Institutions are pouring money into decentralised order books.

And Injective? They've developed one of the best.

I think that its 800% gains in 1 year are just the beginning.

Here's my November 2023 research report on INJ.

Here's what we'll cover in today's edition:

Overview

Use Case

Adoption

Revenue

Tokenomics

Treasury

Governance

Team & Investors

Competitors

Risks & Audits

Summary

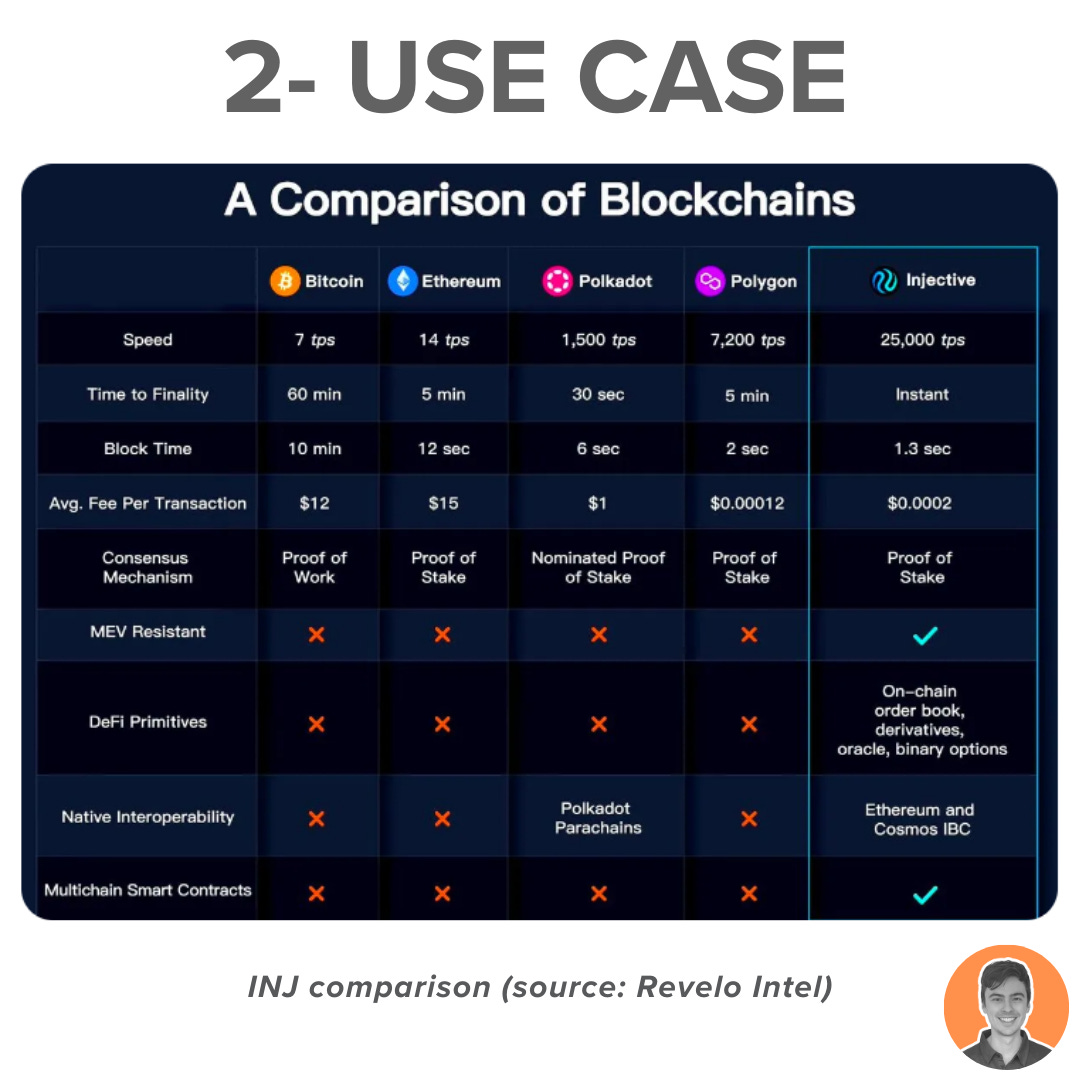

Injective is a blockchain that has been specifically built for finance applications.

It boasts the following features:

Fastest L1 blockchain

Decentralised and modular order book

Instant transaction finality using the Tendermint

Interoperable across a no. of chains

It's value proposition is to provide the most advanced and next-generation financial infrastructure for onboarding the next cycle of user adoption.

Injective are determined to build applications that onboard new users and facilitate the growth of institutional adoption.

The industry is moving away from exorbitant DeFi yields coming from highly inflationary assets.

Injective is ready to offer products that are often seen in TradFi, such as spot and derivatives markets based on an orderbook model.

All of that combined with insanely low gas fees.

TVL has cooled off recently and is sitting at $9.75m.

The majority of TVL (83%) is currently sitting on Helix, the top DEX on @Injective_

Despite this recent drop in TVL, $INJ has been one of the better performing coins of the year (+817% 1y).

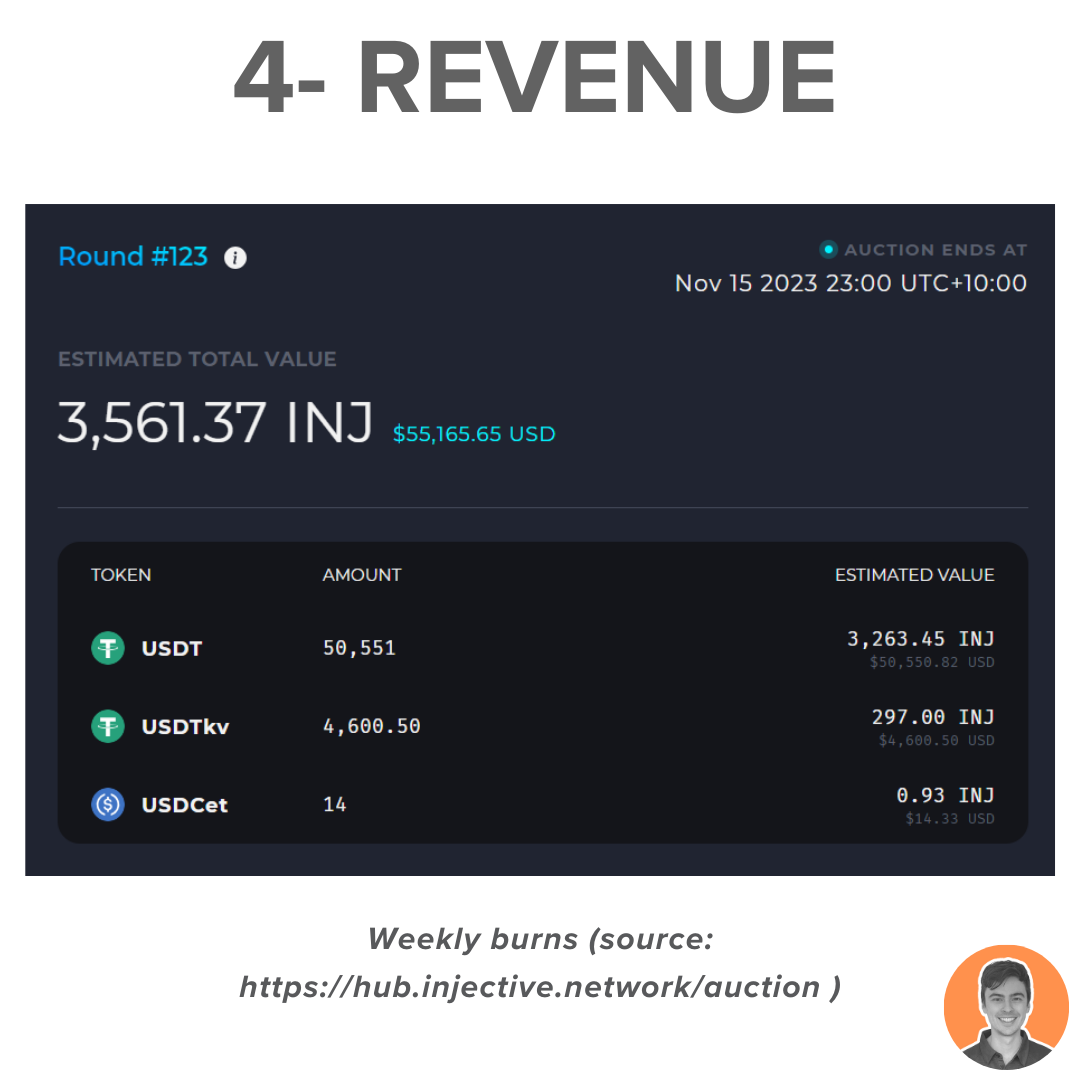

Trading fees are 0.1% for makers and 0.2% for takers.

