The Cosmos ecosystem is thriving, and Kujira is leading the way.

TVL has skyrocketed by 1,200% this year and shows no signs of slowing down.

Here's my November 2023 research report on KUJI.

Here's what we'll cover in today's edition:

Overview

Use Case

Adoption

Revenue

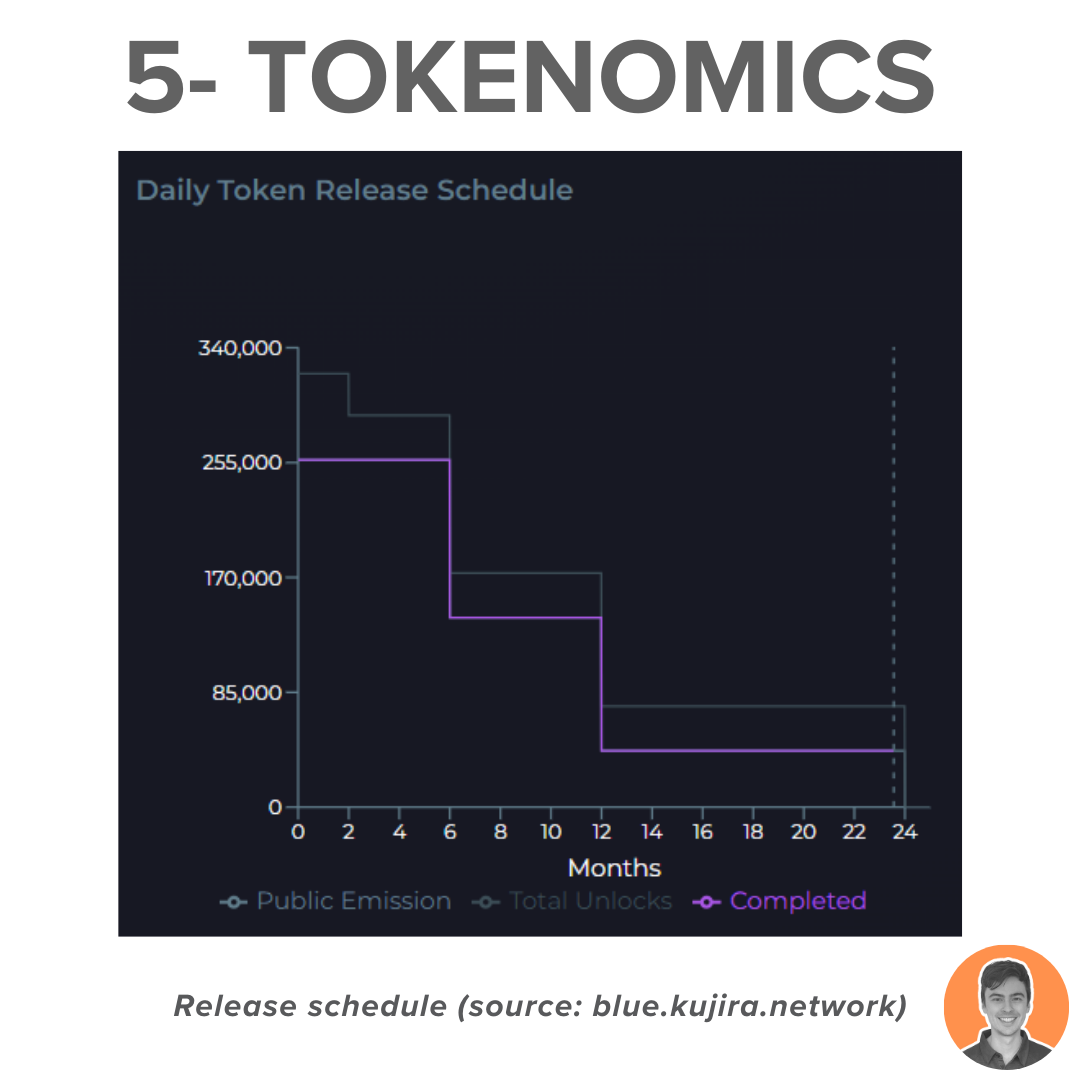

Tokenomics

Treasury

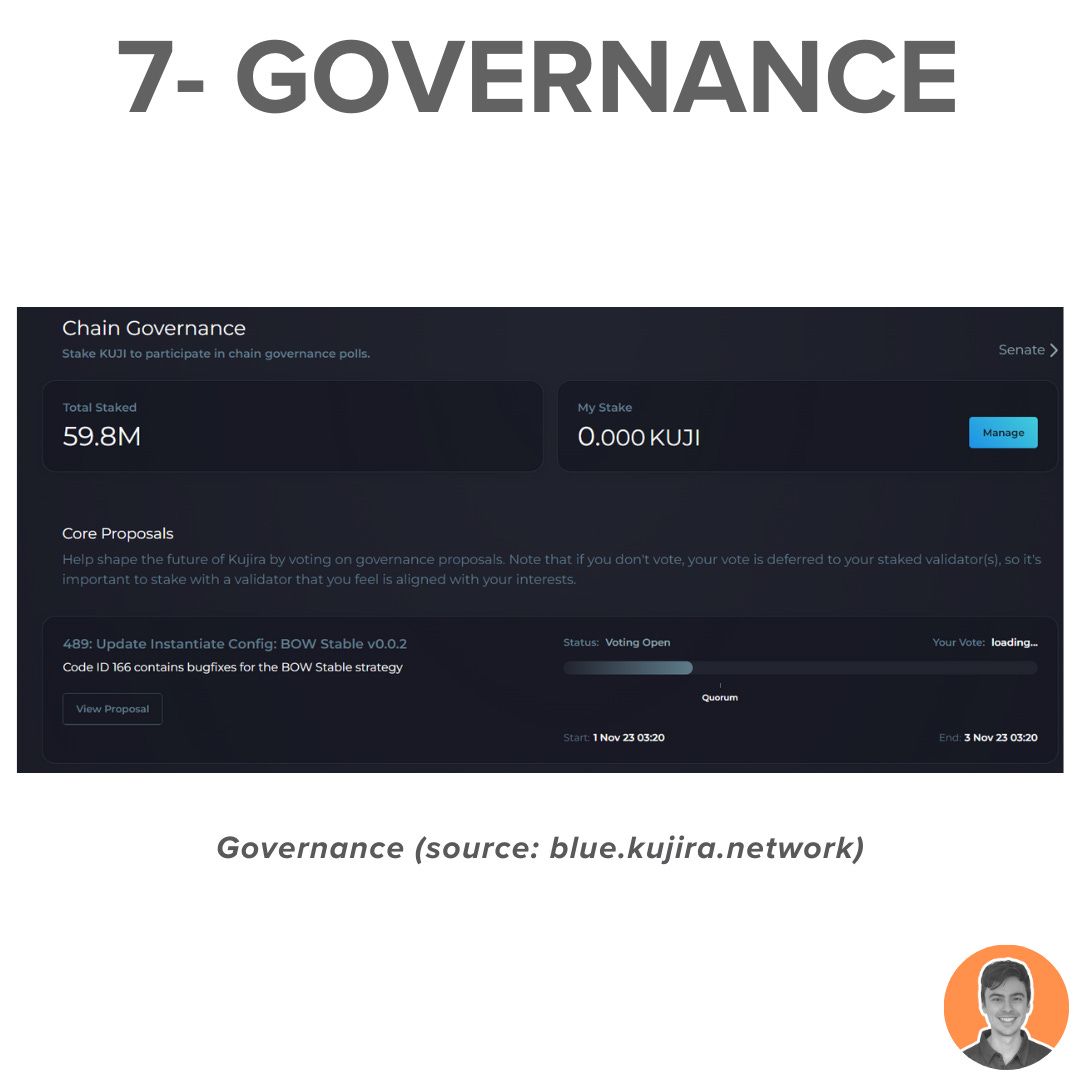

Governance

Team & Investors

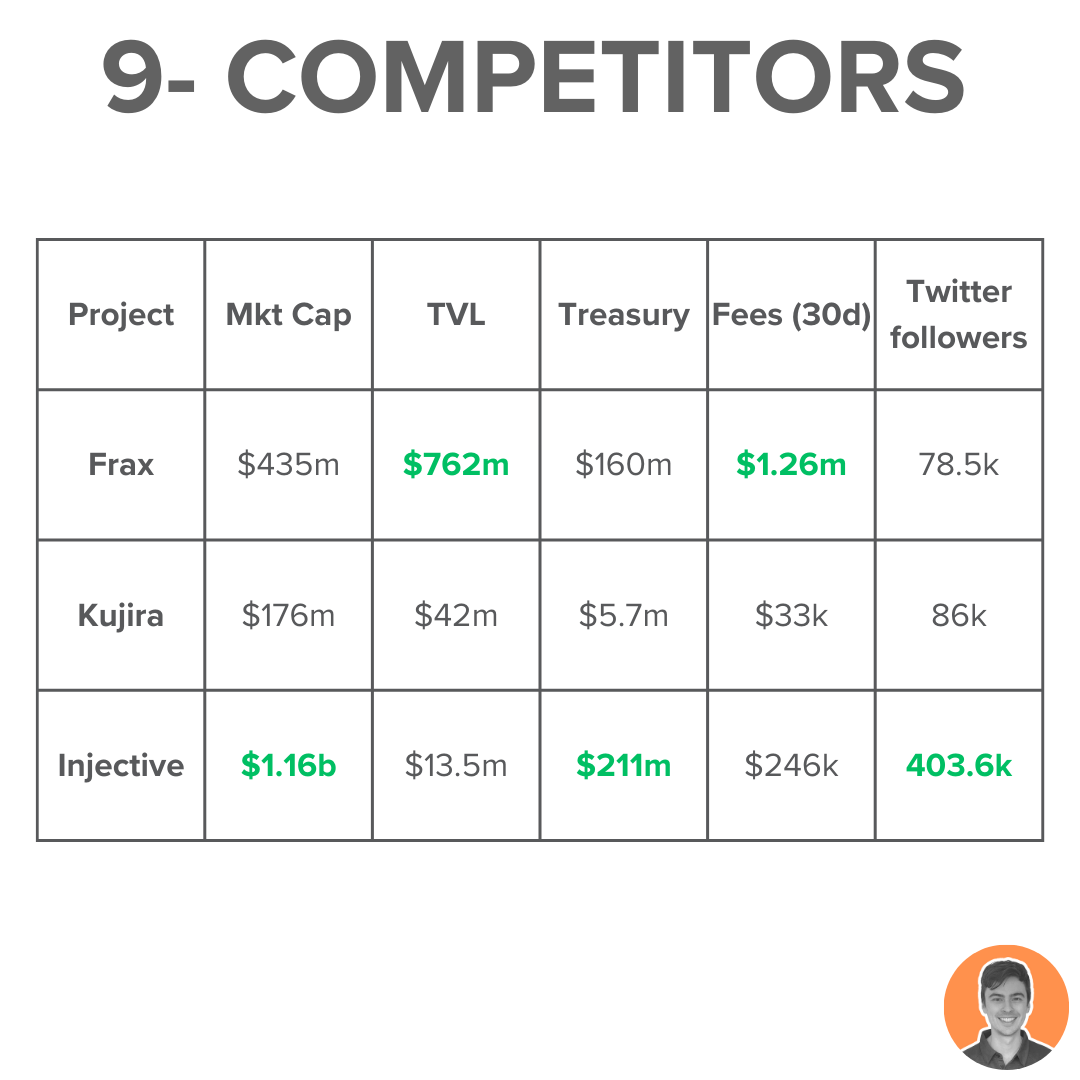

Competitors

Risks & Audits

Summary

Don't forget to bookmark this post for future reference.

Kujira is a decentralised layer 1 ecosystem focused on building sustainable FinTech solutions and tools.

