Bitcoin is set for a huge 2024 with two massive catalysts: ETF approval and the halving.

Stacks is in the perfect position to capitalise on these massive inflows into Bitcoin DeFi.

Check out my January 2024 research report on STX.

Here's what we'll cover in today's edition:

Overview

Use Case

Adoption

Revenue

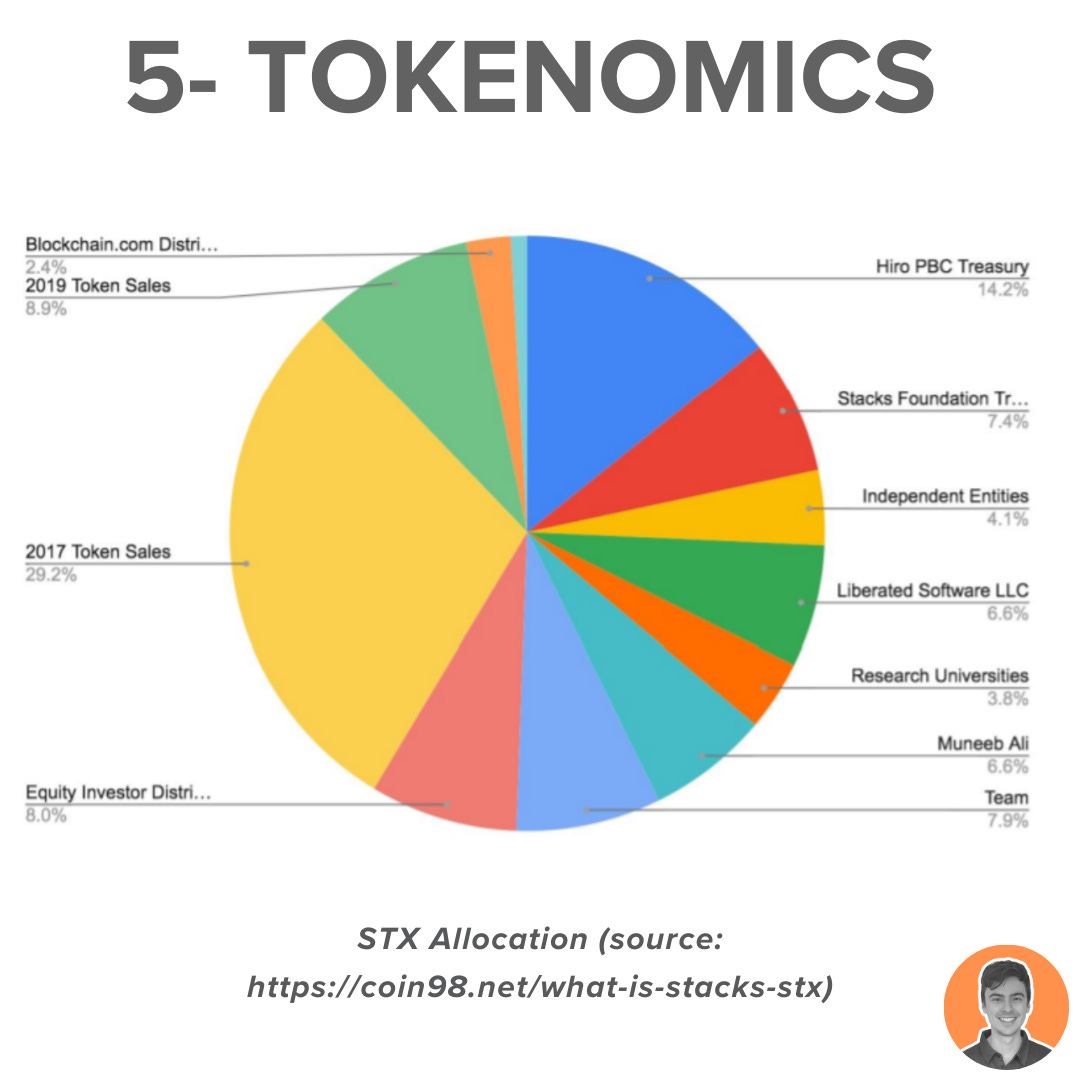

Tokenomics

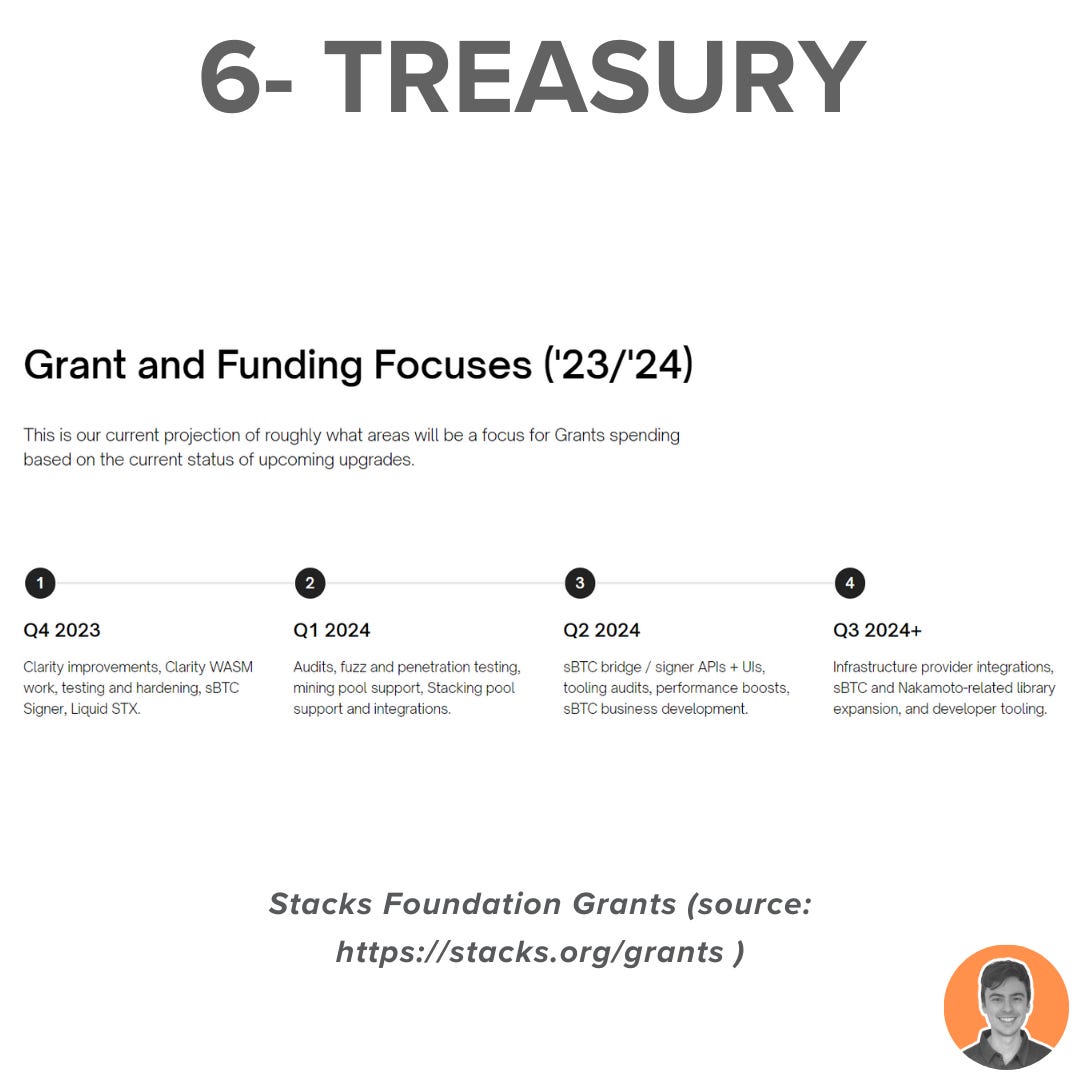

Treasury

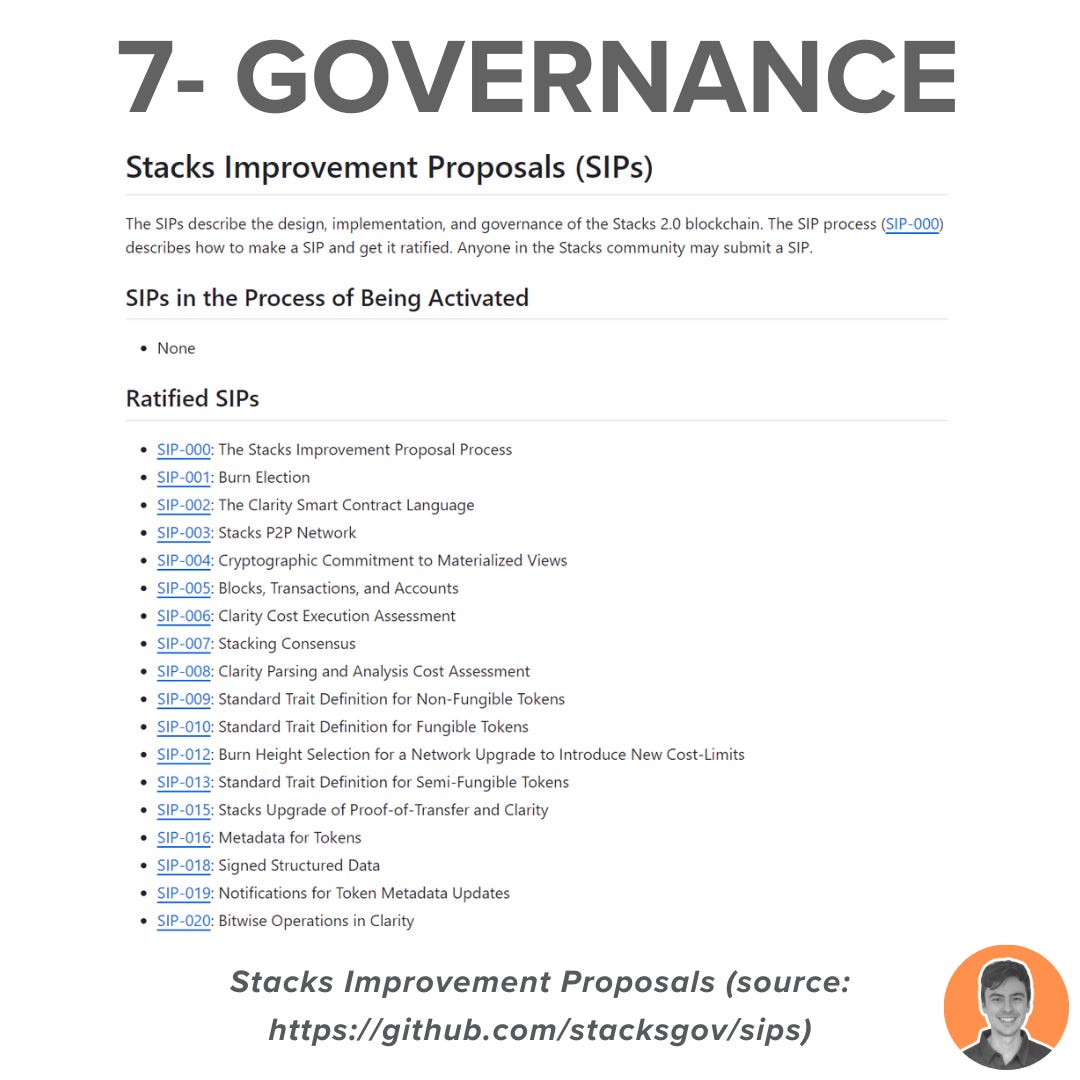

