Give someone a fish, they eat for a day.

Teach someone to fish, they thrive for a lifetime.

After a long crypto winter, the bull run is here and it's time to go fishing.

Steal my DYOR framework and uncover the next 100x opportunity.

I'm not here to shill you random altcoins.

My mission is to equip you with investing tools that will enable your long-term success.

I want to teach you to fish, so you'll never go hungry again.

Throughout the past year, my entire focus has been on leveling up my investing framework.

After thousands of hours, I am excited to share with you my updated framework and investing methodology.

This framework is what I use to develop my deep dive threads (e.g. Chainlink).

Here are the 11 categories that I use to structure my research:

Overview

Use Case

Adoption

Revenue

Tokenomics

Treasury

Governance

Team & Investors

Competitors

Risks & Audits

Summary

To begin, it's crucial to understand the project. Follow these steps:

Read the whitepaper & project docs.

Answer these questions:

What is the project?

How does it work?

Use the protocol.

Play around with the app and familiarize yourself with it.

Understanding use case is critical in forming an investment thesis.

Answer these questions:

What problems does it solve?

Who will want to use it?

How can it grow and scale?

Assess the size of the sector/ narrative and it's growth potential.

So you found a project with an amazing use case... but is anyone actually using it?

Dive into the fundamental data and look at:

TVL trend

New users

Stablecoin inflows

Developer activity

You want to see a project that is attracting attention and users.

Like companies on the stock market, strong revenue growth is an important metric for crypto projects.

Projects generate revenue through:

Transaction fees

Trading fees

Liquidation fees

Does that revenue get distributed to token holders? Let's dive into tokenomics.

Bad tokenomics can absolutely make or break a project.

Ask yourself these key questions:

Is the token supply capped?

How many tokens have been issued?

Are there any buybacks/ burn mechanisms?

Any big unlocks coming up?

What % of supply is unlocked/ circulating?

A treasury is a projects slush fund. Its protective moat.

Like any business, crypto projects need to pay for devs, marketing & operating expenses.

Make sure you look at size and diversification of assets.

Excessive concentration of the project's own token can introduce risks.

A strong, decentralised and functional governance process is critical for the long term success of any project.

Investigate whether the project has:

DAO setup

Voting process

Multisig treasury wallet

Strong community engagement

Large wallets controlling supply

There is no "I" in TEAM.

Who is the team made up of?

Are they doxxed

Experience in Web3

Active on socials

Open source code

Be wary of cult leaders

Find out who are the early investors (VCs/ funds).

Or is it totally funded by the team/ community.

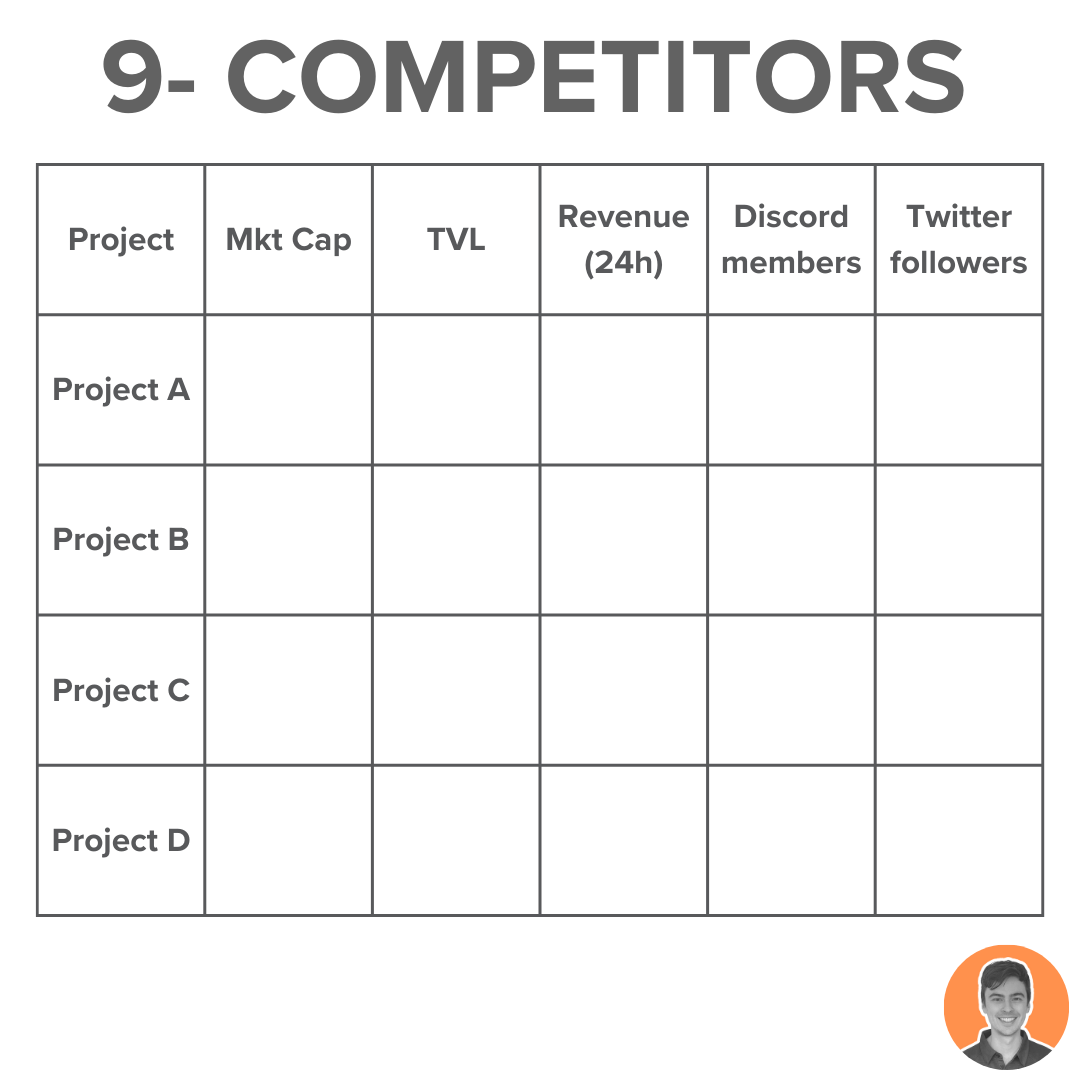

Crypto is a fast paced and highly cut-throat industry.

