Cosmos is exploding with opportunities.

Osmosis, the liquidity hub, is perfectly positioned to ride this wave of growth.

With potential lucrative airdrops in the mix, it could lead the bull run.

Here's my January 2024 research report on OSMO.

Here's what we'll cover in today's edition:

Overview

Use Case

Adoption

Revenue

Tokenomics

Treasury

Governance

Team & Investors

Competitors

Risks & Audits

Summary

Osmosis is the largest DEX and liquidity hub on the Cosmos Interchain. It serves as the leading cross-chain DeFi platform for protocols built with IBC.

Osmosis offers a range of features, including:

Swap

Stake

Margin trading (Mars)

Perpetuals (Levana)

LPs

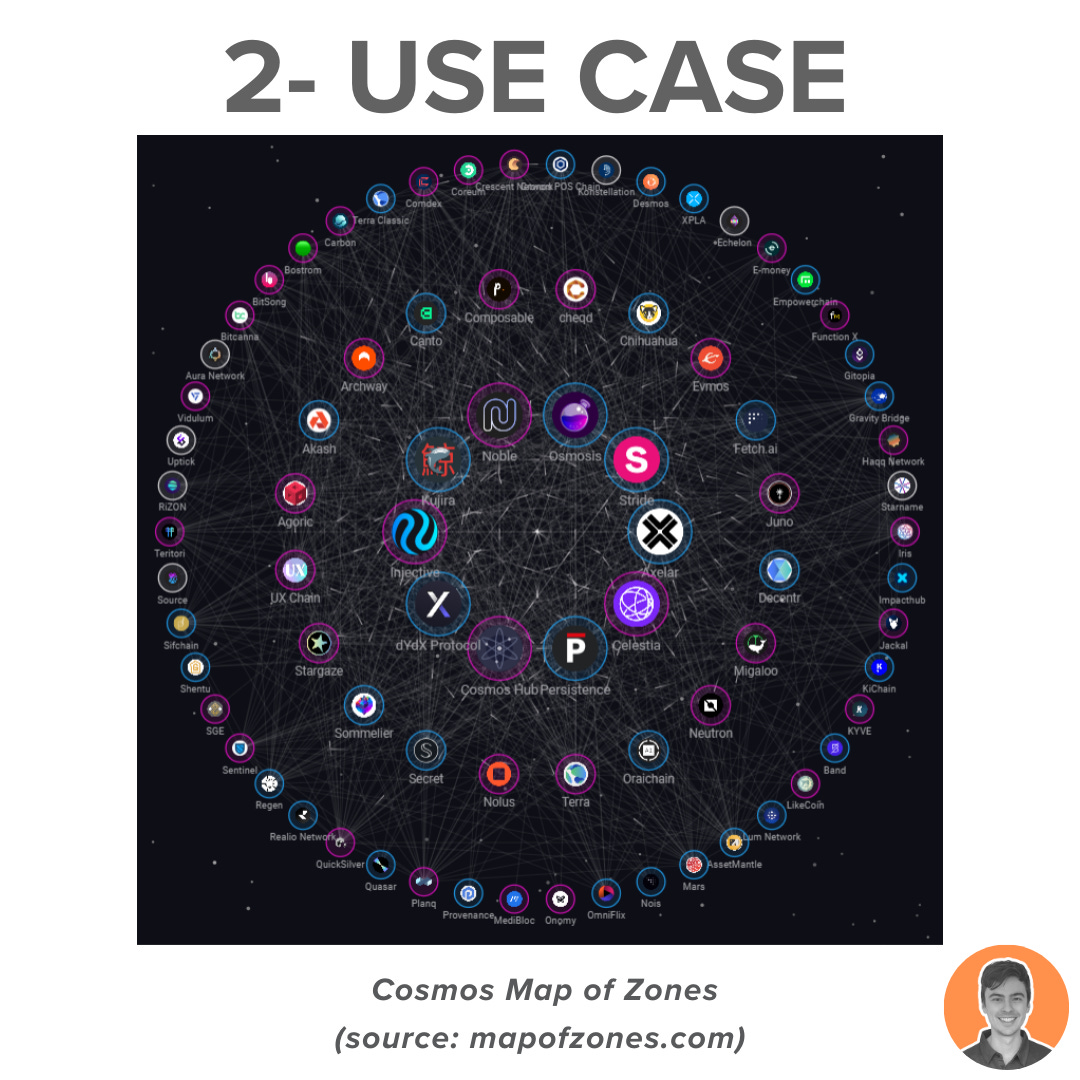

The Cosmos ecosystem is thriving, with over 100+ chains built using the IBC protocol. Including:

Cosmos Hub

Axelar

dYdX

Celestia

Kujira

Injective

I'm highly optimistic about the Cosmos ecosystem, and I believe Osmosis can greatly benefit from its growth.

