama.

Anyone can submit a proposal for a vote, but only $MKR holders have the power to vote on changes to the Maker Protocol.

The process consists of two stages:

Proposal polling

Executive Voting

Ensuring careful consideration before being subjected to a final vote.

In 2014, MakerDAO was launched on the Ethereum blockchain and has since become one of the largest decentralized finance (DeFi) applications.

The protocol was co-founded by Rune Christensen (@RuneKek) and Nikolai Mushegian.

$DAI is now one of the most widely used stablecoins.

Over multiple secondary token sales, Maker has raised around $54.5m.

$12M on 16 Dec 2017, funded by Andreessen Horowitz and Polychain Capital

$15M on 23 April 2019, funded by a16z Crypto

$27.5M inn April 2019, funded by Paradigm & Dragonfly Capital

MakerDAO has established itself as the the clear market leader in the Collateralized Debt Position (CDP) category.

It now faces competition from protocols like Liquity and Lybra Finance.

Other established DeFi players (Curve & AAVE) have also recently launched stablecoins.

The Maker protocol has been audited by several reputable firms including:

Trail of Bits (Security review of smart contracts)

PeckShield (Traditional audit)

Runtime Verification (Model used to verify the logic of system)

Overall, I am quite bullish on MakerDAO and the DAI ecosystem.

There are a number of upcoming bullish catalysts:

Launch of Sub DAOs

Spark Protocol

RWA narrative

5% APY on DSR

11% APY on Gnosis Agave

Token split

Rebranding

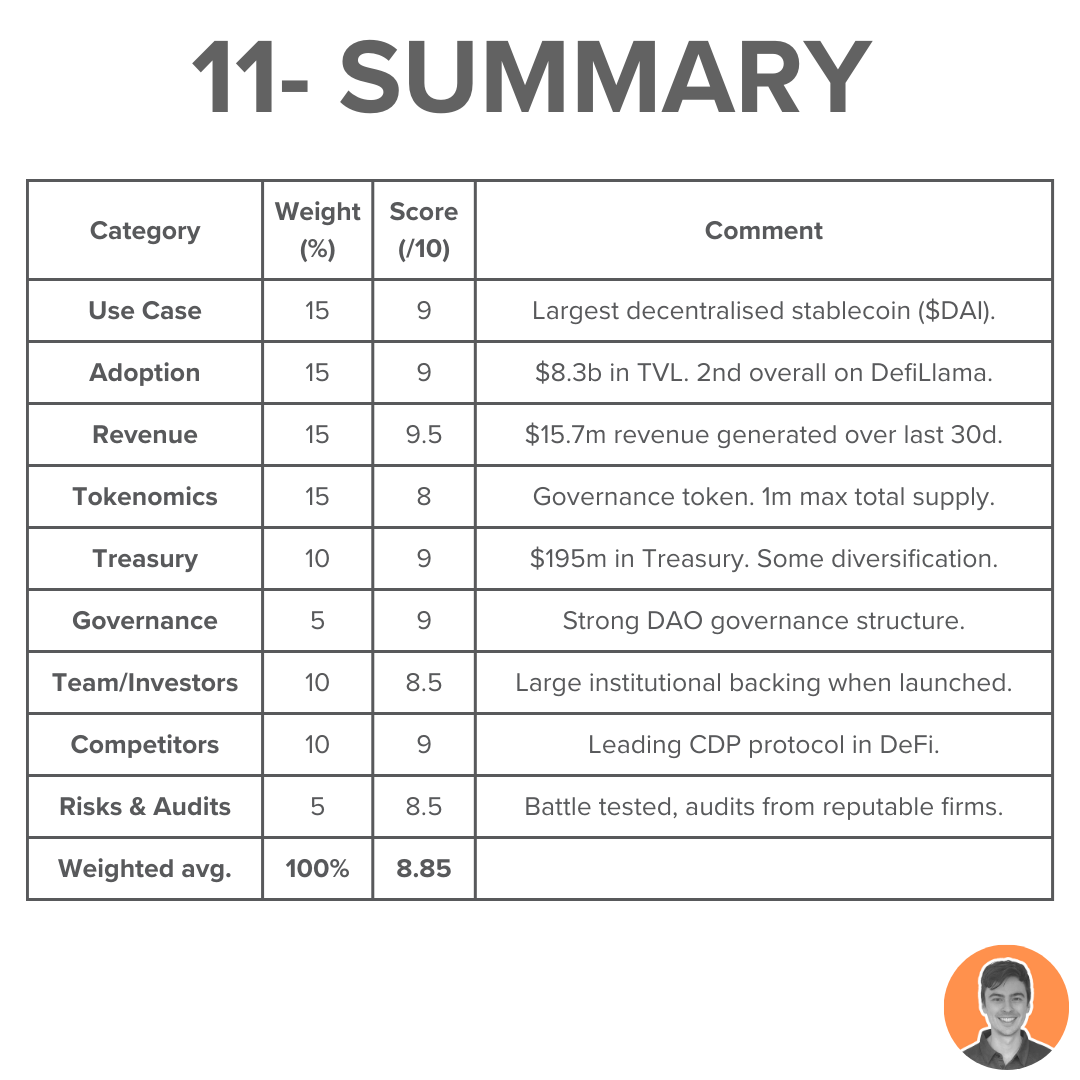

Overall weighted score = 8.85

Note: I am NOT an ambassador or advisor of MakerDAO. This is NFA.

Awesome man ... really good stuff. Please keep this up.