Governance

Team & Investors

Competitors

Risks & Audits

Summary

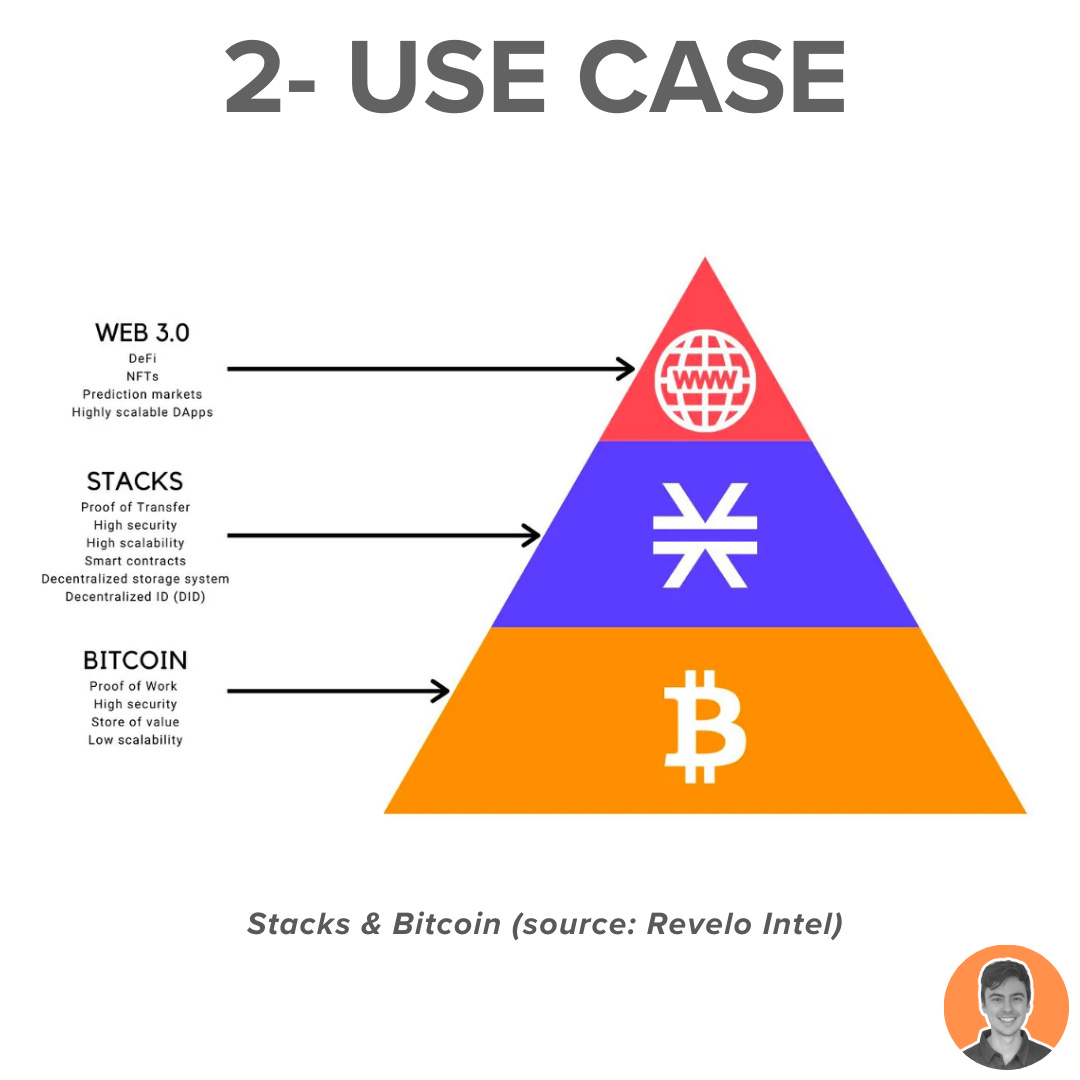

Stacks is a smart contract layer for Bitcoin.

Traditionally, Bitcoin is thought of as a store of value/ digital gold.