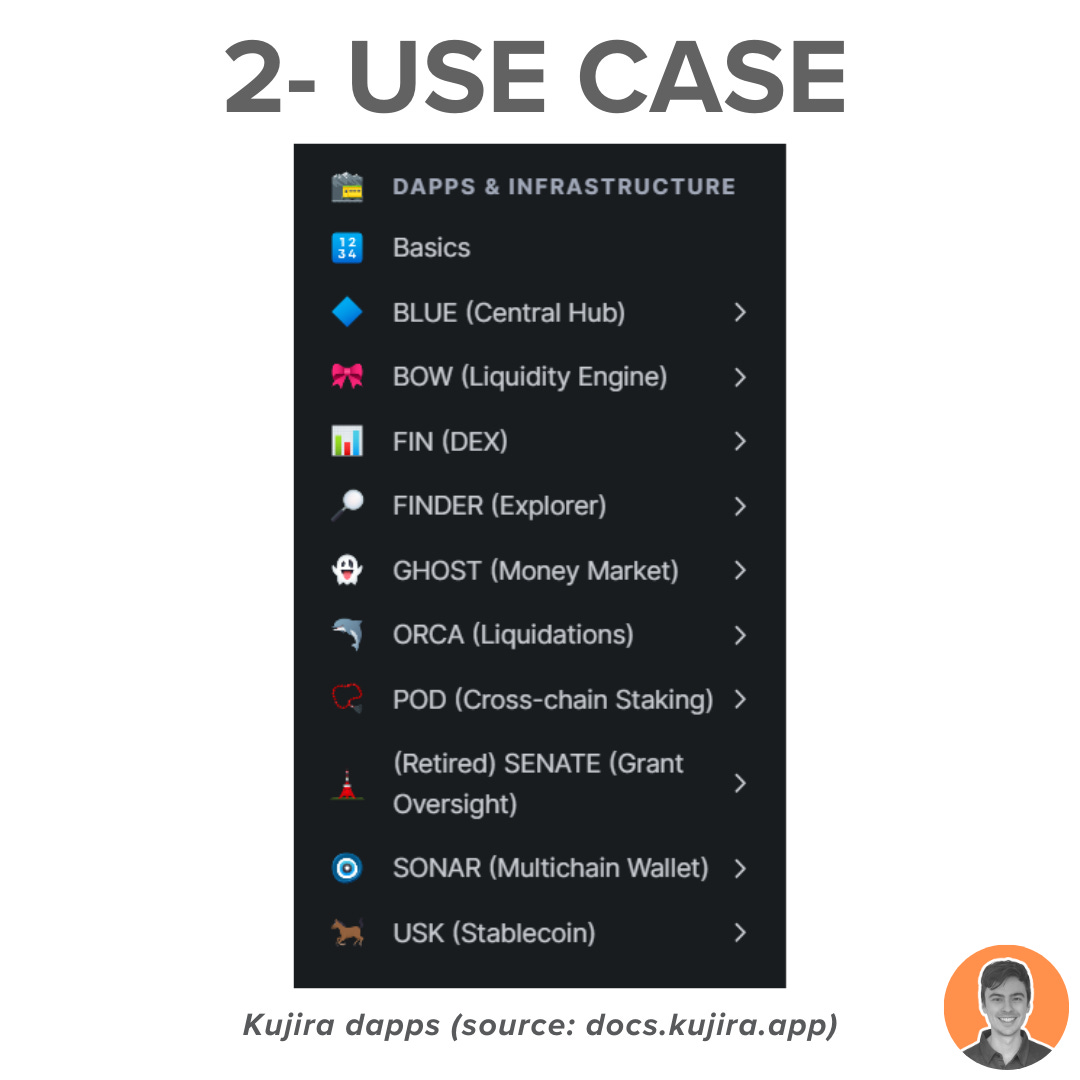

Their suite of DeFi products continues to expand and includes:

Liquidity engine

DEX

Money market

Liquidations

Stablecoin

Order book (on-chain)

Kujira have created an ecosystem of dApps and infrastructure that bring institutional grade tools to everyone.

Here's what sets them apart:

Built with Cosmos SDK

Fast block times (2.2s)

Application-specific chain

Avoiding network congestion & block-space issues

Despite being written off after the Luna classic collapse in 2022, the team showed remarkable adaptability.

They quickly pivoted, building a fully semi-permissioned blockchain on cosmos in under 6 weeks.

The project now boasts a thriving ecosystem of dapps and tools.