40% of fees from INJ dApps → developer incentives

60% of fees from INJ dApps → auctioned off every week via a buy back and burn mechanism.

Trading fees generated over the last week are approx. $55k USD.

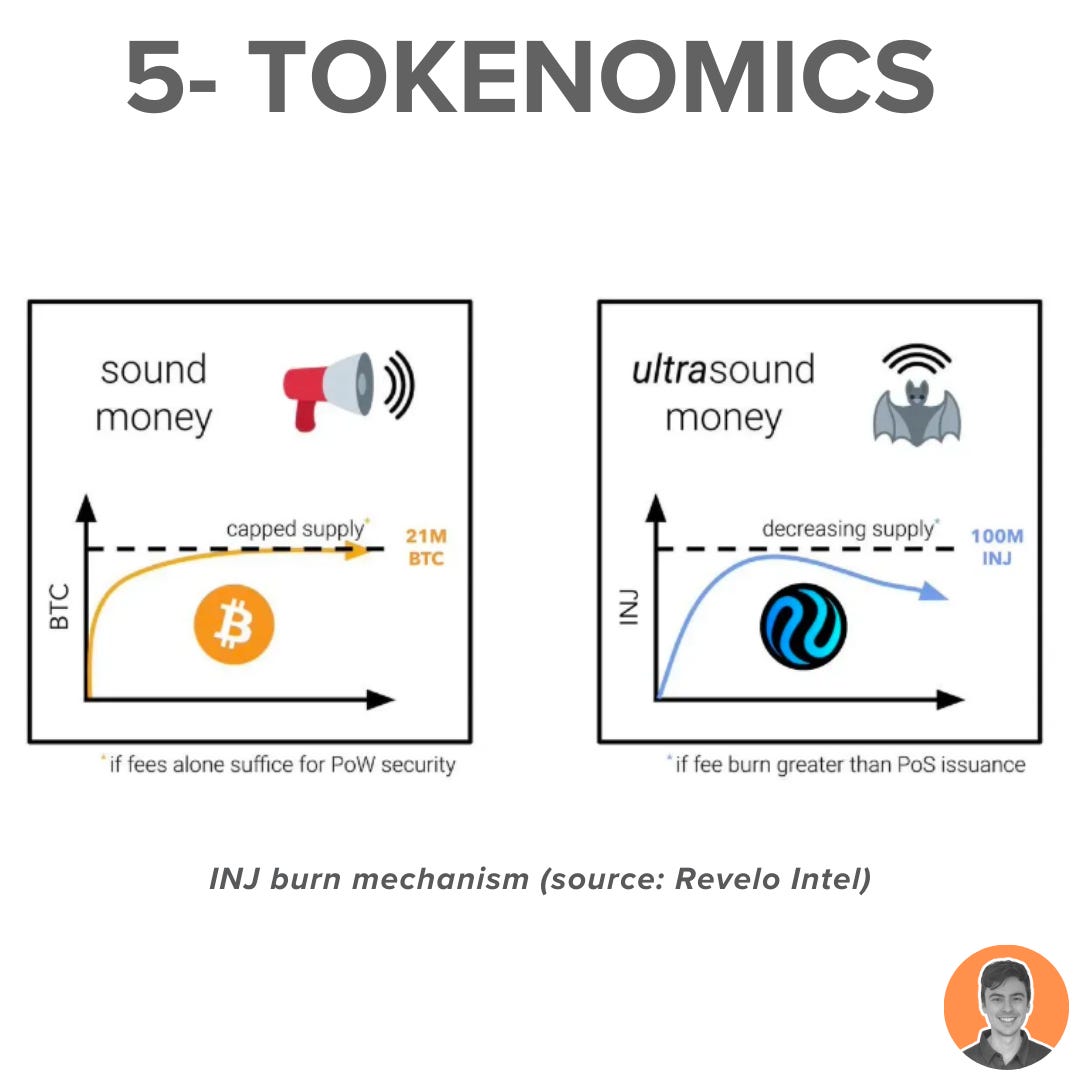

INJ is the native and deflationary asset that powers Injective and its ecosystem. It's used to:

Secure the network

Pay for gas fees

Governance

It's a proof of stake network where currently you can earn a 16% APR for delegating.