Stacks can provide novel use cases for $BTC holders. These include:

Bitcoin-backed loans

Bitcoin DeFi

Using $BTC to trade NFTs

Stacks aims to bring DeFi to Bitcoin, unlocking over $900b in capital.

It uses the Bitcoin network as the settlement layer and adds Smart Contracts and programmability.

Instead of running on centralized servers, apps would run on the Stacks blockchain itself.

There is a growing ecosystem with over 30 teams are actively engaged in developing on Stacks.

Some of the largest projects include:

Alex (DEX)

StackingDAO (Liquid staking)

Arkadiko (CDP)

Stacks aims to help scale the Bitcoin economy.

TVL on the Stacks chain is hitting ATHs and is at $63m.

Up about 6x from the September 2023 lows ($10m TVL).

Volume is also up considerably over the last few months. Corresponding to a surge in popularity of NFTs, DEXs, and domain name services.

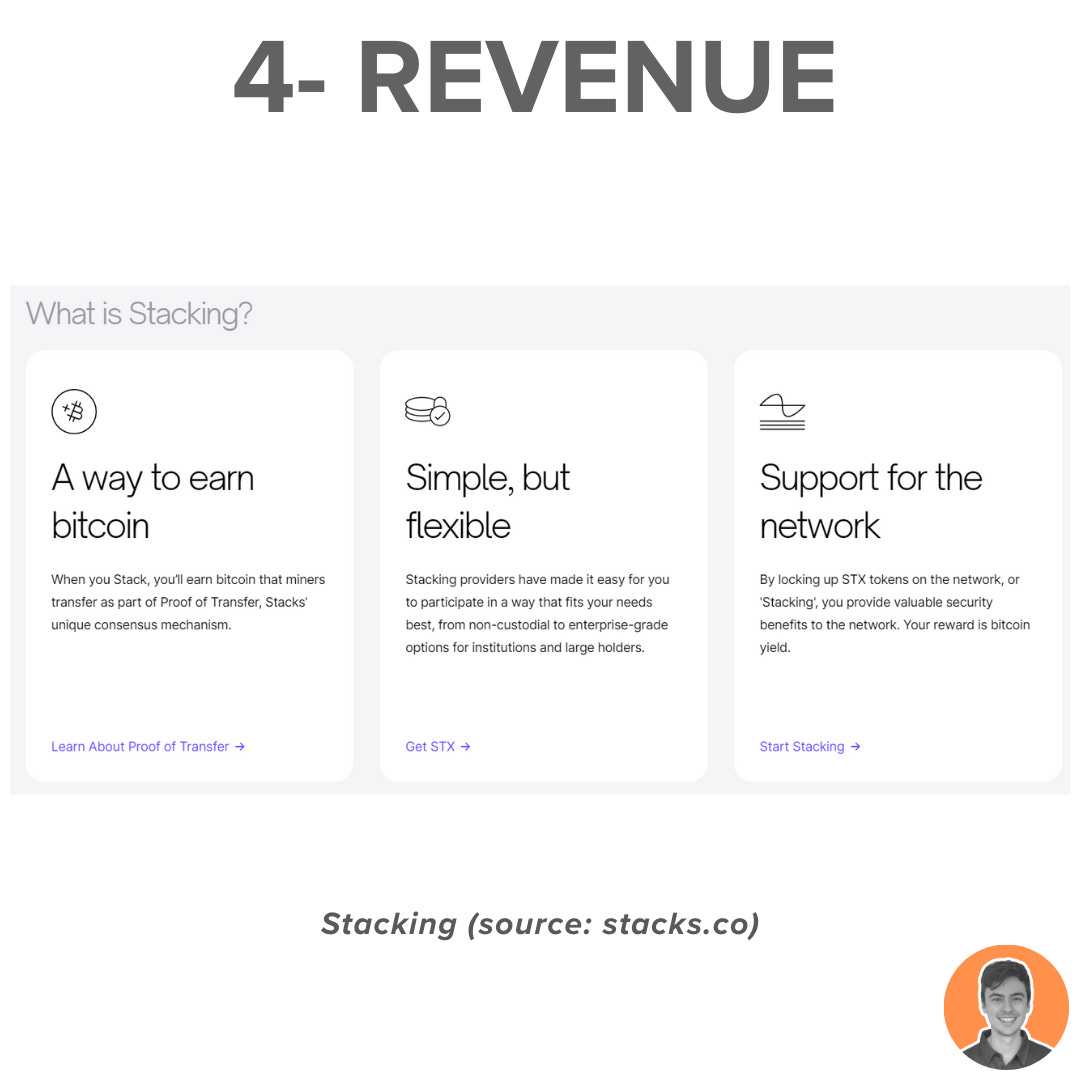

Stacking (Staking) secures the Stacks network and offers stackers a real yield in $BTC (currently around 7%).

The yield is tied to network activity. As activity grows and blocks become more valuable, $BTC bids increase, leading to higher yields for $STX stakers.

