Just scored an ALT airdrop - HODL or sell?

Let's dive into my AltLayer research report to guide your decision.

Project scorecard revealed at the end of thread.

Here's what we'll cover:

Overview

Use Case

Adoption

Revenue

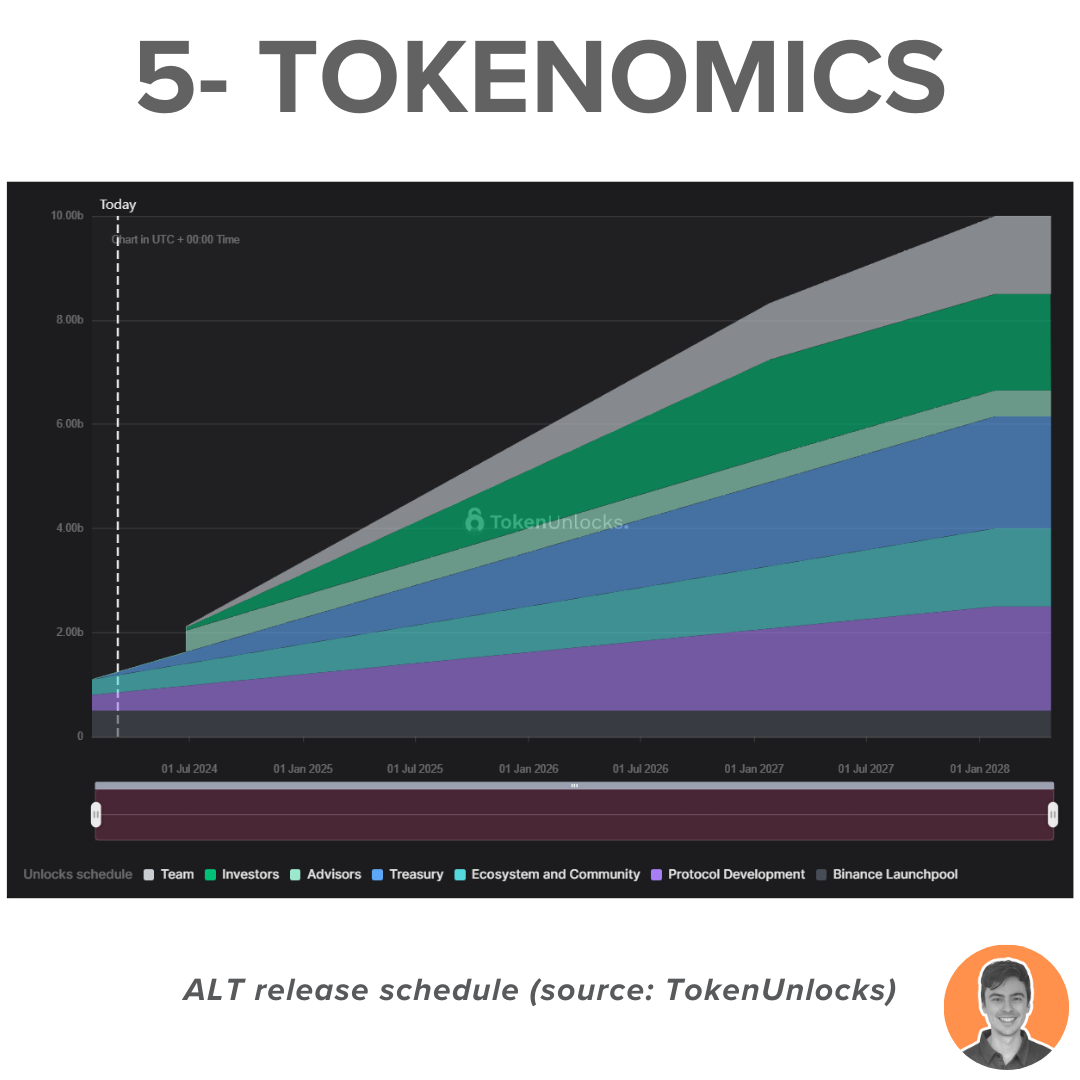

Tokenomics

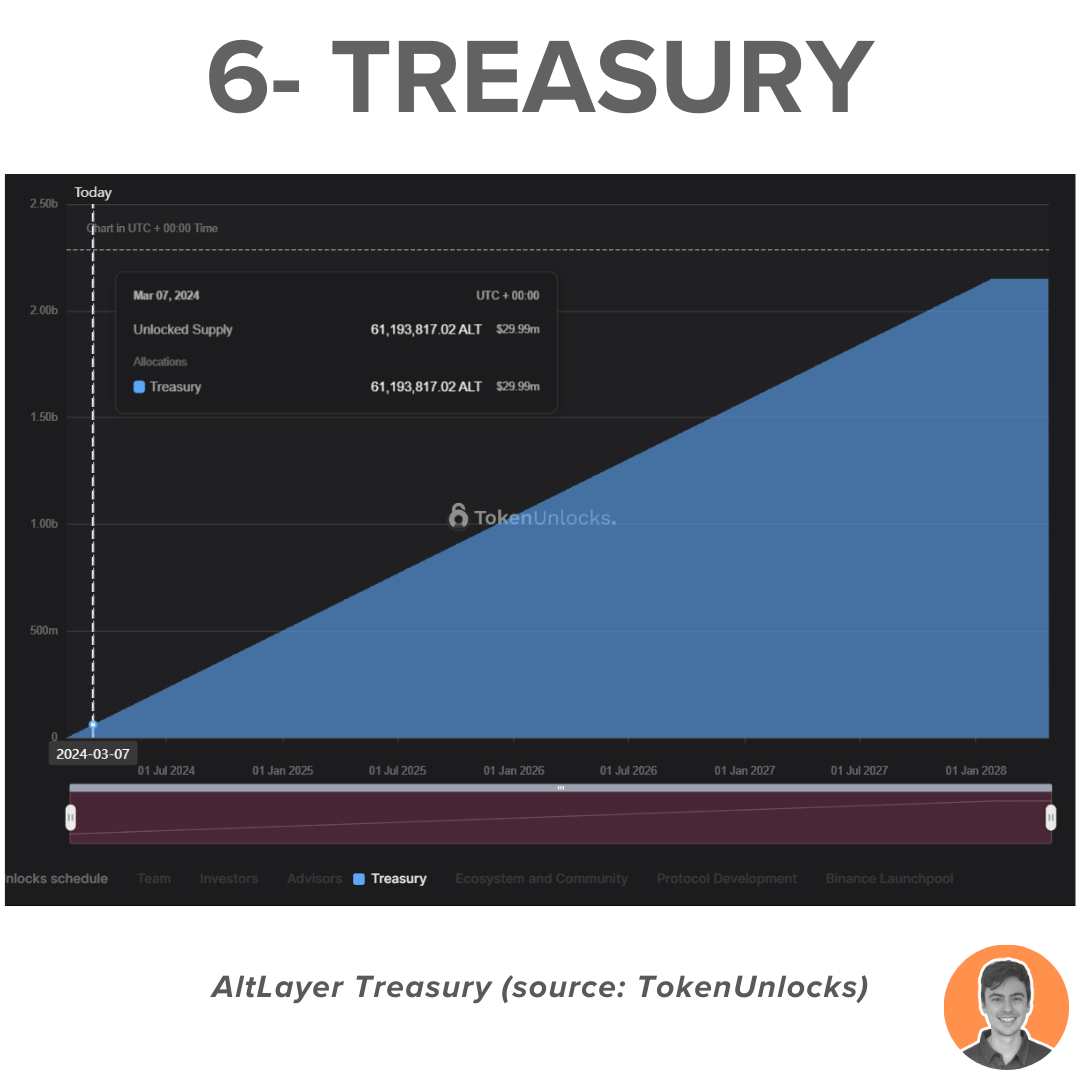

Treasury

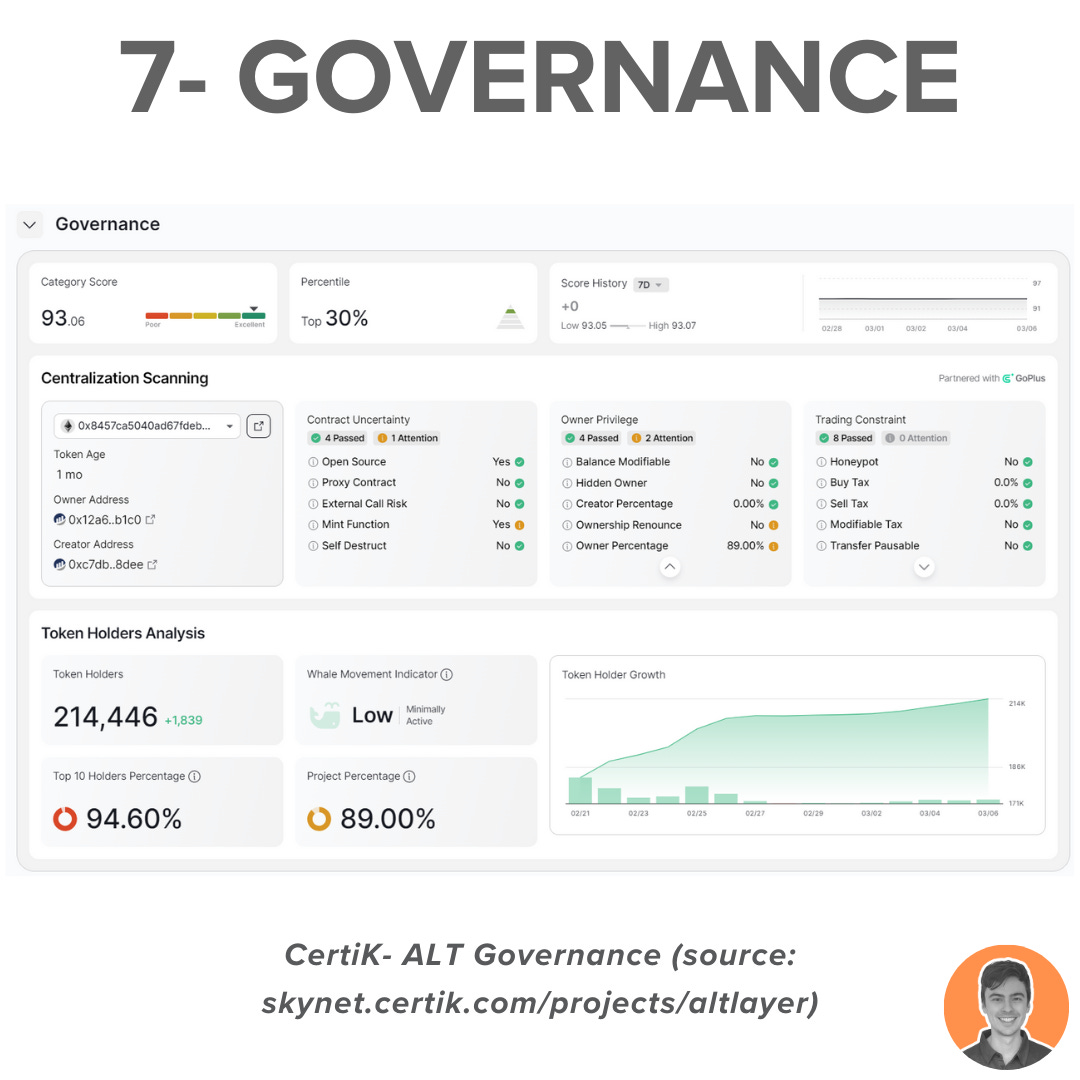

Governance