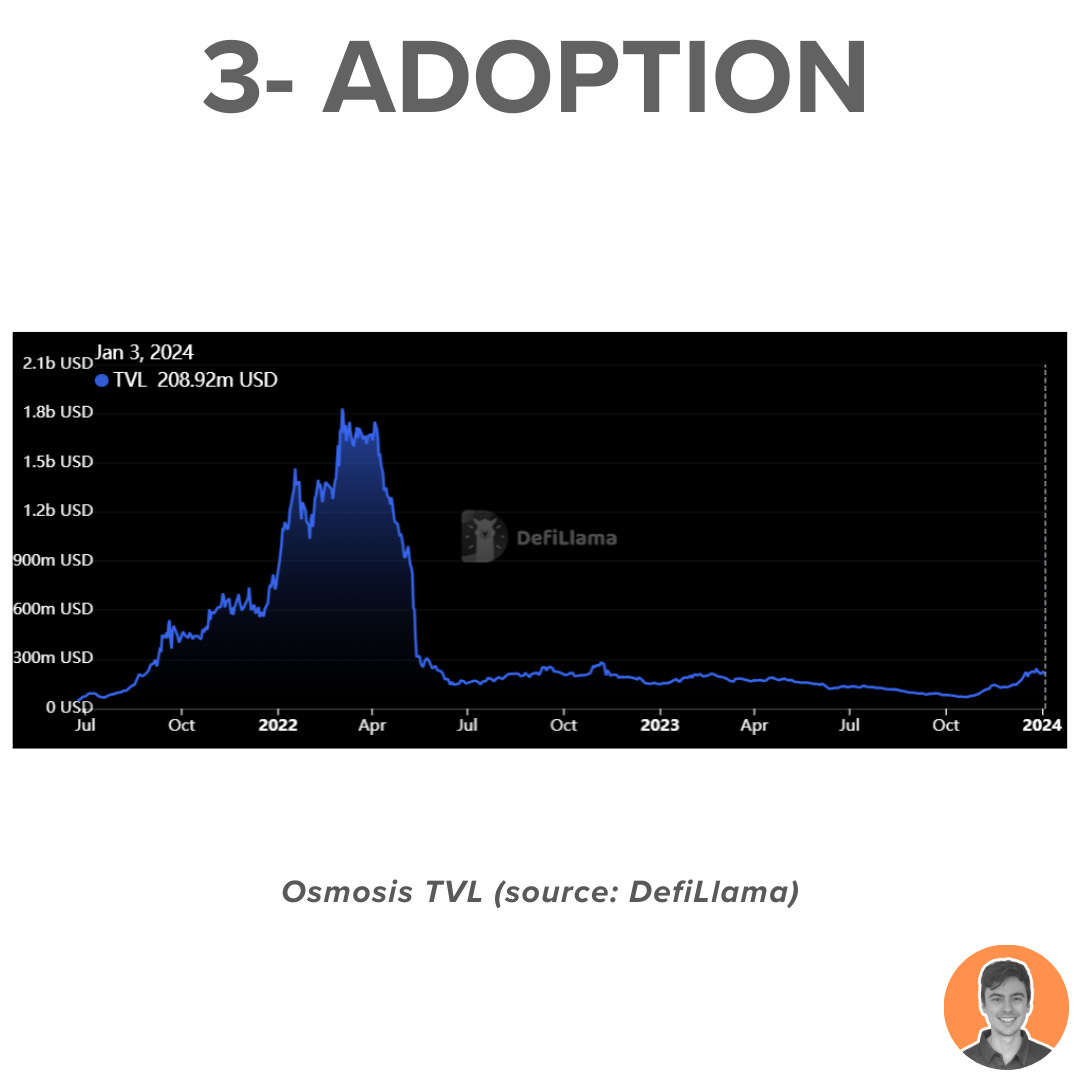

TVL on Osmosis chain: $209m, up 3x from October 2023 lows ($68m).

87% comes from the Osmosis DEX.

Still far below 2022 peak of $1.8b TVL.

Plenty of room for growth and upside potential in the impending bull market and altcoin season.

In the past 30 days, Osmosis Dex generated $1.79 million in fees, placing it at the 43rd position overall and 8th among other Dexes.

Transaction fees are paid by any user to post a transaction on the chain. This transaction fee is distributed to $OSMO stakers on the network.