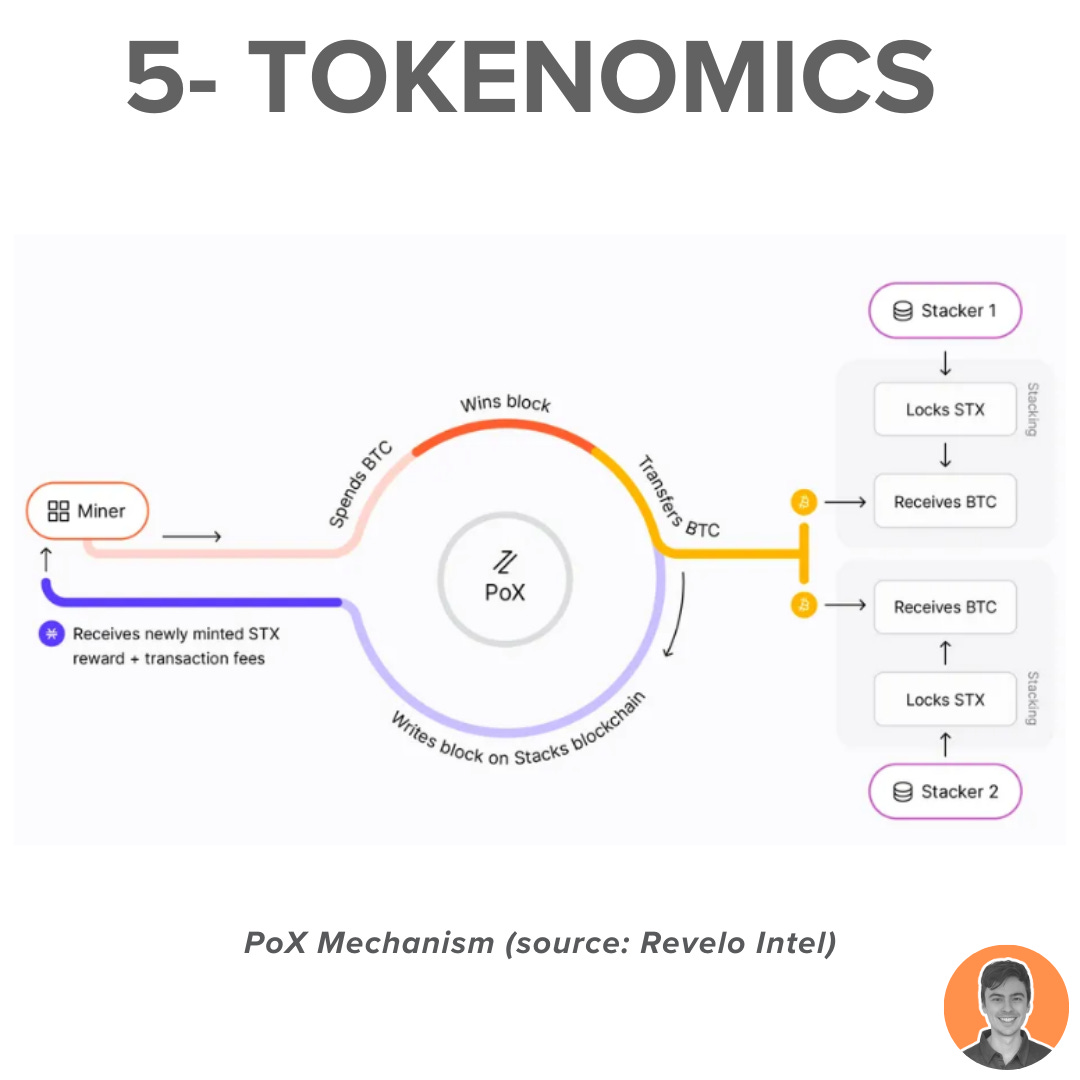

Proof of Transfer (PoX) is the mechanism behind the Stacks blockchain. Miners validate transactions by bidding with $BTC to receive $STX rewards.

$STX is the native token and can be used to:

Pay transaction fees

Stacking (locked on the network to earn BTC rewards)

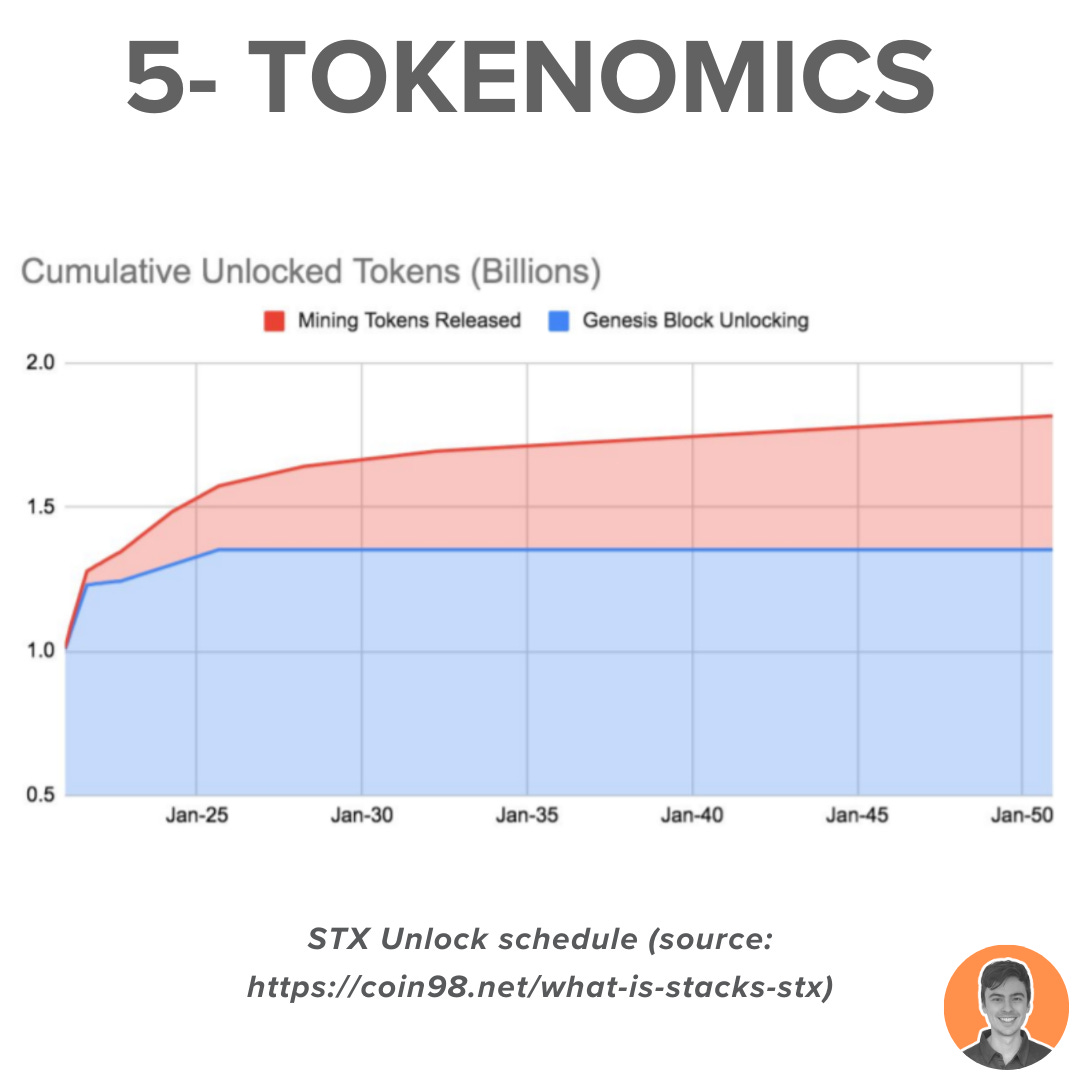

Like Bitcoin, Stacks operates a halving program that reduces miners' rewards by half of their previous value.

STX also has a fixed and predictable future supply that halves every 4 years.

By the year 2050, the total supply of STX is projected to reach 1.82B.

Current supply stats:

Circulating supply: 1.43b

Max supply: 1.82b

Market cap: $2.6b

FDV: $3.3b

Market cap/FDV: 0.79

As per the unlock schedule, there are two main treasuries:

Hiro PBC Treasury: 200m $STX = $366m USD

Stacks Foundation Treasury: 100m $STX = $183m USD

The Stacks Foundation treasury is used to invest in projects building on Stacks. The exact amount utilized is unknown.

Anyone in the Stacks community can submit an SIP (Stacks Improvement Proposal).

Each SIP is then discussed and voted on by the Steering Committee. Joining this committee requires the consent of the Stacks Foundation board.

This process is still fairly centralised.