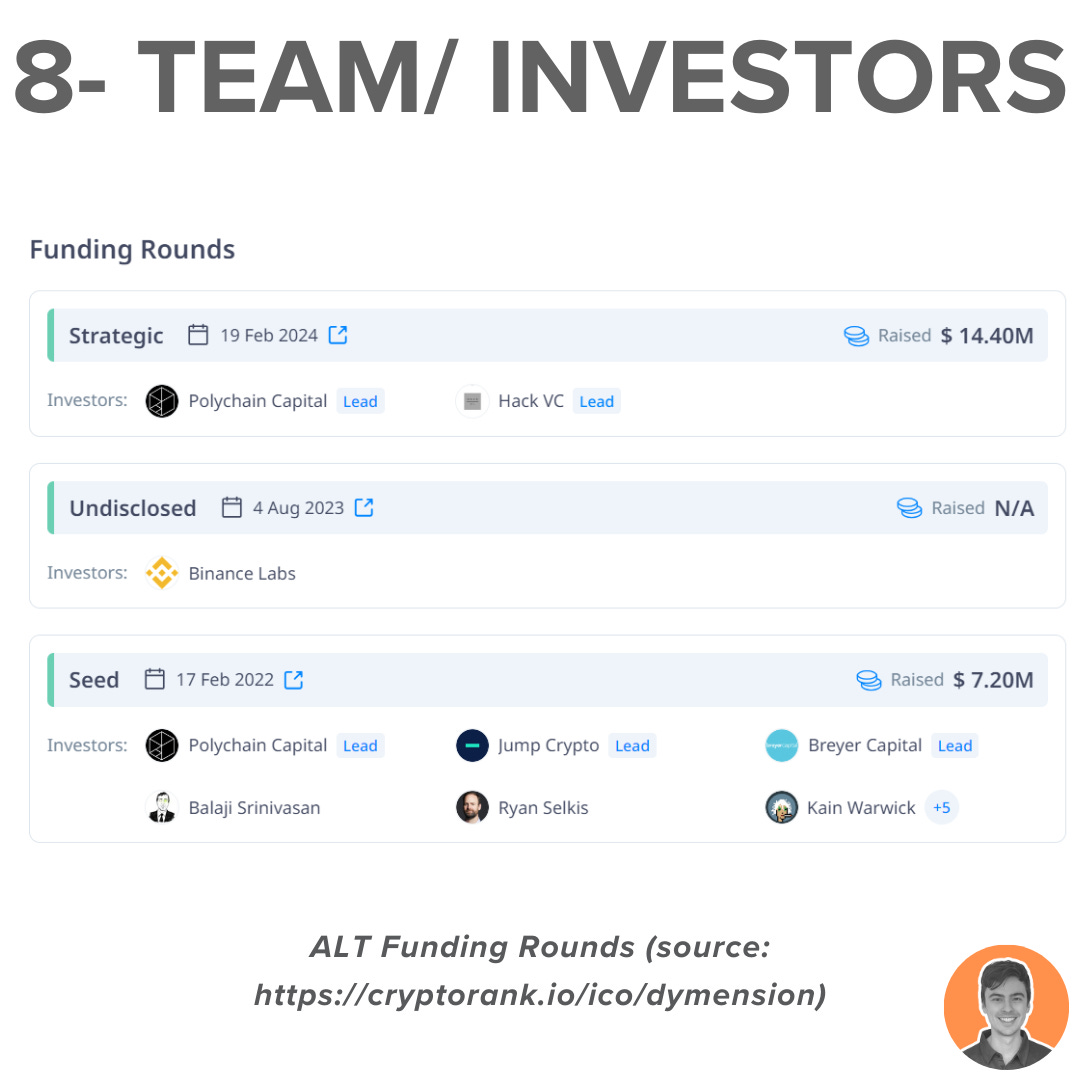

Team & Investors

Competitors

Risks & Audits

Summary

Don't forget to bookmark, like and repost!

Note: I am NOT an ambassador or advisor of AltLayer.