The $OSMO token serves as a governance token, granting staked token holders the power to shape the protocol's future. It offers several key functionalities:

Voting/ Governance

Transaction fees

Securing the network

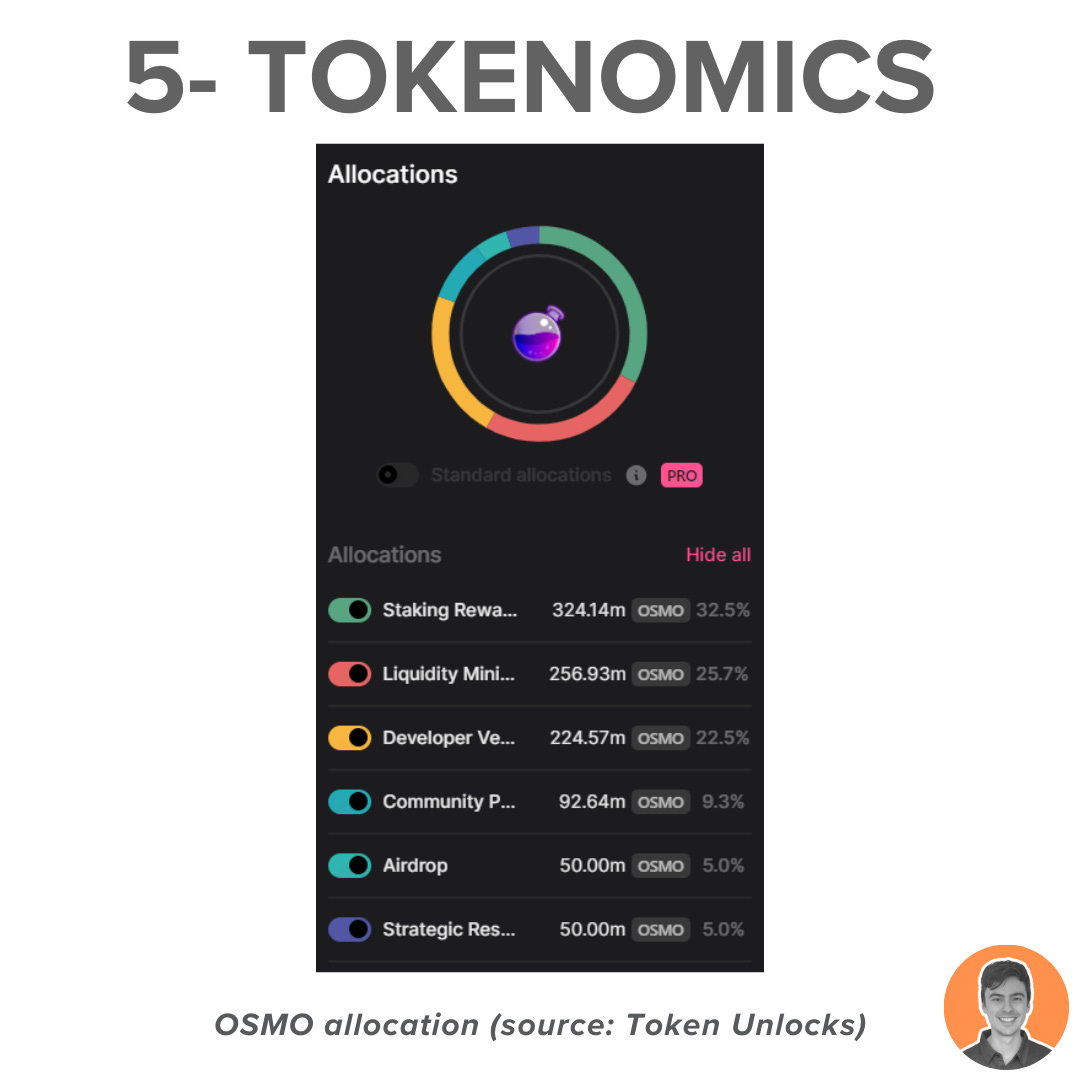

OSMO 2.0 tokenomics upgrade was implemented in 2023.

The main problem: $OSMO inflation rate was higher than staking rewards. You would be losing money unless you went for higher risk LPs.

@Flowslikeosmo explains the improvements that were passed, resulting in:

Reduced inflation

Increased net yield

Increased LP net yield

https://twitter.com/Flowslikeosmo/status/1641968640420614148

Current supply stats:

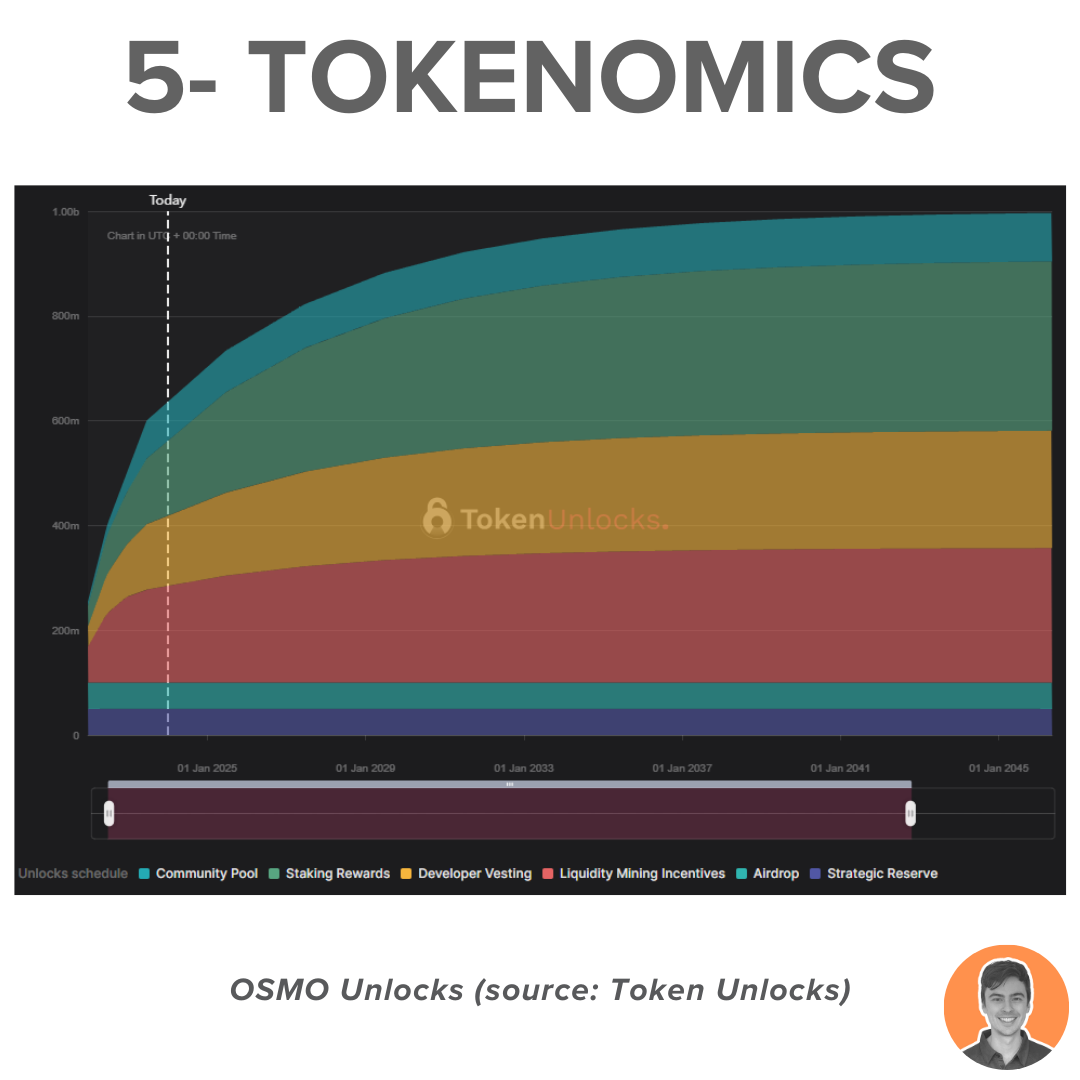

Circulating supply: 633m

Max supply: 1b

Market cap: $963m

FDV: $1.52b

Market cap/FDV: 0.63

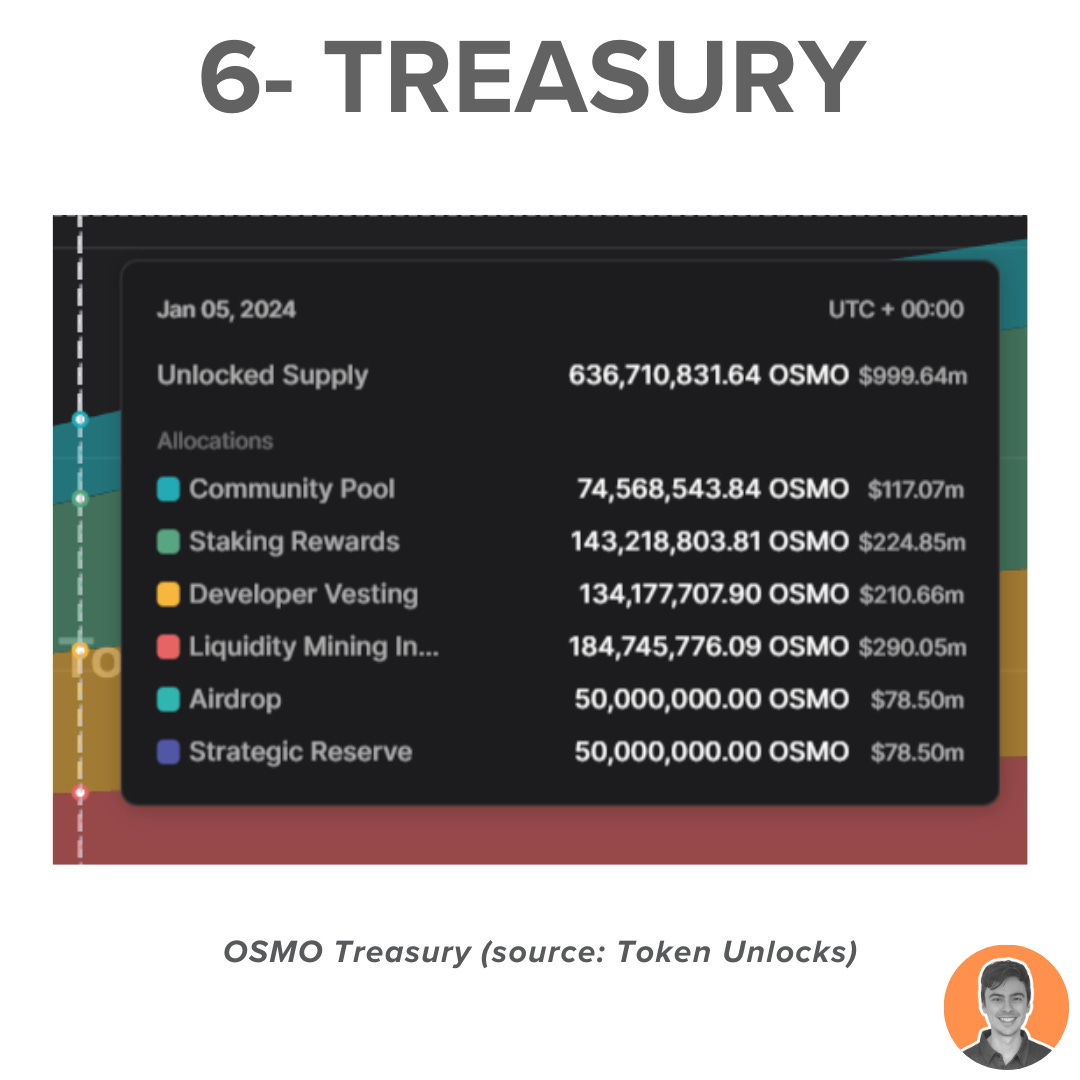

According to the unlock schedule, there are two main entities that could be considered the treasury.

Community Pool: 74.6m $OSMO = $117m

Strategic Reserve: 50m $OSMO = $78.5m

The ProtoRev module account is currently worth $1.5m- (910k $OSMO, 7.5k $ATOM, 15k $axlUSDC).

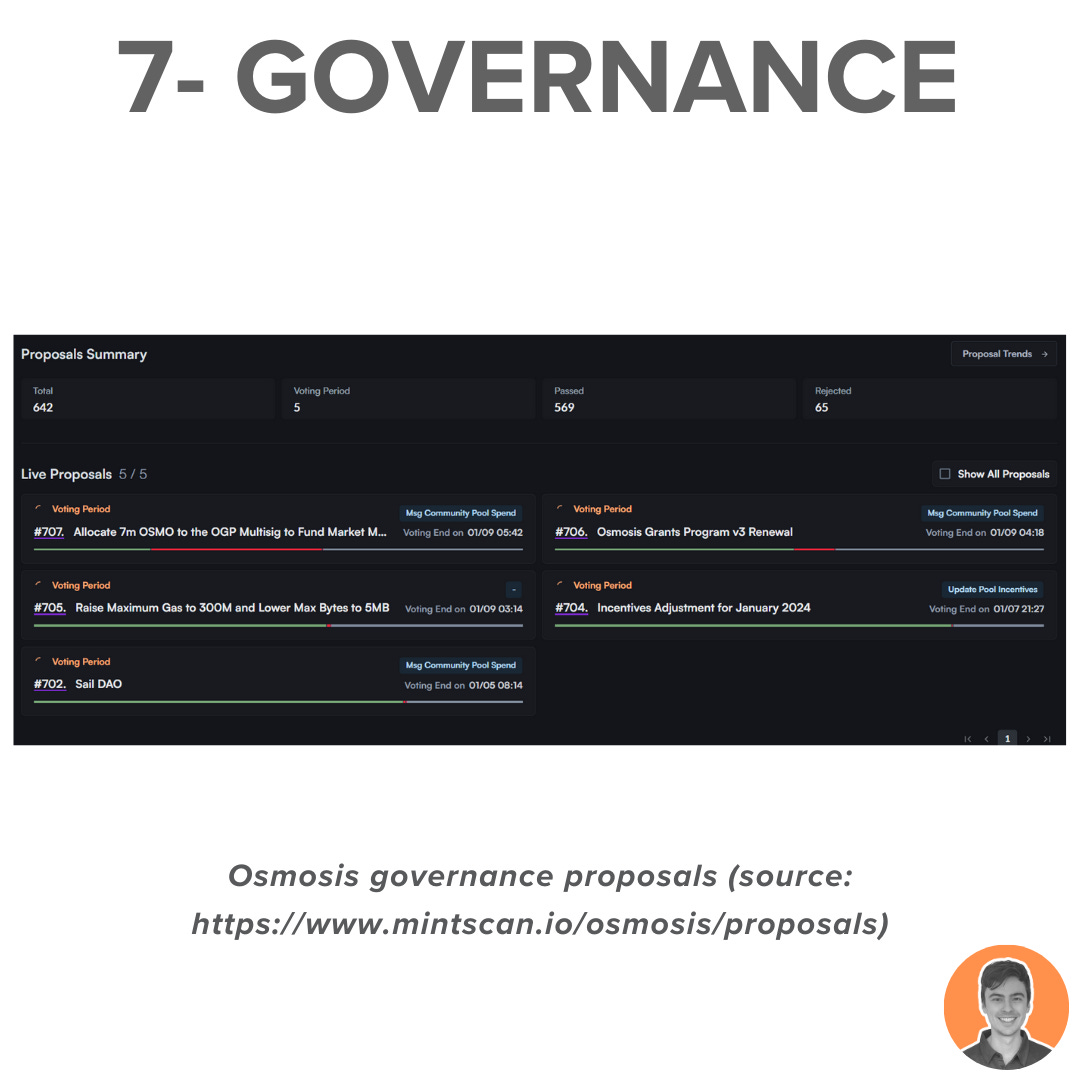

A decentralized governance forum has been established, allowing the community to vote on proposals.

Osmosis boasts a robust governance forum, with the following:

Total proposals submitted: 642

Proposals passed: 569

Proposals rejected: 65

Proposals in progress: 5

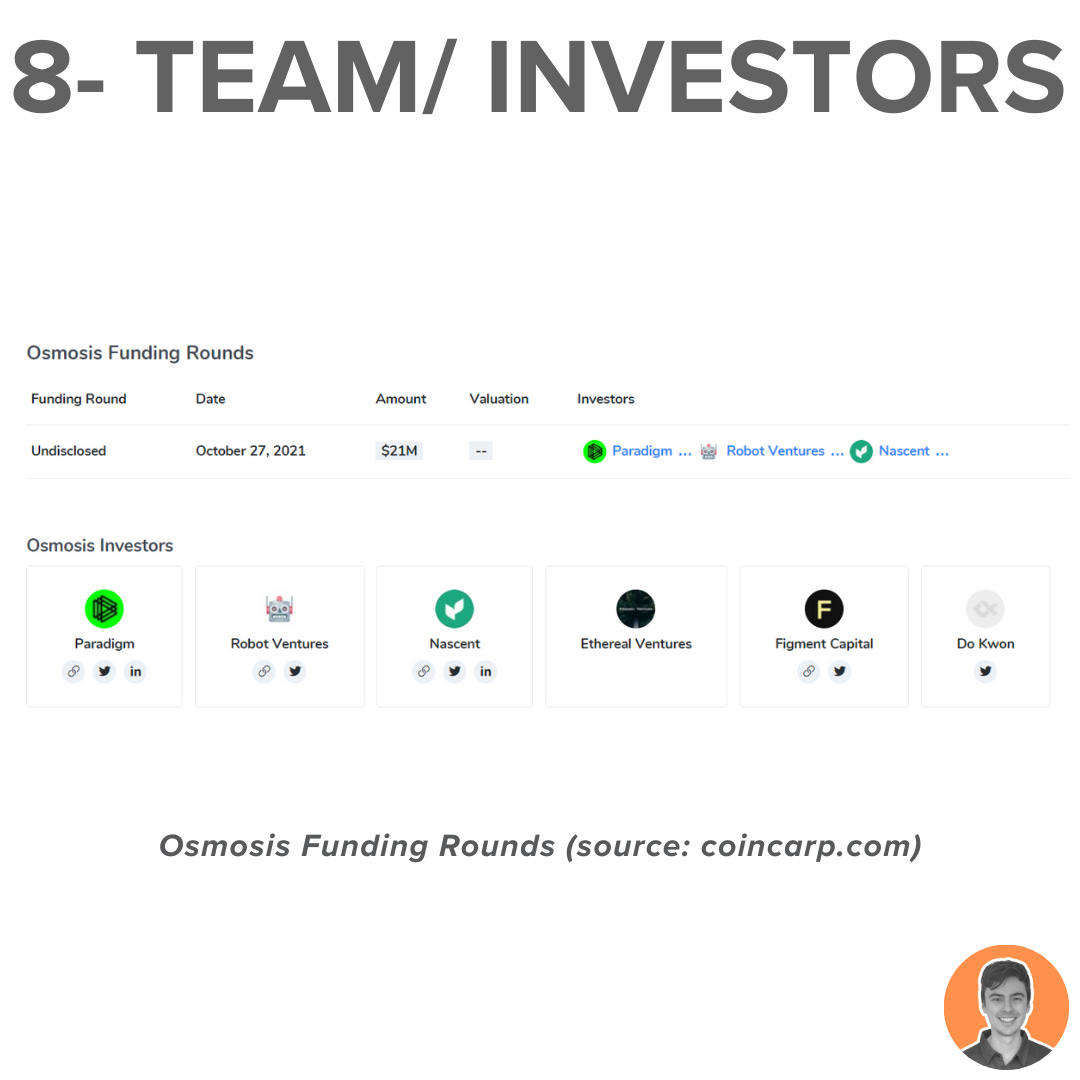

Osmosis was founded by Sunny Agarwal and Josh Lee in 2021.

The Osmosis Foundation raised a total of $21m through