Unibot: The driving force behind the telegram trading revolution.

Poised to onboard the next wave of crypto investors.

Has it peaked... or is this just the beginning?

Here's my November 2023 research report on UNIBOT.

Here's what we'll cover in today's edition:

Overview

Use Case

Adoption

Revenue

Tokenomics

Treasury

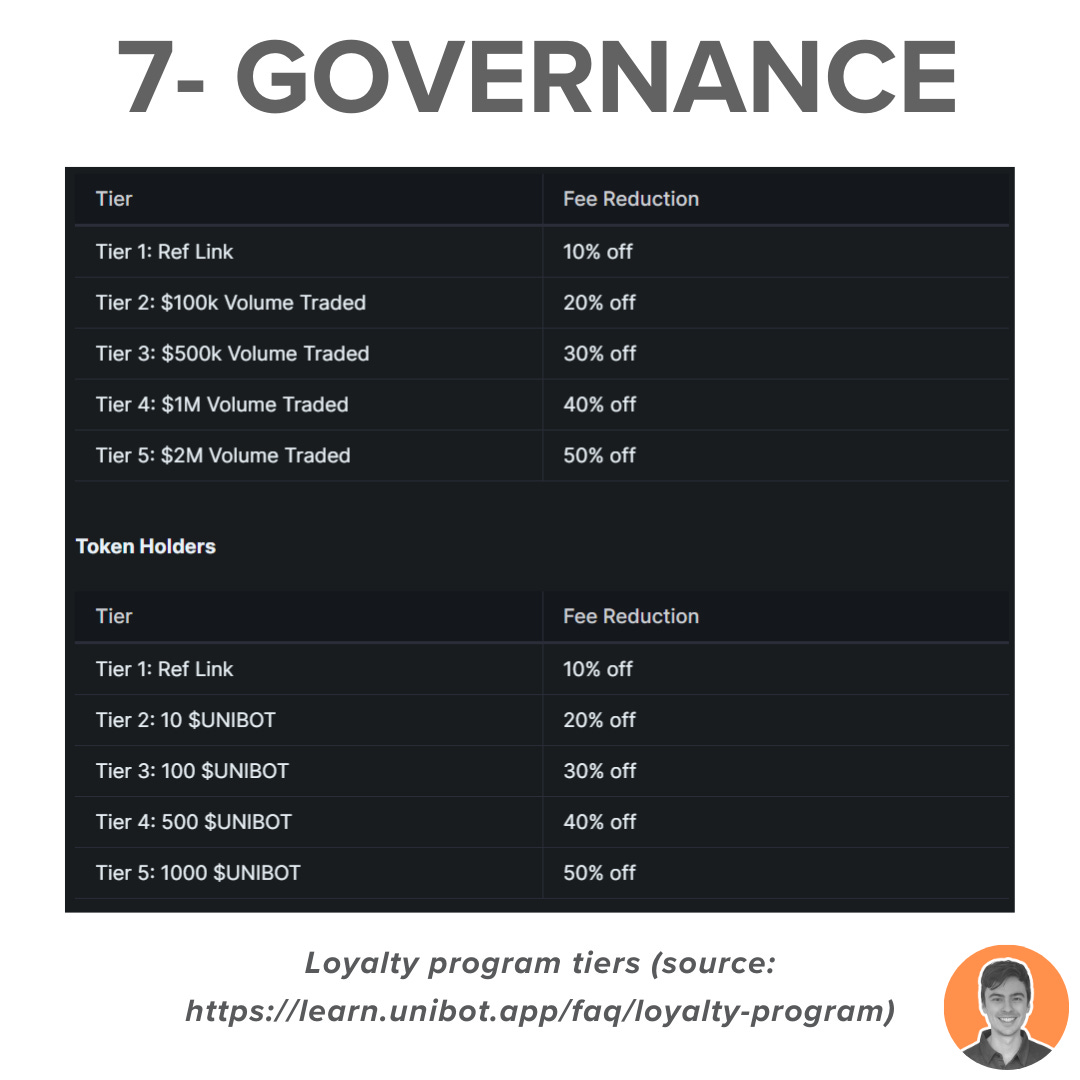

Governance

Team & Investors

Competitors

Risks & Audits

Summary

Don't forget to bookmark this post for future reference. 📚

Unibot is a trading bot that allows you to conduct automated DEX trades using the Telegram app.