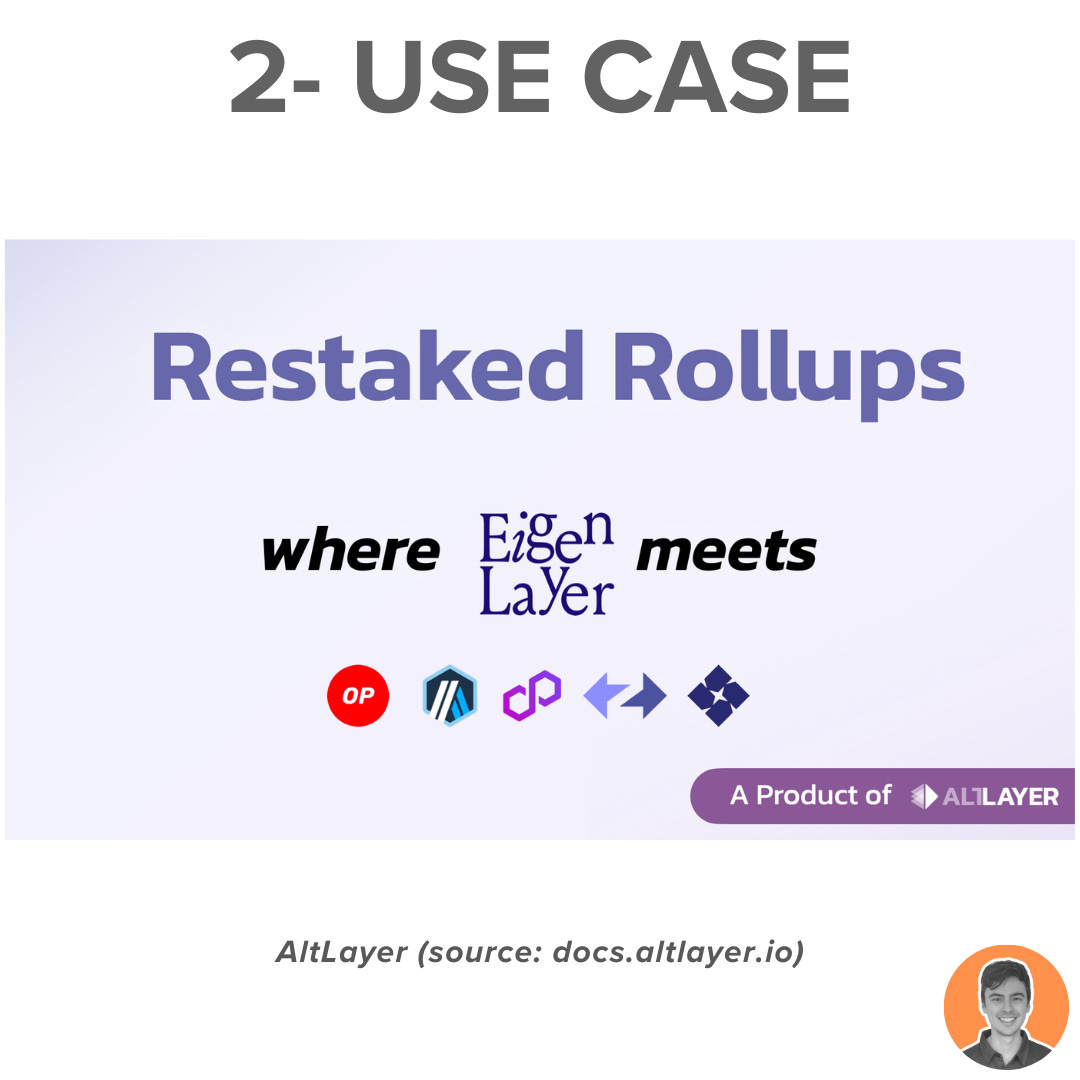

AltLayer is a decentralized protocol for launching native and restaked rollups using optimistic and ZK rollup stacks. Its main product offerings are:

Restaked Rollups

Rollups-as-a-Service

The goal is to help projects save time and capital while promoting innovation.

Restaked rollups take existing rollup solutions (OP Stack, Arbitrum Orbit, ZKStack etc.) and provides them with enhanced security, decentralisation, interoperability and fast finality.

They combine the best of existing rollup stacks with EigenLayer's restaking mechanism.