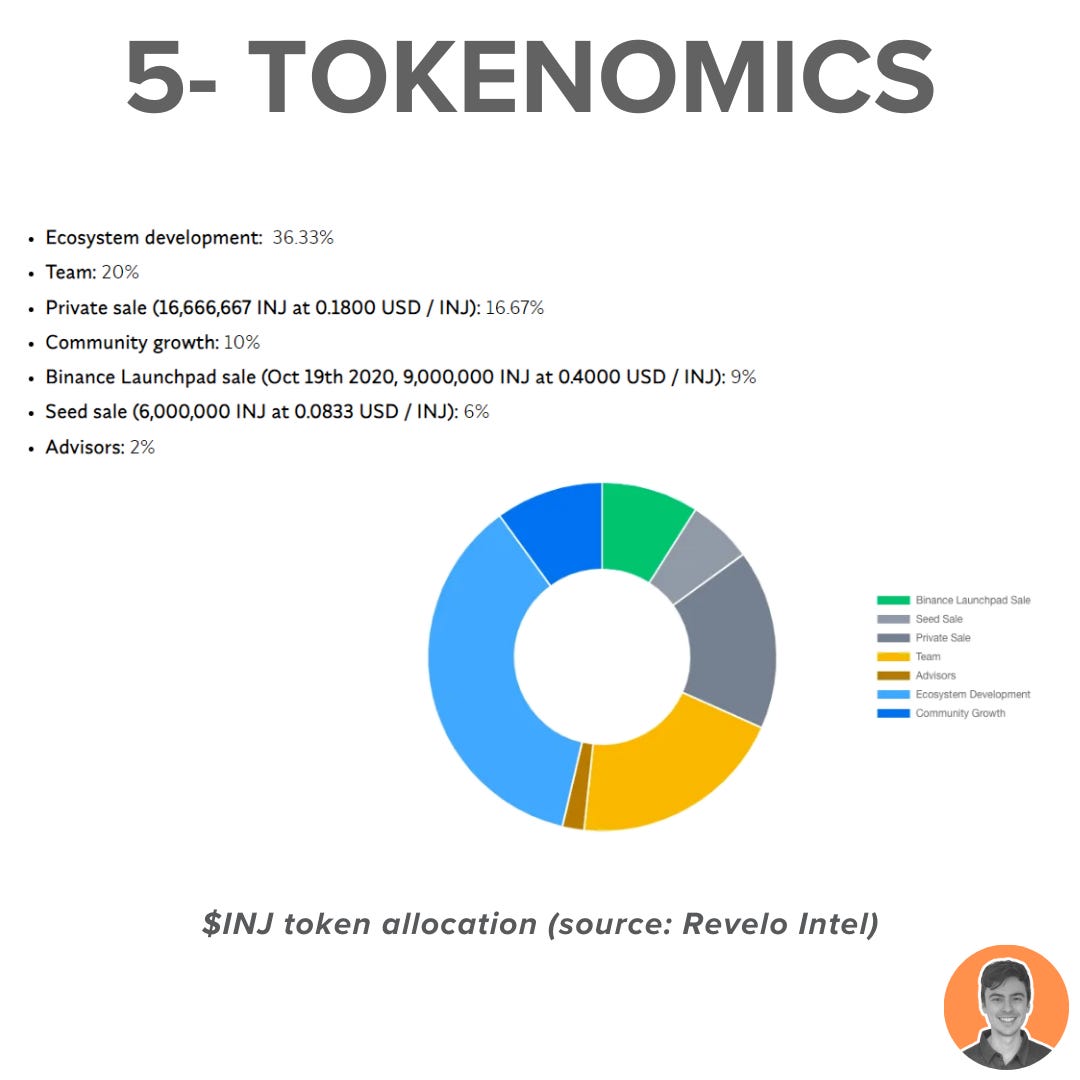

Here is the initial token allocation:

Injective also implements weekly token burns that are currently the highest in the industry.

60% of Protocol Revenue from exchange fees is auctioned off in exchange for INJ, which is then burned.

So far, over $5.8m $INJ tokens have been burned to date ($89.5m USD).

These are the current supply stats:

Circulating supply = 83.76m

Max supply = 100m

Market cap = $1.3b

FDV = $1.59b

Market cap/ FDV = 0.84

There is one final vesting cliff set for January 2024.

