Is Solana the Ethereum killer or just another Layer 1 blockchain?

Don't miss my December 2023 research report on SOL.

Here's what we'll cover in today's edition:

Overview

Use Case

Adoption

Revenue

Tokenomics

Treasury

Governance

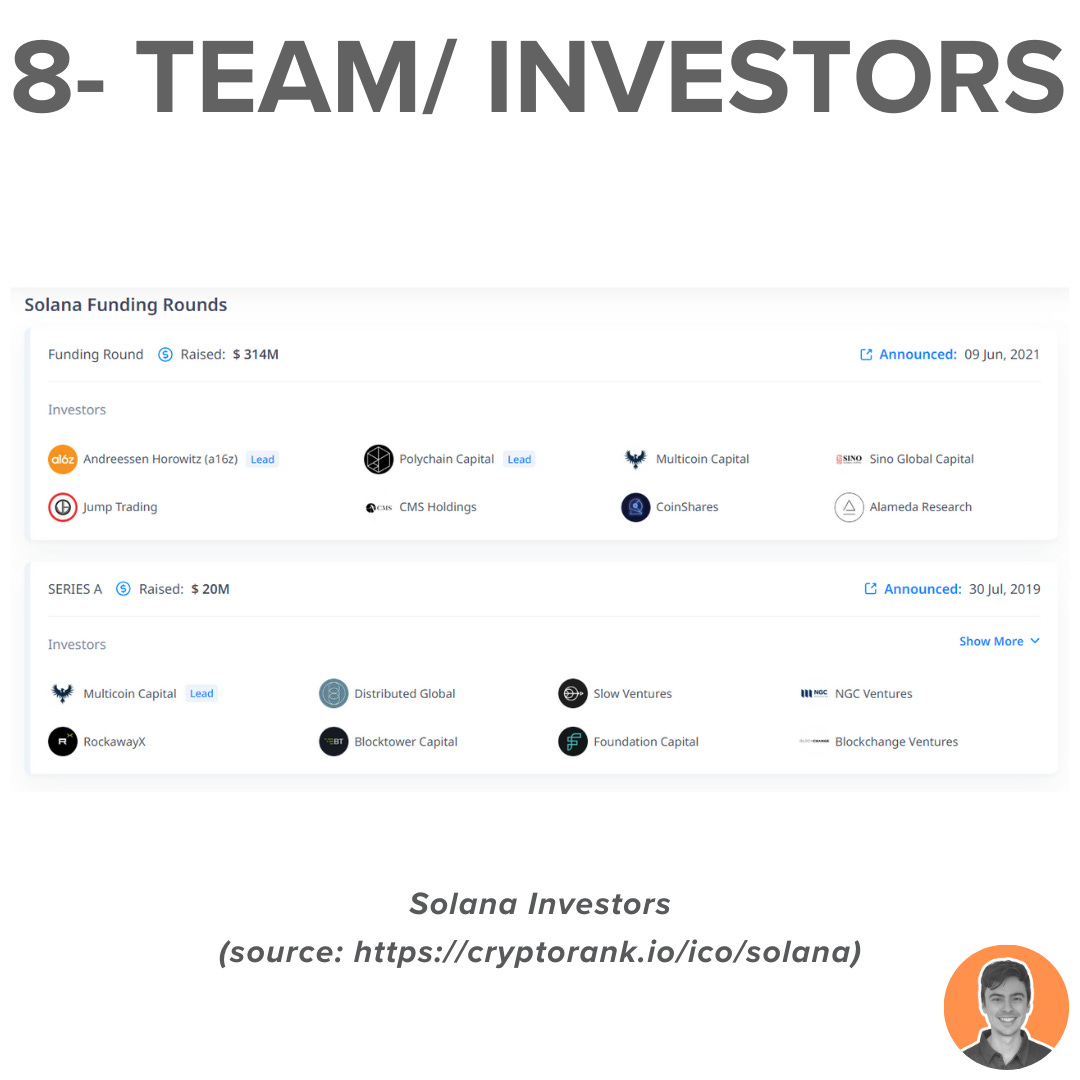

Team & Investors

Competitors

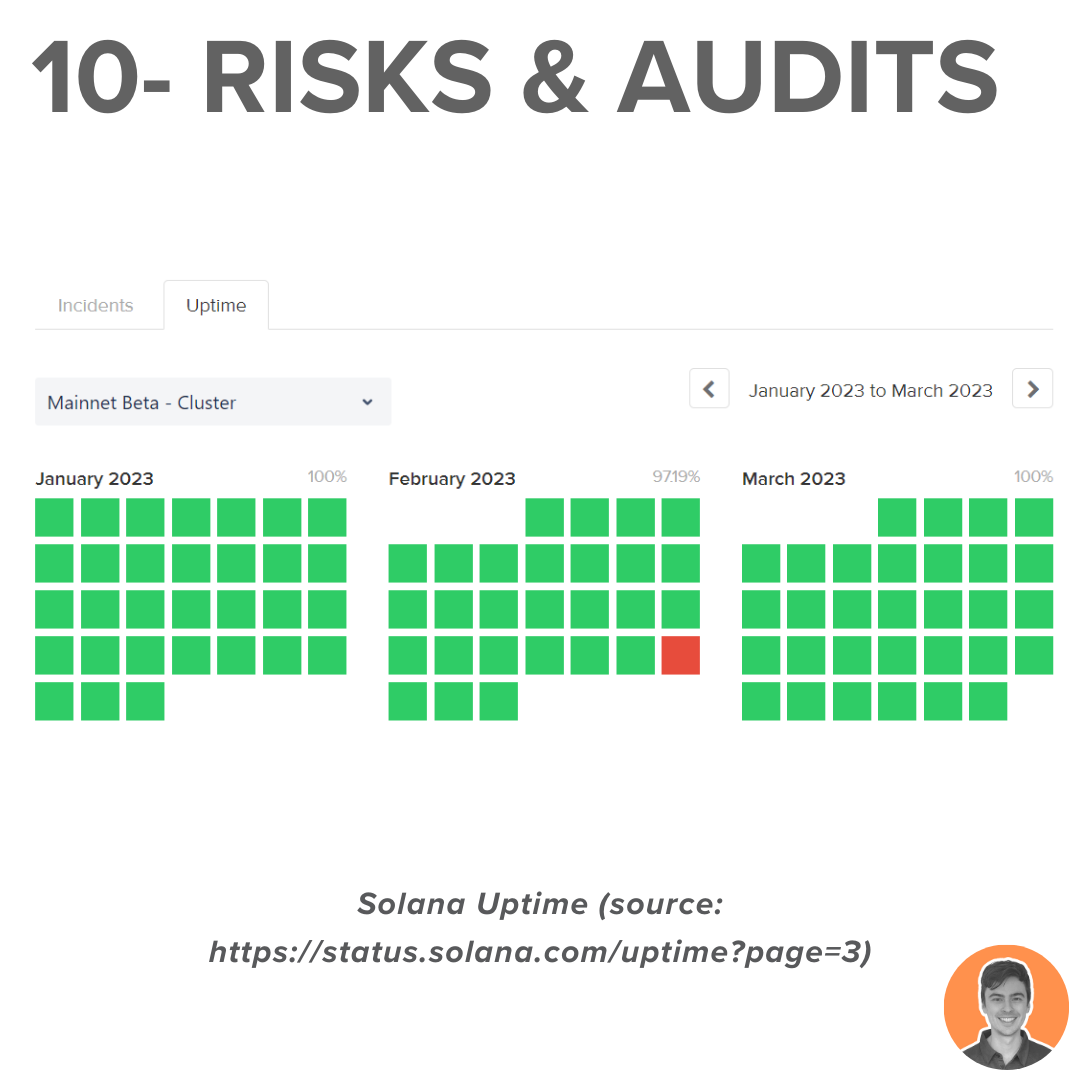

Risks & Audits

Summary

Don't forget to bookmark this post for future reference. 📚

Solana: a Layer 1 chain with key features:

Fast transactions

Low fees

Scalability

Decentralization

Solana synchronizes time on the blockchain, ensuring agreement among all computers in the network. Unlike Bitcoin and Ethereum.

Also referred to as Proof of History.

By solving the synchronization issue, Solana unlocked the possibility of an extremely fast blockchain, bound only by network bandwidth.

While Bitcoin and Ethereum have an upper bound of 15 transactions per second, Solana can achieve over 3,000 tps with extremely low gas fees.