Code is often open source meaning projects can be easily forked.

Find the projects competition and size them up against each other.

Do they have a competitive advantage/ moat?

Are they innovating fast enough?

Everyday it seems like there is another rug-pull, scam or depeg event.

We are at the leading edge of a new technological revolution. It is expected.

However, you want to understand your investment risks:

Has the project been audited?

Any past exploits?

Any red flags?

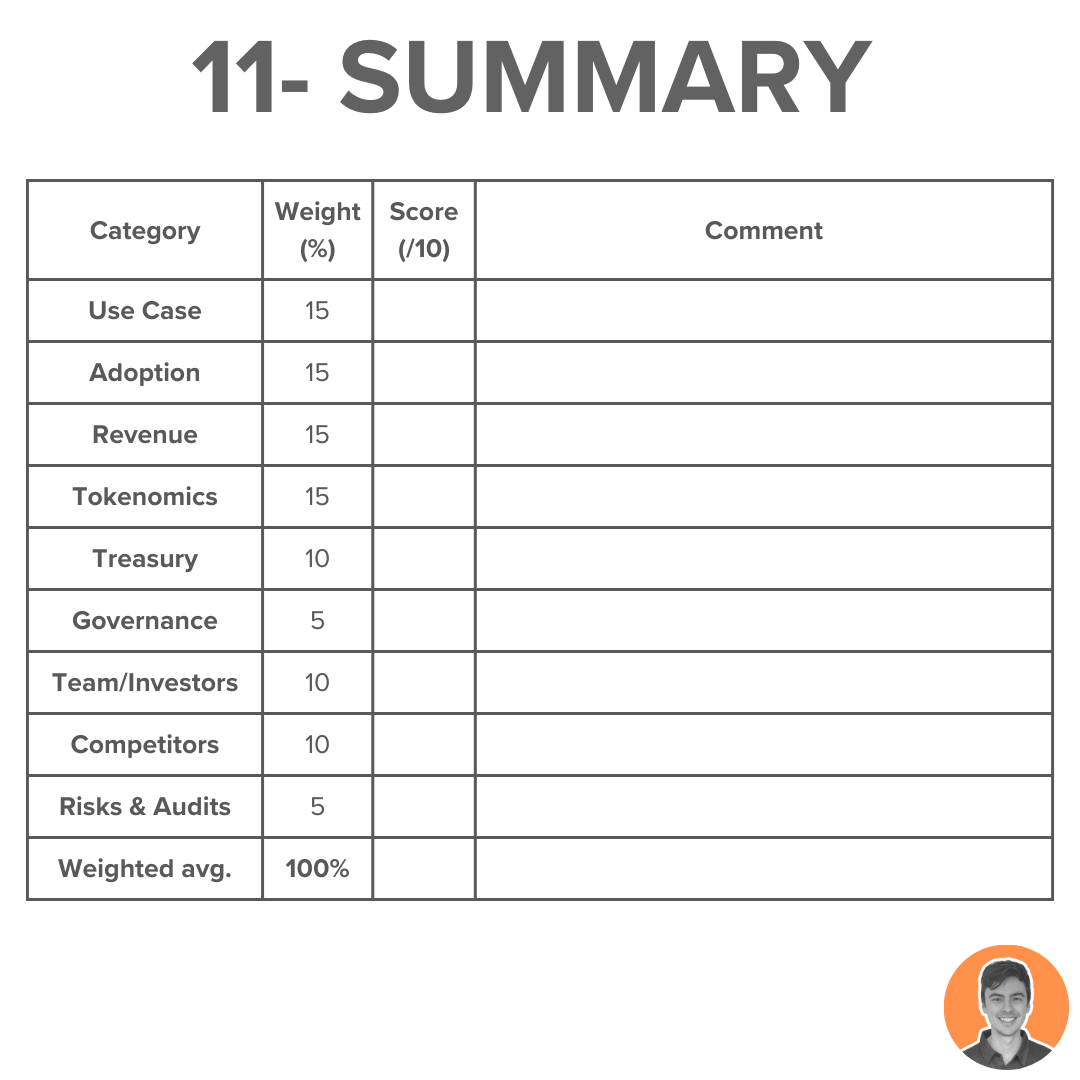

Now the fun part.

You get to score each project.

Step 1: determine what weighting you give each of the 10 categories.

What is more important to you? Tokenomics or Governance.

For me, the most important categories are:

Use case, Adoption, Revenue & Tokenomics.

Step 2: now you can give an individual rating for each category.

The project might have fantastic tokenomics but a terrible governance structure.

Or terrific revenue streams but the treasury is bare.

I like to use a google sheet where I update the scores for each project.

Step 3: Apply a weighted average.

=AVERAGE.WEIGHTED(SCORES)

Now you will have a quantitative score for your project.

As you continue to build your database, you will be able to identify the top-performing projects.

This has become an essential part of my investing toolkit.

The beauty of this framework is its customizability.

Use it however you like. Add categories, change weightings or tweak the scoring system.

Most importantly, you now have a process in place to make investment decisions.

Investing without a process is just gambling.

Links to some of my favourite resources: