DeFi’s fastest growing narrative: Restaking.

TVL has surged past $7B in less than 3 months and shows no sign of slowing down.

How you can qualify for the biggest airdrop of 2024 and position yourself for maximum gains.

Everything you need to know: @eigenlayer Mega🧵

Here's what we are going to cover:

What is EigenLayer?

My investment thesis

$EIGEN Airdrop

Liquid Restaking

LPDs

Closing Thoughts

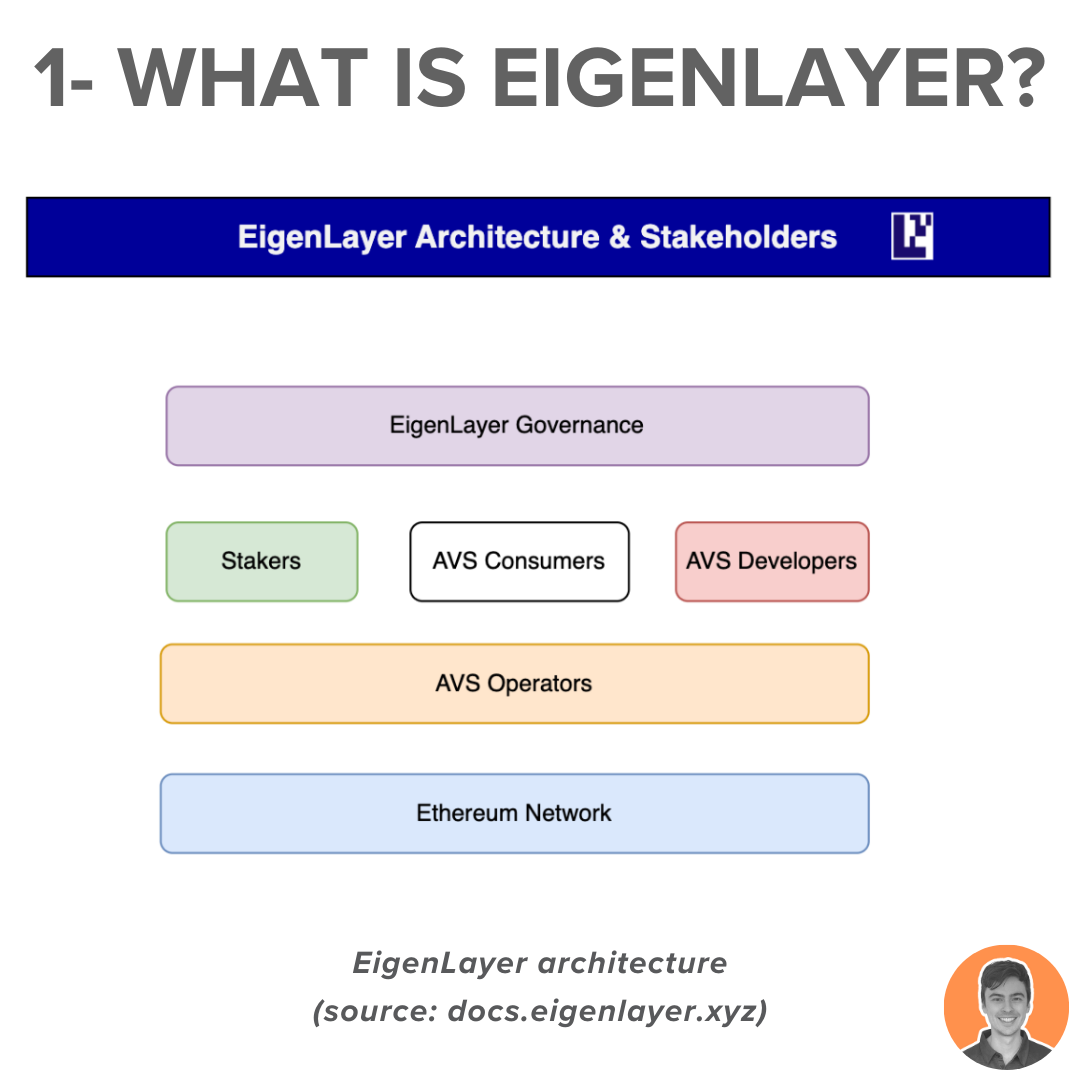

In simple terms, EigenLayer offers the ability to stake ETH across multiple protocols simultaneously through a process called Restaking.

Restaking enables staked ETH to be used as security for protocols other than Ethereum, in exchange for protocol fees and rewards.

So what are the benefits?

