When fear grips the market, it's your cue to get greedy.

Altcoins are plunging just like in mid-2021.

This might be your golden opportunity to buy the dip ahead of the final Alt-season.

Here are the top projects on my radar.

Firstly, let's zoom out for a second.

BTC is only 11% below ATHs

BTC Dominance continues to trend up

ETH/BTC is still trending down

Alts are getting rekt

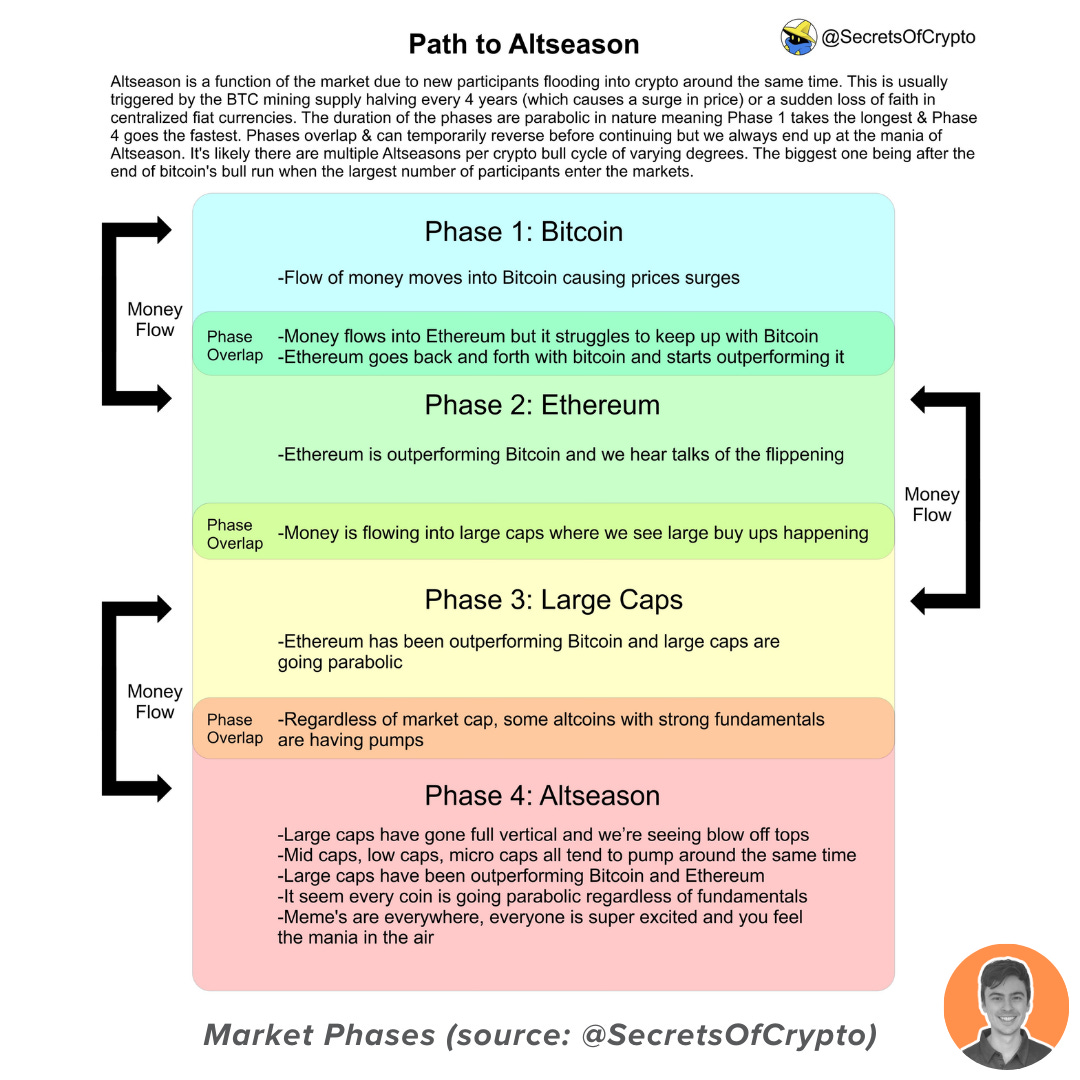

I think we are still in the first phase of a structural bull market.