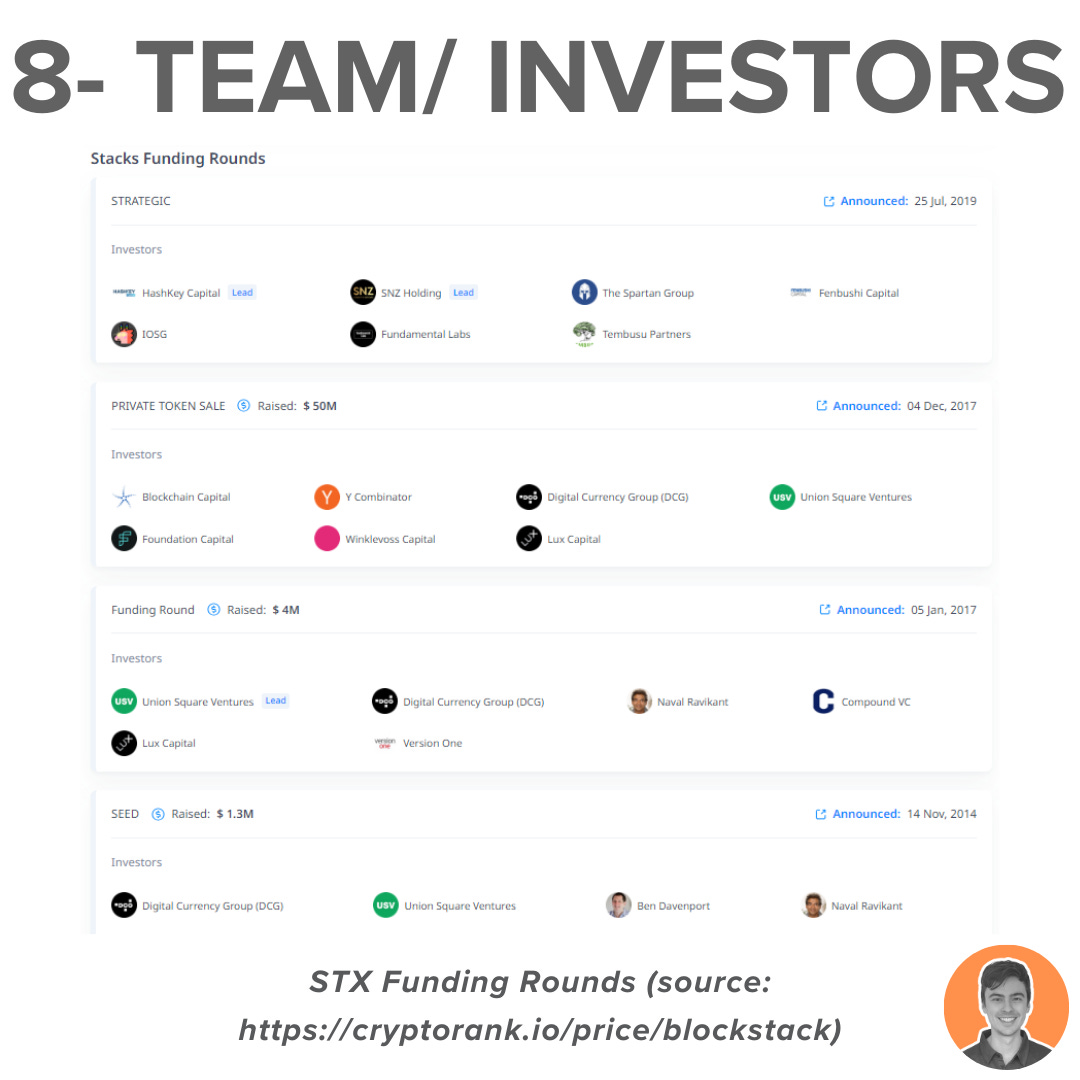

Stacks was founded in 2017 by Muneeb Ali @muneeb and Ryan Shea @ryaneshea

Over the years, it has raised over $45m from various funding rounds, private sales and ICOs.

Prominent Investors included Hashkey, SNZ Holding, Blockchain Capital, DCG, Winklevoss Capital & Naval.

There are other solutions to the inefficiencies of Bitcoin. These include the Bitcoin Lightning Network, RSK, Ark, and Liquid.

However, Stacks is unique as it's the only one with its own native token- $STX.

This gives the project a significant competitive advantage.

