Part 5 of my deep dive research series will be on COSMOS.

Could $ATOM and Cosmos become THE Internet of Blockchains??

The purpose of this deep dive series is to analyse a number of popular projects and rank them against a set framework. I outline my DYOR framework below.

As I complete each project, I will update and track scores on my google sheet. You can view for free below.

https://docs.google.com/spreadsheets/d/1mPGbrsSEqBCN4lTVIIfdu3UzhZVqGP6LWMXlJrWJ5RE/edit?usp=sharing

Let’s dive in…..

As of 11th Jan 2023

Price = $11.30

Market cap = $3.3b – Rank 21

Layer 0

All time high = $44.5 (-75%)

All time low= $1.2 (+877%)

Cosmos is a layer 0 blockchain and its closest competitor is Polkadot. The Cosmos network consists of many independent, parallel blockchains, powered by Byzantine fault-tolerance (BFT) consensus mechanisms.

The Cosmos Hub can be described as a multi-asset distributed ledger which has been built using a standardised protocol called Interblockchain Communication (IBC). It is like a TCP/IP protocol for blockchains.

Revenue

Cosmos comes in at 17th amongst other blockchains for 30day total fees generated. Sitting just below its competitor Polkadot. As you can see, fees paid by users is well off the bull market highs, but stabilising around the $1k per day.

Capturing revenue through the Atom token has been one of the challenges Cosmos has faced. P/F ratio is the 8th highest amongst other blockchains. Indicating overvalued based on mcap to fees generated.

6.5 for Revenue.

Treasury

Cosmos does not have a treasury as such. The recent ATOM 2.0 proposal included the formation of a treasury; however, this proposal was rejected by governance vote. There is a small community pool which has been used for community spend proposals.

As it stands, this pool currently has

1.64M ATOMs

~$18m at current price

This is quite small relative to it’s mcap of 3.2b. A proposal was recently passed (#88) to increase the community tax rate from the current 2% to 10% with the aim of increasing inflows to the community pool in order to help with future funding that brings utility to the Cosmos Hub. This proposal passed with 97.7% vote. Staking rewards are slightly reduced by 8% to account for the increase % directed to community pool.

6 for Treasury.

Tokenomics

According to coingecko, these are the current supply stats

Circulating supply = 323.7m

Total supply = Infinite

Market cap = $3.3b

$ATOM is an inflationary token with dynamic emissions. Every block, the target inflation rate is recalculated

If > 2/3 of atoms are staked – block rewards gradually decrease to 7%

If < 2/3 of atoms are staked - block rewards gradually increase to 20%

Inflation is capped between 7-20%. Currently inflation sits at around 14%.

In Sep 2022, the ATOM 2.0 whitepaper was released which proposed some big upgrades, including to the tokenomics. However, this proposal was rejected over fears it would split the community in half. @TheDeFinvestor has a good thread explaining ATOM 2.0.

I think that the tokenomics do need an overhaul to ensure long term sustainability. I will be keeping a close eye on any upcoming proposals and upgrades.

7 for Tokenomics.

Locked up funds

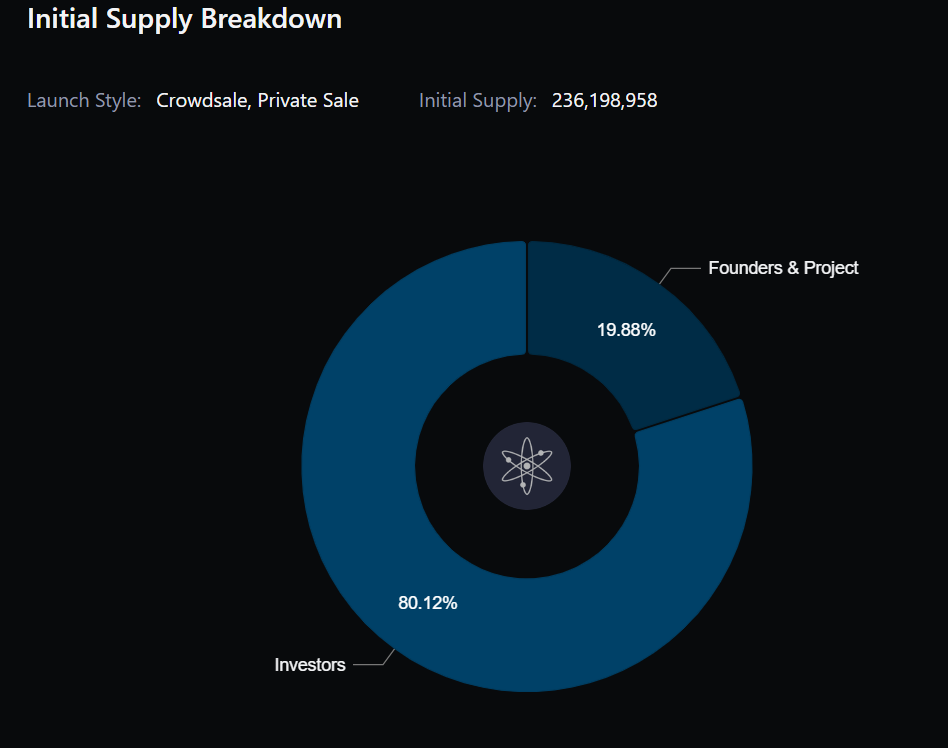

As of March 2021, all tokens distributed to investors and team were unlocked- meaning the risk of dumping on unlocks is greatly reduced.