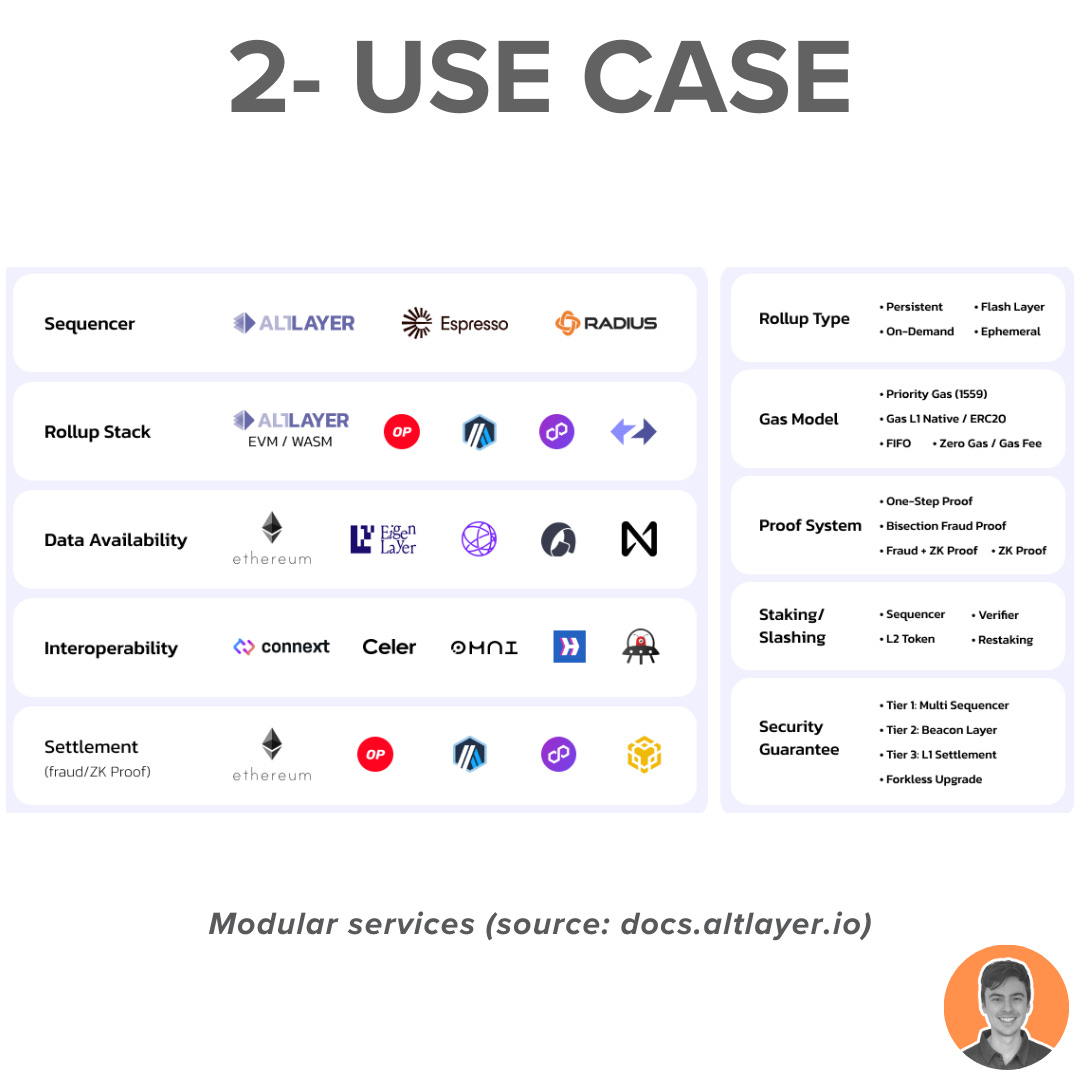

AltLayer envisions a world where thousands of rollups exist, including general-purpose and application-specific rollups. Creating a rollup would be like building with Lego. For example, one could be:

AltLayer= sequencer

OP = stack

Celestia = DA

Ethereum = settlement

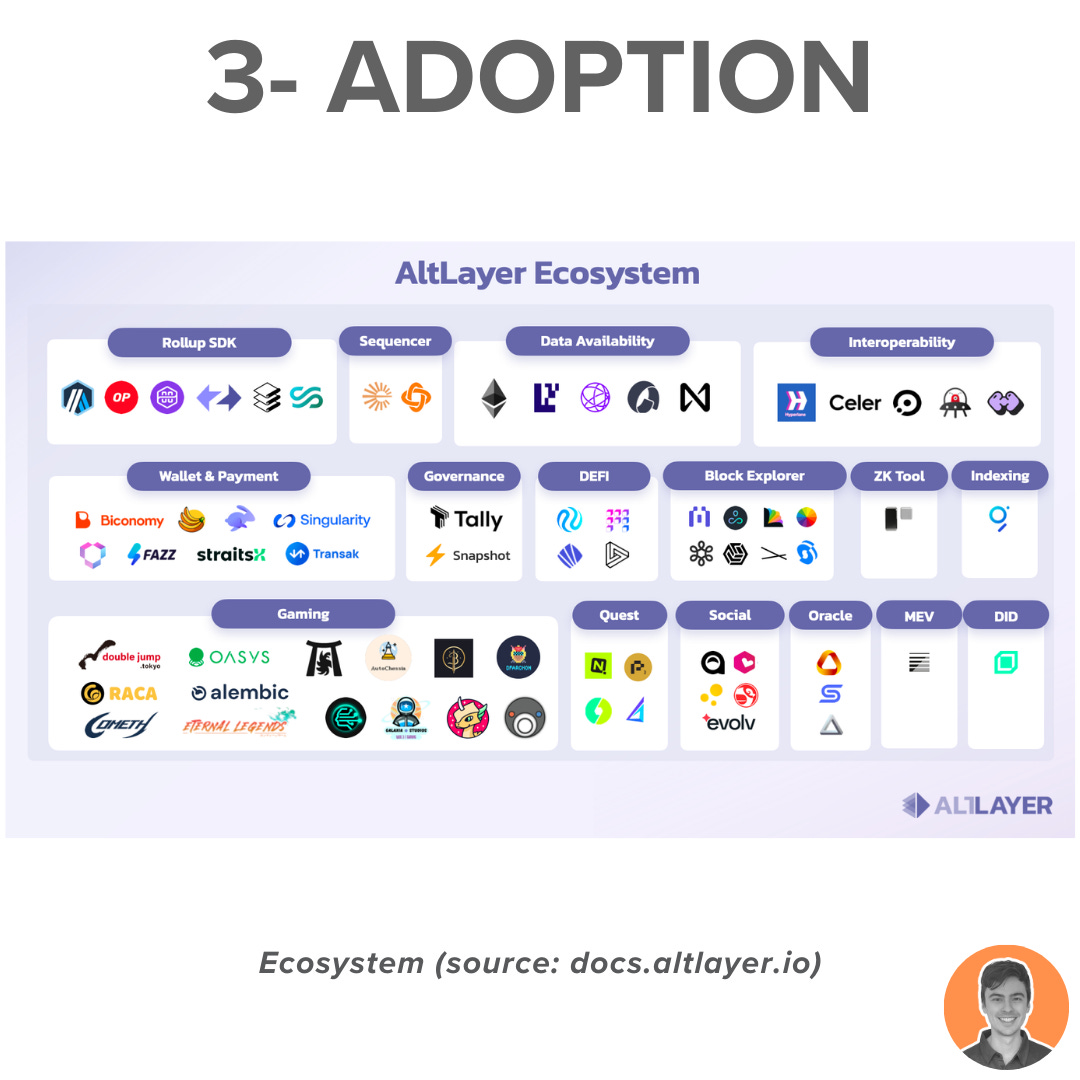

The ecosystem is growing rapidly and includes some impressive partners:

Arbitrum

Optimism

Polygon

EigenLayer

Celestia

Espresso

Hyperlane

Injective

Rabby

They have also launched 4 public testnets and worked with 20+ high profile clients to date.

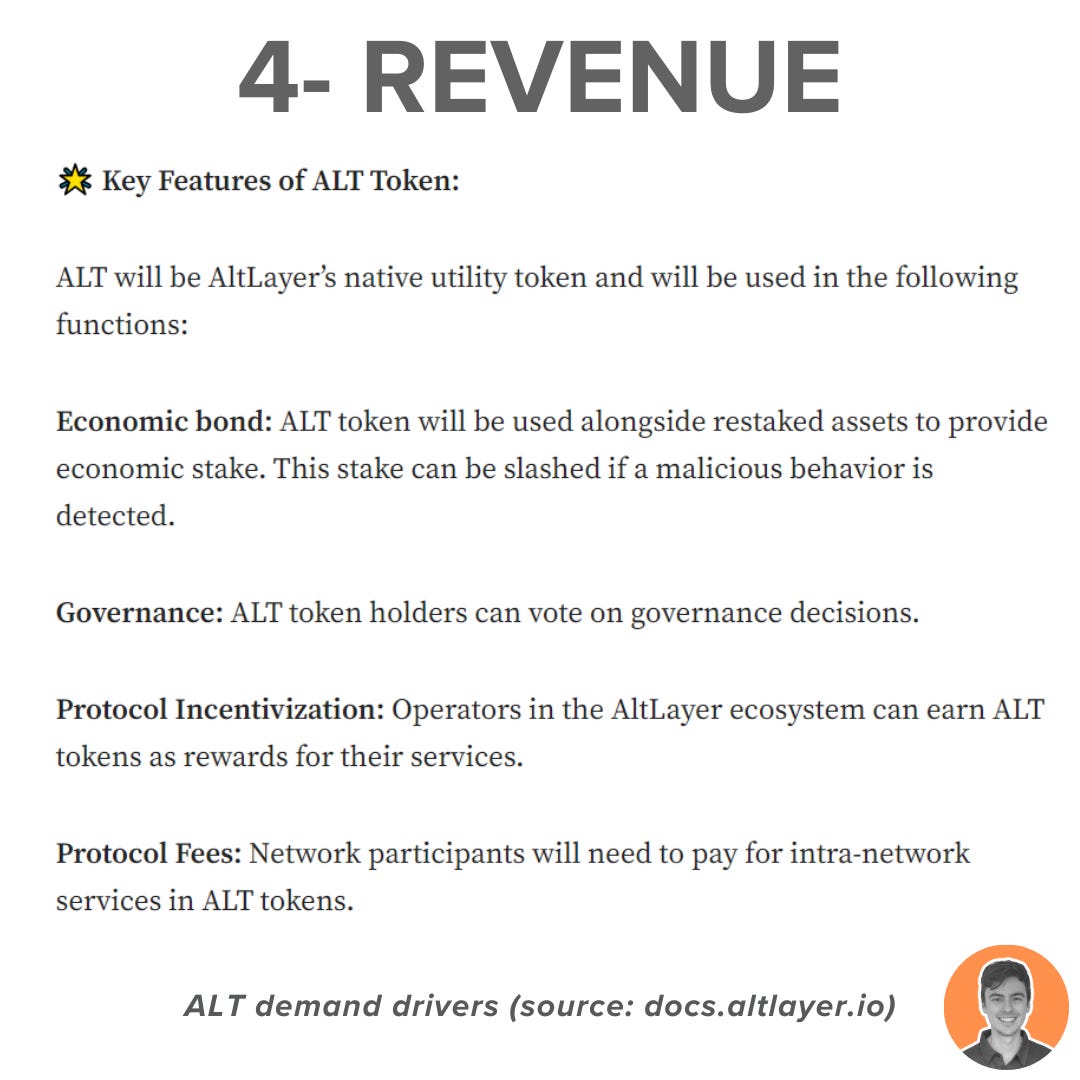

$ALT Demand is driven by 3 main mechanisms:

Bonding: ALT token used as collateral alongside restaked assets.

Incentives: Operators in the AltLayer ecosystem can earn ALT tokens as rewards for their services.

Transaction fees: pay for intra-network services in ALT.

$ALT is the native utility token used for:

Economic bond

Governance

Protocol Incentivization

Protocol Fees

Initially, the project has airdropped 3% of the supply (300m $ALT) to NFT holders, Altitude campaign participants, EigenLayer restakers & Celestia stakers.

The airdrop claim window for Celestia stakers has now closed. Overall, it wasn't a huge airdrop for the majority and you needed to be staking 35 $TIA.

Current supply stats:

Circulating supply: 1.1b

Max supply: 10b

Market cap: $545m

FDV: $5b

Market cap/FDV: 11%

According to current valuations, the AltLayer treasury holds:

61m $ALT = 30m USD (unlocked tokens)

Over the next 4 years, the rest of the allocation will be linearly unlocked. Once fully vested, this will be worth $1.05b at current token prices.

$ALT token holders will have the opportunity to vote on governance decisions. At this time, no formal governance structure has been established.

According to CertiK, AltLayer excels in the Governance category, demonstrating a relatively high level of decentralization.

AltLayer was founded in 2021 by Jia Yaoqi ( @jiayaoqi ).

In the past few years, @alt_layer has raised over $21.60m in funding.

Prominent Investors include: Polychain Capital, Jump Crypto, Breyer Capital, Binance Labs, Hack VC, Balaji, Ryan Selkis, & Gavin Wood.