its Initial Coin Offering on October 27, 2021.

Investors included Paradigm, Robot Ventures, Nascent, Ethereal Ventures & Figment Capital.

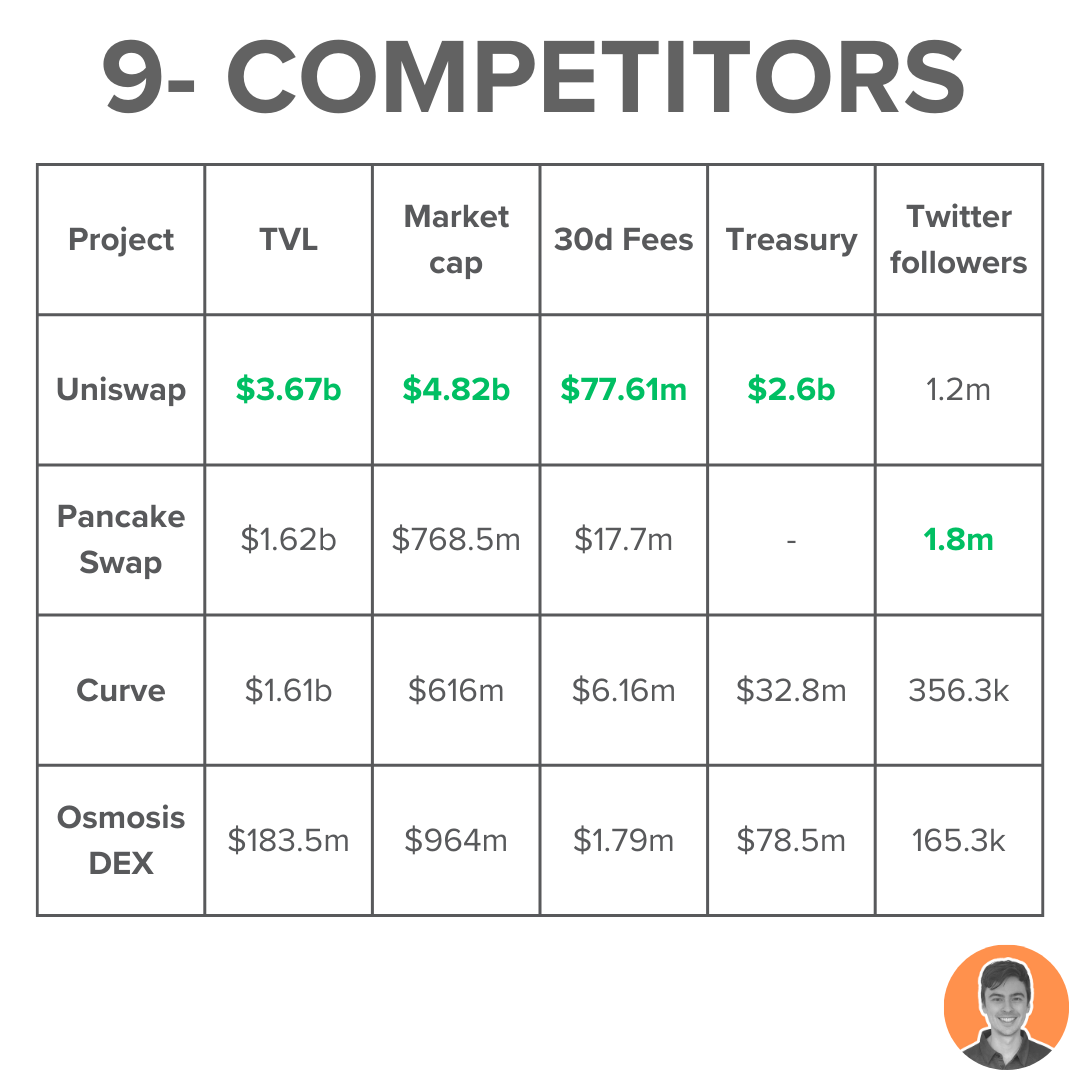

The Osmosis DEX is the 8th largest in terms of TVL according to DefiLlama.

