Frax is the Swiss Army Knife of DeFi.

Stablecoins, staked ETH, swaps & lending.

And in 2024, brace yourself for Fraxchain - their very own Layer 2 solution.

The team just can't stop building.

You can't miss my October 2023 research report on FXS.

Here's what we'll cover in today's edition:

Overview

Use Case

Adoption

Revenue

Tokenomics

Treasury

Governance

Team & Investors

Competitors

Risks & Audits

Summary

Don't forget to bookmark this post for future reference.

Frax Finance is an ecosystem of DeFi tools centered around three stablecoins:

$FRAX

$FPI

$frxETH

Their objective is to establish a self-sustaining DeFi economy with stablecoins as the primary currency.

Initially developed on Ethereum, Frax now operates on 8 chains.

The Frax ecosystem consists of several subprotocols:

Fraxswap (DEX)

Fraxlend (Lending)

Fraxferry (Bridge)

Liquid staking (frxETH)

Each of these products offers innovative features in its own right.

Together, they form a powerful flywheel.

The team are also building their highly anticipated L2-Fraxchain (set to be released 2024).

Key features:

Hybrid Optimistic & zk-rollups

frxETH = gas token

Fees distributed to holders of veFXS

There are rumors that they'll utilize account abstraction instead of EOAs.

TVL across all the Frax Finance products is currently at $690m.

Each products TVL:

$453m - Frax ETH

$141m - Fraxlend

$59m - Fraxswap

$38m - Frax

Over 65% of TVL is from the liquid staked ETH product (frxETH).

Putting it 4th behind Lido, Rocketpool & Binance.

There are 2 ways Frax currently accrues fees and rewards:

Frax swap

Frax Ether

Over the last 30d Frax generated:

$1.21m Fees

$106k Revenue

This would put it 2nd amongst other liquid staking protocols and 45th overall (DeFiLlama).

Frax Share ($FXS) is the governance token of the entire ecosystem.

It has the following key functions:

Governance & voting

Seignorage

Buy back & burn

Fee revenue accrual

FXS supply was initially set to a maximum of 100 million tokens at genesis.

However, the design of the protocol is such that FXS would be largely deflationary in supply if FRAX demand grows.

These are the current supply stats:

Circulating supply = 74.8m

Max supply = 99.7m

Market cap = $399m

FDV = $531m

Market cap/ FDV = 0.75

In total, Frax has approximately $153m USD in their Treasury.

Comprising:

$151.74m - own tokens (FXS & FPIS)

$1.12m stablecoins

$450k others (BTC, ETH)

This would put it 14th amongst Treasuries tracked by Defi Llama.

Some concerns around diversification (own tokens).

Frax is controlled by veFXS holders through on-chain governance.

veFXS utilizes Curve's veCRV mechanism and represents a vesting and yield system.

Benefits of holding $veFXS:

Voting rights in governance proposals

Earning protocol revenue

Access to Gauge Farming Boosts

The project was founded in 2020 by @samkazemian .

It's grown to a team of ~50 key contributors, most of which are doxxed.

Investors and backers include:

ParaFi Capital

Mechanism Capital

Dragonfly Capital

Electric Capital

Multicoin Capital

Galaxy Digital

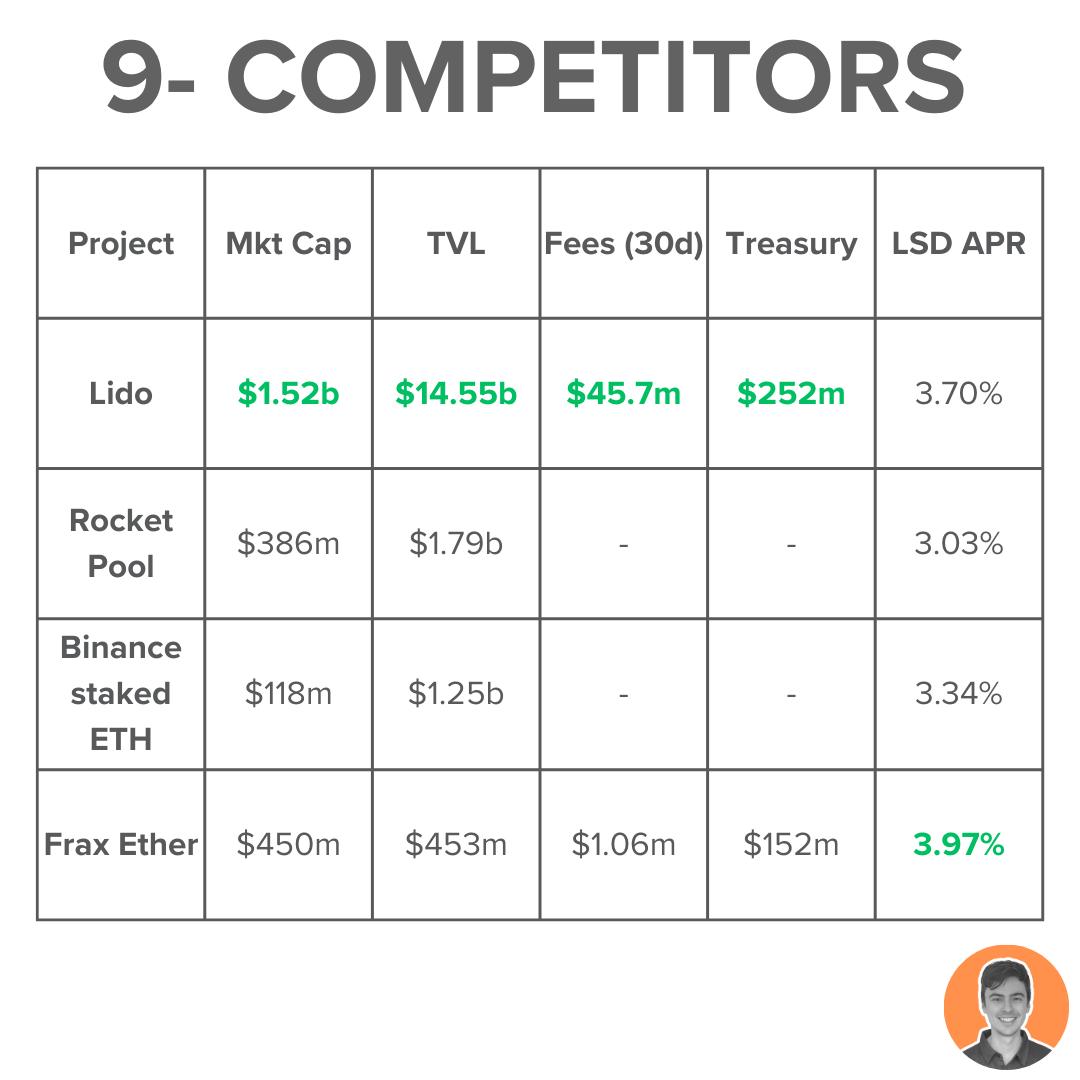

Frax is a unique protocol so for this section we'll focus on comparing its liquid staked ETH competitors.

Currently, Lido has the largest market share at 77%.

However, Frax stands out with a slightly higher yield of 3.97%.

Compared with 3% - 3.7% yield from it's competition.

The project has been audited and has been given a security score of 91.48 by CertiK.

As with any DeFi project, there are always risks involved including:

Peg stability

Liquidity for $sfrxETH on-chain

Smart contract vulnerability

Counterparty

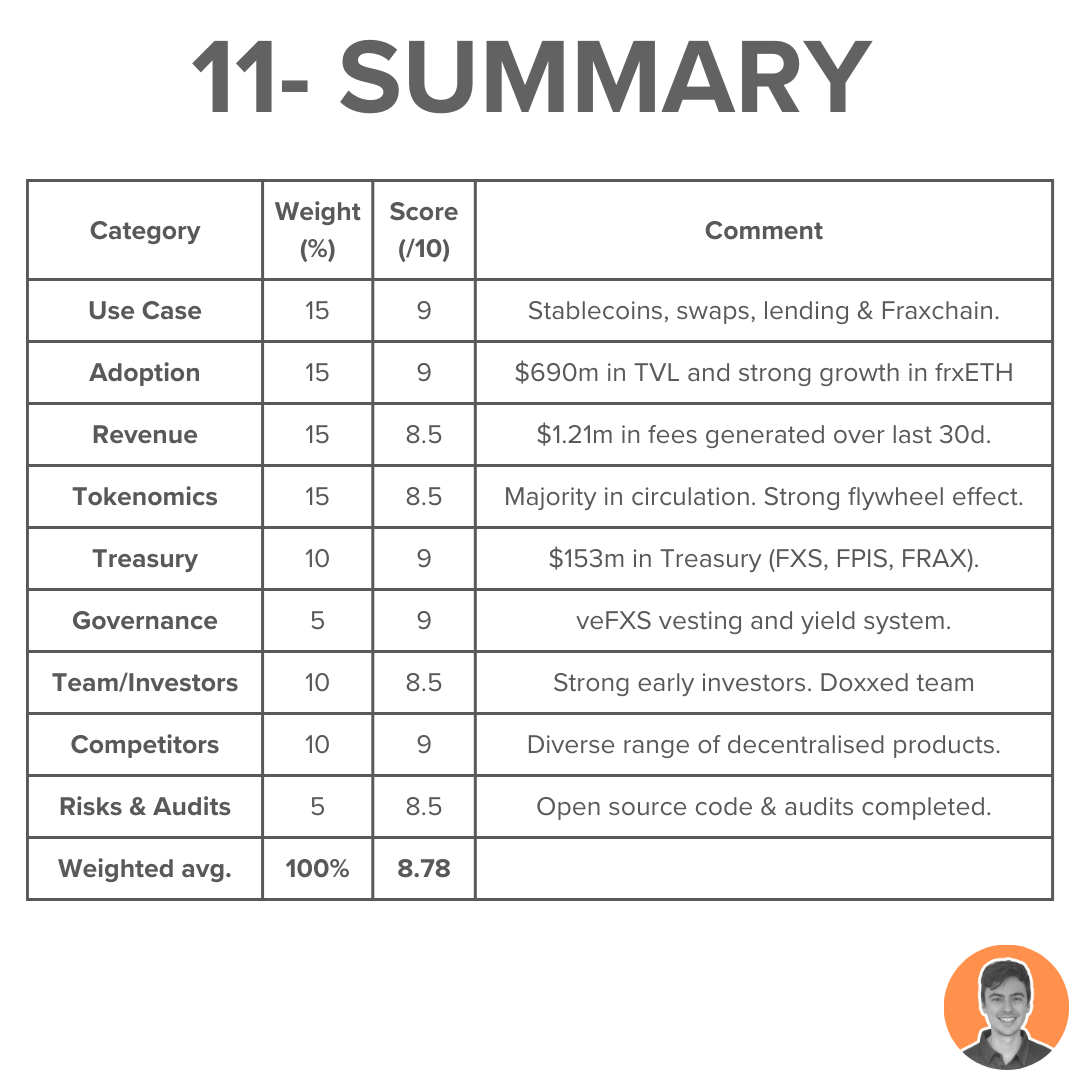

Overall, I am very bullish on $FXS and the Frax Finance protocol.

There are a number of upcoming bullish catalysts:

Fraxchain (2024)

FXS buybacks < $5 per token

Growth of RWA

Growth of LST

Ecosystem & integrations expanding

Overall weighted score = 8.78

Note: I am NOT an ambassador or advisor of Frax. This is NFA.

Great report Jake! Love this format. I'm building an on-chain analytics tool called Loch. You can use it to check out the wallet of FRAX whale - fraximaxi.eth . Here's a link to it. Let me know what you think! https://app.loch.one/home/fraximaxi.eth?redirect=home

Thank you for this Jake🫡