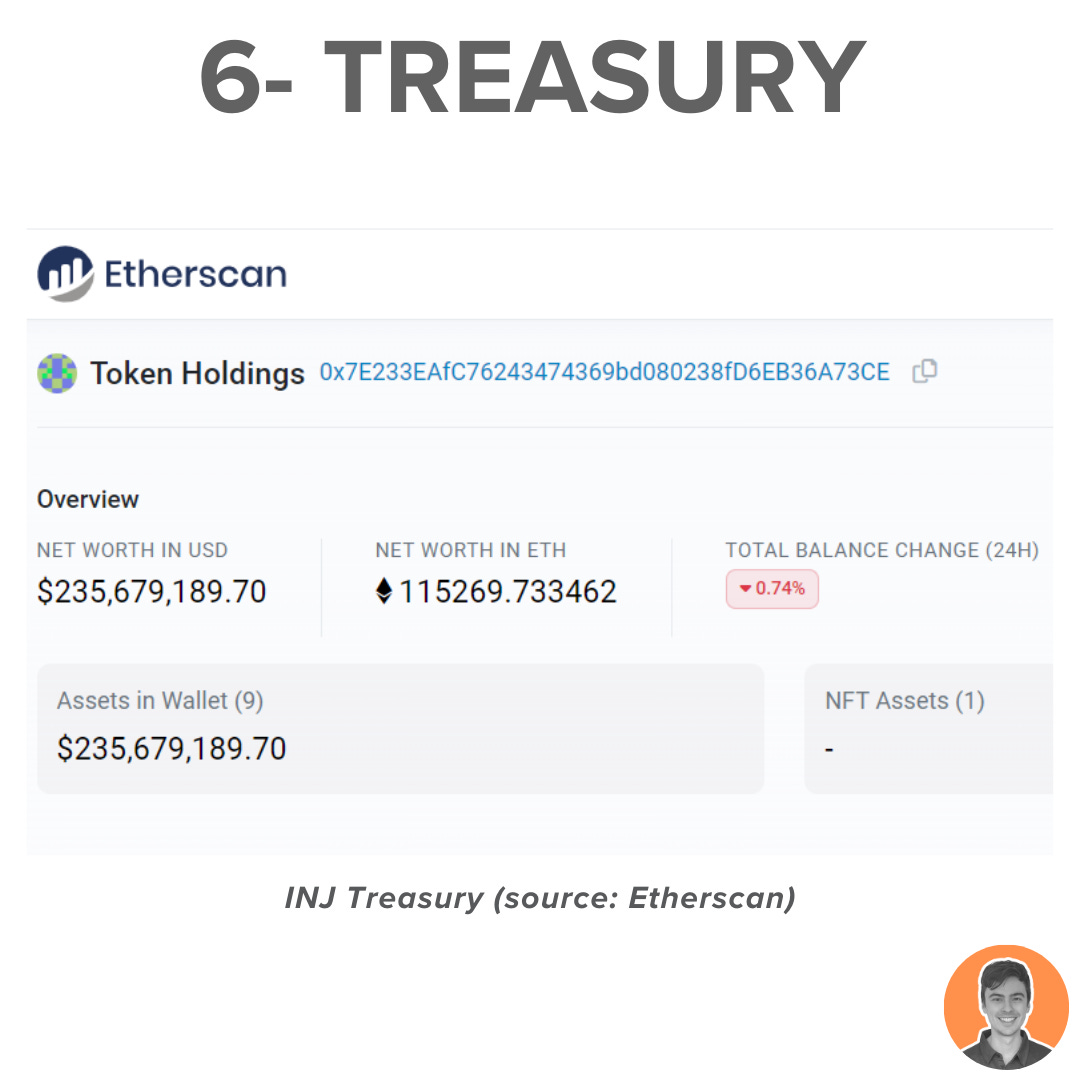

The Injective Treasury comprises of:

15.2m $INJ tokens

Total 236m USD worth

It is concentrated in the native token which does pose a significant diversification risk.

A global DAO has been established to allow the community to participate in:

Protocol upgrade proposals

Validate the network (staking rewards)

Burn auctions

There is a minimum deposit required of 500 INJ and each voting period lasts over 4 days.

Injective Labs was founded by @ericinjective and @albertchon in 2018 and was incubated by Binance Labs in that same year.

The project has attracted some impressive investors after becoming the first project to launch on Binance Launchpad in October 2020.

Over multiple funding rounds, INJ has raised around $56.7m.