Don't panic, the fun isn't over.

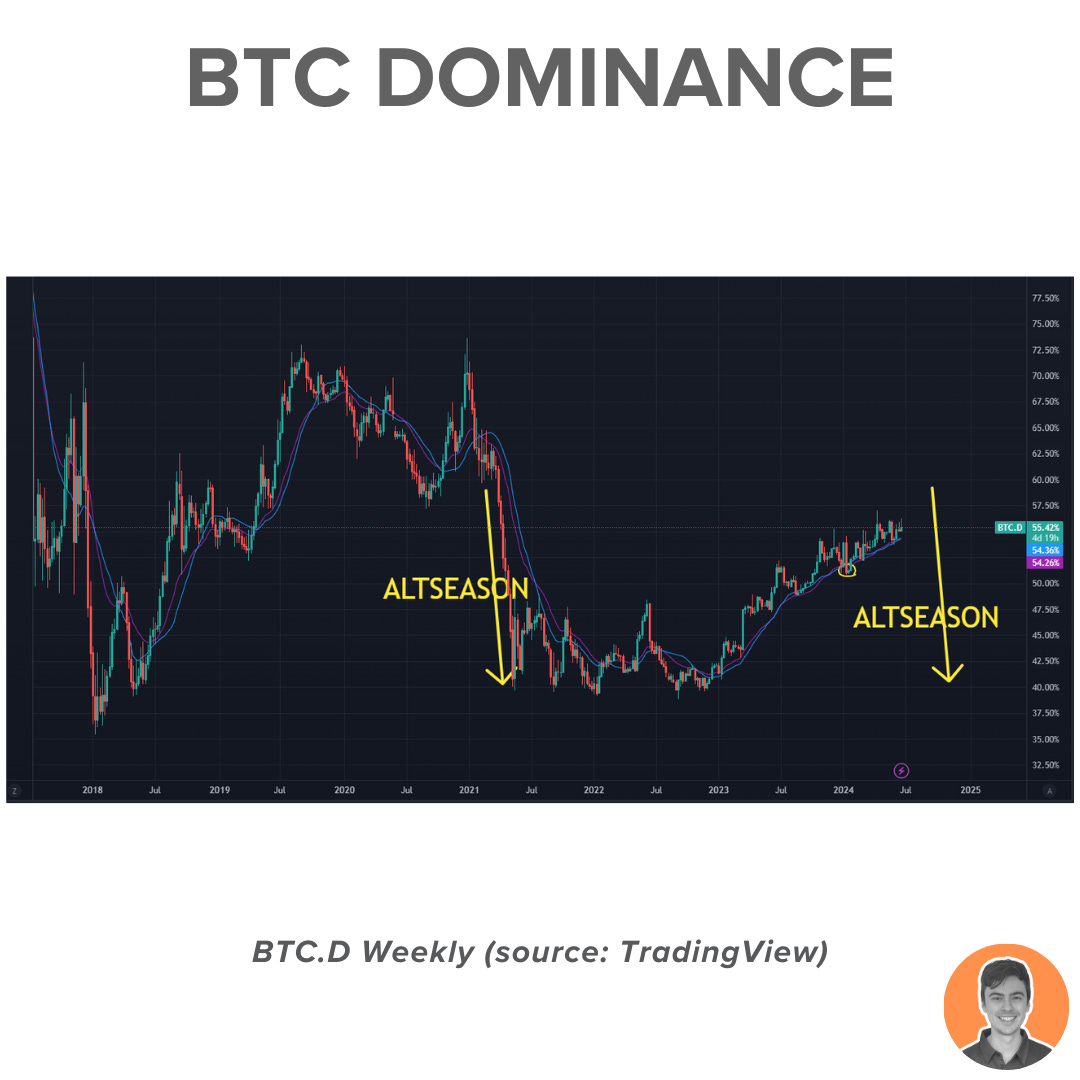

Every crypto bull market has seen a 30%+ correction in BTC dominance, signaling a proper "Alt-season."