It simplifies the experience of trading on Uniswap by offering:

Cleaner UI

MEV protection

Failed transaction protection

Faster trading (6x quicker than Uniswap)

If you've ever used Uniswap, you'll understand that the experience can be quite cumbersome.

Telegram trading bots have revolutionized the world of crypto trading, offering a cleaner and faster alternative, particularly for newcomers.

They have the following benefits:

Speed

Improved UX

Automation

Easier to use for new users

Security (MEV & rug protection)

I think this is just the beginning for this sector as telegram bots will help to onboard more users and investors into the web3 space.

Since its launch in May 2023, Unibot has witnessed remarkable growth in its user base.

However, there has been a recent slowdown in numbers due to the hack and increased competition:

733 active users last 24h

$2.2m trading vol last 24h

20k total cumulative users

Unibot distributes a revenue share from its protocol to holders of the native token.

If you hold at least 10 $UNIBOT tokens, you will receive ETH as rewards, with no staking or lockup required.

Revenue distributed to holders:

40% of all bot transaction fees incurred

2% of all UNIBOT volume traded

Over the past 30d, Unibot has generated $433k in revenue.

Putting it in 38th place amongst all protocols according to DeFi Llama.

The tokenomics of Unibot are fairly simple:

Fair launch on May 17th, 2023.

1M tokens issued. Fully circulating and non-dilutive.

4% tax on UNIBOT traded (1% to LP, 2% to holders, 1% to team)

These are the current supply stats:

Circulating & Max supply = 1m

Market cap = $50.7m

FDV = $50.7m

Market cap/ FDV = 1

The green bubblemaps cluster is the revenue share distribution (a healthy cluster).

As you can see, largest individual wallet only holds 2.7% of supply (27k $UNIBOT = $1.3m).

Check out the @bubblemaps thread for a more detailed analysis.

https://twitter.com/bubblemaps/status/1684610663090724864

There's no mention of a treasury in any of the documentation.

However, they do note that there is a 1% tax directed to the team and operating expenses.

Since the project is still relatively new, I would like to see a treasury implemented as they continue to grow.

Currently, there is no formal decentralized governance forum established to manage Unibot.

However, Unibot has recently launched a loyalty program as an initiative to encourage engagement and promote long-term growth.

They have demonstrated a strong following and community.

Unibot was 'fair launched' in May 2023, but there is very limited information available about the anonymous team behind the project.

The vote to pass the V2 migration received 81% support in the holders telegram channel, although it was not an official DAO vote.

The sector of Telegram bots is filled with competitors.

Maestro, as the longest-standing player, currently holds the lead in terms of lifetime fees and revenue.

Unibot dominance has experienced a significant decline recently, coinciding with the launch of $BANANA in September.

Of all the telegram bots with tokens, here is the current FDV marketcap comparisons.

$BANANA- $155m - 75%

$UNIBOT- $46m - 22%

$MBOT- $2.9m - 1.4%

$WAGIEBOT- $1.7m - 0.8%

It's clear that Banana Gun is providing strong competition to Unibot across all metrics.

On October 31, Unibot was hacked through a token approval exploit.

Over $600k of user funds was lost and sent to Tornado cash.

Shortly after, the team halted any further trades via the vulnerable contract and revoked any problematic token approvals in affected user wallets.

Unibot has released a comprehensive summary of the incident and their response.

Although I was personally unaffected by this exploit, it is evident that the team responded exceptionally well to the crisis.

They acted swiftly and have returned the majority of user funds.

https://twitter.com/TeamUnibot/status/1720156911147045219

However, this just underscores the inherent risks associated with using Telegram bots.

Always consider your Unibot wallet as a separate "hot wallet" and regularly transfer funds to cold storage.

It is encouraging to see that the team is planning some security enhancements.

I am thoroughly impressed with Unibot. It offers a distinctive use case and presents an innovative approach to simplify DEX trading.

There is room for improvement in areas such as risk management, governance and clarity on security enhancements.

Overall weighted score = 7.30

Note: I am NOT an ambassador or advisor of Unibot. This is NFA.