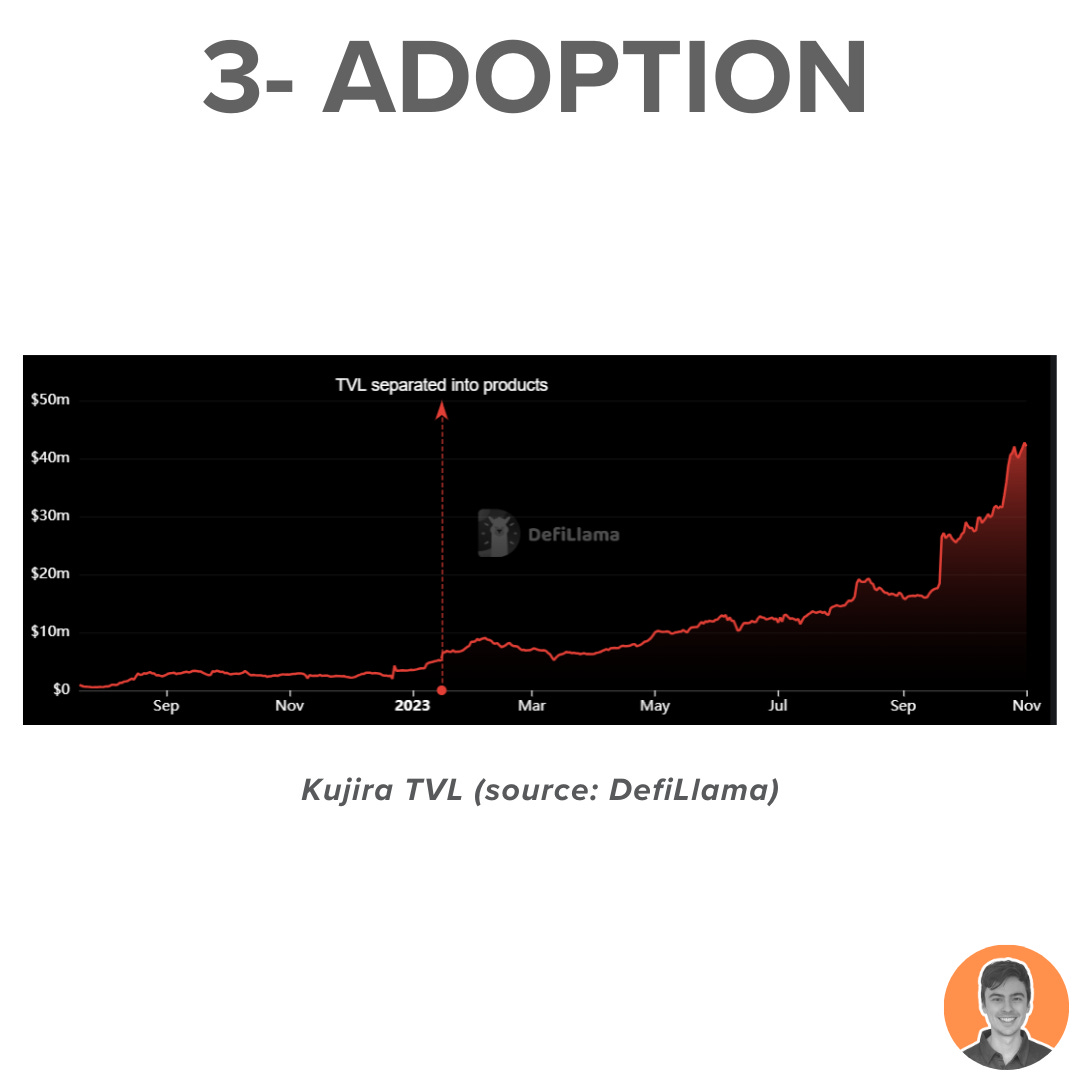

Kujira TVL has seen some strong growth in 2023, currently sitting at just over $42m.

Over the last month alone, it has seen a 50% growth in TVL.

Here is the breakdown for each of it's products:

Ghost- $18.7m

USK- $12.2m

FIN- $5.6m

Bow- $5.3m

Orca- $212k

The primary source of revenue for the protocol comes from its dApps.

Users pay network and dApp fees using the $KUJI token.

All fees and rewards are subsequently distributed to $KUJI stakers.

Over the last 90 days, the protocol has generated $100k in revenue.

The native token $KUJI serves several purposes:

Paying network and dApp fees

Staking

Governance

Unlike inflationary assets, KUJI relies on the adoption of its dApp and products to generate fees, ensuring the sustainability of the protocol.