This has allowed Solana to build a thriving ecosystem:

DeFi (Marinade, Jito, marginfi)

NFTs (STEPN, Mad Lads, Kromes)

Solana mobile (Saga)

Payments (Sol Pay & Shopify)

Gaming (Bladerite)

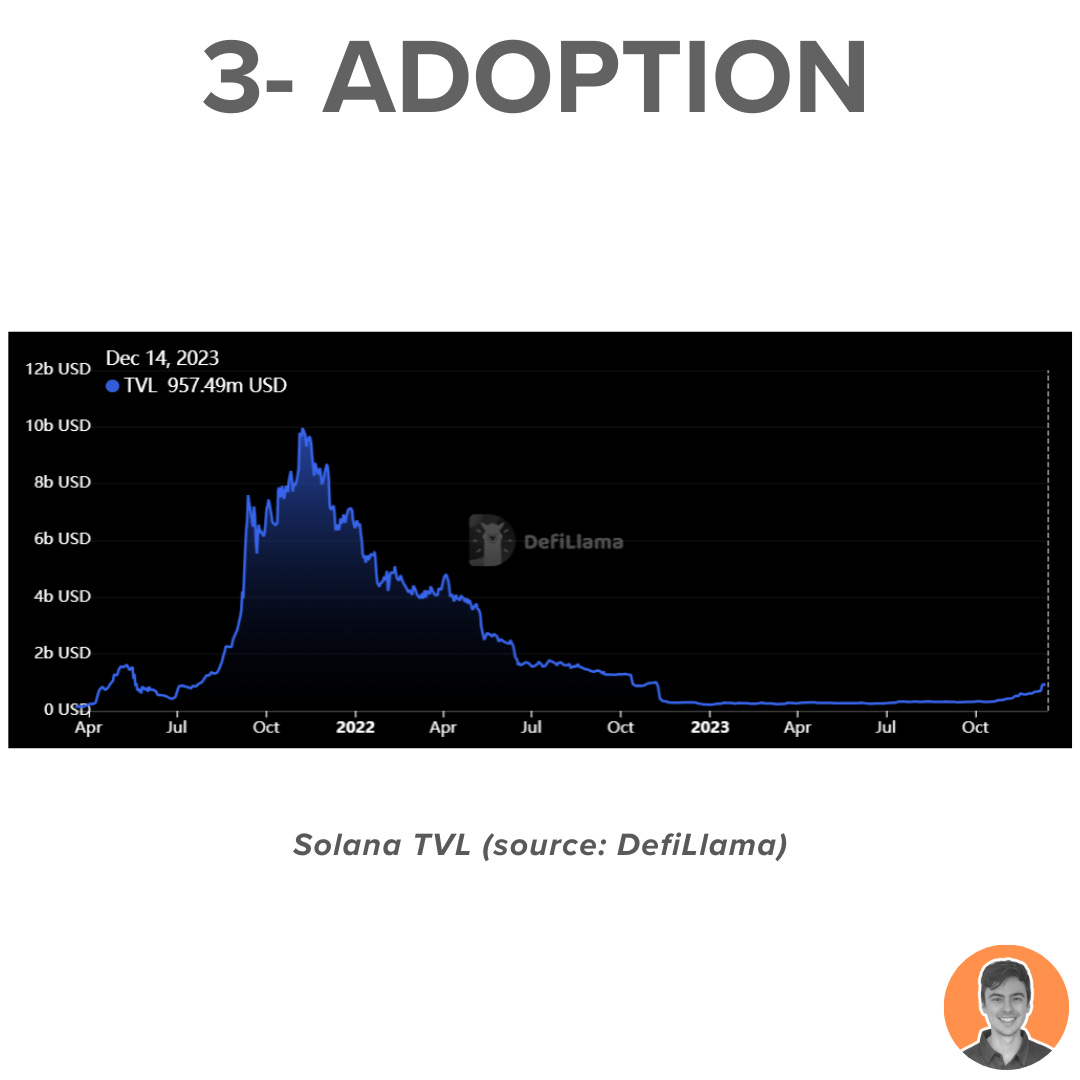

After a rough 2022 (FTX), we find ourselves in a Solana renaissance.

TVL is sitting at around $1.06b. Which is up 5x since the start of 2023 ($210m TVL).

While this is an impressive gain, it's easy to forgot how crazy SOL went in 2021, peaking at just under $10b TVL.

Meaning that we are still about 10x off the ATH in TVL (plenty of room to run).

Over the past 30d, SOL has generated an impressive $1.85m in revenue. Putting it 20th overall and 5th amongst other chains.

Nice recent uptrend starting in October.

50% of each transaction fee is burned, with the remaining going to the validator processing the transaction.

Solana is a proof of stake blockchain that boasts more than 2,000 validators.

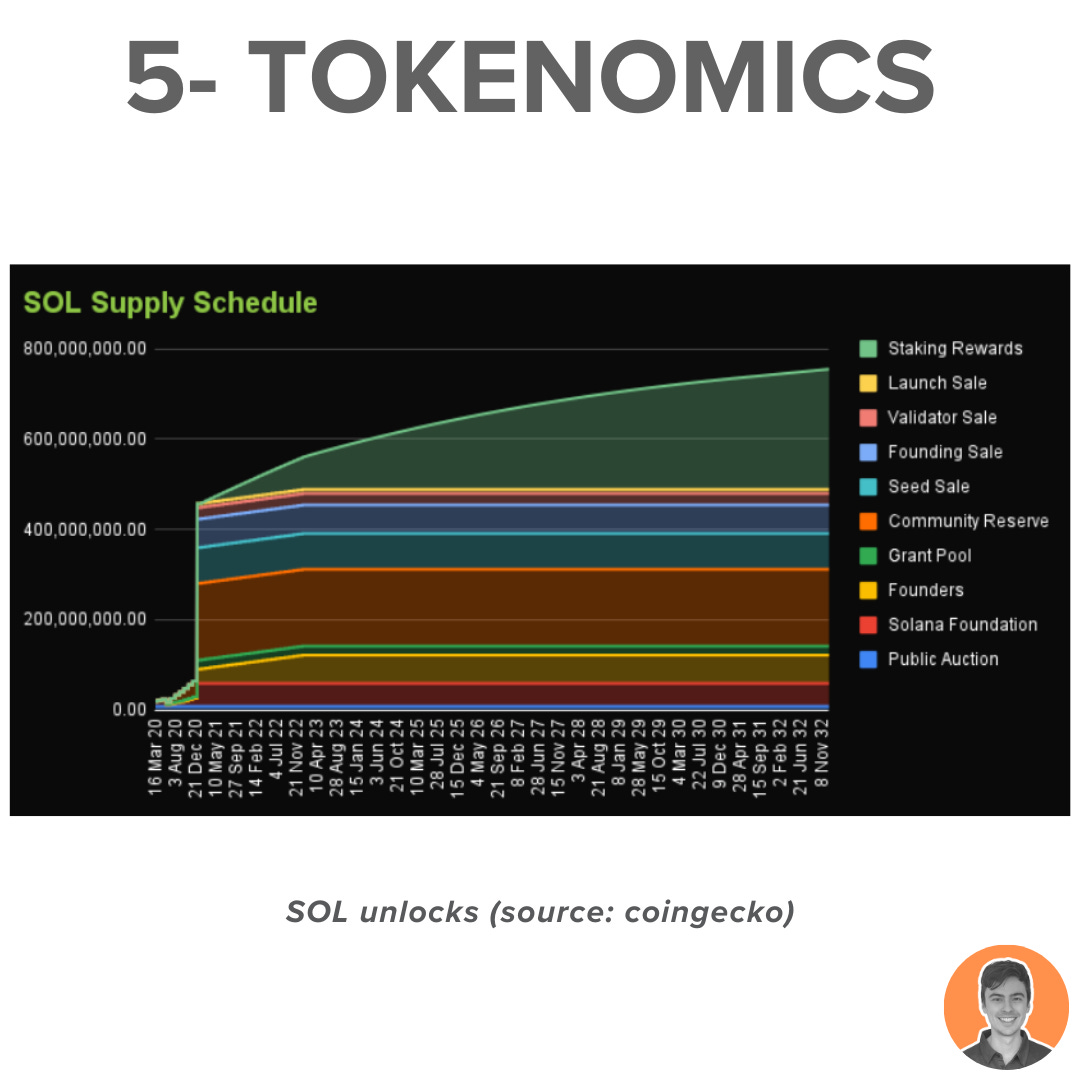

It has an uncapped maximum supply and features a unique dis-inflationary emission rate from its genesis.

These inflationary emissions serve as rewards for the stakers and validators of the network.

Currently, the inflation rate stands at 6.75%, while the staking yield is 6.78%.

$SOL serves as the native token and is utilized for transaction fees and network security.