According to mintscan.io there are approx. 323m atom tokens currently circulating with around 62% staked. This also helps to reduce sell pressure due to a high % of tokens staked.

8 for locked up funds.

Use case

$ATOM is the native token of Cosmos Hub, the PoS blockchain that constitutes one of many hubs on the Cosmos network. It can be used to

Pay for transactions,

Execute smart contracts,

Secure network through PoS

Vote in governance

However, Cosmos is much bigger than this, it is home to an ecosystem of blockchains that can scale and interact with each other. It aims to be the internet of blockchains, providing modular framework to enable interoperability between chains.

The ecosystem is thriving with close to $60b of digital assets under management across over 266 apps and services. Some of the biggest projects have been built using Cosmos SDK

BNB Chain

Cronos

THORchain

Osmosis

dYdX

Secret Network

Kujira

Juno

As @Dynamo_Patrick explains –Metcalfe's Law means that the value of a network increases exponentially as more people join. In my opinion, this type of explosive growth is possible for the cosmos ecosystem.

9 for Use case.

Roadmap

Most recent major upgrade was the v7-Theta Upgrade which was completed in March 25, 2022. As outlined on the Cosmos Hub, here are the upcoming proposed upgrades.

▶️v8-Rho Upgrade (expected Q1 2023)

Interchain Security

Global fee module

▶️ v9-Lambda Upgrade (expected Q1 2023)

Liquid staking module

▶️ v10-Epsilon (expected Q2 2023)

Hub ATOM Liquidity (HAL)

▶️ v11-Gamma (expected Q3 2023)

Interchain Security v2 - Layered Security

There was alot of hype and excitement around ATOM 2.0. However, it was rejected and the community decided to split this up into smaller proposals. If Cosmos is to continue to grow, it needs to deliver these much-needed improvements in 2023.

https://hub.cosmos.network/main/roadmap/cosmos-hub-roadmap-2.0.html#

8 for roadmap.

Team/ funding

In 2014, Jae Kwon founded Tendermint Inc and joined forces with Ethan Buchman in 2015. In Feb 2022, All in Bits inc (formerly Tendermint Inc)- was split into two entities, Ignite Inc. and NewTendermint Inc.

It is all quite confusing but this is how I currently understand the structure.

▶️ NewTendermint Inc. – CEO Jae Kwon. Focus on contribution to the Cosmos ecosystem core technology. Gno.land, Tendermint2 project and Cosmos SDK

▶️ Ignite Inc. - CEO Peng Zhong. Focus on product development of flagship products- Ignite CLI and Emeris.

The two entities hold complete independence from each other, with their own team, equity and funds.

There are also the ICF and IRIS foundation.

▶️ Interchain Foundation (ICF)- Swiss non-profit foundation that supports Cosmos ▶️ IRIS Foundation Ltd. is supported by the ICF to build IRISnet, a Cosmos Hub that facilitates construction of distributed business applications

In 2017- The ICF raised $16.8M for the funding of the Cosmos Network in 30 minutes. It is cited as one of the most successful blockchain-based fundraising events in history. Some significant early investors included Pantera Capital, Paradigm, Polychain Capital and SNZ.

Daily active devs is in a strong uptrend which is a really good sign for the project. Data from token terminal.

8 for Team/ Funding.

Summary

TLDR summary for each category’s score out of 10.

6.5 - Revenue – Low revenue relative to mcap

6 - Treasury– Small community pool, but increasing

7 - Tokenomics – Inflationary- needs improvement 31/

8 - Locked up funds – 62% staked and no further vesting unlocks

9 - Use case – Huge potential as internet of blockchains

8 - Road map – Everyone watching for ATOM 2.0

8 - Team/ funding – Confusing team structure, well backed by VCs

TOTAL- 7.6 weighted avg. score

Before I started this deep dive, I was extremely bullish on Cosmos in the long term. However, after diving into the detail, I am slightly less bullish due to the issues around tokenomics and capturing value through the ATOM token.

If Cosmos can successfully implement some of the measures outlined in ATOM 2.0, I think it can be one of the biggest success stories of the next bull run. The project has limitless potential if it can execute well.

The purpose of this thread is for education and research, not investment or financial advice. The current macro conditions are still very choppy with the risk of recession in 2023 and a tightening Fed so please be cautious out there frens.

Tagging some accounts...

@NickDrakon

Appendix- useful links

https://hub.cosmos.network/main/hub-overview/overview.html