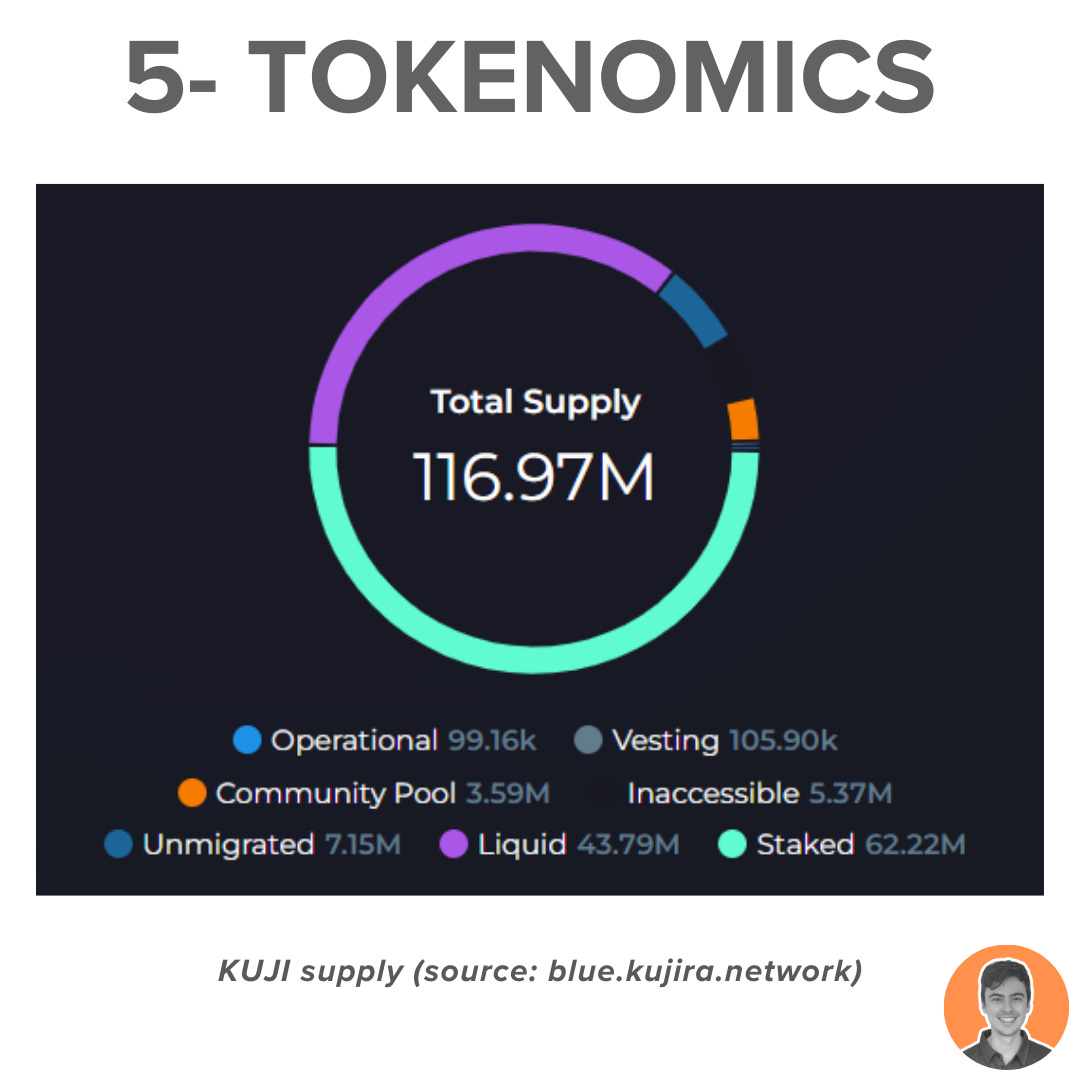

Total token supply was reduced from 150m to 122.4m through a governance vote in Jan '22.

All vesting will be completed in Nov '23.

Current supply stats:

Circulating supply = 116.9m

Max supply = 122.4m

Market cap = $186m

FDV = $194m

Market cap/ FDV = 0.96

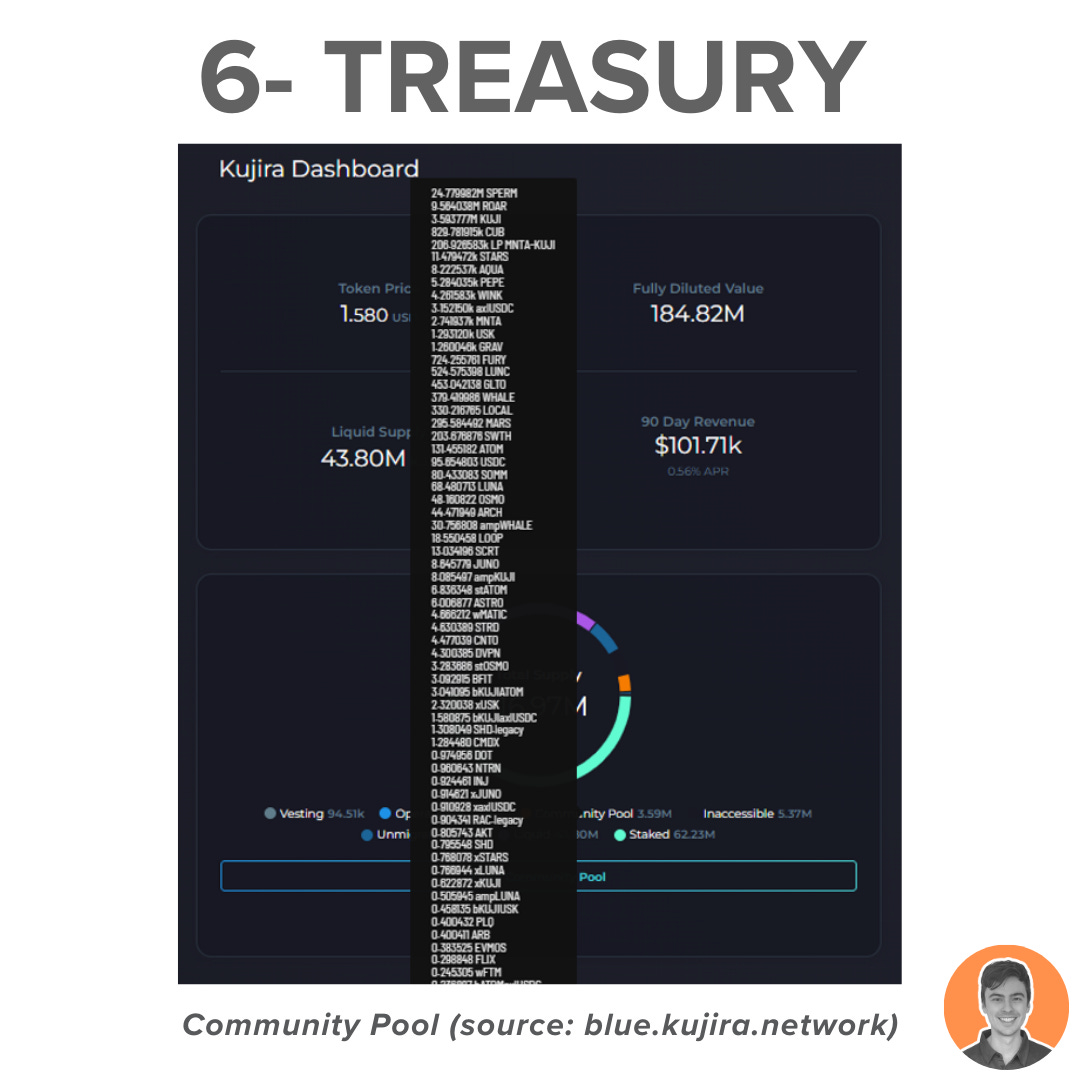

The community pool is a collection of tokens used to fund projects, partnerships, and other initiatives that benefit the community.

Current total holdings is $5.7m (Majority in $KUJI).

Holdings include:

3.59m $KUJI

5.3k $PEPE

2.7k $MNTA

131 $ATOM

1.3k $USK

Members of the Kujira community have the ability to submit governance proposals that can address various topics.

Anyone staking $KUJI can participate in voting on these proposals.

At present, there is a healthy 62 million $KUJI tokens staked (50% of circulating supply).

Kujira was formed in May 2021 and was initially built as a platform for decentralized liquidations on Luna classic.

The founders include:

@cryptoslang1

@deadrightdove

@codehans1

$KUJI was launched via a token generation event (StarTerra platform) in November 2021.

Kujira's closest competitors, Frax and Injective, are also developing a suite of DeFi products consisting of DEX, stablecoins, and order books.

However, Kujira stands out with its distinctive features, including liquidations, multichain wallet support, and cross-chain staking.

The project has the following security features:

Code audits completed by SCV

Built using CosmWASM v1.0

This significantly reduces risk of reentrancy and DoS attacks.

