Arbitrum season has arrived.

And Radiant Capital is perfectly poised to capitalise.

Here's my November 2023 research report on RDNT.

Here's what we'll cover in today's edition:

Overview

Use Case

Adoption

Revenue

Tokenomics

Treasury

Governance

Team & Investors

Competitors

Risks & Audits

Summary

Don't forget to bookmark this post for future reference.

Radiant Capital is an omni-chain borrowing & lending protocol.

It is built using LayerZero which allows users to:

Deposit collateral - e.g. USDC on Ethereum

Borrow on another chain e.g. ETH on Arbitrum

One of DeFi's major problems is fragmented liquidity.

Lenders decide on a chain, and the assets they withdraw must exist on that same chain.

Bridging between chains can be cumbersome & risky.

Radiant aims to:

Unify liquidity

Simplify lending experience

Innovate

The release of Radiant V2 in March '23 significantly reduced inflation and improved overall tokenomics.

User behavior is now aligned with the protocol whereby emissions only go to holders of RDNT

Increase revenue to lockers (50 -> 60%) & reduced for lenders (50% ->25%)

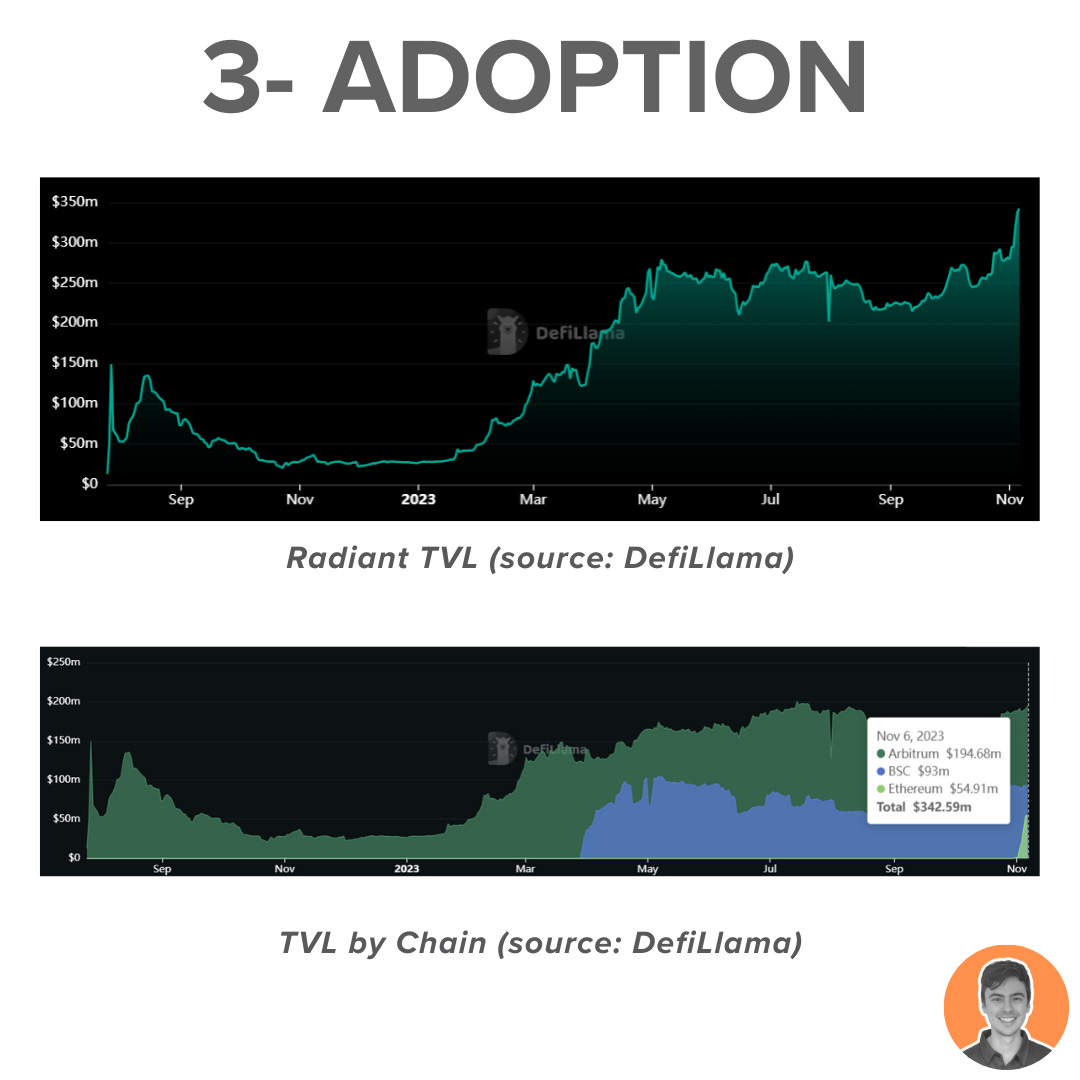

Radiant TVL is seeing some decent growth, hitting an ATH at $342m.

Over the last month alone, it has seen a 26% growth in TVL. Predominantly due to it going live on Ethereum in October.

Putting it 7th amongst lending protocols and 32nd amongst all protocols on DefiLlama.

Protocol revenue is distributed as follows:

60% - locked RDNT dLPs

25% - Lenders

15% - OPEX

Over the last 30 days, the protocol has generated:

$1.78m in fees

$1.33m in revenue

Putting it 2nd amongst lending protocols, and 15th overall.