Pooled security for new decentralized services

Reduced capital costs for stakers

Increases the trust guarantees to individual services

Essentially it is unifying staked ETH (stETH, cbETH, ETHx, rETH) pooling it together and putting it to work.

Over the last few years we have seen Liquid Staking TVL surge to over $40b. It is now the top category in DeFi and continues to grow.

Restaking is the next evolution of liquid staking. It further optimizes the capability of staked ETH and provides additional yield to investors.

EigenLayer TVL has quickly grown to $7b in just a few months, making it the 4th largest DeFi protocol. Behind only Lido, Maker & AAVE.

To ensure proper stress testing of the protocol, the team has been opening only short restaking windows, thereby keeping a cap on the TVL.

Once the caps are fully opened, we can anticipate TVL to grow at an even faster rate.

Here's how I am positioning myself to take advantage of this narrative:

Farming the $EIGEN airdrop

Participating in Liquid Restaking

Identify new projects that could capitalize

Unless you have been hiding under a rock, you would have heard the enormous hype around the $EIGEN airdrop in 2024.

Like many other projects, EigenLayer are running a points program for the airdrop.

Points are awarded based on amount of ETH restaked and for how long.

There have already been over 2.5m $ETH restaked. So the airdrop may already be fairly diluted.

@ThorHartvigsen has developed a cool calculator to speculate on the airdop value.

https://twitter.com/ThorHartvigsen/status/1754634903348498637

However, I think you still need skin in the game and there will be opportunities that arise from it.

There are two main ways to participate in the airdrop and get EL points:

Restake directly through the EigenLayer app.

Use a liquid restaking protocol (e.g. Kelp DAO).

Both have their pro's and con's and associated smart contract risks. I'll run through both methods.

Direct through https://app.eigenlayer.xyz/

There are two main methods:

Deposit native ETH (You have to operate a validator node to participate- min 32 ETH)

Deposit LSTs (e.g. $cbETH, $stETH, $sfrxETH, $rETH, $ETHx)

However, currently LST deposits are paused.

Another option is to utilize a Liquid Restaking protocol.

You can restake on their app, and once the caps are lifted, they will restake directly with EigenLayer for you. Some of the most popular options include:

@KelpDAO

@ether_fi

@swellnetworkio

@RenzoProtocol

@Eigenpiexyz_io

There are several benefits to using liquid restaking protocols:

Earn EL points + project points (2 x airdrops)

No caps on deposits

DeFi opportunities for yield (e.g. Pendle, Penpie)

There's a strong change of airdrops from these projects as most don't have tokens yet.

Personally, my two favorites are @KelpDAO and @Eigenpiexyz_io who both have tremendous teams.

I am an ambassador of Kelp and have been helping to spread the good word about their excellent project. Here's a full deep dive I released last month.

https://twitter.com/jake_pahor/status/1749210477190930508

They also just launched native ETH restaking which makes it even easier to deposit:

Select asset → $ETH

Restake

Earn EL points + Kelp Miles + 30 EL points/ rsETH

I would really appreciate it if you use my referral link below (+10% bonus).

https://kelpdao.xyz/?utm_source=jakepahor

One of the other benefits of farming EigenLayer points is the potential for airdrops from AVS (actively validated services) projects that utilize EigenLayer.

@alt_layer was the first airdrop with $ALT and I have no doubt there will be more. Check out Thor's running list below.

https://twitter.com/ThorHartvigsen/status/1756333477836800283

So we have ventured pretty deep into degen land:

ETH → Staking → Liquid Staking→ Restaking → Liquid Restaking

Now I want to take you one level deeper: LPDs (Liquidity Position Derivatives).

The objective of LPDs is to capture the complete value of optimized liquid staking and liquid restaking yields using a single reserve currency ($vETH), while providing superior yields.

@vectorreserve have introduced the very first LPD in the form of $vETH.

Vector Reserve is an exciting new project I have just started working with as an ambassador. LPDs could be the next iteration of the EigenLayer/ Restaking narrative.

So how does it work?

Mint vETH (using $wETH)

Stake vETH + Vector ($VEC)

Claim Rewards

The benefits of holding/ staking $vETH:

Points for 4 airdrops (Eigen, Kelp, Renzo & EtherFi)

Highest yielding ETH-derivative (approx. 100% APR)

Yield from LP fees & DEX emissions

Future yield from Superfluid Staking

Diversified risk (no single point of failure)

Overall, I am extremely bullish on the whole EigenLayer ecosystem.

I think the Restaking narrative is only just getting started and the inevitable $EIGEN airdrop will add further hype and attention.

TVL has already grown exponentially and I don't see it stopping any time soon.