However, as with any DeFi project, there are always residual risks such as centralisation and liquidity.

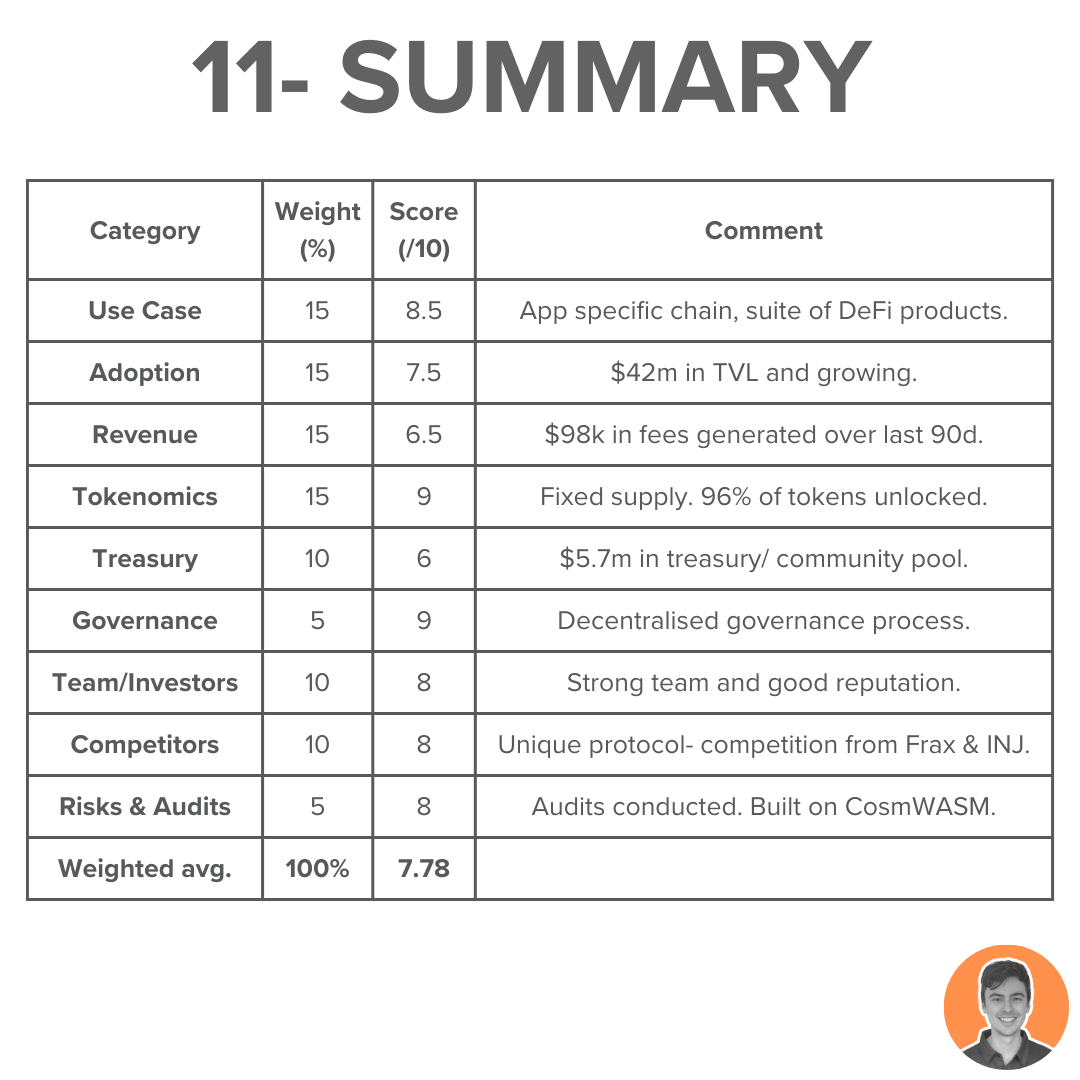

Overall, I am bullish on $KUJI and the Kujira protocol.

There are a number of upcoming bullish catalysts:

Sonar wallet

Potential for RWA

FIN upcoming perps & margin trading

TVL growth during bear

All tokens unlocked

Overall weighted score = 7.78

Note: I am NOT an ambassador or advisor of Kujira. This is NFA.