It has recently announced the formation of two incentives programs:

$120M incentives program for Cosmos ecosystem

$150M ecosystem fund initiative with partners (Pantera, Jump, Kucoin, Delphi labs)

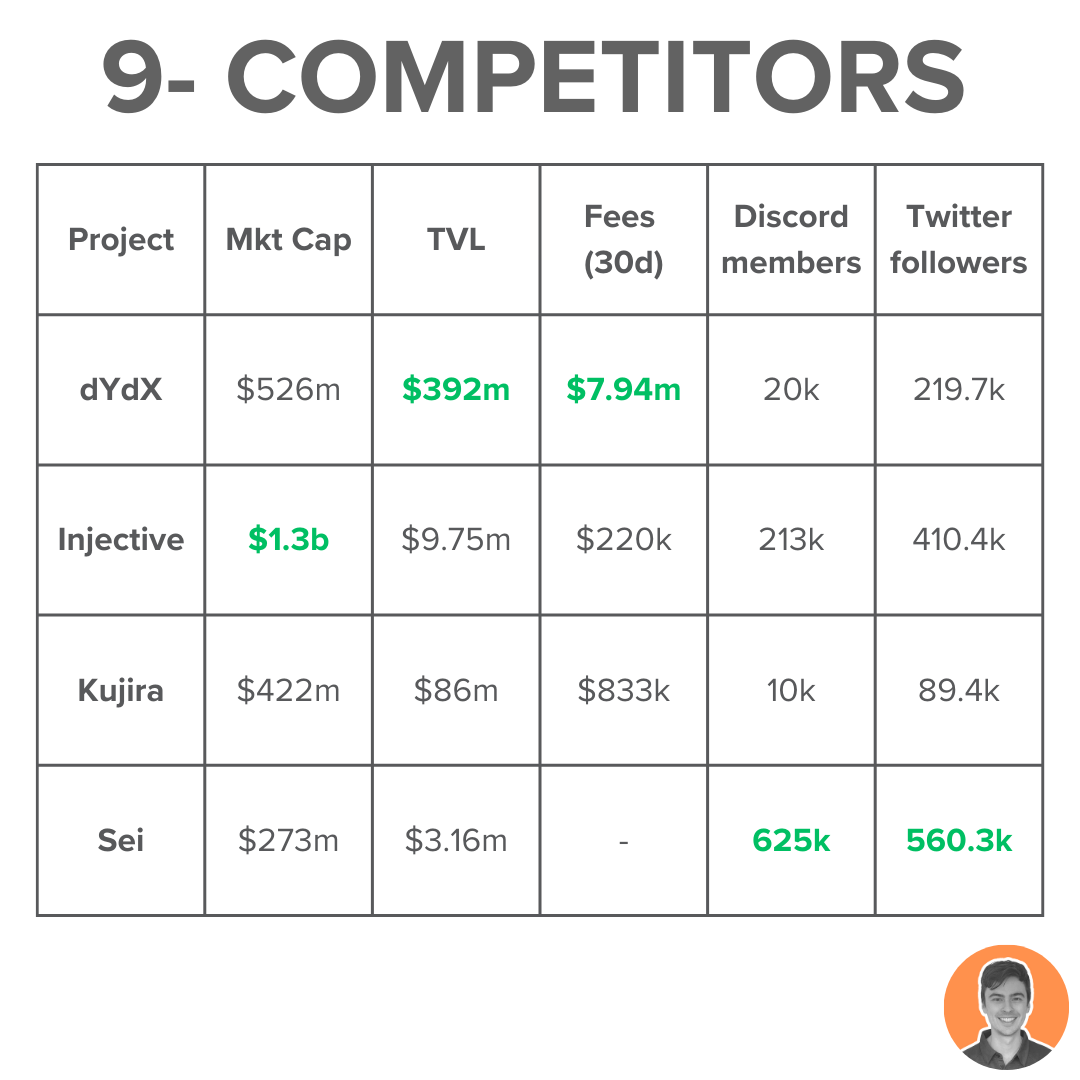

Injective faces competition on two fronts.

First from the traditional EVM-based Perpetuals protocols such as GMX, Gains and Synthetix.

And also from new rivals that have developed their own custom app-chain such as dYdX, Kujira and Sei (Decentralised order books).

While dYdX is the clear leader in terms of TVL and revenue, Injective has a large Treasury and also some hefty institutional backing.