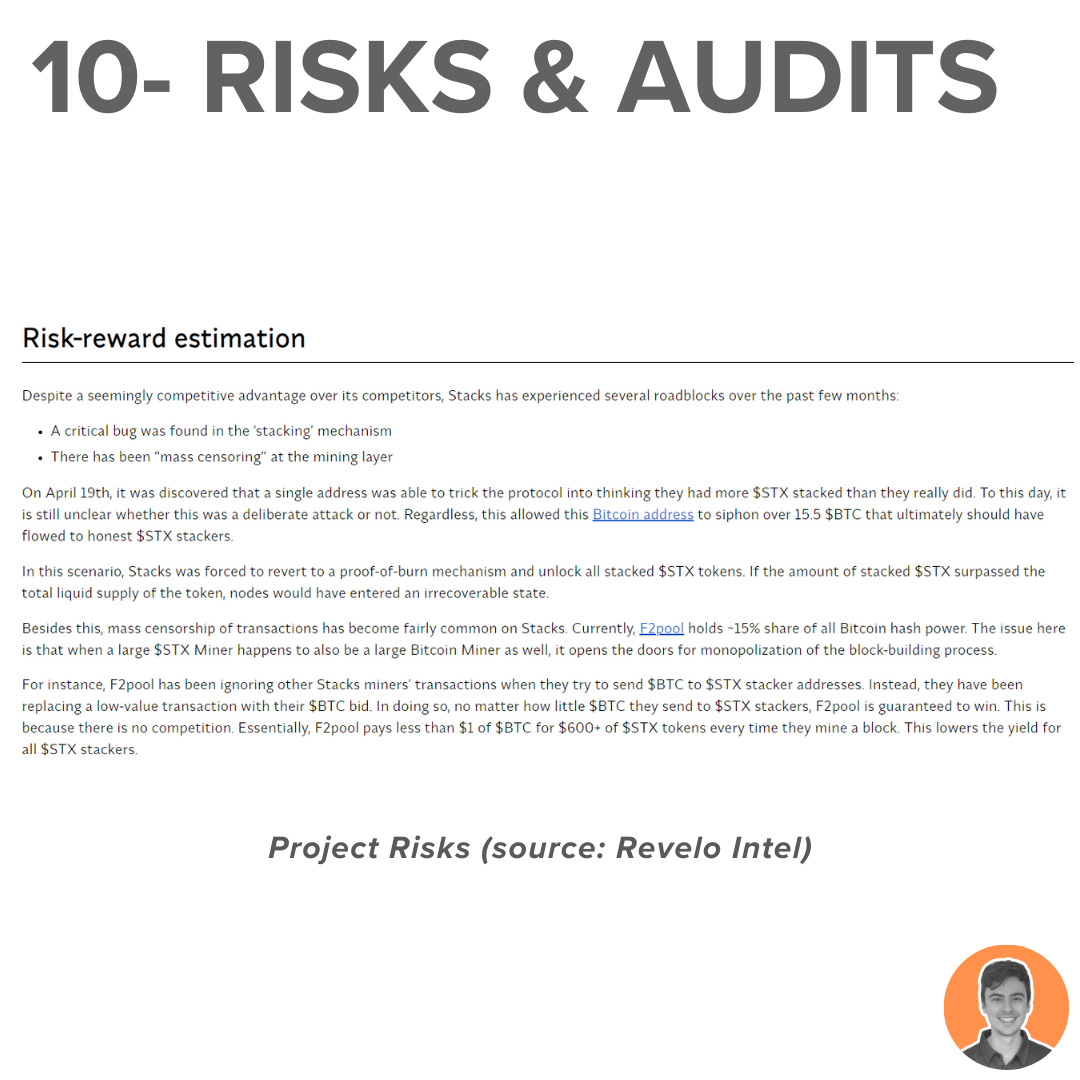

Stacks has faced several roadblocks in recent months:

The discovery of a critical bug in the 'stacking' mechanism

Instances of 'mass censoring' at the mining layer

Interestingly, the $STX token sale marked the first SEC-qualified offering in U.S. history.

The Bitcoin ecosystem has huge potential for growth and Stacks is a project I am watching closely.

Upcoming catalysts:

BTC ETF approval

BTC halving (April '24)

Nakamoto upgrade

sBTC to be released

Bitcoin DeFi, and NFT trading

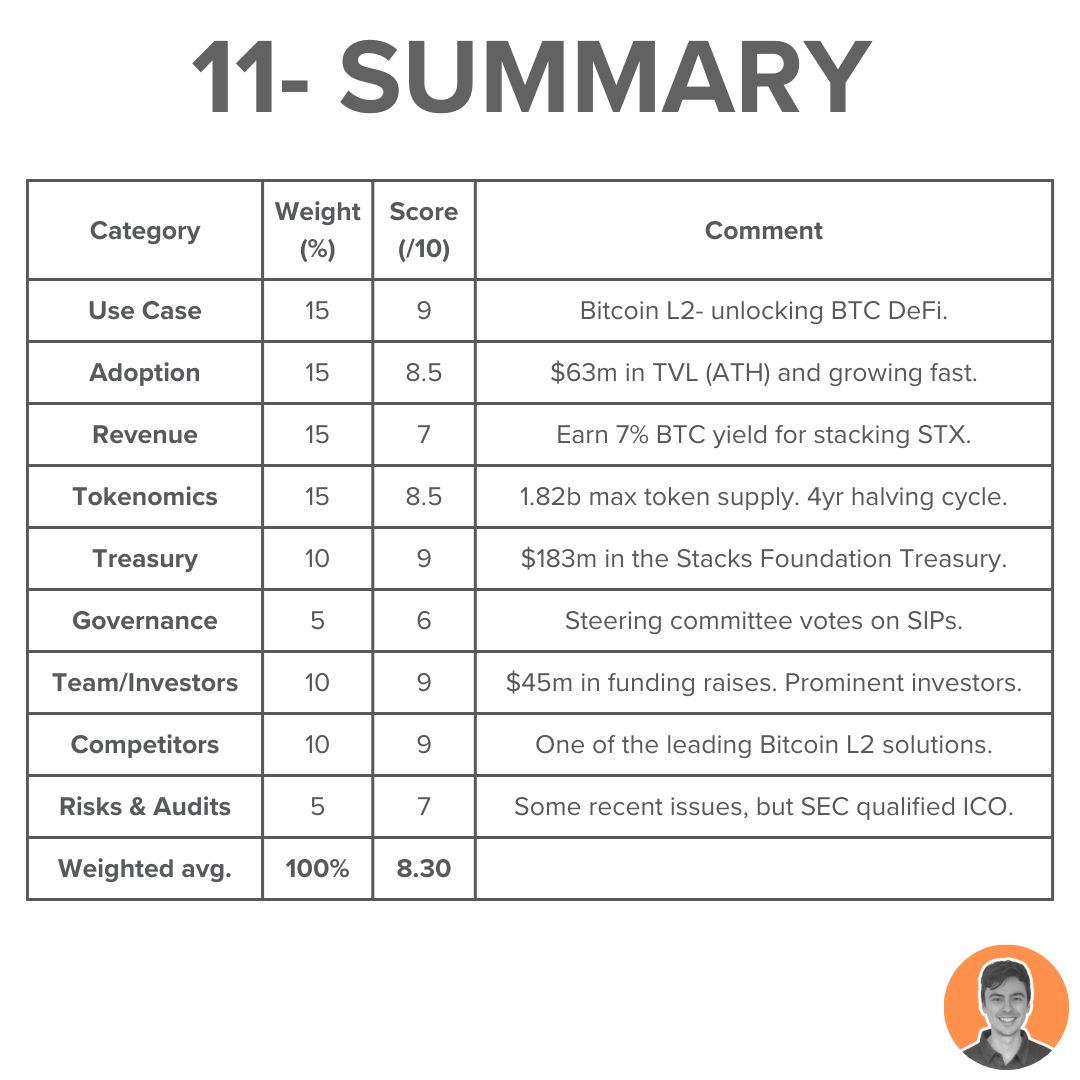

Overall weighted score = 8.30

Note: I am NOT an ambassador or advisor of Stacks. This is NFA.