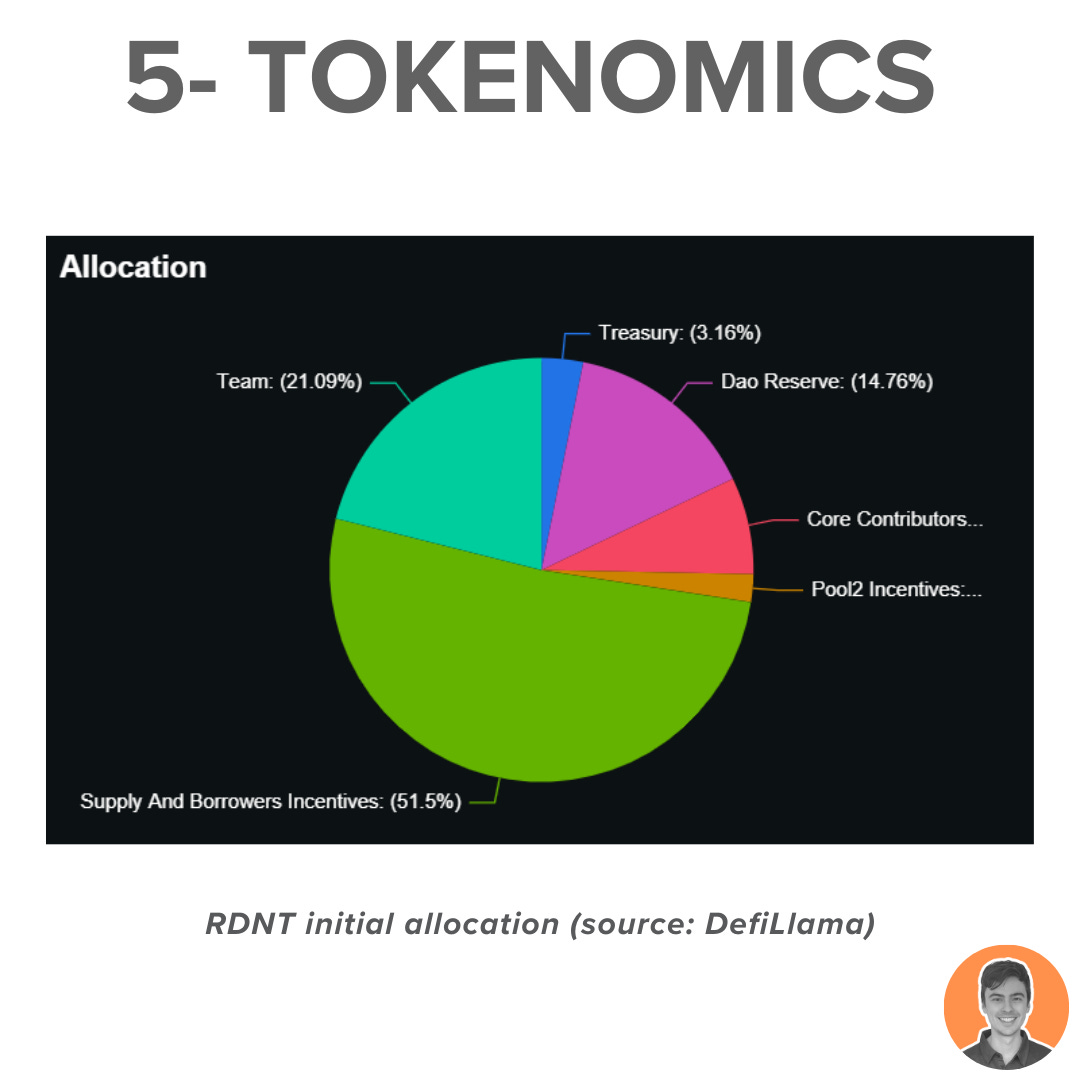

$RDNT is Radiant's native utility token (OFT-20).

LayerZero's omnichain solution enables seamless token transfers across chains.

$RDNT facilitates protocol fee sharing and provides governance through locked dLP.

The Protocol is now live on Arbitrum, BNB Chain, Ethereum.

All vesting will be completed in 2027.

Current supply stats:

Circulating supply = 347m

Max supply = 1b

Market cap = $95.5m

FDV = $275.2m

Market cap/ FDV = 0.35

The Radiant DAO has two main treasury wallets:

Radiant Reserve - $44m USD

Radiant DAO Treasury - $28.5m USD (RDNT, USDT, ARB)

The DAO Reserve serves as a router for RDNT emissions.

The Treasury is used for operational expenses (salaries, listings, marketing etc.).

Radiant Capital operates as a DAO with 25k members in the governance forum, voting on 25 proposals to date.

To participate in the voting process for these proposals, it is necessary to lock your RDNT tokens.

Currently, there are over 44 million dLP tokens locked.

Radiant was launched in 2022 and the founding team funded all development work (~$1.5m).

There were no VC investments, private sales or ICOs to raise capital.

Key working partnerships:

LayerZero

Chainlink

Lido

Arbitrum

Balancer Labs

Binance labs

Aave is the dominant player in DeFi lending. Radiant, a fork of Aave, is emerging as a strong competitor with omni chain capability.

Tapioca DAO is another up-and-coming protocol that operates as an omni chain money market on LayerZero.

There is strong competition in the space.

V2 of the codebase has been audited by Open Zeppelin, Peckshield and Zokyo with zero unresolved critical or high risk issues.

There is also a bug bounty program being run by Immunifi.

As with any DeFi investment, there are always residual risks. Always make sure to DYOR.

Overall, I am bullish on $RDNT and the Radiant protocol.

There are a number of upcoming bullish catalysts:

Live on Ethereum

ARB season

STIP grant- ARB directed to fresh dLP lockers

LayerZero narrative

Radpie integration

Overall weighted score = 8.43

Note: I am NOT an ambassador or advisor of Radiant. This is NFA.