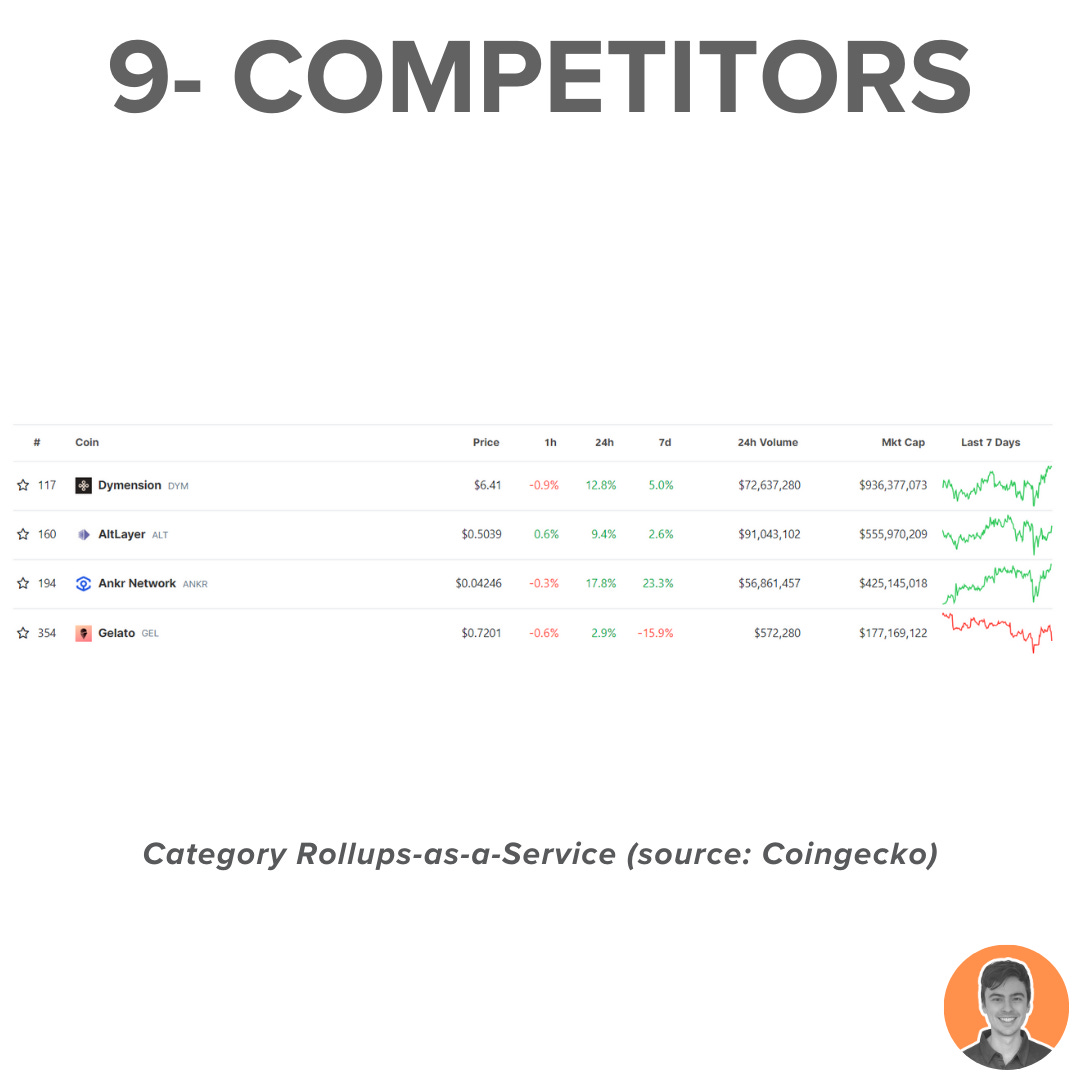

AltLayer is at the forefront of a new wave of modular blockchain applications that are quickly gaining popularity. Some refer to the category as "Rollups-as-a-Service."

Its primary competitor, Dymension ($DYM), has also recently completed an airdrop and token launch.