However, it is by far the biggest and most established DEX on the Cosmos ecosystem.

Osmosis has a significant competitive advantage in this respect and is set to prosper as the Cosmos ecosystem expands.

In June 2022, Osmosis experienced a $5m exploit of the protocol.

Validators halted the chain upon discovering the issue, and the team swiftly rectified it, covering all losses.

No exploits since then.

CertiK had audited the project but the vulnerability was not discovered.

I am very bullish on the Cosmos ecosystem and the network expansion effect could have a positive impact on Osmosis.

Upcoming catalysts:

Airdrops

Supercharged Liquidity

Bitcoin trading in 2024

$TIA liquidity hub

Perps (Levana)

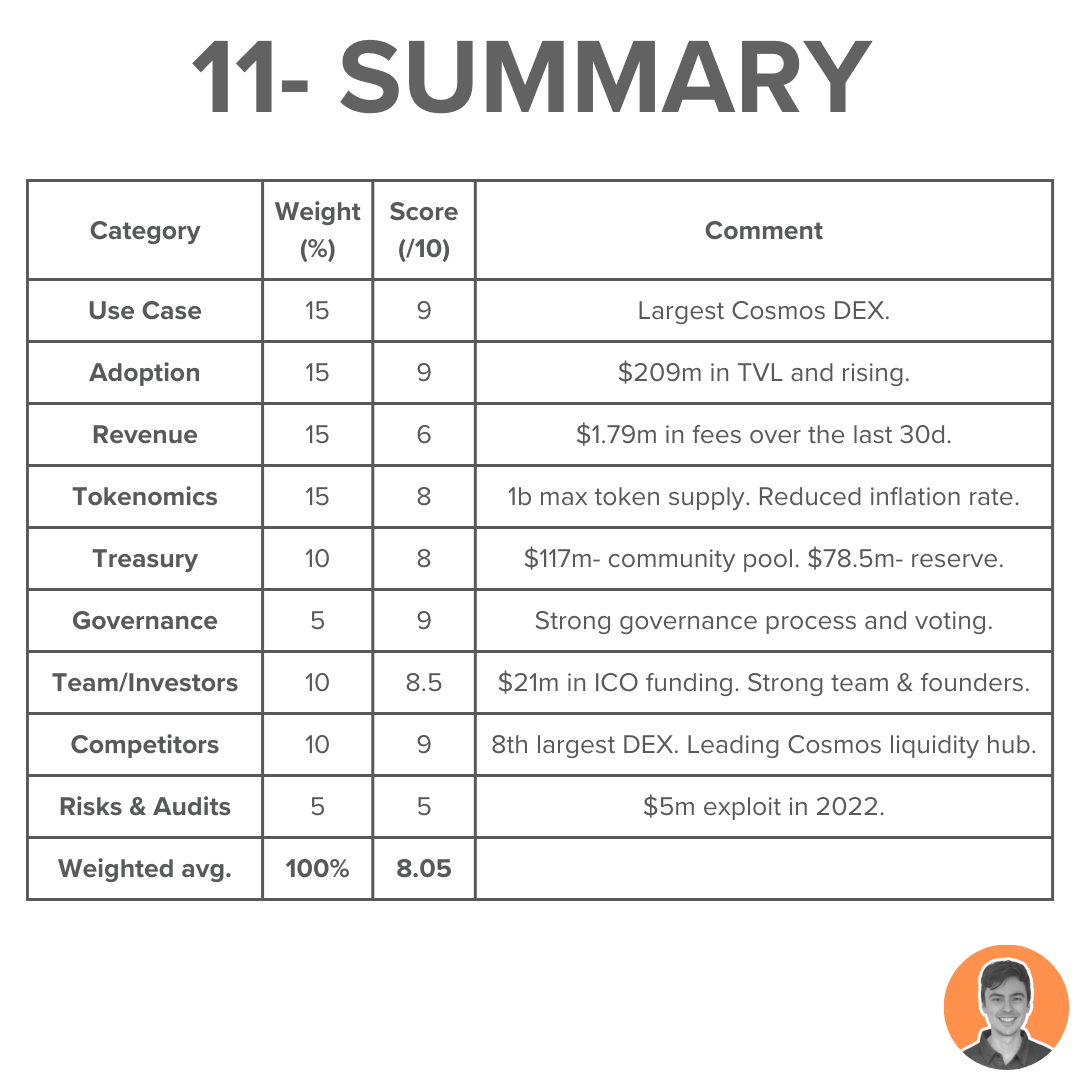

Overall weighted score = 8.05

Note: I am NOT an ambassador or advisor of Osmosis. This is NFA.