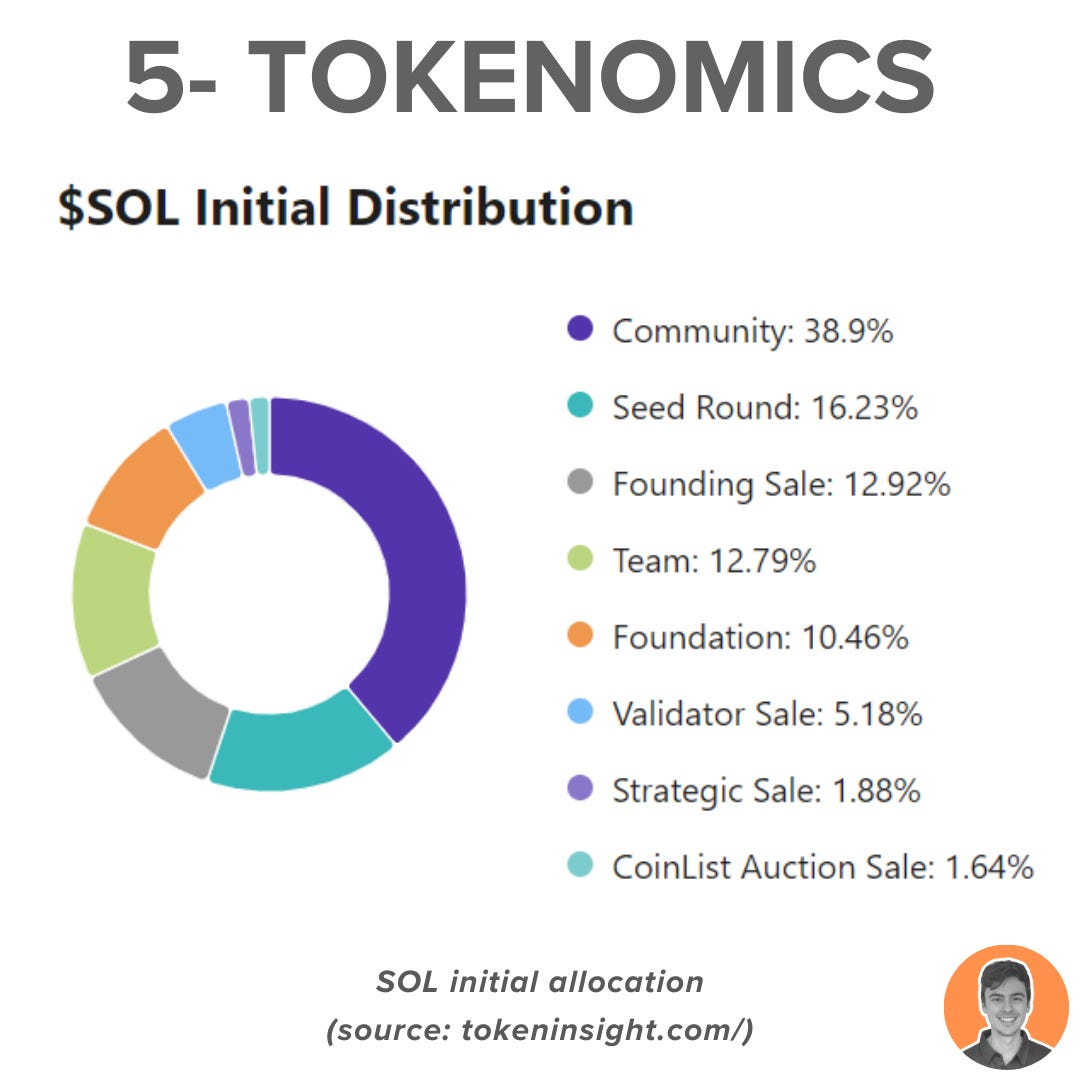

A significant allocation was made to the team, investors (seed & founding sale), and the foundation.

Current supply stats:

Circulating supply: 427.7m

Total supply: 565m

Max supply: ∞

Market cap: $31.2b

FDV: $41.2b

Market cap/FDV: 0.76

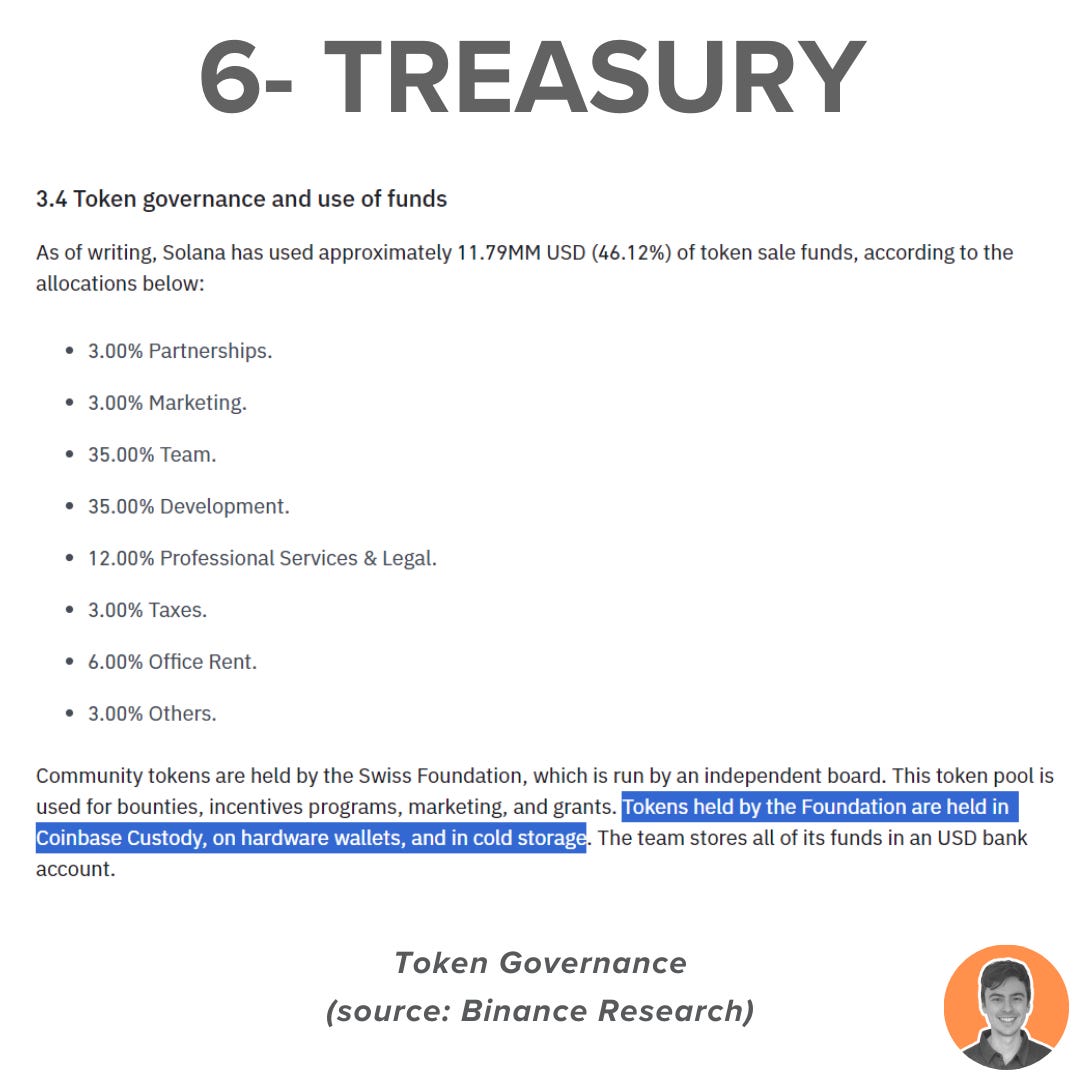

The treasury consists of foundation allocated tokens representing 10.46% of the total token supply, valued at $4.14 billion USD.

Additionally, the Solana Foundation Grants Program funds initiatives for decentralizing, growing, and securing the network.

In August, a proposal was made to establish governance on Solana.

Previously, changes were discussed with the community, but Solana Labs had the ultimate responsibility/ authority.

The first Governance vote, "Who should vote in a Solana Governance DAO," took place in October.

The concept for Solana was developed by Anatoly Yakovenko @aeyakovenko in 2017. The project was then officially launched in March 2020.

Solana has raised a total funding of $374M over 4 rounds.

It remains one of the most heavily backed crypto projects by VCs/ Investors.

Solana is not only competing against other Layer 1 blockchains but also against Layer 2 solutions such as Arbitrum, Optimism, and Polygon.

In this highly competitive market, Solana is emerging as one of the frontrunners, establishing a robust ecosystem of NFTs and dApps.

The Mainnet-Beta has been operational for almost 4 years, undergone audits, and evolved into a mature blockchain.

Despite a notable 18-hour network outage in February '23, Solana has achieved 100% uptime since then.

The project also runs a sizeable bug bounty program.

Solana is one of the biggest comeback stories of 2023. After being one of the hardest hit during 2022, it has rocketed back as one of the leading chains.

Upcoming catalysts:

Airdrop season (Jito)

Meme coins

Saga phone

NFT growth

Overall weighted score = 8.58

Note: I am NOT an ambassador or advisor of Solana. This is NFA.