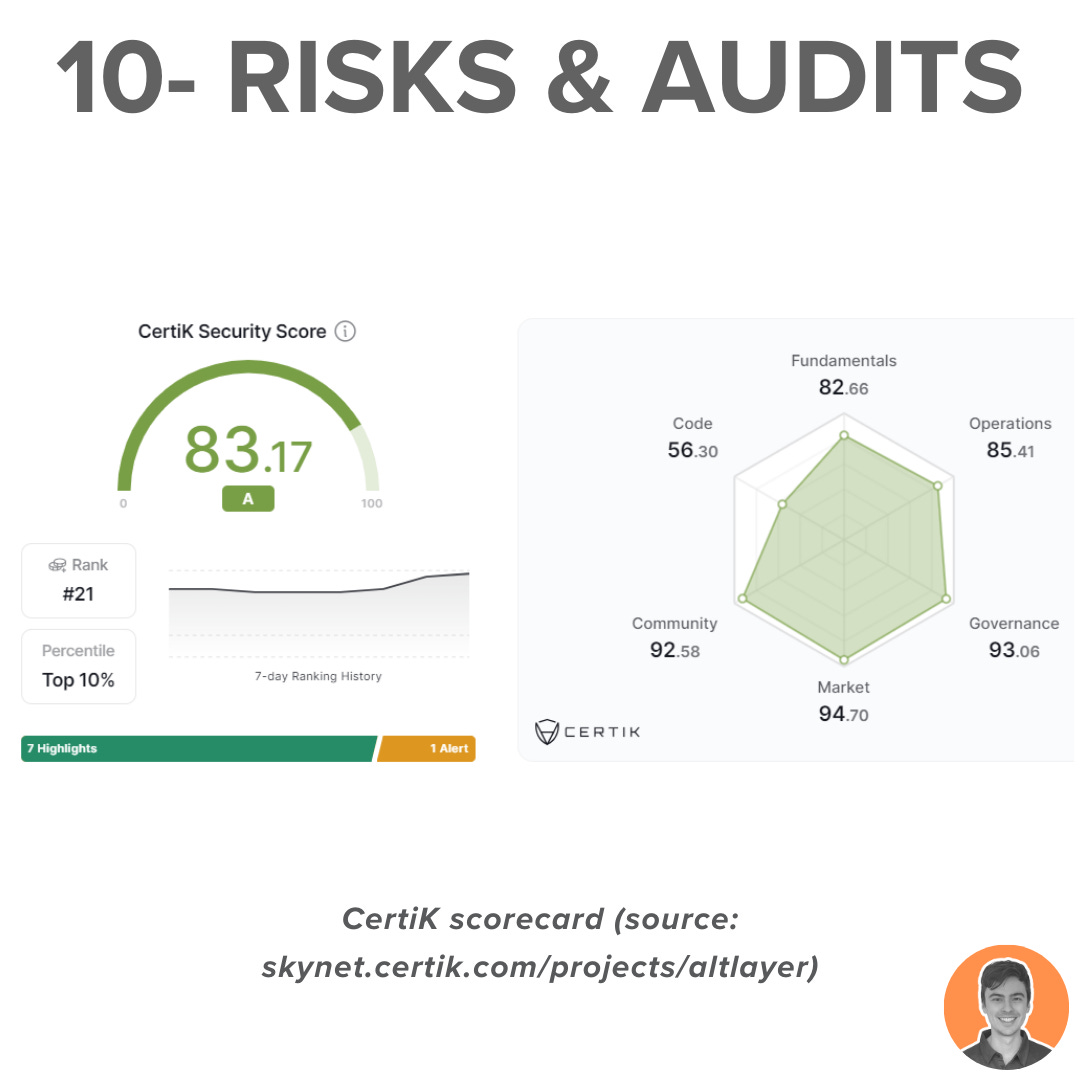

The CertiK security score of 83.17 positions it in the top 10% of projects, ranking 21st among new launches.

It stands out for its market performance, governance practices, and community engagement.

As of now, there are no publicly available code audits that I could find.

Overall, I am very bullish on the modular blockchain thesis. I think that AltLayer are positioned very well to capitalise on the growth of this narrative.

Upcoming catalysts:

Modular narrative growth

Further airdrops

Integrations

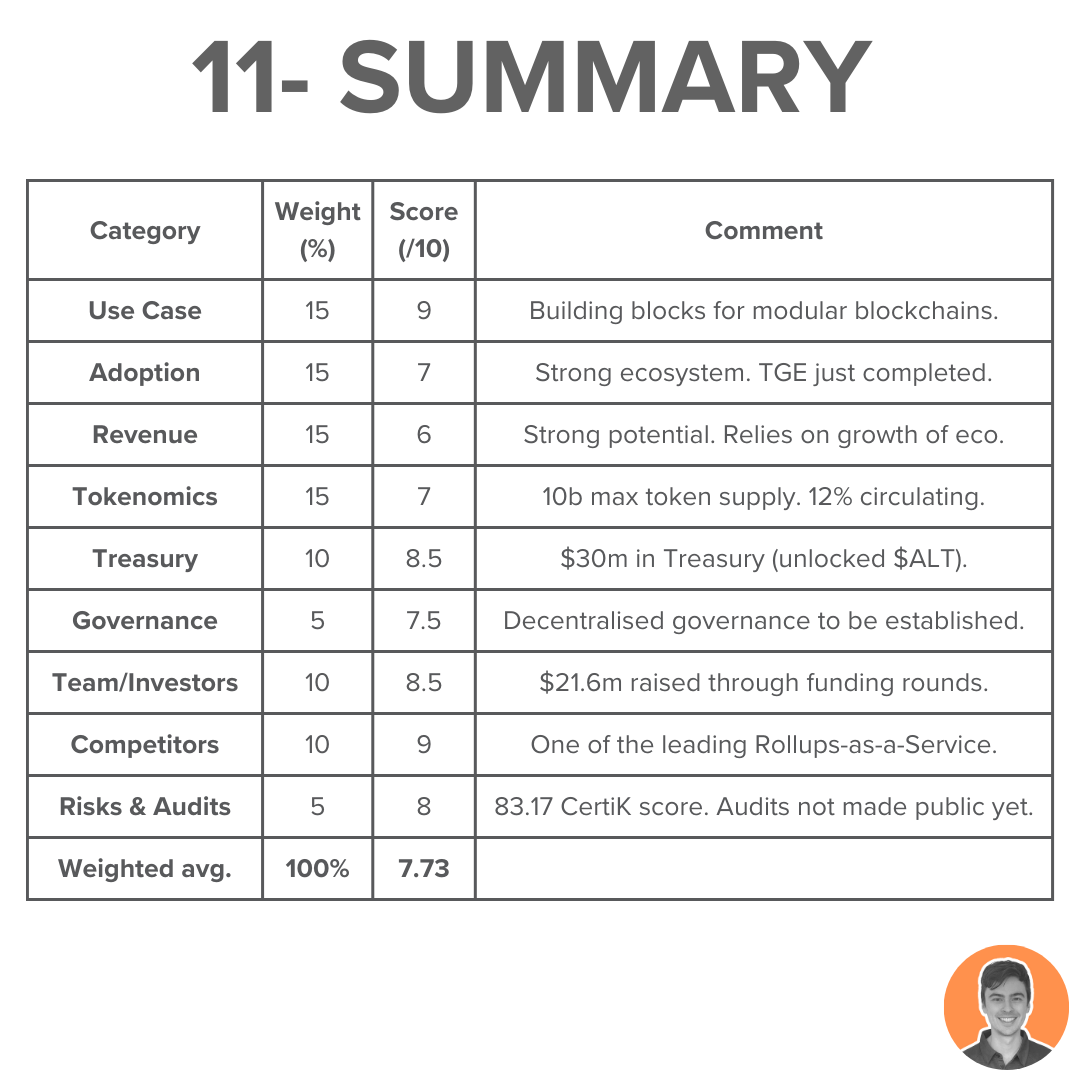

Overall weighted score = 7.73

I was staking $TIA at the snapshot and received a small airdrop of 241 $ALT tokens.

I've decided to hold onto my small bag for now. AltLayer has left a good impression on me, and if we transition into a full-fledged altseason, there could be some significant gains ahead.