This hasn't happened yet in this cycle. BTC.D has been rising since 2022 and hasn't broken down. When it does, this is when the real party starts.

Some argue that there won't be another altseason due to the explosion of new coins, aka "altcoin dispersion."

I believe it will still occur but in a more subdued form, as liquidity is now spread across many more coins. This means we need to be much more selective with our bags.

Perhaps we were also just ahead of schedule. Historically, BTC breaks its ATHs after the halving, not before, like in March '24.

So, what does this mean for altcoins? Is this just a routine correction? Let’s dive into the $OTHERS chart (marketcap of all tokens outside the top 10).

Let's examine the 2021 bull market, which experienced a similar summer correction:

70% correction from May to July 2021

280% increase from July to November 2021

Those who stayed patient and added to their positions saw excellent gains.

Fast forward to 2024.

We are in a very similar summer lull.

Currently, we are down 40% from the highs of March 2024. If the pattern from 2021 repeats, there could be more downside ahead.

However, a 280% surge, similar to the second half of 2021, could push the market cap of $OTHERS to $1 trillion+.

This is your golden opportunity to position yourself for the final, most explosive phase of the bull run.

Maintain conviction, hold spot and add to your winners.

However, not all altcoins are equal. After thousands of hours of research, here are the top projects on my list.

SOL

Solana is a layer 1 blockchain that offers fast transactions, low fees and scalability.

Bullish Catalysts:

No.1 chain for meme coins

Growth of ecosystem

Risks/ Bearish:

Already large market cap

Outages/ technical issues

LINK

Chainlink is a decentralised oracle network that connects smart contracts to the real world.

Bullish Catalysts:

Growth of RWAs / tokenisation

SWIFT partnership/ collaboration

Risks/ Bearish:

Chainlink foundation sell pressure

Already large market cap

FTM

Fantom is a Layer 1 blockchain offering fast transactions and low fees in a permissionless manner.

Bullish Catalysts:

Sonic upgrade

Ecosystem airdrops

Risks/ Bearish:

L1 space is oversaturated

Regulatory risk

RUNE

THORChain is a decentralized liquidity network that enables cross-chain swaps.

Bullish Catalysts:

SOL integration

Native swaps (no bridging or KYC)

Risks/ Bearish:

OG coin- not as much attention

Highly competitive DEX space

ENA

Ethena is a synthetic dollar protocol on Ethereum, offering a crypto-native alternative to traditional banking.

Bullish Catalysts:

Season 2 airdrop hype

Growth in RWAs/ stablecoins

Risks/ Bearish:

High FDV/ low circulating supply

Regulatory risk

PENDLE

Pendle is a decentralised yield-trading protocol where users can execute various yield-management strategies.

Bullish Catalysts:

Growth in points farming

ARB STIP incentives

Risks/ Bearish:

Smart contract risk

Regulatory risk

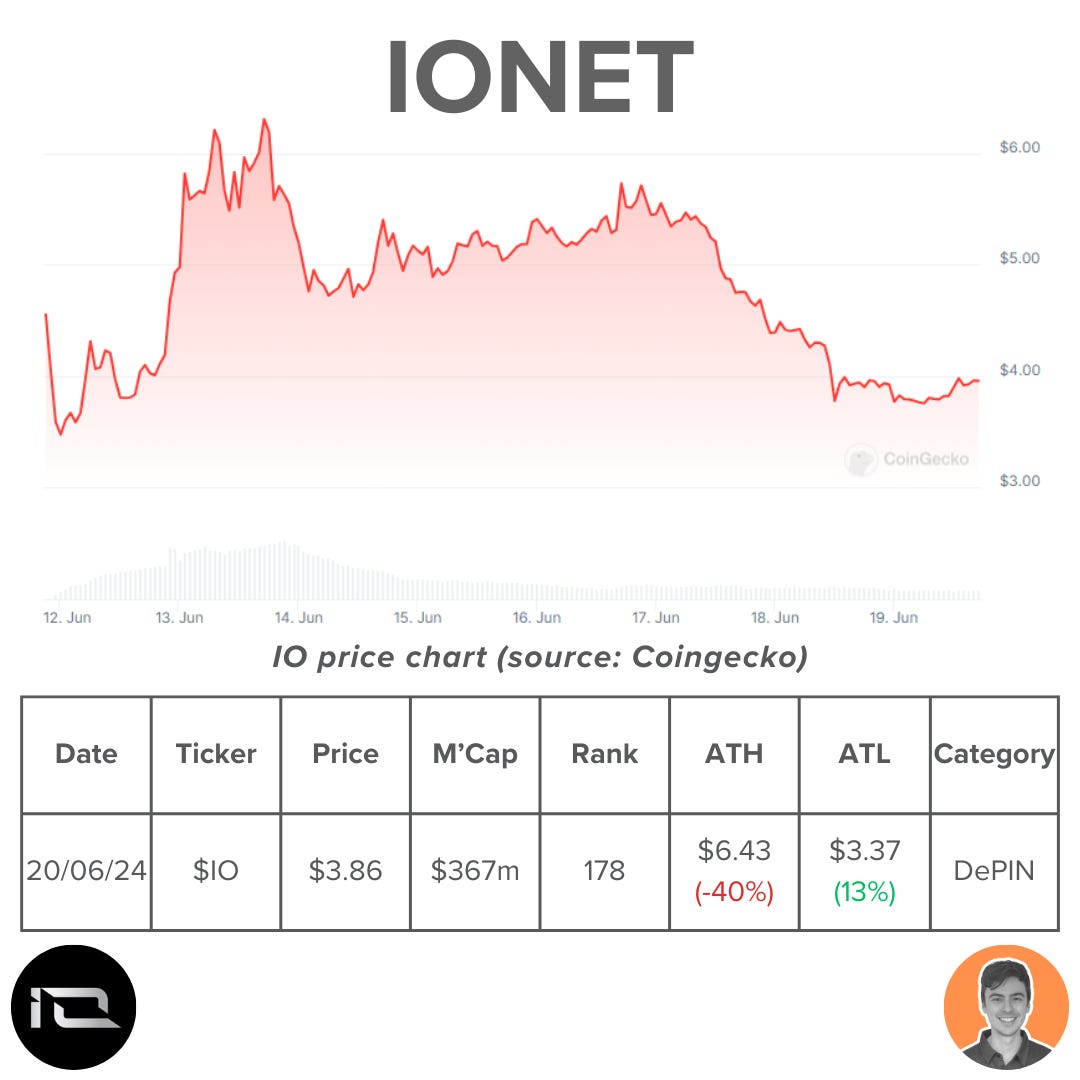

IO

Ionet is a decentralized cloud computing platform offering cost-effective clusters of CPU/GPU power.

Bullish Catalysts:

Growth of AI / computing power

DePIN narrative

Risks/ Bearish:

High FDV/ low circulating supply

Highly competitive space

NGL

Entangle is an omni-chain connector in the Web3 ecosystem, offering a range of interoperability products.

Bullish Catalysts:

Borpa meme coin launch

Launch of liquid vaults

Risks/ Bearish:

High FDV/ low circulating supply

Chart does not look great

Enduring these significant corrections can be challenging. I'm with you; it’s painful.

However, if we set emotions aside, the data suggests potential for further upside, particularly for altcoins in the long term.

What do you think? Let me know what projects are on your list.

Excellent thread I agree with most of your picks. Some I don’t agree but overall great deep dive.