It will have to continue innovating to make sure it keeps up with all of the strong competition.

The project has been audited and has been given a security score of 73.66 by CertiK.

It scores extremely high (top 10%) in code security, fundamental health, operational resilience and governance strength.

However, it scores in bottom 5% for market stability.

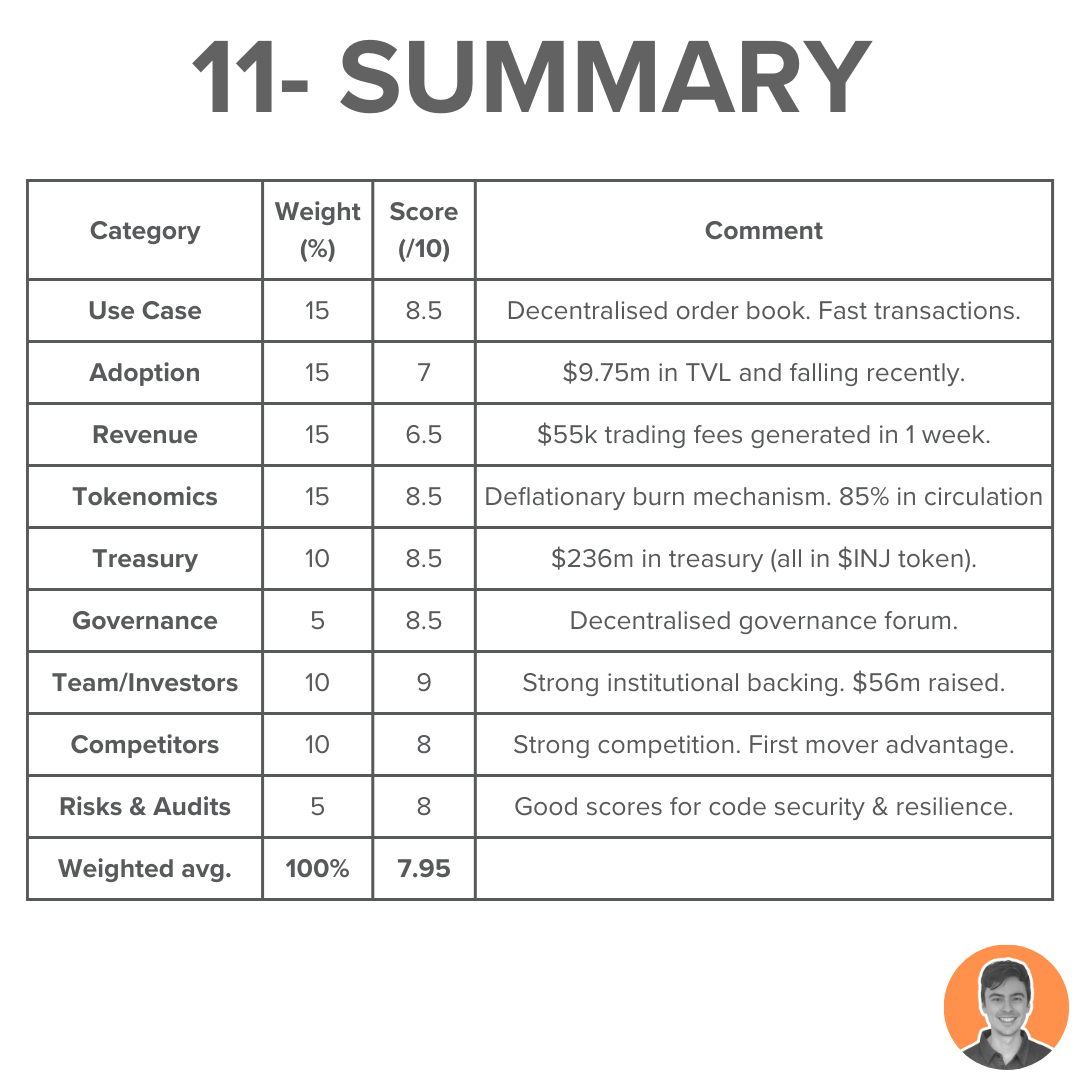

Overall, I am quite bullish on Injective and the ecosystem they are building.

There are a number of bullish catalysts:

Institutional adoption

$150m Injective Venture Group

Bullish token burns

Ecosystem & integrations expanding

Overall weighted score = 7.95

Note: I am NOT an ambassador or advisor of Injective. This is NFA.